Below you will find a list of Forex Brokers that offer Direct Market Access (DMA) order execution. Typically, brokers provide DMA trading accounts only to institutional and premium clients. Hence, you have to deposit significant amount of funds to get on board, although this is not always the case. The DMA is very similar to the STP, but traders receive quotes from much wider range of global banks and liquidity providers. Another positive side is that transaction costs are slightly lower compared to other types of accounts. True DMA execution usually is offered by Forex Brokers operating in countries with advanced interbank markets.

FP Markets (2005)

Leverage: up to 1:500 *

Deposit: from 100 AUD

Spreads:

FP Markets (2005)

Leverage: up to 1:500 *

Deposit: from 100 AUD

Spreads:

Darwinex (2012)

Leverage: up to 1:30

Deposit: from 500 USD

Spreads:

Darwinex (2012)

Leverage: up to 1:30

Deposit: from 500 USD

Spreads:

IG Markets (1974)

Leverage: up to 1:200 *

Deposit: from 300 USD

Spreads:

IG Markets (1974)

Leverage: up to 1:200 *

Deposit: from 300 USD

Spreads:

Forex.com (2001)

Leverage: up to 1:50 *

Deposit: from 100 USD

Spreads:

Forex.com (2001)

Leverage: up to 1:50 *

Deposit: from 100 USD

Spreads:

XTB Group (2004)

Leverage: up to 1:200

Deposit: from 250 USD

Spreads:

XTB Group (2004)

Leverage: up to 1:200

Deposit: from 250 USD

Spreads:

Advanced Markets (2006)

Leverage: up to 1:100

Deposit: from 2500 USD

Spreads:

Advanced Markets (2006)

Leverage: up to 1:100

Deposit: from 2500 USD

Spreads:

Saxo Bank (1992)

Leverage: up to 1:30

Deposit: from 2000 USD

Spreads:

Saxo Bank (1992)

Leverage: up to 1:30

Deposit: from 2000 USD

Spreads:

JFD Bank (2011)

Leverage: up to 1:400 *

Deposit: from 500 USD

Spreads:

JFD Bank (2011)

Leverage: up to 1:400 *

Deposit: from 500 USD

Spreads:

Just2Trade (2015)

Leverage: up to 1:30

Deposit: from 100 USD

Spreads:

Just2Trade (2015)

Leverage: up to 1:30

Deposit: from 100 USD

Spreads:

Rockfort Markets (2014)

Leverage: up to 1:100

Deposit: from 500 USD

Spreads:

Rockfort Markets (2014)

Leverage: up to 1:100

Deposit: from 500 USD

Spreads:

LCG (1996)

Leverage: up to 1:200

Deposit: from 100 USD

Spreads:

LCG (1996)

Leverage: up to 1:200

Deposit: from 100 USD

Spreads:

Capital.com (2016)

Leverage: up to 1:200

Deposit: from 20 USD

Spreads:

Capital.com (2016)

Leverage: up to 1:200

Deposit: from 20 USD

Spreads:

Exclusive Markets (2018)

Leverage: up to 1:3000

Deposit: from 200 USD

Spreads:

Exclusive Markets (2018)

Leverage: up to 1:3000

Deposit: from 200 USD

Spreads:

Fortrade (2014)

Leverage: up to 1:200 *

Deposit: from 100 USD

Spreads:

Fortrade (2014)

Leverage: up to 1:200 *

Deposit: from 100 USD

Spreads:

As far as the forex market is concerned, the term “direct market access (DMA) brokers” is used to refer to a model of forex brokerage where the trader is given access to the interbank market in terms of trade pricing and order execution. DMA forex brokers do not handle any orders at the dealing desk. They are therefore also known as non-dealing desk (NDD) brokerages. They can be said to be the 100% true NDD brokerages.

DMA forex brokers basically work directly with the major banks that operate in the interbank market. These banks provide the interbank market liquidity and include entities such as Deutsche Bank, BNP Paribas, Bank of America, UBS, etc. The DMA brokers aggregate bid-ask prices from these prime brokerages using an aggregator engine and transmit these prices to their clients. When the clients select a particular bid-ask price belonging to one of the liquidity providers, the DMA forex broker sends these orders directly to the interbank market for execution.

There is usually some confusion as to the similarities and differences between ECN and STP brokers. Many times, traders confuse both types of brokers to mean the same thing. While they are similar in some respects, there is a key difference between the DMA brokers and the ECN brokers. DMA brokers typically do not send their clients’ orders to prime brokers; rather, they send them directly to the banks that act as liquidity providers (i.e. Tier-1 brokers) in the interbank market. That is where the term “direct market access” came from; giving clients and end-traders 'direct access' to the interbank forex 'market' where the liquidity providers (and not a prime broker) will act as the counterparty to the trades.

