There’s no doubt crypto trading can be lucrative. We’ve all heard the stories of successful investors who bought into coins like Bitcoin early on, and are now sitting on massive digital fortunes. And while these stories certainly exist, it’s important to know that there are also many stories of lost fortunes in the world of crypto, some of which are due to bad trading and gambling-like behavior in the markets.

To navigate the volatile crypto markets successfully, traders need both effective strategies, disciplined execution and proper risk management. In this article, we'll explore some essential crypto trading strategies along with practical tips to help you maximize your chances of success.

One of the simplest but still most effective strategies in crypto is “hodling,” or what some in the crypto community will say stands for “hold on for dear life.”

As the name implies, this strategy involves buying a coin and holding onto it for the long term, regardless of short-term price fluctuations. Put simply, hodlers believe in the long-term potential of their chosen cryptocurrency and aim to capitalize on its growth over time.

Similar to how you would invest in the stock market, there are two ways to go about a hodl/buy-and-hold strategy: making a one-time lump sum investment or dollar-cost averaging.

Investing a lump sum into a cryptocurrency involves purchasing a significant amount of the asset at once and holding onto it for the long term. This strategy is suitable for those who have done thorough research on the cryptocurrency in question and are confident in its long-term growth potential.

To be successful with this strategy, it's essential to choose fundamentally strong cryptocurrencies with actual use cases and experienced development teams. In addition, it can be wise to pick a coin that has demonstrated its staying power through more than one market cycle consisting of both a major bull and bear market.

Needless to say, it also helps to buy the coin at a price that is as low as possible, and at least try to avoid buying at market peaks.

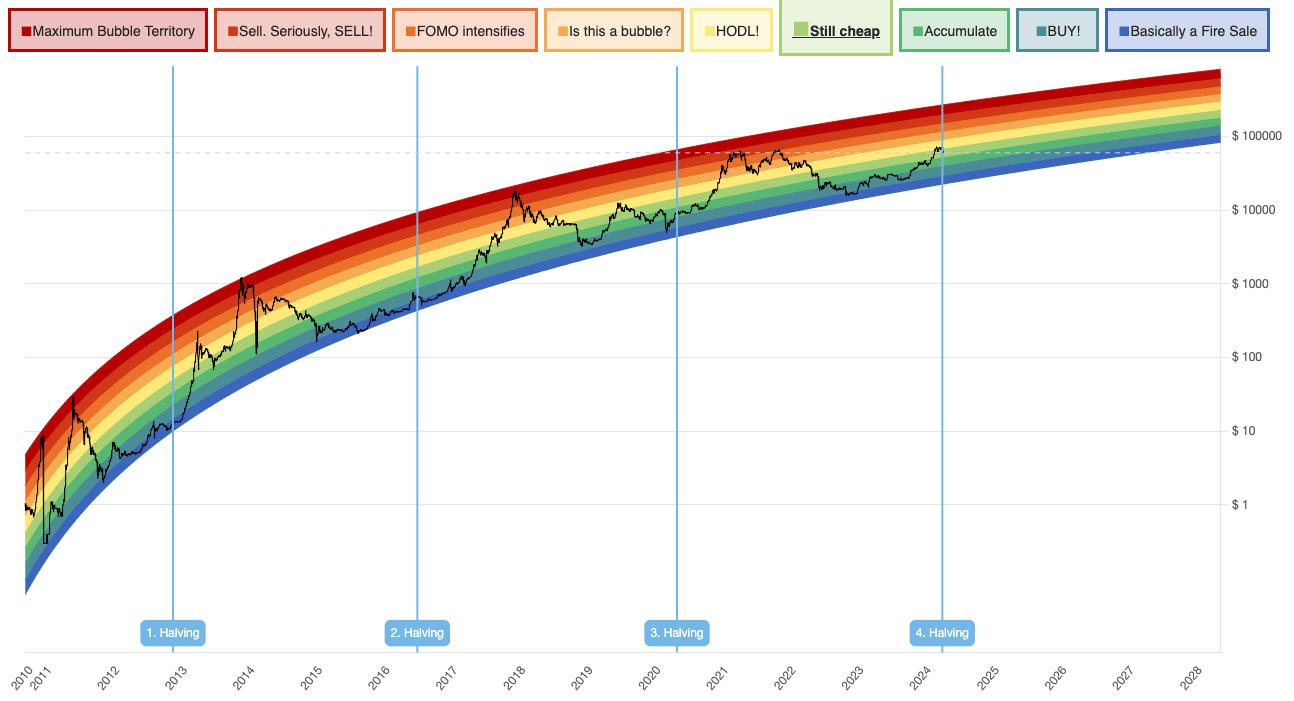

The Bitcoin Rainbow Chart. Bitcoin is an example of a fundamentally strong cryptocurrency that has survived through several market cycles and come back stronger every time.

