Fundamental analysis involves the use of the news to determine the long-term outlook for a financial asset. The news here refers to the political and economic events that are mostly captured in a schedule known as the economic news calendar.

The “fundamentals” of an economy are essentially captured by the economic and political news releases seen on an economic news calendar. Some other events outside of the calendar can also define the fundamentals of an economy. For instance, the announcement of trade sanctions on Chinese products by US President Donald Trump was not an announcement captured in the news calendar. Rather, it was a policy decision driven by the President himself, and which has impacted not just the economies of the US and China, but other economies as well. It has also affected certain segments of the local economy and impacted other news contained in the economic news calendar. Therefore, traders need to be aware of such extraordinary instances that could present themselves for use in fundamentally analysing an economy.

Ultimately, investor sentiment and perception of an economy are all defined by the news events used in fundamental analysis. Key events such as interest rate decisions typically affect the flow of investment into and out of an economy; all with consequences for the currencies of the countries involved as well as the national stock markets.

The basis of fundamental analysis is being able to trade the news. It must be mentioned that not all news items are captured in the economic news calendar. There are also some surprise political or economic events that cannot be captured in a schedule. In other words, “unscheduled” news can shake the markets. As a trader, you need to know how to respond to these unplanned events. They include unscripted statements from speeches of key economic and political players, a declaration of war, a terrorist attack or even a natural disaster.

More commonly, you will encounter news releases that are captured in the economic news calendar. Apart from detailing the economic indicator in question, as well as the country from which such news will originate, an economic news calendar will feature the following:

There is a factor called the deviation. This is the difference between the consensus figure and the actual number. What determines if a news release is actually tradable is the relationship between the deviation and the previous number. A deviation that is better or worse than the previous number makes a news release tradable. What does this mean?

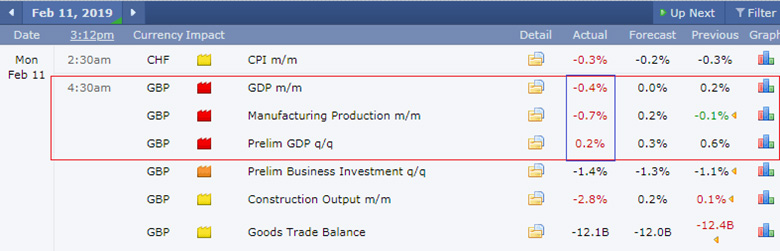

Let us take an example here. We use a news event from Monday February 11 to illustrate the power of a high impact news item in shaping currency direction. The GDP and Manufacturing Production data for the United Kingdom was released at 4.30 am EST (9.30am UTC). The GDP month-on-month reading was expected to come in flat at 0%, worse than the previous figure of 0.2%. Manufacturing production m/m was expected to come in at 0.2%.

But the data came in with an actual reading of -0.4% for the GDP and -0.7% for the manufacturing production. Both results were bad for the British Pound, but what was it that made the news tradable?

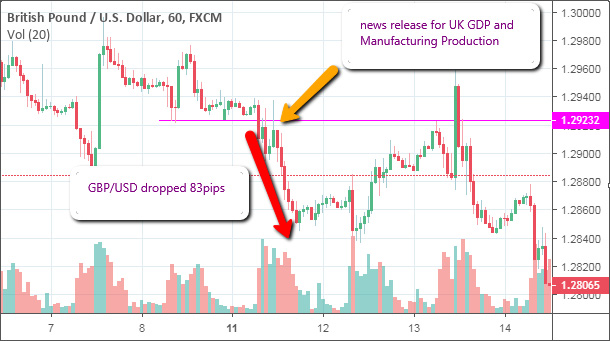

Note the difference between the actual and consensus figures: 0.4 for GDP, and 0.5 for manufacturing. These figures were larger than the difference between the consensus and previous figures (0.2 and 0.3 for GDP and manufacturing respectively). Where the deviation between the consensus and actual figures is higher than the difference between the consensus and previous figures, the data becomes tradable and the trader can trade in the direction the figures are pointing to. Lower than expected figures for GDP and manufacturing are not good for a country’s economy and currency. The trade here is to short the British Pound. Here is how the trade played out on the GBP/USD chart.

GBP/USD 1-hour Chart Showing Price Action on Feb 11, 2019 A discussion of how to trade the news cannot be covered here as it is a very technical subject which must be discussed in detail in another article. But suffice it to say that fundamental analysis is based on the news, which serves as the trigger for a trend. You will need technical analysis to determine the methodology of trade entries and exits.

Trigger fundamentally, but enter technically.

The most important news trades are those which have strong market impact. These are the ones that move the markets and currencies because they attract interest from institutional traders. In forex, the money from institutional traders moves the markets, and this is what causes the initial spikes seen in some news trades.

In a nutshell, these are the most important news trades:

Notice that item C is captured in our example. The high impact nature of these data is usually shown (e.g. as a red icon) beside the news itself, on the economic news calendar.