Crypto has revolutionized the financial world, offering far faster and cheaper borderless transactions than what has traditionally been possible. However, with its rise in popularity, the number of crypto scams has also increased. From Ponzi schemes to phishing scams, the crypto space is rife with fraudulent activities that target unsuspecting investors. In this article, we'll explore some common crypto scams and provide practical tips for how you can identify and avoid them.

Perhaps the most common type of crypto scam, Ponzi schemes present themselves as projects with high returns on investment with little to no risk. In reality, returns are paid using funds from new investors, creating a cycle of dependency, and the project has no real revenue-generating use cases. Eventually, the scheme collapses, leaving the majority of investors with significant losses.

One of the best-known examples of a Ponzi scheme in crypto is BitConnect, a project that gained huge popularity during the crypto mania of 2017.

BitConnect was one of the best-known Ponzi schemes in crypto.

In short, BitConnect was a crypto lending platform that promised investors high daily returns through its lending program. Investors were encouraged to exchange their Bitcoin for BitConnect tokens and lend them to the platform in exchange for “guaranteed” profits. However, BitConnect's business model was unsustainable, relying on new investor funds to pay existing investors.

In January 2018, BitConnect abruptly shut down its lending and exchange platform, resulting in significant losses for investors and allegations of fraud from regulators.

Phishing scams involve fraudulent attempts to obtain sensitive information, such as passwords or private keys, by posing as a legitimate entity. Scammers often use fake websites or emails that mimic reputable exchanges or wallet providers to deceive users into disclosing their personal credentials.

An example of a well-known phishing attack in crypto is the EtherDelta attack.

Known as a popular decentralized exchange (DEX), EtherDelta fell victim to a phishing attack in December 2017. Hackers created a fake version of the EtherDelta website and deployed a malicious smart contract to collect users' private keys and login credentials. Unsuspecting users who accessed the fake website and entered their information then ended up handing over control of their accounts to the attackers.

The phishing attack resulted in the theft of users' funds and raised concerns about the security of decentralized exchanges in crypto.

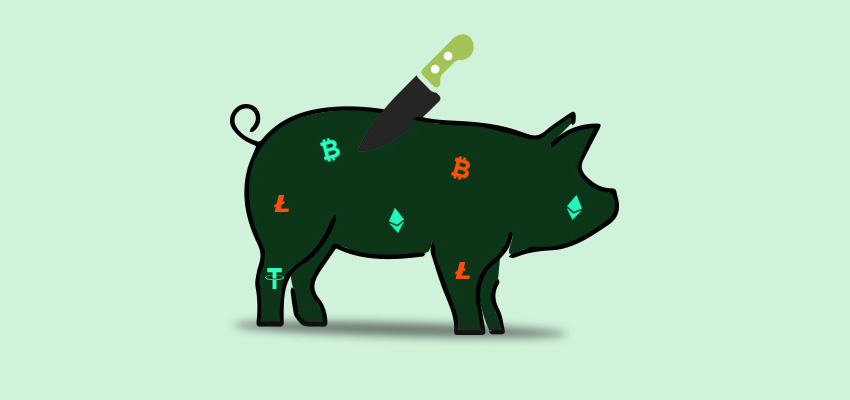

A relatively new but increasingly prevalent form of crypto scam is known as the "pig butchering" scam. Originating in Southeast Asia where they are often orchestrated by ethnically Chinese gangs, these scams involve perpetrators gradually luring victims into fraudulent crypto schemes through online communication. Using social apps and dating platforms, scammers build trust with victims before persuading them to invest in fake crypto projects.

Pig butchering scams have received attention from blockchain intelligence firms like Chainalysis.

“Pig butchering” scam victims are often coerced into making increasing contributions, believing they are part of a legitimate investment opportunity. However, once victims realize they have fallen prey to fraud, their assets are typically stolen by the criminals (the “butchering” of the victim).

Before investing in any crypto-related opportunity it's important to conduct extensive research. Verify the legitimacy of the project, its team members, and the project's whitepaper. Look for red flags such as unrealistic promises of “guaranteed” returns or lack of transparency.

Be wary of investment opportunities promising unrealistically high returns with little to no risk. Remember the old adage: if it sounds too good to be true, it probably is. Exercise caution and skepticism when approached with such offers, and avoid investing more than you can afford to lose.

Always double-check website URLs and email addresses to ensure they belong to legitimate entities. Scammers often use slight variations of legitimate domain names or email addresses to deceive users. Look for HTTPS encryption and padlock icons in website URLs to confirm that the websites are authentic.

Choose reputable crypto wallets and exchanges that prioritize security measures such as two-factor authentication (2FA) and that are transparent about their security practices.

Avoid storing large amounts of money on crypto exchanges, and instead opt for reputable self-custodial wallets. Using a hardware wallet is the preferred option for long-term storage of large amounts in crypto.

Stay informed about the latest trends and developments in the crypto space by following reputable news sources and forums. Educate yourself about common scams and warning signs to enhance your ability to identify and avoid fraudulent activities.

As the popularity of crypto continues to grow, so too does the prevalence of scams that target unsuspecting investors. By understanding common crypto scams and following the tips in this article, you can protect yourself from falling victim to these frauds. Remember to exercise caution, conduct thorough research, and prioritize security at all times when navigating the crypto landscape.