DCA involves investing a fixed amount of money into a cryptocurrency at regular intervals, regardless of the price the coin is trading at. This strategy helps smooth out the impact of market volatility and allows investors to slowly build a position in the coin over time.

The DCA strategy is suitable for investors looking to build a position in a cryptocurrency without trying to time the market. It's particularly effective in volatile markets where prices fluctuate widely, which definitely is true for crypto.

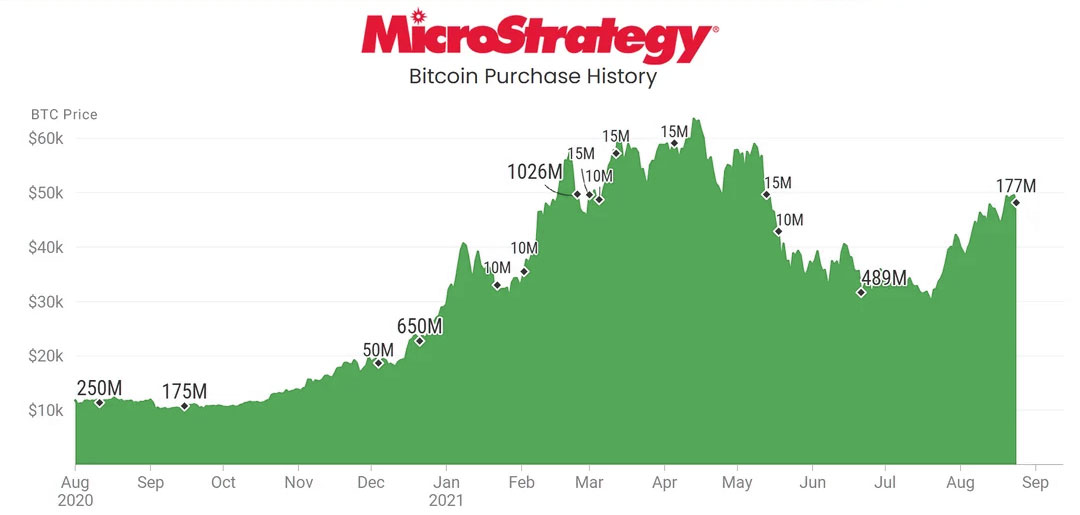

An example of a well-known entity that successfully has employed the dollar-cost average strategy on Bitcoin is the US company MicroStrategy. The company in August 2020 decided to adopt Bitcoin as its main reserve asset, and has over time since then added more and more coins to its holdings.

The strategy has so far worked out fantastically for MicroStrategy, which now holds Bitcoin worth billions of US dollars and ranks as the largest institutional holder of the cryptocurrency.

MicroStrategy is an example of a company that has successfully used the dollar-cost average strategy on Bitcoin.

While hodling is a very good strategy for accumulating long-term wealth in the markets, it may not be suitable for everyone. Some people are more restless, want faster profits, or simply want to be more actively engaged with the markets.

For these investors, day trading, defined as the buying and selling of an asset within the same day, may be a better trading style.

Common chart timeframes to use for day traders include the 1-minute, 5-minute, and 15-minute charts.

Broadly speaking, we can divide day trading strategies into three categories or trading styles: scalping, breakout trading and trend following.

Scalping is a day trading strategy that involves making quick, small trades to profit from minor price movements. Scalpers typically execute numerous trades throughout the day, aiming to capitalize on even the smallest price movements. This strategy requires quick decision-making, good timing, and the ability to react instantly to market changes.

Scalping is suitable for experienced traders who can handle high levels of stress. It’s also important to have access to advanced trading platforms with low latency.

Example of a scalping strategy with entry and exit points on the 5-minute timeframe on Bitcoin.

