Below you will find a list of Forex Brokers that presumably offer true ECN trading accounts, alongside with other types of accounts. The Electronic Communications Network (ECN) is an automated system that facilitates trades between different market participants. The net connects various brokerage companies, liquidity providers and individual traders in one place. The broker in this scenario usually acts only as an intermediary. It earns money by charging a commission on each opened or closed trade. For the record, one simple way to verify if you really have an ECN account is to check the type of order execution. It should be ‘Market Execution’. Not ‘Instant’ or any other type.

RoboForex (2009)

Leverage: up to 1:2000

Deposit: from 10 USD

Spreads:

RoboForex (2009)

Leverage: up to 1:2000

Deposit: from 10 USD

Spreads:

FXCC (2010)

Leverage: up to 1:500 *

Deposit: from 20 USD

Spreads:

FXCC (2010)

Leverage: up to 1:500 *

Deposit: from 20 USD

Spreads:

Moneta Markets (2016)

Leverage: up to 1:1000

Deposit: from 50 USD

Spreads:

Moneta Markets (2016)

Leverage: up to 1:1000

Deposit: from 50 USD

Spreads:

IC Markets (2007)

Leverage: up to 1:500 *

Deposit: from 200 USD

Spreads:

IC Markets (2007)

Leverage: up to 1:500 *

Deposit: from 200 USD

Spreads:

FP Markets (2005)

Leverage: up to 1:500 *

Deposit: from 100 AUD

Spreads:

FP Markets (2005)

Leverage: up to 1:500 *

Deposit: from 100 AUD

Spreads:

VantageFX (2009)

Leverage: up to 1:500

Deposit: from 200 USD

Spreads:

VantageFX (2009)

Leverage: up to 1:500

Deposit: from 200 USD

Spreads:

AMarkets (2007)

Leverage: up to 1:3000

Deposit: from 100 USD

Spreads:

AMarkets (2007)

Leverage: up to 1:3000

Deposit: from 100 USD

Spreads:

Alpari (1998)

Leverage: up to 1:3000

Deposit: from 1 USD

Spreads:

Alpari (1998)

Leverage: up to 1:3000

Deposit: from 1 USD

Spreads:

FxOpen (2005)

Leverage: up to 1:500 *

Deposit: from 1 USD

Spreads:

FxOpen (2005)

Leverage: up to 1:500 *

Deposit: from 1 USD

Spreads:

FirewoodFX (2014)

Leverage: up to 1:3000

Deposit: from 10 USD

Spreads:

FirewoodFX (2014)

Leverage: up to 1:3000

Deposit: from 10 USD

Spreads:

Anzo Capital (2015)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

Anzo Capital (2015)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

Dukascopy (1998)

Leverage: up to 1:200

Deposit: from 100 USD

Spreads:

Dukascopy (1998)

Leverage: up to 1:200

Deposit: from 100 USD

Spreads:

Z.com Trade (2011)

Leverage: up to 1:30

Deposit: from 50 USD

Spreads:

Z.com Trade (2011)

Leverage: up to 1:30

Deposit: from 50 USD

Spreads:

Exness (2008)

Leverage: up to 1:2000 *

Deposit: from 1 USD

Spreads:

Exness (2008)

Leverage: up to 1:2000 *

Deposit: from 1 USD

Spreads:

Key To Markets (2010)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

Key To Markets (2010)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

FXTM (2011)

Leverage: up to 1:2000 *

Deposit: from 10 USD

Spreads:

FXTM (2011)

Leverage: up to 1:2000 *

Deposit: from 10 USD

Spreads:

Grand Capital (2006)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

Grand Capital (2006)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

TradersWay (2011)

Leverage: up to 1:1000

Deposit: from 5 USD

Spreads:

TradersWay (2011)

Leverage: up to 1:1000

Deposit: from 5 USD

Spreads:

AAAFx (2007)

Leverage: up to 1:500 *

Deposit: from 10 USD

Spreads:

AAAFx (2007)

Leverage: up to 1:500 *

Deposit: from 10 USD

Spreads:

LiteFinance (2005)

Leverage: up to 1:1000

Deposit: from 50 USD

Spreads:

LiteFinance (2005)

Leverage: up to 1:1000

Deposit: from 50 USD

Spreads:

Forex.ee (1998)

Leverage: up to 1:500

Deposit: from 50 USD

Spreads:

Forex.ee (1998)

