Published: July 4th, 2020

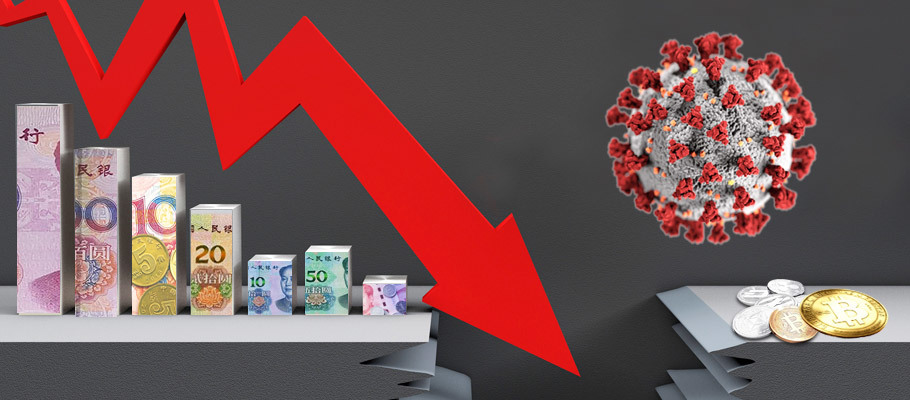

Is cash still king? A new study by Accenture predicts the use of bills and coins will fall by 30 per cent this year across Europe, as consumers switch to digital payments. If the pattern continues, it will mirror the long-term trend already underway in North America.

Cash’s decline has been accelerated by the global coronavirus pandemic. The World Health Organisation (WHO) has said it doesn’t think physical money is a vector for infection, but close to 20 per cent of Britons say they’ve tried to ‘lauder their money’ by cleaning or disinfecting it. In the UK, people have gone without using cash for 44 days on average. Many say they don’t miss it.

Apps like PayPal, Apple Pay, Venmo and Square have all seen a spike in adoption amidst the pandemic. Last week, Visa said it was forecasting a permanent shift to digital payment forms.

Central banks are racing to get ahead of the curve and create national digital currencies, though the usual worries and privacy and security are slowing progress. Poverty advocates worry a mass shift to digital payments or currencies will leave vulnerable people behind. Others say cryptocurrencies may hold the key.

Services like PayPal and Square can be used without a bank account by transferring money to a prepaid debit card. But most payment services today assume users have access to a bank account, a smartphone, and fast internet. Those expectations could exclude close to 9 million people in America alone.

But the writing may be on the wall. Our means of obtaining cash are already disappearing.

The cost of running the UK’s ATM network, plus the warehousing and printing services needed to support a cash economy, is around £5 billion a year. If cash demand continues to fall, that may become unsustainable. Banks are already shuttering physical branches and ATMs, while businesses are increasingly resistant to accommodating cash payments and the costs that come with them.

Of course, some parts of the world still rely on cash. India and Mexico still see cash dominate most transactions.

But how will they fare against the interest most banks have in phasing out coins and bills? Financial services executives say it would lower crime and raise tax revenues, claiming those as the reasons they add hefty fees when customers opt for cash.

Sweden has pioneered the use of tax breaks and P2P payments in a campaign to meld its underground and formal economies. But many businesses are stubbornly reliant on cash. The Swedish government put the brakes on its cashless society drive recently to avoid putting cash businesses at a disadvantage. Britain says it will protect access to cash, while some US state governments have made moves to legislate against retail business going cashless too quickly.

Some banking industry watchers have expressed concern that whenever a bank closes an ATM, it becomes that much more difficult to disentangle from the web of financial processes spun by institutions to ensure they get a cut of transactions.

Banks want to harvest ever more data and ensure they maintain a controlling stake in the economic lives of countries and individuals. Cash is part of the system of checks and balances that stops banks from overstepping. If they have to live with the threat of people switching to cash and leaving their services behind, they’ll be more likely to take care.

Cash transactions per person have fallen by 80% in Sweden over the past ten years, and the value of cash purchases amounted to just 6 per cent last year in Norway.

A UK government review into the future of cash last year said that the coronavirus pandemic has sped-up cash’s demise by at least a decade.

For businesses where most customers pay using card or by digital, going cashless makes sense, but it doesn’t work for everyone. Not everyone has access to the internet or a smartphone or even access to a bank account. The sudden shift towards digital payments threatens to hurt the most vulnerable: homeless people and those who don’t have the necessary immigration status to open a bank account.

For many people, cash is still a necessity.

In America, the disincentives around cash hit the ‘unbanked’ hardest. People who can’t afford bank accounts pay higher fees for using hard currency, and have to jump through procedural hoops to access even basic financial services.

Stopping unbanked Americans from being left behind in finance’s final digital transformation has spurred calls for a new digital dollar. Plans for an e-greenback would see people obtain straightforward access to simple online accounts, and make it easier to distribute government stimulus checks. Some see it as the necessary technical cornerstone for a future shift to universal basic income (UBI).

Ex-Chairman of the US Commodities and Futures Trading Commission, Chris Giancarlo, has said that any digital dollar would need to function like regular cash if it's going to achieve mass adoption, with the same privacy and portability benefits ensured.

Privacy is the primary concern. Consumer surveys have shown that around 60 per cent of consumers see a cashless society as less private and more prone to theft by cyberattack.

Could cryptocurrency provide the answer to all these worries? Advocates claim that digital coins and tokens allow users to sidestep big financial institutions and protect their privacy.

But exchange rate volatility, low rates of adoption, and the frequent crypto hacks that make the news are still a big barrier to adoption.