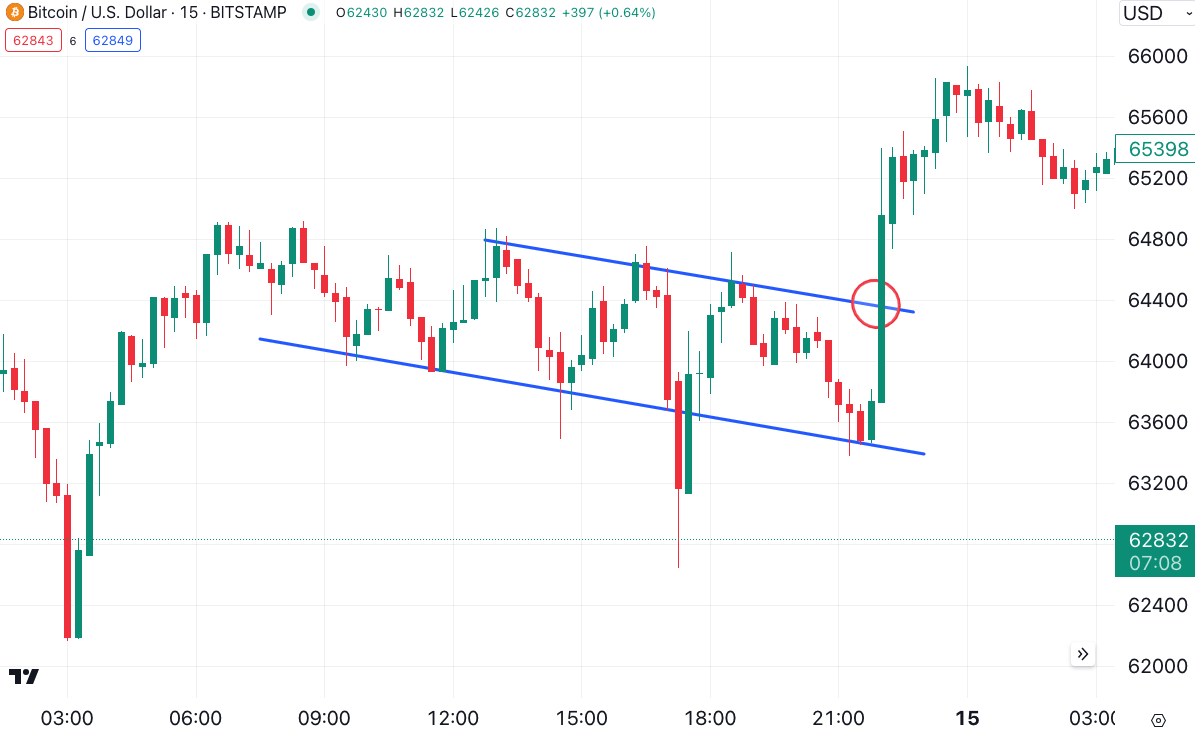

Breakout trading involves identifying key support and resistance levels and entering trades when the price breaks out of these levels with high volume. Traders look for strong momentum and volatility to confirm breakouts, and aim to capitalize on larger price movements than scalpers.

The breakout trading strategy is suitable for traders who can effectively analyze price charts and identify potential breakout opportunities. It requires patience, discipline, and the ability to carefully manage risk.

Example of a breakout trade on the 15 minute timeframe on Bitcoin.