Leverage: up to 1:500

Deposit: from 50 USD

Spreads:

TenkoFX (2012)

Leverage: up to 1:500

Deposit: from 10 USD

Spreads:

TenkoFX (2012)

Leverage: up to 1:500

Deposit: from 10 USD

Spreads:

Price Markets (2013)

Leverage: up to 1:30

Deposit: from 500 USD

Spreads:

Price Markets (2013)

Leverage: up to 1:30

Deposit: from 500 USD

Spreads:

Arum Capital (2017)

Leverage: up to 1:30

Deposit: from 500 USD

Spreads:

Arum Capital (2017)

Leverage: up to 1:30

Deposit: from 500 USD

Spreads:

Xtream Markets (2015)

Leverage: up to 1:1000

Deposit: from 5 USD

Spreads:

Xtream Markets (2015)

Leverage: up to 1:1000

Deposit: from 5 USD

Spreads:

FreshForex (2004)

Leverage: up to 1:2000

Deposit: from 10 USD

Spreads:

FreshForex (2004)

Leverage: up to 1:2000

Deposit: from 10 USD

Spreads:

JustForex (2012)

Leverage: up to 1:3000

Deposit: from 1 USD

Spreads:

JustForex (2012)

Leverage: up to 1:3000

Deposit: from 1 USD

Spreads:

FXDD (2004)

Leverage: up to 1:200 *

Deposit: from 10 USD

Spreads:

FXDD (2004)

Leverage: up to 1:200 *

Deposit: from 10 USD

Spreads:

FXPrimus (2009)

Leverage: up to 1:1000

Deposit: from 15 USD

Spreads:

FXPrimus (2009)

Leverage: up to 1:1000

Deposit: from 15 USD

Spreads:

TeleTrade (2000)

Leverage: up to 1:500

Deposit: from 10 USD

Spreads:

TeleTrade (2000)

Leverage: up to 1:500

Deposit: from 10 USD

Spreads:

BlackBull Markets (2014)

Leverage: up to 1:500

Deposit: from 1 USD

Spreads:

BlackBull Markets (2014)

Leverage: up to 1:500

Deposit: from 1 USD

Spreads:

Tifia Markets (2011)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

Tifia Markets (2011)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

IronFX (2010)

Leverage: up to 1:2000

Deposit: from 100 USD

Spreads:

IronFX (2010)

Leverage: up to 1:2000

Deposit: from 100 USD

Spreads:

XBTFX (2019)

Leverage: up to 1:500

Deposit: from 0.0001 BTC

Spreads:

XBTFX (2019)

Leverage: up to 1:500

Deposit: from 0.0001 BTC

Spreads:

Just2Trade (2015)

Leverage: up to 1:30

Deposit: from 100 USD

Spreads:

Just2Trade (2015)

Leverage: up to 1:30

Deposit: from 100 USD

Spreads:

Veracity Markets (2020)

Leverage: up to 1:500

Deposit: from 250 USD

Spreads:

Veracity Markets (2020)

Leverage: up to 1:500

Deposit: from 250 USD

Spreads:

Arum Trade (2018)

Leverage: up to 1:200

Deposit: from 1 USD

Spreads:

Arum Trade (2018)

Leverage: up to 1:200

Deposit: from 1 USD

Spreads:

TMGM (2013)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

TMGM (2013)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

Doo Prime (2014)

Leverage: up to 1:400

Deposit: from 100 USD

Spreads:

Doo Prime (2014)

Leverage: up to 1:400

Deposit: from 100 USD

Spreads:

ForexVox (2020)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

ForexVox (2020)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

AZAforex (2016)

Leverage: up to 1:1000

Deposit: from 1 USD

Spreads:

AZAforex (2016)

Leverage: up to 1:1000

Deposit: from 1 USD

Spreads:

CXM Trading (2019)

Leverage: up to 1:500

Deposit: from 2000 USD

Spreads:

CXM Trading (2019)

Leverage: up to 1:500

Deposit: from 2000 USD

Spreads:

Lirunex (2016)

Leverage: up to 1:1000

Deposit: from 25 USD

Spreads:

Lirunex (2016)

Leverage: up to 1:1000

Deposit: from 25 USD

Spreads:

VT Markets (2016)

Leverage: up to 1:500

Deposit: from 50 USD

Spreads:

VT Markets (2016)

Leverage: up to 1:500

Deposit: from 50 USD

Spreads:

