Published: April 10th, 2024

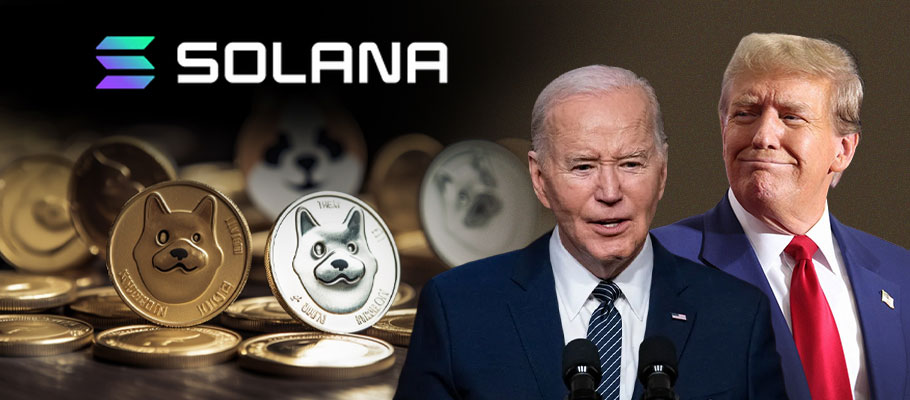

Two meme coins lampooning the upcoming contest between current US President Joe Biden and past White House resident Donald Trump are generating impressive gains on the Solana blockchain.

Figures from blockchain data analytics firm DexScreener show Trump-esque coin ‘Doland Tremp’ (TREMP) battling it out with the Biden-ish ‘Jeo Boden’ (BODEN) for trading volume. Both are trading blows mainly on the Raydium Solana-based decentralized exchange (DEX).

At time of writing, BODEN had the edge with a market cap of close to USD 472 million, with the price up 64 per cent over the past week and trading as high as USD 0.97 on Tuesday 9th April. TREMP, meanwhile, was trading as high as USD 0.87 on 9th April, starting the day at USD 0.68. TREMP has fewer coins in circulation, claiming a market cap of ca. USD 83 million.

TREMP generated roughly USD 10 million in 24-hour trading volume, while BODEN raced ahead with USD 30 million in the same one-day period. While Biden’s crypto doppelganger is beating Trump's coin for now, the Tremp faithful haven't given up.

Meme coins are cryptocurrencies created to mimic memetic internet themes, jokes and satire relating to current affairs or specific celebrities. Unlike standard coins like Bitcoin and Ethereum, the value of meme coins is linked to news events and pop culture happenings. They also tend to be highly volatile, spiking and cratering quickly in line with internet attention spans.

Solana’s low transaction costs help mitigate the risks of meme coin trading, one reason why they’ve grown in popularity on the blockchain, posting a combined market cap of USD 8.14 billion, according to CoinGecko.

Last Summer, meme coins SHIB and PEPE bore the brunt of risk-off sentiment as the broader crypto market faced a downturn. Figures from CoinGecko showed both coins had shed double-digit values, taking losses exceeding 20 per cent. PEPE fell furthest with a 22 per cent decline to USD 0.00000111. SHIB posted a seven-day drop of 21.6 per cent, wallowing at USD 0.00000818 at time of writing.

PEPE experienced a notable rally in July 2023 when it added USD 150 million to its market cap and reached 70th place on the league table of top cryptocurrencies. Those gains evaporated a few weeks later and dropped the coin back to 84th position.

The meme coin cull happened against a backdrop of broad-based negative sentiment. Bitcoin (BTC) and Ethereum (ETH) dropped significantly during the same seven-day period on news that Chinese property giant Evergrande would file for bankruptcy in a New York City court. The news promoted a series of risk-off moves and saw many investors flee positions in riskier assets like crypto.

Bitcoin had 11.4 of its value lopped off over the week and was trading at USD 26,037 at time of writing. Ethereum shed 9.5 of its value and was trading at USD 1,673 at time of writing.

In SHIB’s case the negative price performance may have been made worse by the tepid response to the launch of Shibarium, the layer-2 Shiba Inu blockchain on Ethereum.

Earlier in August 2023, press reports suggested that close to USD 1.7 million in Ethereum sent to Shibarium had been lost or become ‘unrecoverable.’.

While assets based on something as ephemeral as social media jokes might be excused from normal investment rules, meme coins can feel the pull of real-world market pressures.

Back in November 2022, DOGE and Bitcoin both erased gains as markets were gripped by US election jitters and the anticipated release of CPI data.

At that point in time, the biggest coin by market cap was trading at USD 18,257, down around 7.3 per cent from the previous two days.

That erased gains made when BTC broke above the USD 21,000 mark just two days before, reaching USD 21,400 at one point on news of US job growth.

Ethereum, the second biggest coin by market cap, fell sharply too, shedding more than 10 per cent of its value in 24 hours.

Both had been trending down since Monday 7th November, but also experienced sudden drops as the US vote count got underway. Early trends suggested the Republicans might be on track to narrowly take control of both the Senate and House of representatives.

As BTC and ETH sank, original meme coin Dogecoin (DOGE), then the eighth biggest cryptocurrency by market cap, also dropped off a cliff. The first meme coin and personal favorite of Twitter (Now X) owner Elon Musk had plunged by more than 12 per cent.

The coin rallied into November when Musk announced his pursuit of Twitter had finally happened. DOGE shot up by 94 per cent in a week, making it November 2022’s best performing digital asset to date.

Things began to change however when American voters headed to the polls in ‘mid-term’ elections that would decide the political make-up of the current US Congress. The outcome was thought to be significant for the crypto market as lawmakers would likely decide how to regulate digital assets in the subsequent 12 months.

As the election count rolled on, the US Bureau of Labor Statistics also planned to release the latest CPI inflation data on Thursday 1oth November. The figures showed how deeply inflation was biting into household spending on essential goods like fuel and clothing.

High inflation would have set Bitcoin up for more losses as investors fleed to safe-havens like the US dollar.

DOGE briefly doubled in value to almost (USD) 15 cents on 31st October. That lifted its total value to about USD 15.8 billion and sending its market cap past established coins like Cardano.

During the week commencing 31st October DOGE saw heavy trading on the major cryptocurrency exchanges. On Coinbase it was the third most traded coin, accounting for over 15 per cent of total trading volume.