ECN is the acronym for Electronic Communication Networks. ECN represents a pathway for pricing of currencies and execution of trades, which are routed directly from the forex trader’s trading station to the interbank market for execution without the intervention of a dealing desk.

The structure of the forex market is such that the majority of forex transactions are conducted at the interbank market. Indeed, some authorities have indicated that the trades performed by the various categories of institutional traders and central banks in the interbank market account for between 60% and 90% of total daily turnover in the forex market.

The interbank market is the virtual network of banks that serves as the virtual exchange for forex transactions. Participants in the interbank FX market include:

The banks trade with each other and sell currencies wholesale to other participants. You can look at the interbank market as the wholesale market for the FX trading industry. If you look at the list above, you will notice that the participants are mostly corporate in structure. This is not to say that individuals cannot participate in the interbank market. But the fact is that the liquidity requirements for interbank trading are very high and beyond the reach of most individual traders. Those who can afford it have to open special trading accounts known as ECN accounts to participate, as all trades at the interbank level are done using ECN networks.

For an end-user, using an ECN to trade at the level of the interbank market represents the most transparent pathway to trade. Access to the market is direct, and the trader has a chance of viewing pricing from several liquidity providers. The orders made on the basis of such direct pricing also get executed quickly without requotes.

An ECN platform is capable of matching orders at very high speeds in the order of milliseconds. Due to the fact that an ECN matches orders and pricing from different providers of liquidity, there is a lot of competition which makes spreads very competitive.

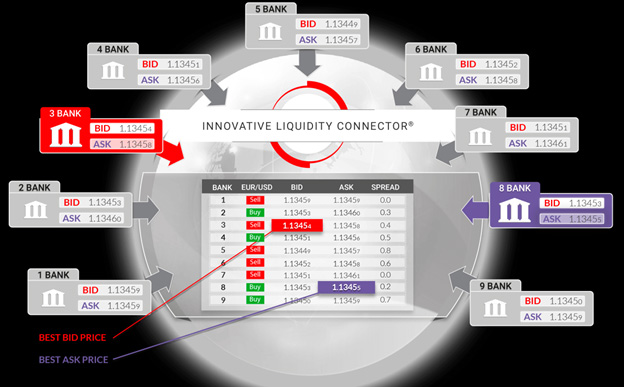

An ECN platform uses a technology that aggregates the best bid/offer prices from different banks (i.e. the liquidity providers). Some robust ECN platforms can pool prices from as many as 50 liquidity providers for various currency pairs. These are delivered to the trader’s front end where they are displayed for each currency pair. So the EUR/USD may for instance, have as many as 20-30 different bid/offer displays. Remember, this is a market and there are many providers who want to sell their products to the end user. In this case, the end-user is a forex trader, the market venue is the interbank market and the communication is done using ECN to display various price quotes (bid and offer).

The trader then selects the best bid/offer price for the trade situation and this is transmitted to the order station on the ECN platform, where it is sent for execution by the click of the trade button on the platform.

The order is routed to the relevant liquidity provider that has provided the bid/offer price chosen by the trader and it is executed in a matter of milliseconds. There is no conflict of interest with the ECN broker, so there is no need for internally generated requotes as is often the case with market makers and STP providers. The structure of forex trading in an ECN is demonstrated using this snapshot from Tradeview Ltd’s liquidity connector ECN platform.

Here, we can observe the following:

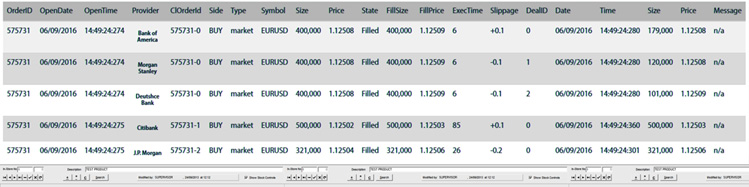

The broker’s back end will display the status of all orders including the liquidity provider that filled the order, the price at which the order was filled, the trade volume as well as the execution status of the order.

ECN platforms confer a number of advantages over Straight Through Processing (STP) and Market Maker (MM) platforms. To understand these advantages, there is a need to know how market makers and STP platforms operate.

Market makers are participants in the interbank market. They bridge liquidity gaps between the interbank market and the retail traders (most of whom cannot afford the capital required to trade in the interbank arena). They do this by taking up large positions, and then creating a smaller in-house market to resell same to their retail clients.

Market makers bid at interbank and offer to their clients, or they bid from clients and offer at the interbank market. For instance, if they buy EUR/USD at 1.1839 (Ask price), they will sell to their clients at a bid price that must exceed this price (i.e. at 1.1840 and above). If they sell at 1.1765, they must buy from clients at a lower price (1.1764 and below) in order to make a profit. If the market moves too fast or the trader wants to trade at a price that does not guarantee this profit for the market maker, the dealing desk will electronically ask the trader to requote.

Also, the trader sees only one set of bid/offer prices. It is a “take it or leave it” situation. Slippage is common as well. There is also the little business of conflict of interest, as the market maker will do all that can be done (legally or illegally) to make a profit from the trader.

All retail trade operations are done in-house at the dealing desk (market maker model). Only when the market maker is dealing with a very smart and profitable trader who poses a risk to this profit-making model do the orders from that particular trader get transmitted directly to the interbank market (STP model). Usually market makers put such traders in a special liquidity bucket called the A-Book.

The advantages of the ECN model are therefore very clear.

The ECN broker is incentivized to keep things transparent. The market maker is more incentivized to make you lose money, as your loss is their gain.