Juno Markets (2014)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

Juno Markets (2014)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

ZFX (2017)

Leverage: up to 1:2000

Deposit: from 50 USD

Spreads:

ZFX (2017)

Leverage: up to 1:2000

Deposit: from 50 USD

Spreads:

Opoforex (2021)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

Opoforex (2021)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

Fxview (2017)

Leverage: up to 1:1000 *

Deposit: from 50 USD

Spreads:

Fxview (2017)

Leverage: up to 1:1000 *

Deposit: from 50 USD

Spreads:

Solid ECN (2021)

Leverage: up to 1:1000

Deposit: from 1 USD

Spreads:

Solid ECN (2021)

Leverage: up to 1:1000

Deposit: from 1 USD

Spreads:

GANNMarkets (2010)

Leverage: up to 1:400

Deposit: from 100 USD

Spreads:

GANNMarkets (2010)

Leverage: up to 1:400

Deposit: from 100 USD

Spreads:

SAM Trade (2015)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

SAM Trade (2015)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

PU Prime (2015)

Leverage: up to 1:1000

Deposit: from 50 USD

Spreads:

PU Prime (2015)

Leverage: up to 1:1000

Deposit: from 50 USD

Spreads:

Investizo (2019)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

Investizo (2019)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

Varianse (2015)

Leverage: up to 1:500

Deposit: from 500 USD

Spreads:

Varianse (2015)

Leverage: up to 1:500

Deposit: from 500 USD

Spreads:

MTFXG (2022)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

MTFXG (2022)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

CapitalXtend (2005)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

CapitalXtend (2005)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

CXM Direct (2015)

Leverage: up to 1:2000

Deposit: from 10 USD

Spreads:

CXM Direct (2015)

Leverage: up to 1:2000

Deposit: from 10 USD

Spreads:

LCG (1996)

Leverage: up to 1:200

Deposit: from 100 USD

Spreads:

LCG (1996)

Leverage: up to 1:200

Deposit: from 100 USD

Spreads:

Crystal Ball Markets (2020)

Leverage: up to 1:1000

Deposit: from 50 USD

Spreads:

Crystal Ball Markets (2020)

Leverage: up to 1:1000

Deposit: from 50 USD

Spreads:

FXCL (2006)

Leverage: up to 1:2000

Deposit: from 10 USD

Spreads:

FXCL (2006)

Leverage: up to 1:2000

Deposit: from 10 USD

Spreads:

HonorFX (2018)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

HonorFX (2018)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

Fxcess (2020)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

Fxcess (2020)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

GMI (2009)

Leverage: up to 1:2000

Deposit: from 15 USD

Spreads:

GMI (2009)

Leverage: up to 1:2000

Deposit: from 15 USD

Spreads:

ZForex (2022)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

ZForex (2022)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

ForexMart (2015)

Leverage: up to 1:3000

Deposit: from 15 USD

Spreads:

ForexMart (2015)

Leverage: up to 1:3000

Deposit: from 15 USD

Spreads:

Blackwell Global (2010)

Leverage: up to 1:200

Deposit: from 50 USD

Spreads:

Blackwell Global (2010)

Leverage: up to 1:200

Deposit: from 50 USD

Spreads:

RannForex (2013)

Leverage: up to 1:500

Deposit: from 20 USD

Spreads:

RannForex (2013)

Leverage: up to 1:500

Deposit: from 20 USD

Spreads:

FXGiants (2020)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

FXGiants (2020)

Leverage: up to 1:1000

Deposit: from 10 USD

Spreads:

Inveslo (2021)

Leverage: up to 1:2000

Deposit: from 100 USD

Spreads:

Inveslo (2021)

Leverage: up to 1:2000

Deposit: from 100 USD

Spreads:

DBinvesting (2018)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

DBinvesting (2018)

Leverage: up to 1:1000

Deposit: from 100 USD

Spreads:

Fortune Prime Global (2022)

Leverage: up to 1:500

Deposit: from 40 USD

Spreads:

Fortune Prime Global (2022)

Leverage: up to 1:500

Deposit: from 40 USD

Spreads:

FXGT (2019)

Leverage: up to 1:1000

Deposit: from 5 USD

Spreads:

FXGT (2019)

Leverage: up to 1:1000

Deposit: from 5 USD

Spreads:

Otet Markets (2023)

Leverage: up to 1:1000

Deposit: from 25 USD

Spreads:

Otet Markets (2023)

