Published: March 20th, 2025

Amid speculation that the Bank of Japan (BoJ) will continue to raise interest rates this year, the Japanese yen (JPY) remains in a bid tone against the US Dollar. Substantial wage increases may encourage consumer spending, which could, therefore, lead to inflation and provide the BoJ with leeway to further adjust its policy. The lower-yielding JPY is nonetheless supported by the resulting reduction of the rate gap between Japan and other nations.

The JPY's safe-haven reputation is further supported by geopolitical uncertainties and the uncertainty surrounding US President Donald Trump's trade policy. This adds to the intraday decline of the USD/JPY pair to the 148.00 region, while a slight increase in the US dollar (USD) helps prevent any losses.

Despite ongoing demand for safe havens and predictions of a BoJ rate hike, Japanese yen bulls continue to hold sway. At the conclusion of a two-day review conference on Wednesday, the Bank of Japan stated that prices and the economy of Japan are still unclear and chose to maintain its main policy rate at its current level.

BoJ Governor Kazuo Ueda stated during the press conference held after the discussion that the central bank aims to implement policies before they are outdated and that meeting an inflation goal of two percent is crucial for maintaining credibility over the long run.

As was largely expected, the Federal Reserve also indicated that it would probably announce two rate decreases of 25 basis points by the close of this year while holding interest rates constant for the second consecutive meeting.

Additionally, the Fed increased its inflation forecast. At the June policy conference, traders still believed there was a greater than 65% probability that the nation's central bank would continue its cycle of rate cuts.

Let's see the upcoming price direction of this currency pair from the USDJPY technical analysis:

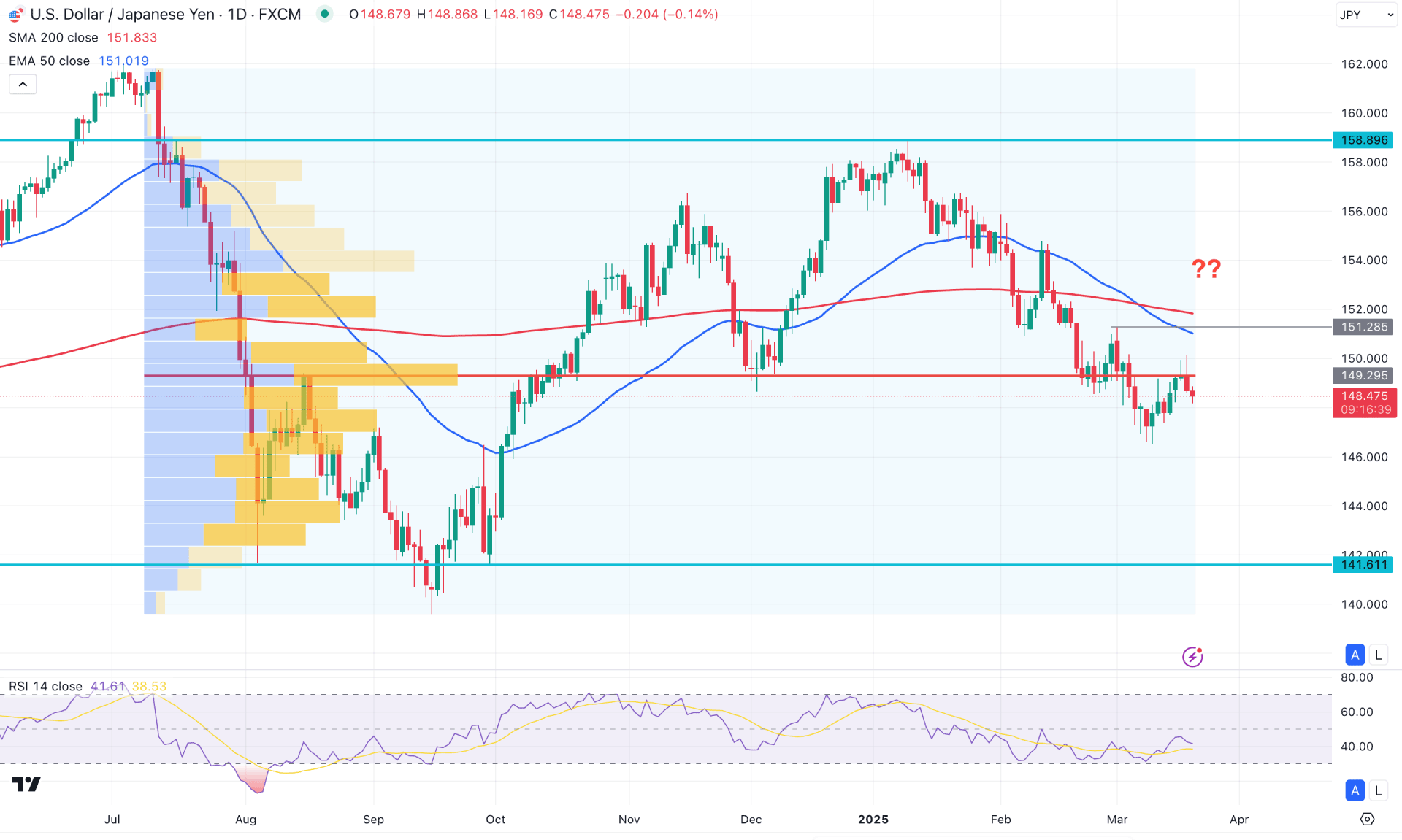

In the daily chart of USDJPY, a simple bearish trend-following opportunity is visible, as the current price is trading below crucial dynamic lines.

In the main chart, the 200-day Simple Moving Average is hovering above the current price with a bearish slope. Additionally, the 20-day Exponential Moving Average has crossed below the 200-day SMA, signaling a potential death cross formation. Since the current price is trading below the 50-day Exponential Moving Average, we may expect a bearish pressure as a death cross continuation.

Looking at the higher timeframe, the price shows the same structure, as the monthly candle has been bearish for three consecutive months. Moreover, the bullish body created in December 2024 has been eliminated, and the current price is trading at a yearly low. As long as the price stays below the 150.68 monthly opening, we may expect further downside continuation.

In the weekly timeframe, downside pressure is visible, as the current price is trading in a bearish continuation pattern after an engulfing candlestick formation.

Looking at the volume structure, the price is trading below the high-volume line spotted at the 149.29 level. As the most recent daily candle is trading bearish below this key level, the primary anticipation is that the price will extend lower, continuing the downtrend.

Based on the daily market outlook for USD/JPY, the current selling pressure from 158.89 is likely to extend and create a new support below the 146.60 swing low.

On the other hand, the 200-day SMA would act as a crucial barrier to this momentum. In that case, any immediate recovery above the 152.00 level, with the Relative Strength Index (RSI) above the 60.00 level, could invalidate the bearish outlook. In such a scenario, bullish momentum might emerge, with the main target being the 158.89 level in the coming days.

