![Tesla Stock [TSLA] Drops 12% – Another Opportunity For Bulls?](https://d3kvcd8uuqwmxt.cloudfront.net/filecache/articles_img/tech-analysis-main-page.jpg_825_618bddfb42fd06.82258033.jpeg)

Published: November 10th, 2021

Tesla Stock [TSLA] moved down by 11.99% on a single day as soon as the CEO proposed to sell 10% of his shares from the electric vehicle company. The drop is considered the largest fall of this stock after the 5% fall on Monday. However, the current price is still 47% up from a year ago as the company disclosed an improved automotive margin while the chip shortage is keeping other companies down.

On the other hand, some other board members of Tesla, including Elon Musk’s brother Kimbal Musk offloaded hundreds of millions of dollars worth of Tesla shares after reaching the market share at $1 trillion. Musk does not take any salary or cash bonus as a CEO, and most of his wealth comes from the stock price gains. The CEO has pledged about 92 million of his Tesla stocks for cash borrowing while some shares were used to pay down debts. The current reason for selling his investment might be to reduce the excessive tax bill and minimize some debts.

As a result, many analysts proclaim that the current sell-off in the Tesla Stock is temporary, and it should grow towards the $1400 level.

Let’s see the upcoming price direction from the Tesla Stock [TSLA] technical analysis:

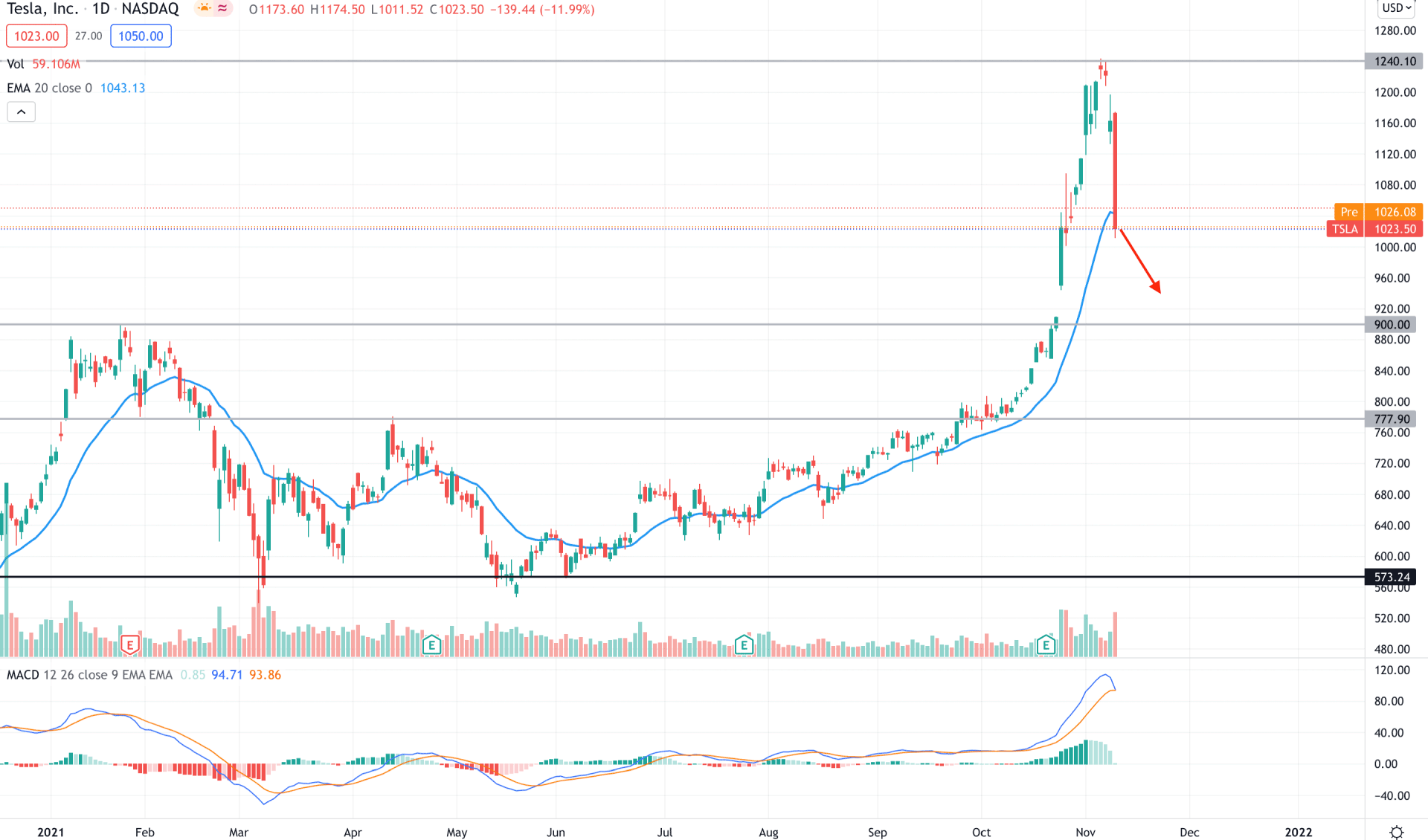

Tesla Stock [TSLA] showed an impressive gain over the past few years where the stock price moved above the 1,000 level with extreme bullish pressure. Later on, the bullish pressure extended to the all-time high level at 1243.44 without any correction. As a result, the price crashed down by 11.9% on a single day with a pure “pump and dump” scheme for the price.