For any brokerage operation, there is a front-end (which is the trading platform that the trader sees on his/her trading station), as well as mid-office and back-office components. Using the back-office components (which include a price aggregator engine), the DMA forex broker obtains pricing from several liquidity providers, and sends these bid-ask price quotes to their clients.

The clients may get up to 8 of these bid-ask price quotes. What this means is that each of the liquidity providers whose prices are featured on the DMA forex broker’s price aggregation engine, will indicate at what price they are willing to sell a currency pair (ASK price), and what price they are willing to buy a currency pair (BID price) from the trader. Usually, a trader who wants to sell a currency pair will select the highest bid price, while a trader who wants to buy a currency pair will choose the lowest ask price. Once a selection is made, the trader clicks the order button, and the information is transmitted to the specific liquidity provider in the interbank market whose prices have been chosen, for execution.

It is not just price quotes that the DMA forex broker will show to clients on the platform. Also displayed on the trading platform are the Level II quotes, which are also known as the Market Depth price quotes. This information tells the trader who is buying or selling at a particular price, and how much trading volume is looking to buy or sell at a particular price.

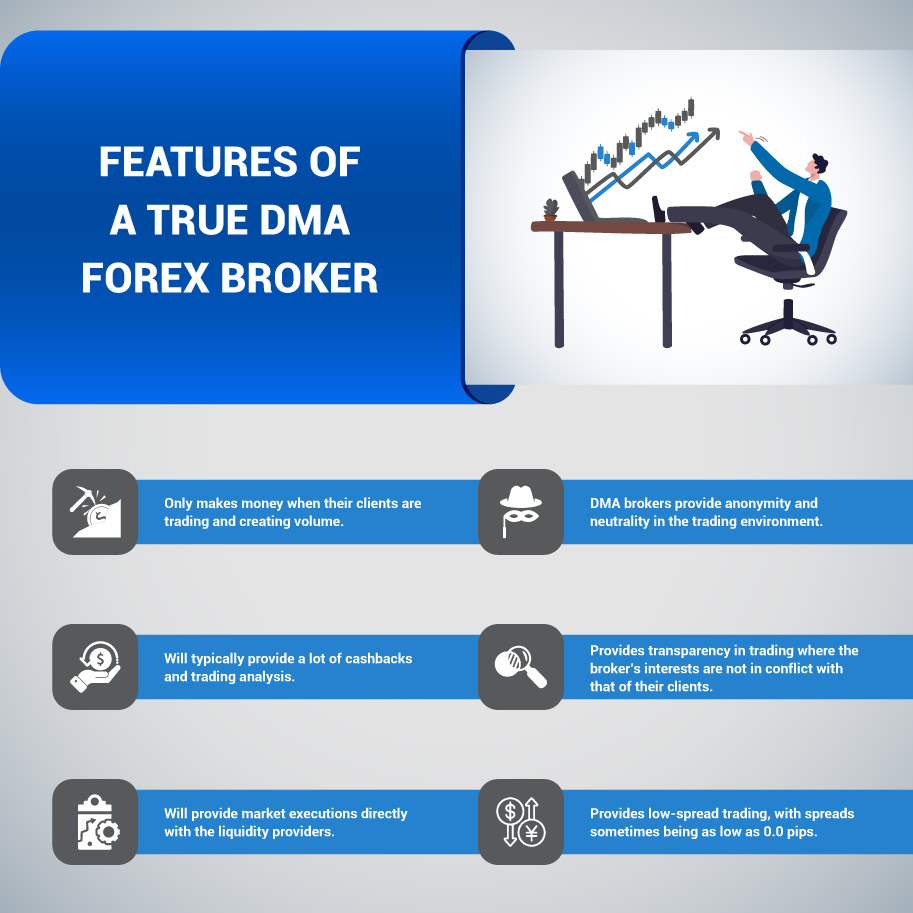

A true DMA forex broker:

What advantages do DMA forex brokers bring to the table for traders who love to trade currencies?

Trading with DMA forex brokers may have some disadvantages, which can usually be overcome:

You can partake of forex trading on DMA forex broker platforms by selecting from our list of DMA forex brokers. Each broker comes with varying degrees of leverage and have different contract specifications. Feel free to look at what each of these DMA forex brokers have to offer and start trading forex with the interbank market today.