Published: November 30th, 2022

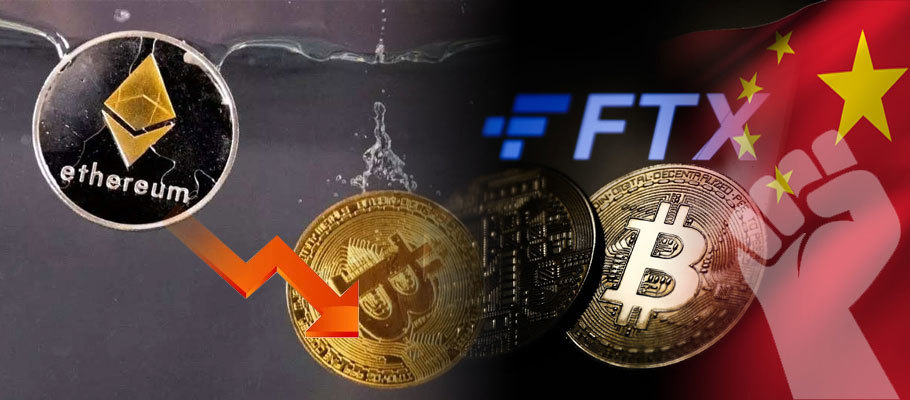

Bitcoin, Ethereum, and the broader crypto market all sank as trading began this week, dragged down by risk-off sentiment as investors sought refuge from the aftershocks of the FTX meltdown and domestic turmoil in China.

A sell-off began that saw BTC trading at USD 16,353 at time of writing, a rapid three per cent drop from weekend trading. Ethereum saw an even bigger sell-off, trading at USD 1,160 for a five per cent fall in 24 hours.

On-chain analytics firm Lookonchain wrote in a blog that ETH’s sharper price plunge could be partly due to one whale shifting 73,200 Ethereum (value = ca. USD 85.5 million) to Binance, which traders will have interpreted as preparation for a sale.

The price of ETH fell by 0.3 per cent shortly after the blog was published, with traders seemingly spooked by the news. It continued to drop for hours afterward.

But comment from Bloomberg’s crypto unit suggested that the whale’s move might also be to stake the ETH, since Binance now offers staking for ETH 2.0.

Crypto markets have also been rocked this week by crypto lender BlockFi’s announcement that it was filing for (US) Chapter 11 bankruptcy protection. In a press release published on Monday the firm also announced a second round of layoffs, adding to the 20 per cent of its workforce let go in June.

BlockFi adds its name to a growing list of crypto companies impacted by the collapse of crypto exchange FTX. The financial links and scale of its exposure to FTX are still being determined.

While attention tends to focus on bellwether Bitcoin whenever crypto market volatility is high, Ether (ETH) has also been battered by the 2022 crypto bear market.

ETH plunged below USD 1,000 in mid-June as the crypto sell-off began to gain steam. Ether eventually fell to USD 975, its lowest level since February 2021 and an 80 per cent drop in value from record highs reached in November 2021. The decline happened amid worries about US Fed’s 75bp rate hike. Jittery investors have since pushed both stock markets and cryptocurrencies into bearish territory.

‘The Fed has hardly even begun to raise interest rates and they have yet to sell anything on their balance sheet,’ said Nick Huntingdon, an analyst at data analytics firm Econometrics, warnings that ‘that strongly suggests that more downside is on the way.’

Crypto traders have been nervously following ETH’s trajectory ever since, worried that other decisive breaks could trigger margin calls or liquidations of large leveraged bets. If that were to happen, ETH would face even more downside pressure.

Worries intensified when crypto lending platforms, Celsius Network and Babel Finance halted withdrawals in the same week due to concerns about ‘undue market volatility’. Things worsened when crypto hedge fund Three Arrow Capital, which had USD 10 billion under management, was unable to beef-up collateral to cover its riskier bets. It had only been 23 days since the Terra stablecoin collapse. Some inventors were clearly in no mood to suffer further risk.

Those three events dovetailed with two large-scale capital withdrawals from Ethereum’s blockchain ecosystem that severely diminished its total value locked (TVL). The first broke out in a wave across Ethereum's decentralized finance (DeFi) projects in May, when TVL fell by USD 93 billion post-Terra. By June's end there had been another USD 30 billion in withdrawals.

‘The deleveraging underway on Ethereum is observably painful, with characteristics that make it look like a financial crisis in miniature,’ said on-chain analytics platform Glassnode in an analyst note. ‘One only hopes that with the pain comes an opportunity to rid the network of excessive leverage and make space for a less risky rebuild on the other side.’

Analysts have said repeatedly this year that a more hawkish Fed and recurring turmoil in the DeFi market could drive bearish moves for ETH.

From a technical perspective, Ether’s price has to stay above the psychologically significant USD 1,000 level to sustain support. Otherwise, it might break downside and plumb depths as low as USD 840, the level that provided resistance back in February 2018, before collapsing into a 90 per cent decline that left it hovering around USD 80 eight months later.

Meanwhile, ETH/USD could also fall to as low as USD 420 if ETH’s correction starts to mimic the 2018 bear cycle. It's worth noting however that USD 420 also proved instrumental as support in July-August 2018, and resistance in September-October 2020.

Events in China have been roiling both crypto and fiat currency markets for much of 2022. Back in April the China State Council said it would stimulate economic activity through a cut to the amount of cash banks are required to hold in reserve. Easing that risk management requirement allows them to lend more freely.

The council said that large Chinese banks could slowly lower their reserve requirement ratio, which is the volume of deposits they are required to park with the central bank.

The moves unfolded as Beijing began to manage slowing growth created by strict COVID lockdowns. China's central bank last lowered its RRR in December 2021, just days after the government suggested the easing move was imminent in a State Council session.

That cut released 1.1 trillion yuan (USD 187.60 billion) in liquidity back in into China's banking system.

‘With the scale of economic weakening we’ve seen in China due to covid lockdown, the market not only expects a fast reduction in the reserve requirement ratio, but traders are also looking for the benchmark prime rate for loans be lowered next week,’ said a market comment from HSBC’s currency strategy unit.

News of stimulus for China's economy normally delivers a tailwind for commodity currencies and those like NZD and AUD, as China accounts for the majority of Australia and New Zealand’s commodity exports.