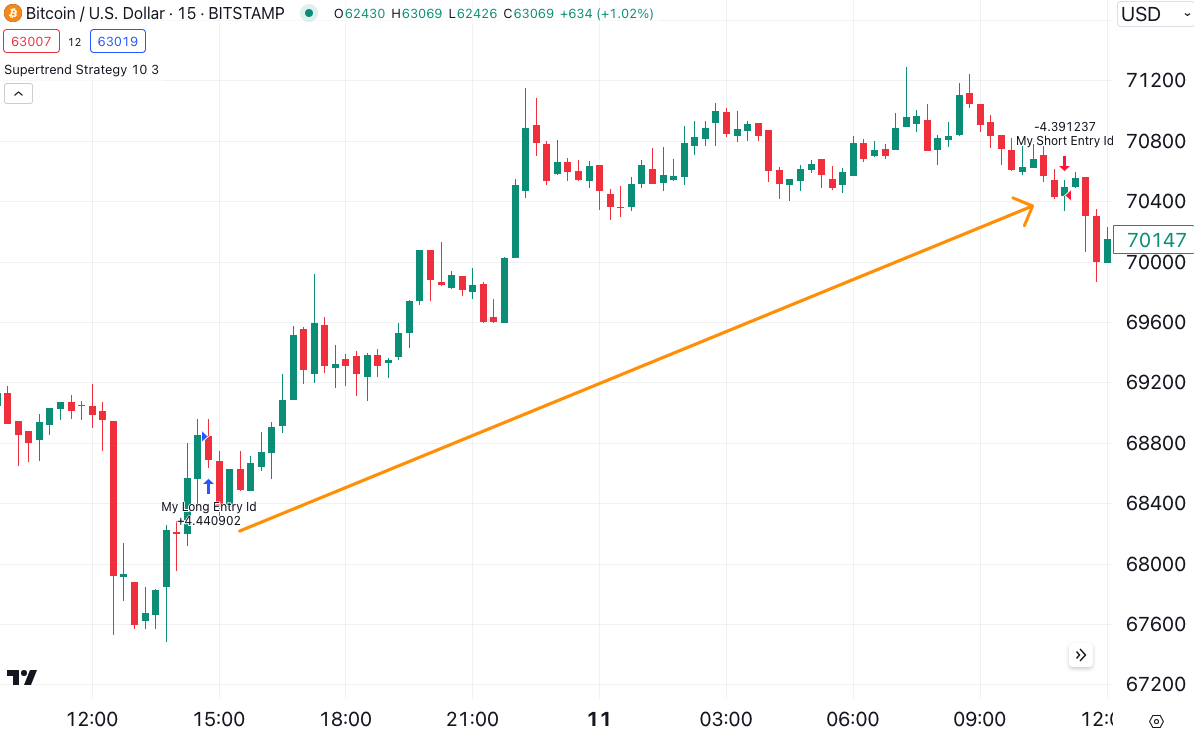

Trend following is a strategy that involves identifying and trading in the direction of established market trends. The strategy has been popularized by legendary traders like Ed Seykota, and it can be used both as a day trading strategy and as a longer-term trading strategy over weeks and months.

Trend following traders look for clear and sustained price movements in one direction and enter trades to ride the trend until it shows signs of reversal. Trend following strategies often use technical indicators such as moving averages and trendlines to confirm trends and identify entry and exit points for their trades.

This strategy is suitable for traders who are experienced enough with technical analysis to identify trends and have the patience to wait for the right set-ups to appear in the charts.

Example of a trend following trade with entry and exit points.

Perhaps the most popular style of trading among retail crypto traders, swing trading involves making trades that are held for anywhere from a few days to weeks. Traders usually use the 4-hour or 1-day timeframe on their chart, and the aim is to profit from the obvious wave-like movements that can be seen on the chart.

As swing trading is a broad term that encompasses many different trading strategies, we will here discuss two common methods swing traders use to make decisions: support and resistance, and Fibonacci levels.

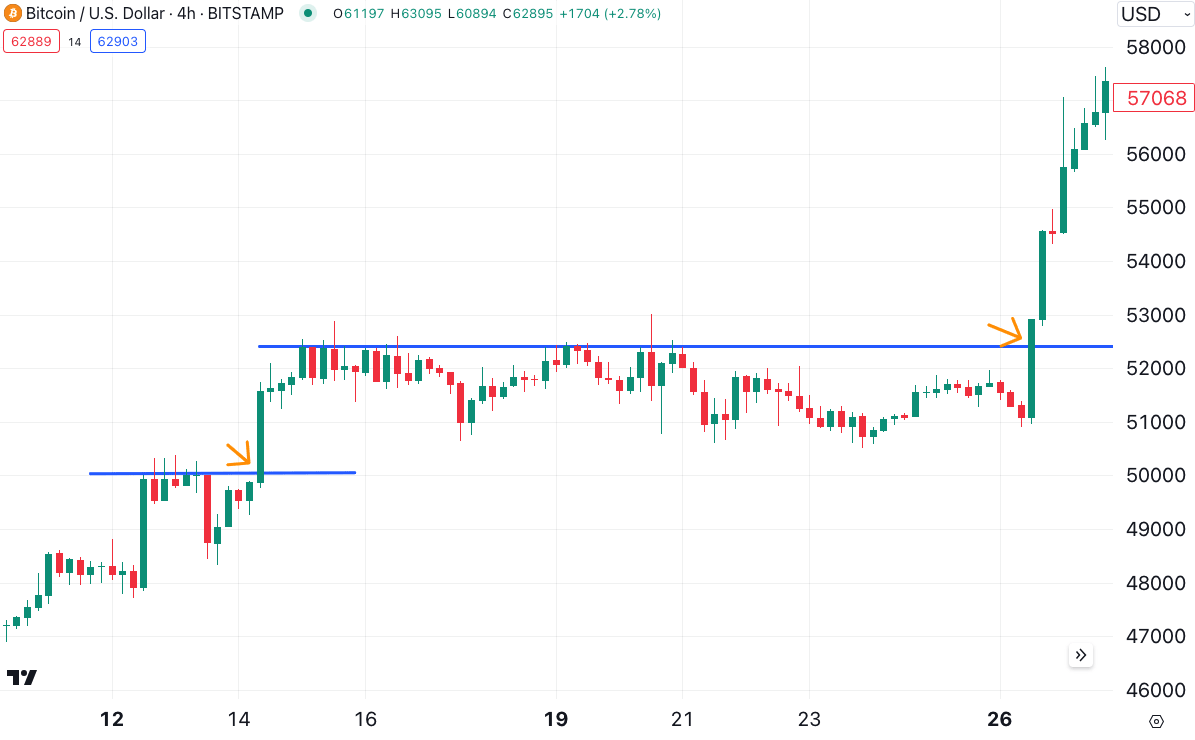

Some swing traders use support and resistance levels to identify potential entry and exit points for their trades. They enter positions when the price bounces off a support level or breaks through a resistance level, expecting the price to continue moving in the same direction.