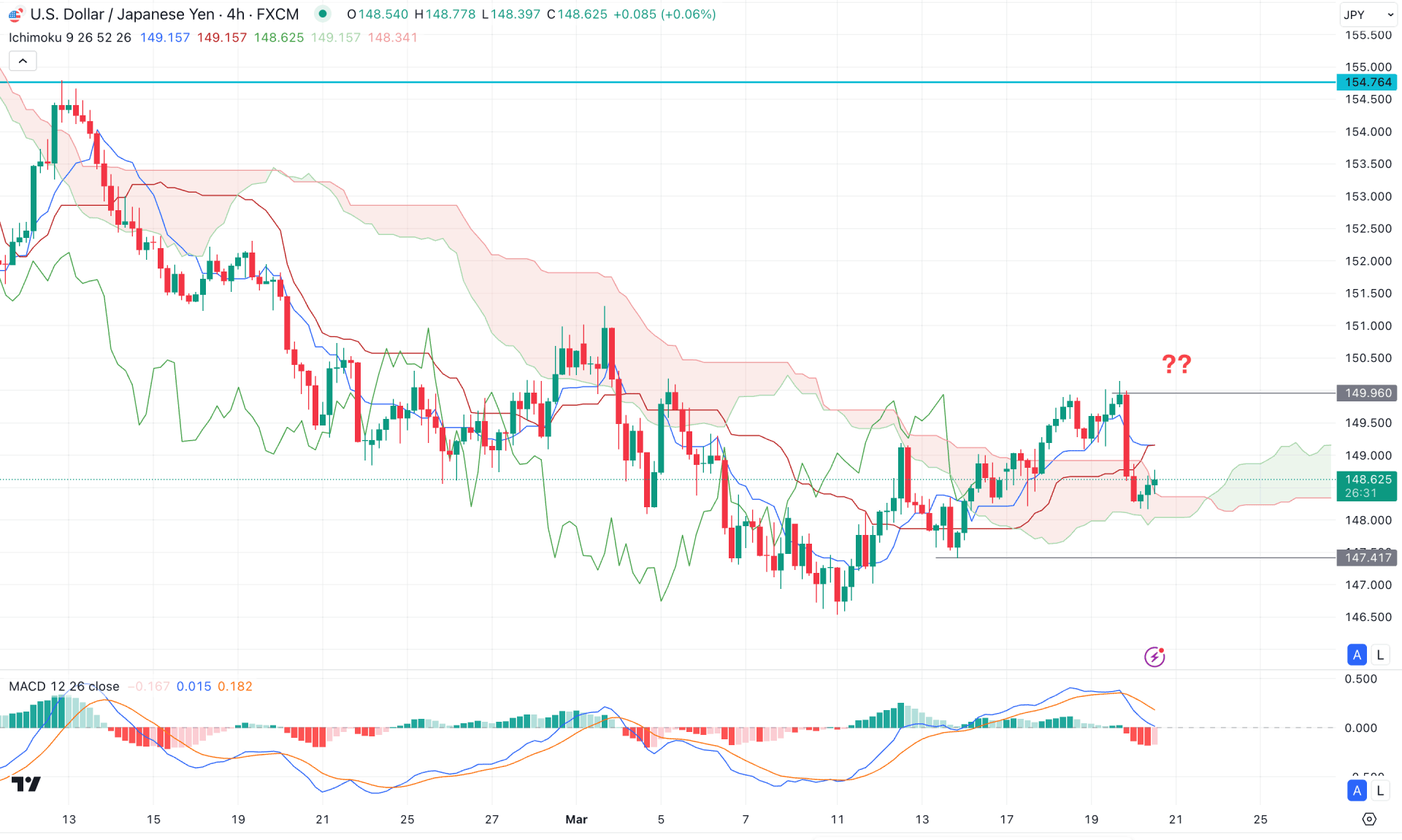

In the H4 timeframe, the ongoing market momentum is bearish, where the most recent price aimed higher above the cloud area but failed to hold the pressure. After creating a top at the 150.18 level, the price showed an immediate bearish reversal. However, the cloud support is still protected and a downside pressure below this zone is needed before confirming the downside continuation.

In the secondary indicator window, a bearish crossover is already visible in the signal line, where the Histogram is hovering below the neutral point for more than a week.

Based on the H4 outlook of USDJPY, bullish momentum is possible after having a stable market above the Kijun Sen with a positive histogram. An H4 close above the 149.30 level could offer a long opportunity, aiming for the 151.00 level.

The alternative trading approach is to find a bearish pressure below the cloud low. An H4 close with a consolidation below the 147.70 level could lower the price towards the 145.00 area.

