Published: November 15th, 2023

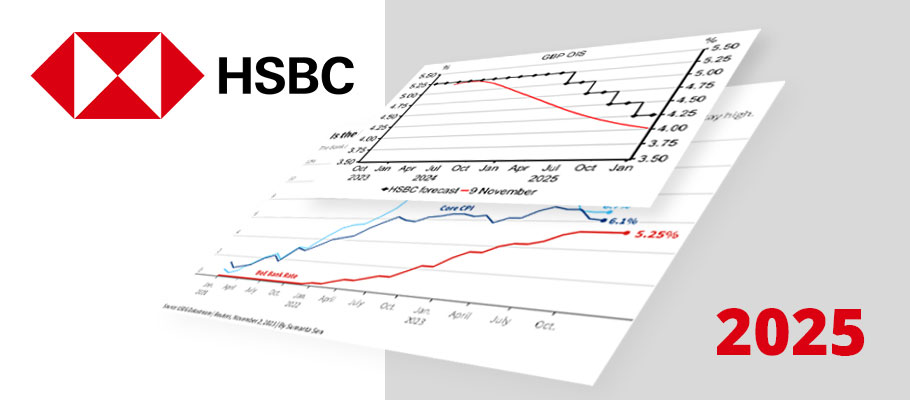

One of the UK's biggest High Street Banks believes the Bank of England (BoE) will leave interest rates unchanged until at least 2025.

Elevated wage growth will keep inflation uncomfortably high for BoE policymakers, HSBC says, who are determined to pull price rises back down to Threadneedle Street’s two per cent target.

‘Given high wage growth and no subsequent rise in productivity, services firms in particular may have to pass on rising costs to customers,’ said an analyst note from HSBC's Economics Unit in London.

‘Core inflation is sticky and wage growth is a key driver,’ the note said, ‘so we expect the BoE to hold the course across 2024.’

HSBC’s forecast goes against the grain of current market consensus, which is looking for new rate cuts to start around mid-2024. Institutional analysts are echoing the mainstream economist expectation and looking for new rate cuts in this timeframe.

A few economists are looking for rate cuts even earlier, by May 2024 if economic slowdown and a rapid decline in inflation pushes the BoE to be more supportive of growth through interest rate reductions.

In one interesting development last week, the Bank of England's Chief Economist diverged from the majority of Monetary Policy Committee members, saying that the market's current expectation for rate cuts to start on or about June 2024 was probably correct.

HSBC says that despite the recent fall in UK inflation, it remains high compared to many of Europe’s large economies. That will put pressure on the Bank to keep rates on hold for most of 2024.

Falling energy prices will make inflation's path from eleven per cent to four per cent simpler than the journey from four per cent to two per cent.

‘Given that reality, we think BoE policymakers will stay the course longer than the market currently expects’.

In June, forex traders were raising their speculative bets on the Pound, believing it was set to strengthen amid rising positive sentiment.

Data published by the US Commodity Futures Trading Commission (CFTC) showed that bullish positions on GBP rose by USD 3.2 billion in the seven days leading up to Wednesday, 21st June.

There was significant growth in 'long' contracts, with 37,110 new positions indicating growing optimism in the UK currency's prospects.

A ‘long’ position means a trader opens a contract based on a presumed future rise in the price of an underlying asset, in this case the asset being Pounds Sterling.

Analysts at MUFG told Bloomberg that speculative traders had ‘aggressively pursed net-GBP longs’ over the past fortnight. The boost created the biggest net long position on GBP held by Leveraged Funds since September of 2022.

For the seven-day trend noted in the CFTC’s report, it was the biggest one-week jump seen since April 2016. But MUFG analysts said the cumulative net GBP long was the biggest since 2014.

‘Traders have been slowly leaning into Sterling since April, but the jump seen last week is very significant.’

The surge in bullish Pound positions reflected a growing consensus among leveraged fund investors that the Bank of England’s shift to aggressive monetary tightening would have a positive effect on the currency.

Threadneedle Street surprised investors the previous week by raising interest rates 50 basis points, a big leap from the successive 25bp hikes seen before.

Traders started looking for Britain’s base rate to settle at or above six per cent, meaning the UK would have the highest rate amongst G10 countries.

In May, Sterling gave back gains against the Dollar and Euro following publication of UK wage and employment data that indicated Britain’s labour market had reached a Spring inflexion point.

According to the UK Office of National Statistics (ONS), average UK earnings rose by 6.6 per cent in March, slightly less than the 6.7 per cent figure consensus had expected, but still a shade above April's 6.5 per cent.

With bonuses factored in, the figure was 5.9 per cent, which was anticipated, and holding steady at the previous month’s level.

Bank of England (BoE) policymakers have been especially focused on wage data as they look for signals that UK inflation is becoming embedded. While the numbers are robust, Threadneedle Street may conclude that wage increases are close to reaching a peak, especially if unemployment continues to rise

Alongside the wage rise, Britain’s unemployment rate increased to 3.8 per cent in March. Consensus had expected unemployment to remain unchanged at the previous month’s 3.7 per cent.

The data may signal that the hot UK labour market may finally be starting to cool, potentially giving the Bank of England breathing space to look again at concluding the current interest rate hiking cycle.

The Pound was unsurprisingly softer in the wake of the data release. The Pound to Dollar rate dropped 0.30 per cent in the 30 minutes following the release to 1.2474. The Pound to Euro rate fell 0.20 per cent in the same period, dropping to 1.1479.

A month later, UBS Bank advised its forex clients to consider long positions on Sterling against the Swiss franc, suggesting a move to 1.14 could be in the offing.

In an analyst note published the w/c 12th June, the bank’s Currency Strategy Unit said the recommendation is supported by solid technical indicators and strong fundamental support.

The note pointed to an attractive valuation for Sterling against the Franc and said the previous downward pressure on GBP could be blamed on political uncertainty and investor perceptions that British monetary policy had become somewhat ‘loose’.

That all changed, UBS said, because UK politics had stabilised and the Bank of England (BoE) was showing stronger commitment to fighting inflation. These positives had yet to be fully reflected in GBP’s valuation but could become evident before the end of the calendar month.