Copy trading is a trading service available in the forex markets, and usually on MT4 and MT5 platforms that enable trades of a group of traders to be implemented on other trading platforms using an automated engine that has been created for this purpose. In other words, copytrading services allow you to copy the same trades being taken by other more experienced traders.

Usually, the system involves signing up to the trading engine of an independent provider. Two categories of traders are needed to complete the circle of participants. You have the signals providers, who are the experienced traders that can trade profitably, and you have the followers, who are mostly traders that do not have the time to trade or the skills to trade profitably.

Copy trading is not the same as social trading. Copy trading is purely automated. Many traders are still confused as to whether social trading and copy trading are the same thing. While there is a lot of similarity between both systems, there is a significant difference: copy trading does not involve the human interaction that goes on in social trading platforms. The Follower traders are copying what is being done by the Copied Traders and getting their trades directly replicated on their trading accounts in an automated fashion.

You may also ask: what differentiates the system of copy trading from the automated trading robots? The difference is that when using automated robots, you are merely paying for a provider to implement the strategies or systems they are selling on your platforms. You do not have a choice: what they provide is what you get. With copy trading, you have a portal which features hundreds of traders whose systems and trade strategies you are at liberty to choose from. You have the power of choice.

Three entities dominate the copy trading ecosystem:

The forex market has the peculiarity in terms of the kinds of trades that can be set up. Pending orders, which are principally delayed orders in the market, are a common feature of the forex market. However, pending orders have no place in the copy trading system.

A typical copy trading engine features a front end (the trader's side) and the back end (the admin end). What the admin end of the computer reading engine does is to transmit the trades of the signals providers onto the trading accounts of the Followers. Usually, the Followers are required to subscribe to a particular signals provider's services. Usage of a copy trade engine by a trader (i.e. Follower) involves the trader taking the following steps:

Usually, signal providers are required to put up the history of their trading account, covering a certain period. The copy trade engine has an inbuilt algorithm that can pull out specific data from the providers trading history. The data include things like profitability number of trades, profitability chart (which shows growth and profits), initial deposit, withdrawals, profit factor, daily profits/loss ratio, number of transactions per month as well as the number of trades won/lost. Risk settings are also a metric used on some platforms as an evaluation tool.

All this information is compiled into actionable metrics that allow for proper evaluation of the performance of a Signals Provider by a Follower, before that Provider's signals being subscribed for.

The Administrators of the copy trading engine make sure that the system runs smoothly and that the entire process of automation is maintained. Signals Providers and Followers have access to the front end of the copy trade engine, even though the interfaces may be different for both categories of participants.

It is possible to make consistent profits from copy-trading if you adopt and follow the correct procedures. It is not enough to sign up for a copy trading service and expect the profits to roll in. It does not work like that. Own experience using copy trade services has shown that merely copying "profitable" traders whose results look very stellar can be a hazardous proposition. So the job of this article is to tell you that copy training can be profitable if the right protocols are followed.

So what are these protocols? These protocols can be split into two categories. The first category consists of protocols that should be observed before signing up for the service. The second category consists of steps to follow when your subscription is active. These protocols must be adopted in the proper sequence and are not independent of each other.

After signing up for the copy trading service, you do not just abandon your trading account to the vagaries of the Signals Provider and the copy trading engine. You need to monitor the performance of the signals you subscribed for from the very first trade. Sometimes, you may notice very early that what you signed up for is not what you are getting. In such circumstances, you can quickly make adjustments by either reducing your trade size, disabling the copy trade engine after a trade is set up, or removing your account from following a Signals Provider entirely.

You can only yield consistent profits from doing thing the right way. Let's now demonstrate the approach to use when performing copy trading.