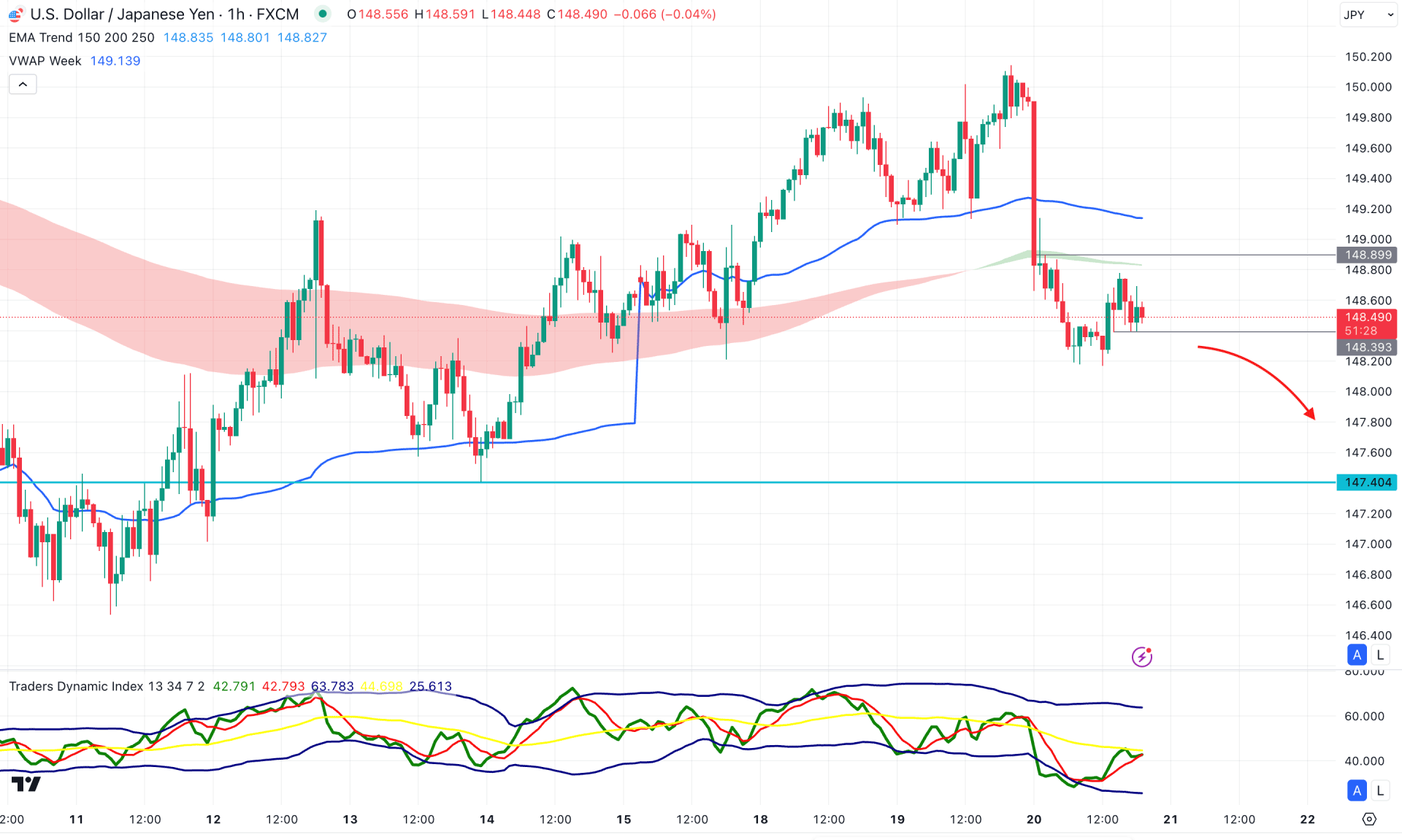

In the hourly time frame, a downside continuation is likely to occur as the current price is trading below the moving average area. Although the thickness of the moving average cloud is not solid, the dynamic weekly VWAP is also above the current price, signaling confluence selling pressure.

On the other hand, the Trader's Dynamic Index has reached the bottom and rebounded above the 45.00 level. Although the 50.00 level has not been breached, the bullish rebound from the overextended area could signal an upward correction.

Based on the hourly outlook, immediate selling pressure below the 148.39 level could trigger a short opportunity, aiming for the 147.40 support level.

Alternatively, a bullish recovery with further selling pressure from the VWAP level could offer another short opportunity. On the other hand, overcoming the 149.80 level with bullish counter-impulsive momentum could create another swing high above the 150.00 area.

Based on the current market outlook, USDJPY is more likely to extend the bearish pressure. However, the current price is in the order-building phase, as the high level is very close. In this case, investors might await a trend after identifying a potential range breakout.