Every guidebook will tell you that emotions must be taken away when you are trading the FX market. The irony is that the FX market can’t operate without emotions. It is the most volatile and unpredictable financial market. That is why it is important to learn how to use other traders’ emotions for your benefit, at the same time staying as calm and confident as possible. Such an approach is referred to trading market sentiment. Let’s explore the basics of this approach to FX trading.

Just like on any music concert or a football game, an individual’s consciousness transforms into crowd thinking, FX traders create the common entity of emotions, moods, and reactions that are known as “market sentiment”.

First and foremost, the FX market sentiment belongs to one of the major pillars that build a trading strategy along with fundamental news and technical analysis.

As you may have guessed, market sentiment reflects the common market’s mood. It directly depends on the current economic events and news that happened recently. And traders need to know the sentiment because it is one of the basic skills for FX trading.

When market sentiment changes it is the best time for traders. How to notice the changing sentiment – follow a surprising data point, political news and economic events that make the currency rate change drastically.

Since there are many various data points and events happening in the FX market within one trading day, it can be hard to define what will affect the common sentiment. This means there are major sentiment changes and minor sentiments – their importance level is surely different. The AMarkets analyst Tim Deev recommends following the central bank’s interest rates and ignoring the press releases of retail companies. However, a FX trader must always be aware of the current news, both major and minor.

It is worthless to follow the sentiment that is older than 48 hours. If you missed the opportunity, it is better to wait for the new sentiment trend before opening a trading position. The fresher the sentiment is, the better for chasing the price fluctuations. Waiting for a retracement is the key priority – don’t just chase the selling or buying the prices at the FX market.

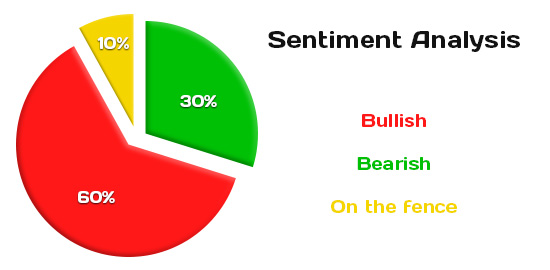

Even novice traders are aware of the fact that in common all emotions of the FX markets can be divided into pessimistic (bearish trends – when traders mostly sell) or optimistic (bullish trends – when traders prefer to buy). The overall sentiment directly depends on the optimistic or pessimistic trend. However, there is also a small amount of traders who are “on the fence”, i.e. they can’t decide – whether to buy or sell.

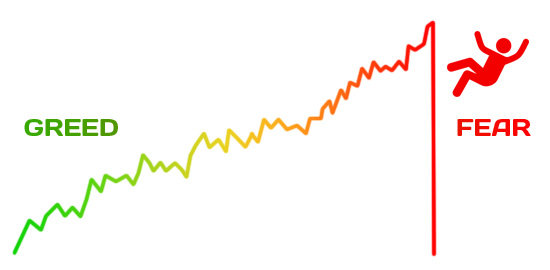

Greed and fear mostly dominate the “market of emotions”. Like all investors, FX traders want to gain more profits or are scared of losing money. Usually, greed prevails when people spot the “hot” asset like a popular cryptocoin or a currency of the country with a fast-growing economy. Just remember the hype when the Bitcoin price was over $20,000.

But occasionally fear rocks the FX boat. Traders start panicking and can’t logically value the prospects of a certain asset that currently goes down. Savvy and experienced investors know that it is the best time to open long positions but novices (the majority of traders) immediately start to sell.

So, the downtrend is related to panic and fear, while the uptrend market means that traders are getting greedier and more confident.

This term directly refers to the major emotions of traders – greed and fear. Dumb money means that a trader checks what the majority of investors do – buying or selling – and follows them. This is a very risky decision but dumb money seems so tempting to resist. No wonder that huge players as institutional banks play against “dumb money”. You may do the same – wait until the crowd starts buying or selling and do the opposite thing. It is called a reversal trend trading. And it is another way to play the sentiment in the right way.

Take as few risks as possible. Avoid trading sentiment if you don’t know where to find and play the “dumb money”. Focus on developing an effectual FX trading strategy through the technical indicators and reversals. For example, the AMarkets broker allows trading primarily on the Forex market sentiment, using the Cayman indicators;

There is no perfect method for chasing sentiment. No matter if you intend to trade just it or fully against sentiment. It can be quite risky to trade only by guessing sentiment of the market. Exceptionally an effective trading strategy that combines the key factors of fundamental and technical analysis may help a trader to play sentiment successfully;

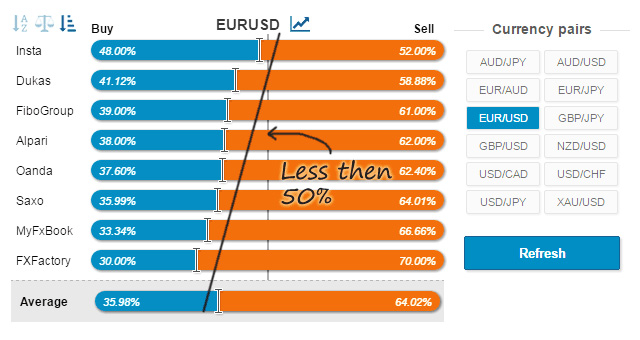

Chasing only the sentiment of major assets is insane. It is worth diversifying your investment and trading portfolio, even if you only play the market sentiment. For example, consider investing in the less popular assets than the EUR/USD pairing. Stick to the brokerage company that offers hundreds of instruments and assets for FX trading;

Forex market sentiment is not that simple to read unless you can see the full visible picture. Novices to sentiment trading should learn how to define the development of greed and when this emotion overwhelms the financial market. Only the most skillful traders can notice the very beginning of a new sentiment development. Novice traders should understand that it is impossible to play the market just from the overtake of greed and fear. It is hard to predict the collective mood of FX traders, even if you were quite successful in prediction in the past. Though, if you have a trustworthy insider’s knowledge or can influence the rates directly due to the huge trading volume. However, it is unlikely that you will be able to do this trick over and over again.