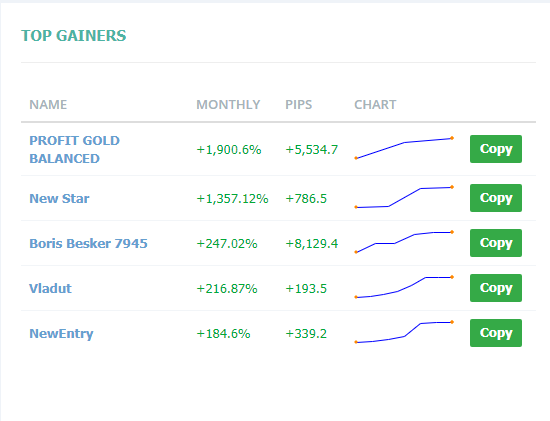

Look at this snapshot. What do you think it is all about?

This is the Leaderboard from a copy trading engine. As you can see, all are supposed to be profitable Signals Providers, with profits ranging from 193.5% to a whopping 8.129.4%. So the first step is to look for Signals Providers who have profitable trading history. You will probably have to pick 5 – 10 Signals Providers, whom you will now subject to the next evaluation stage.

This is the step that will determine if you will eventually end up with a good selection, or one that will cost you big time. In the next few paragraphs, you will see some critical factors you need to look at when analysing a Signal Provider’s statistics.

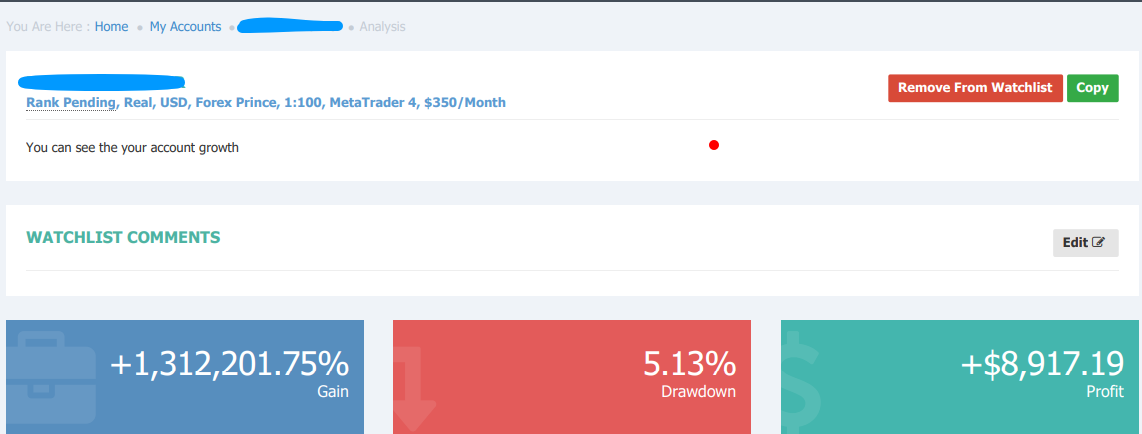

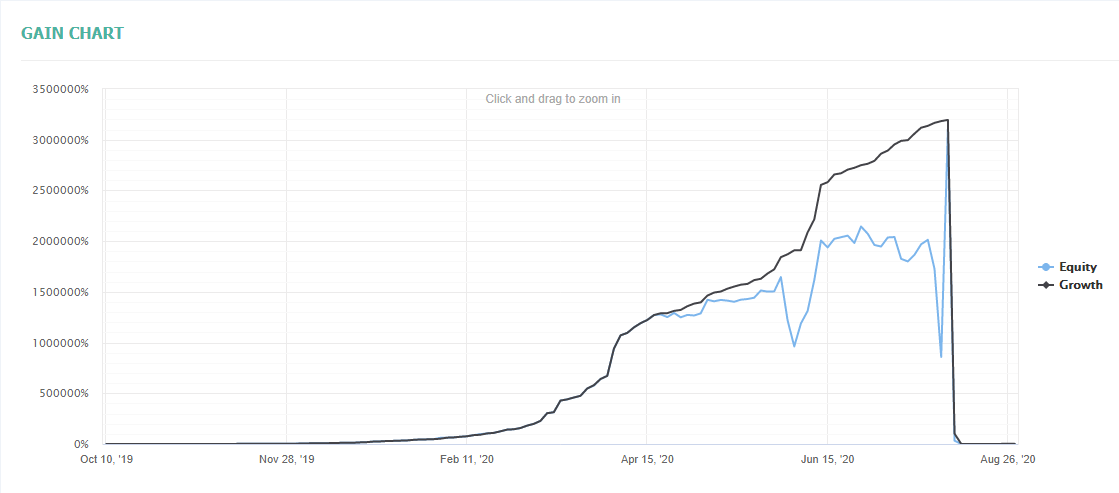

Let us look at another snapshot.