This strategy is suitable for traders who can effectively identify support and resistance levels and are comfortable holding positions for several days to weeks.

Example of two resistance lines, with the breaking points representing trading opportunities on the 4-hour chart of Bitcoin.

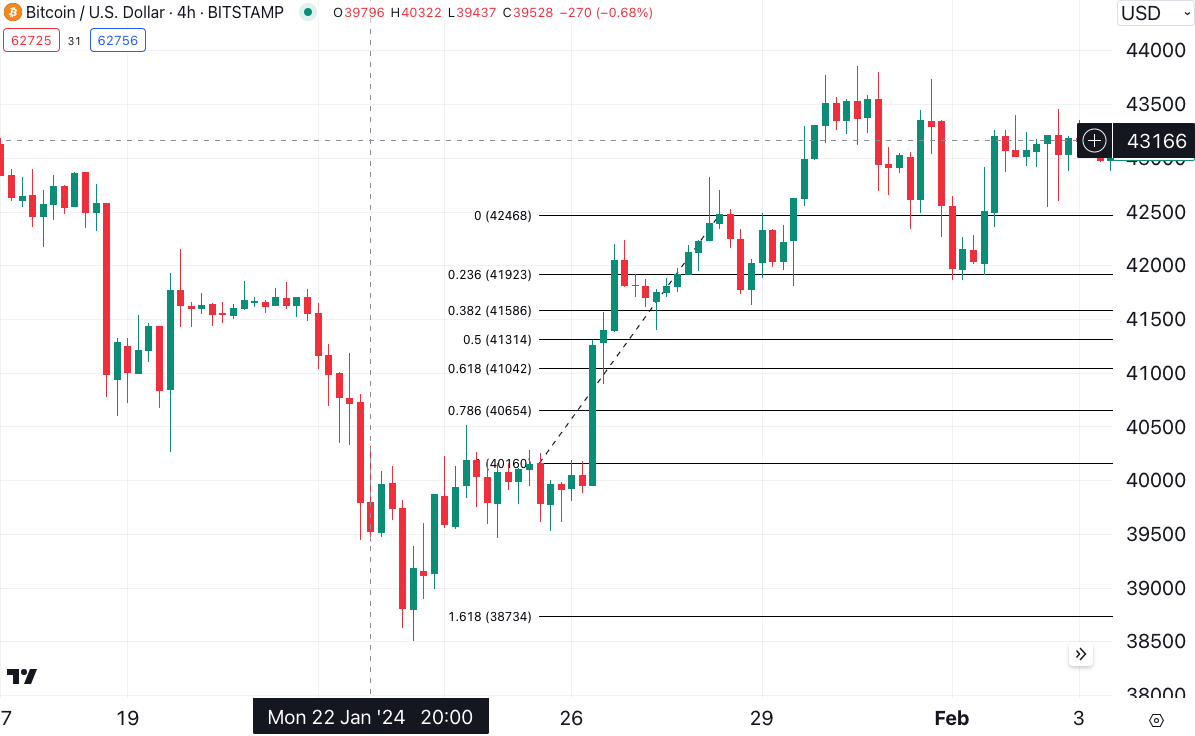

Fibonacci retracement levels are horizontal lines that indicate potential areas of support or resistance based on Fibonacci ratios. Swing traders use these levels to identify potential reversal points in a trend and enter trades accordingly.

Fibonacci retracement trading requires patience and discipline to wait for price to retrace to a Fibonacci level before entering a trade. This strategy is suitable for traders who can accurately identify trends and use Fibonacci retracement levels to time their entries and exits.

Example of a 4-hour chart with the Fibonacci tool.

In conclusion, it’s important to note that while crypto trading can certainly be lucrative, it’s absolutely necessary to have a solid trading strategy coupled with proper risk management techniques before jumping into the market. As with everything else, trading is a skill that can be learned, and proper preparation will undoubtedly increase your chances of success.

As the saying in the markets goes, failing to plan is planning to fail. That is also true in crypto.