Leverage: up to 1:1000

Deposit: from 25 USD

Spreads:

DBG Markets (2007)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

DBG Markets (2007)

Leverage: up to 1:500

Deposit: from 100 USD

Spreads:

TenTrade (2020)

Leverage: up to 1:500

Deposit: from 50 USD

Spreads:

TenTrade (2020)

Leverage: up to 1:500

Deposit: from 50 USD

Spreads:

Climax Prime (2021)

Leverage: up to 1:300

Deposit: from 10 USD

Spreads:

Climax Prime (2021)

Leverage: up to 1:300

Deposit: from 10 USD

Spreads:

MidasFX (2023)

Leverage: up to 1:1000

Deposit: from 1 USD

Spreads:

MidasFX (2023)

Leverage: up to 1:1000

Deposit: from 1 USD

Spreads:

Ultima Markets (2016)

Leverage: up to 1:2000 *

Deposit: from 50 USD

Spreads:

Ultima Markets (2016)

Leverage: up to 1:2000 *

Deposit: from 50 USD

Spreads:

WeTrade (2015)

Leverage: up to 1:2000

Deposit: from 100 USD

Spreads:

WeTrade (2015)

Leverage: up to 1:2000

Deposit: from 100 USD

Spreads:

IUX (2016)

Leverage: up to 1:3000

Deposit: from 10 USD

Spreads:

IUX (2016)

Leverage: up to 1:3000

Deposit: from 10 USD

Spreads:

ECN stands for “Electronic Communication Network”, and is a system of forex trade transmission and execution which relies on external fulfillment of client orders outside of the broker’s facilities. ECN forex brokers are forex brokers that use the ECN technology in the order transmission and execution process for their clients.

There has always been some confusion as to whether the ECN forex brokers are the same as DMA forex brokers. There are similarities between the two types, but also some key differences. ECN brokers operate a non-dealing desk, just like the DMA brokers. But the key difference is that unlike the DMA forex brokers that send their clients’ orders to the interbank market, the ECN brokers will send their clients’ orders to another brokerage entity (and not the interbank market) for execution. So it is possible that the clients’ orders may end up with a Tier-2 broker, or with another broker that will take on the order in-house using a dealing desk.

This is the difference between the ECN forex brokers and the DMA forex brokers.

To understand the ECN brokerage processes, we need to understand how exactly the forex market works. The wholesale market where currencies are offered for sale is known as the interbank forex market. This is a virtual market which has no physical location. Rather, the market is actually a network of computers and trading stations from the different big banks that constitute the liquidity providers.

Banks are usually the largest interbank market participants. They trade huge volumes of currencies running into billions. Some of this money comes from banks that act as commercial traders, who simply come to the market to fulfill the FX needs of their clients (importers, international trade companies, etc). Occasionally, some central banks also come to this market to intervene on their specific currencies. Currency interventions usually require buying or selling a huge amount of one currency against another, in order to swing the demand-supply balance of the currency pairs in their desired directions. Then we have the major banks that are classified as the liquidity providers (LPs). They trade currencies with other banks, commercial banks, investment banks, prime brokers and market makers in large volumes, at what can be described as wholesale pricing conditions. As this is a market where there are no monopolistic forces at work, bid-ask prices of various currency pairs are not usually the same as you move from one liquidity provider to the next.

Prime brokers (also known as Tier-2 brokers), are participants in the interbank market. However, their clients are not the end-traders, but the ECN brokers. ECN forex brokers basically operate as agencies or facilitators. Since they do not operate a dealing desk, they have to look for external venues for fulfillment of their client orders. So what they do is use aggregator engines to bring together several bid-ask prices from various liquidity providers using the mid-office and back office facilities of the electronic communication network, and send these to the clients. Clients will see these prices at the front-end of the network (an ECN platform such as Currenex, cTrader or LMAX), trade by clicking the desired bid-ask price, and by clicking the order button, these are sent back to the ECN forex broker’s back office. From here, the ECN forex broker will transmit these orders to the prime brokers for fulfillment.

Some ECN brokerages are also white-label extensions of the prime brokerages, which provide a seamless arrangement for order fulfillment. Typically, traders will pay a commission on trades, but get a trade-off by getting reduced spreads on their trades.