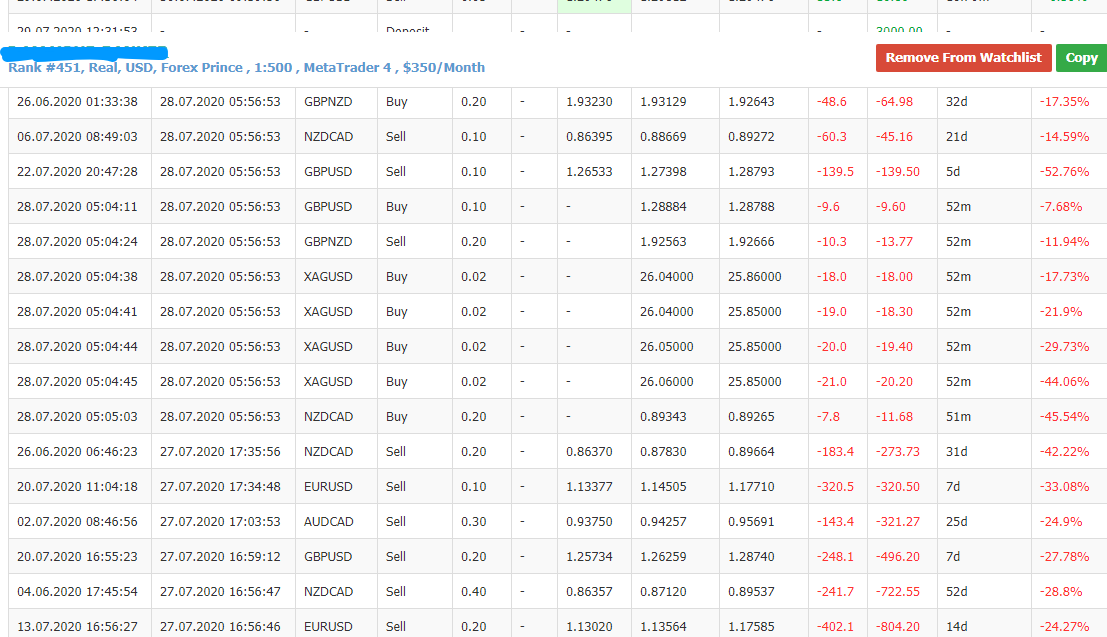

This is a snapshot of a particular signals provider, whose identity has been blocked for privacy reasons. We can see a gain of 1,312,201.75%! Are you kidding me? A trader who has made more than 1 million percent in gains? Another look at the trade details may reveal a stunning run of profits, which may justify the $350 monthly price tag.

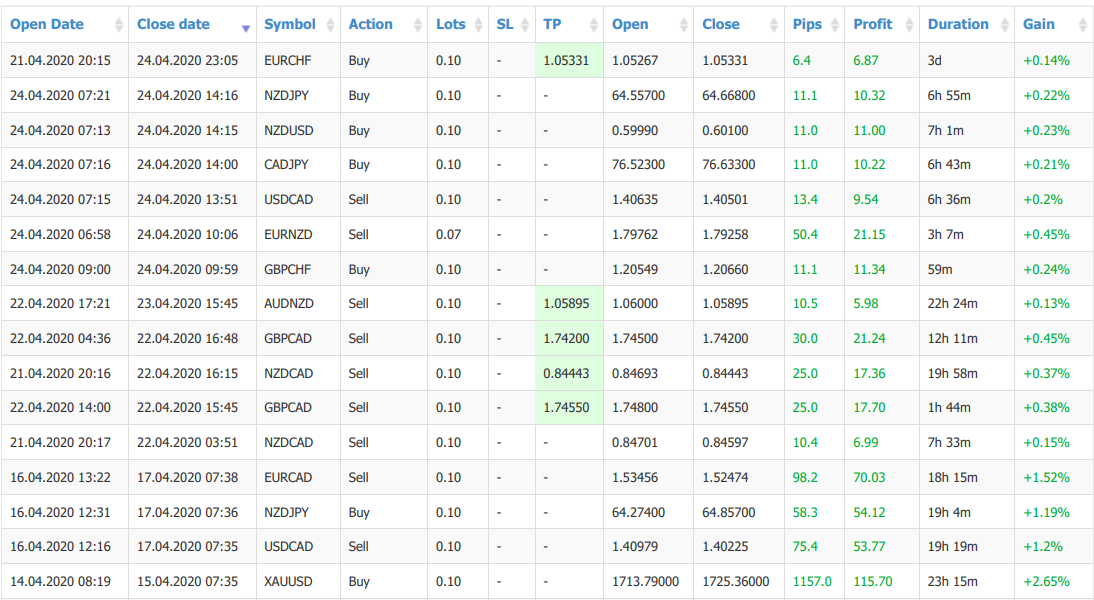

Individual Trade Performance for April 2020

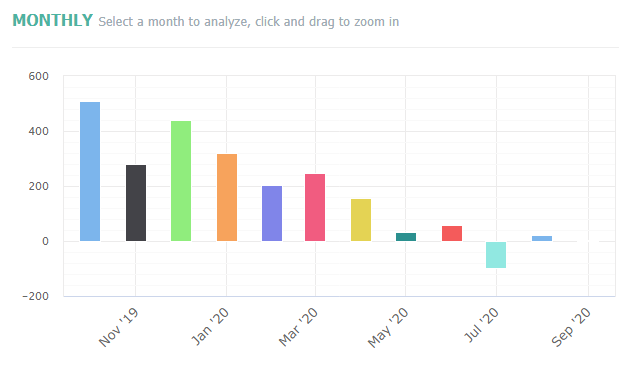

Monthly Profit Profile

Nearly every trader would immediately subscribe for this service without thinking. But there are some crucial pointers which many would have missed that led to this account's eventual collapse in a crazy two weeks of trading in June 2020.

Chart Showing Sudden Profit Drop

The Same Account, Now Amassing Losses

This account was decimated, and the Signal Provider had to recapitalize it. What went wrong, and how should a Follower mitigate against this occurrence?

Things were looking good initially, but there were a lot of worrying signs. The first indication that things were not really right was the fact that:

With no stops, the losing positions only got bigger, and they began to wipe off profits already banked very quickly. You can also see that after recapitalizing the account, the Signal Provider is already repeating the same mistake even though he has several successful trades. Look at the area encircled with the red marker in the snapshot below: he already has losing positions that are nearly 13% of his account equity.

So you must:

These subtle data are things that Followers must look out for all the time to avoid making mistakes.

The moment you start seeing signs of a Signal Provider’s performance starting to fail, please unsubscribe and follow another provider. Also, when a trade has been set, you may have to adjust the settings to prevent too many trades being opened on your account.

The answer is yes. Smart and careful traders do tend to make consistent profits. You need to operate with a copy trading engine that can help you with advanced statistics that others do not give. Avoid Signals Providers who fail to use stop-loss protection on their trades, or who have so many open trades at once that run into several days. Avoid Providers whose profitability graphs have started to plateau or drop off. Look at the account growth pattern and the pattern of trading. Is there an element of risky trading or overexposure involved? You need to check these.

Finally, understand that copy trading will cost you money in sign up fees as well as subscription fees. Make sure that the monthly historical profitability shows that the Signal Provider's trades generate enough profit to cover the costs of using the service.