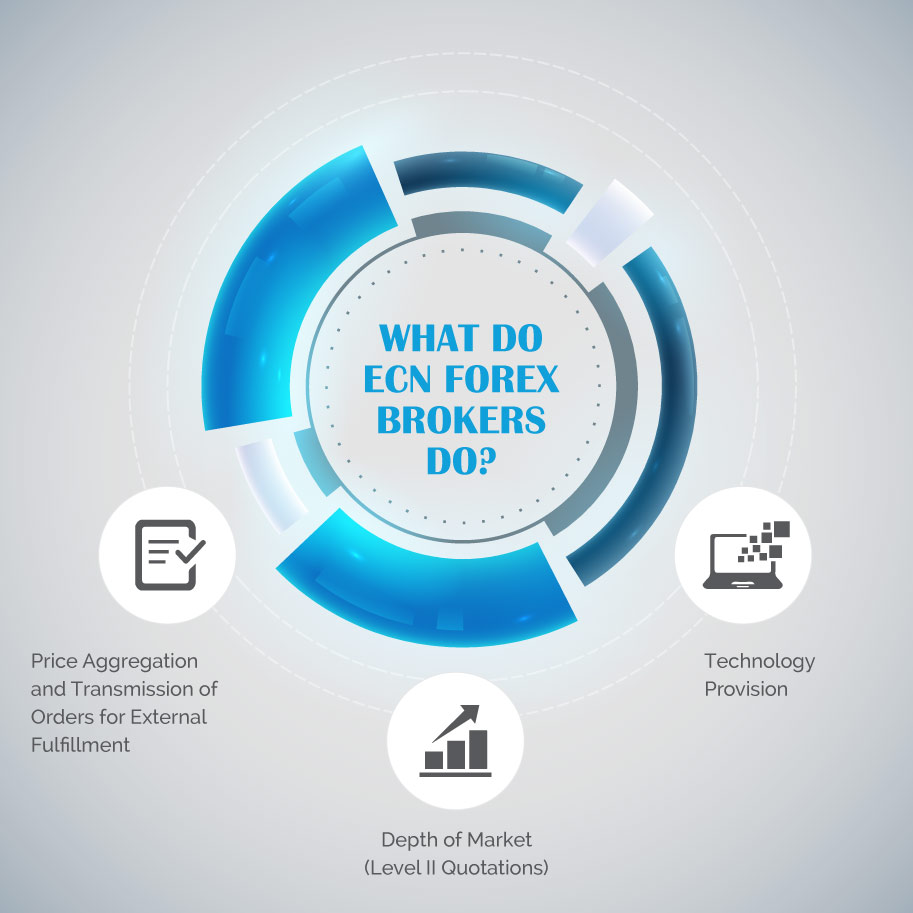

ECN forex brokers play several functions in the market. Let's take a closer look at general ones.

ECN forex brokers aggregate price quotes from various banks that act as liquidity providers and transmit these bid-ask prices to their clients. This enables their clients to select the bid-ask prices that they find most suitable. On selecting a particular bid-ask price quote and clicking on the order button, the trade quote is transmitted by the ECN forex broker to the liquidity provider that owns the selected price for execution. The orders are never filled or tampered with at the level of the broker’s dealing desk.

Another hallmark of ECN forex brokers is that they provide a Depth of Market book, which is basically an order book that shows the price at which various market participants are placing either buy or sell orders, as well as the order volumes at each price. For instance, you may see a range of prices for the EUR/USD that starts from 1.13453 and extends to 1.13467. Between the spectrum of prices which have been defined above, with 1.13453 acting as a price floor and 1.13467 acting as a price ceiling, we will see some buy orders and some sell orders within the spectrum. We will also see different volumes at play. For instance, it is possible to see a volume of 3.45 lots for a sell order at one price, and at another price, you may see an order volume of up to 1,230 lots for a buy order. Such information can easily be used by traders to know where heavy volumes are congregating, the type of orders being seen where the heavy volumes are located, and therefore where the market is likely going to head in a short while as the heavy volumes begin to dominate the market.

Trading on ECN platforms requires technology that is different from what market makers offer retail clients. Therefore, traders on ECN platforms tend to get more specialized tools for faster trades and speedy executions. The trading platforms are also built separately and are suited for price aggregation and order transmission.

There are many advantages to using an ECN forex broker:

ECN forex brokers have the following disadvantages:

We have a list of ECN forex brokers you can trade with in order to get transparent pricing, speedy execution of your trades, and conditions that are favourable for scalping. You get no slippages or requotes when trading with these brokers.