If we compare the bullish and bearish pressure at the all-time high area, we would see that the eight-day bullish price action is eliminated in just three days, which is an alarming sign for bulls. Meanwhile, the volume remained higher during the price fall, and a bearish daily candle appeared below the dynamic 20 days Exponential Moving Average.

The above image shows how the MACD Histogram moved to zero level, while a bearish crossover at the MACD line is in play. Therefore, based on the daily context, Tesla Stock [TSLA] is more likely to move down towards the 900.00 event-level from where bulls should find a buying opportunity. In that case, a bullish daily close above the dynamic 20 EMA would extend the price towards the 1500.00 area in the coming days.

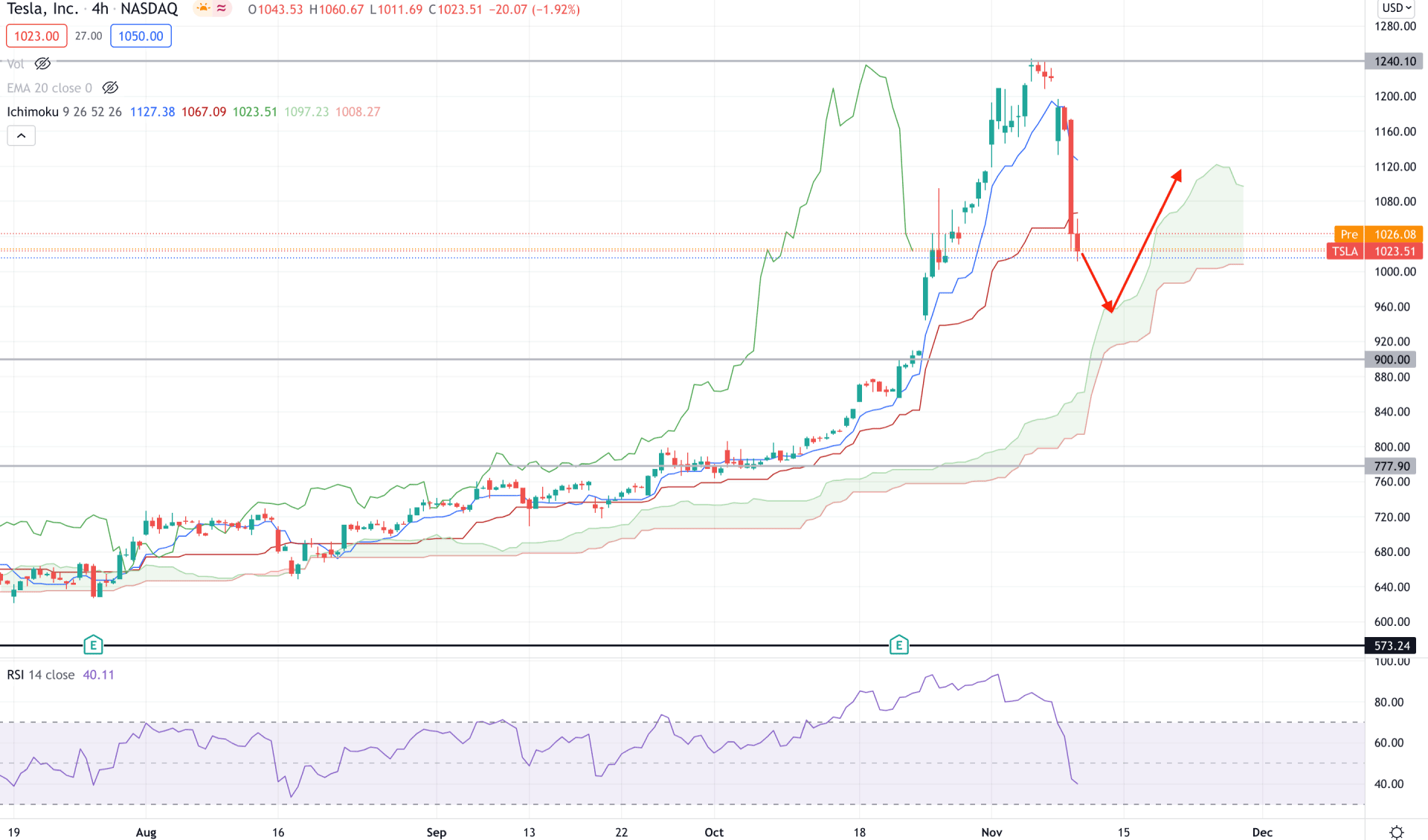

According to the Ichimoku Kinko Hyo, Tesla Stock is still within the bullish territory on the H4 timeframe. However, the most recent price moved below the dynamic Tenkan Sen and Kijun Sen with a massive selling pressure that may drag the price towards the Cloud Support level. Meanwhile, the Future Cloud is still bullish where the Senkou Span A is above the Senkou Span B.

The above image shows how the RSI is moving lower from the overbought level, where it may test the 30 areas soon with a bearish pressure in the price. Based on the H4 context, Tesla Stock is more likely to move down towards the 900.00 static support level from where a bullish pressure may come. However, any bearish pressure below the 900.00 level would be an alarming sign for bulls that may lower the price towards the 777.90 level.

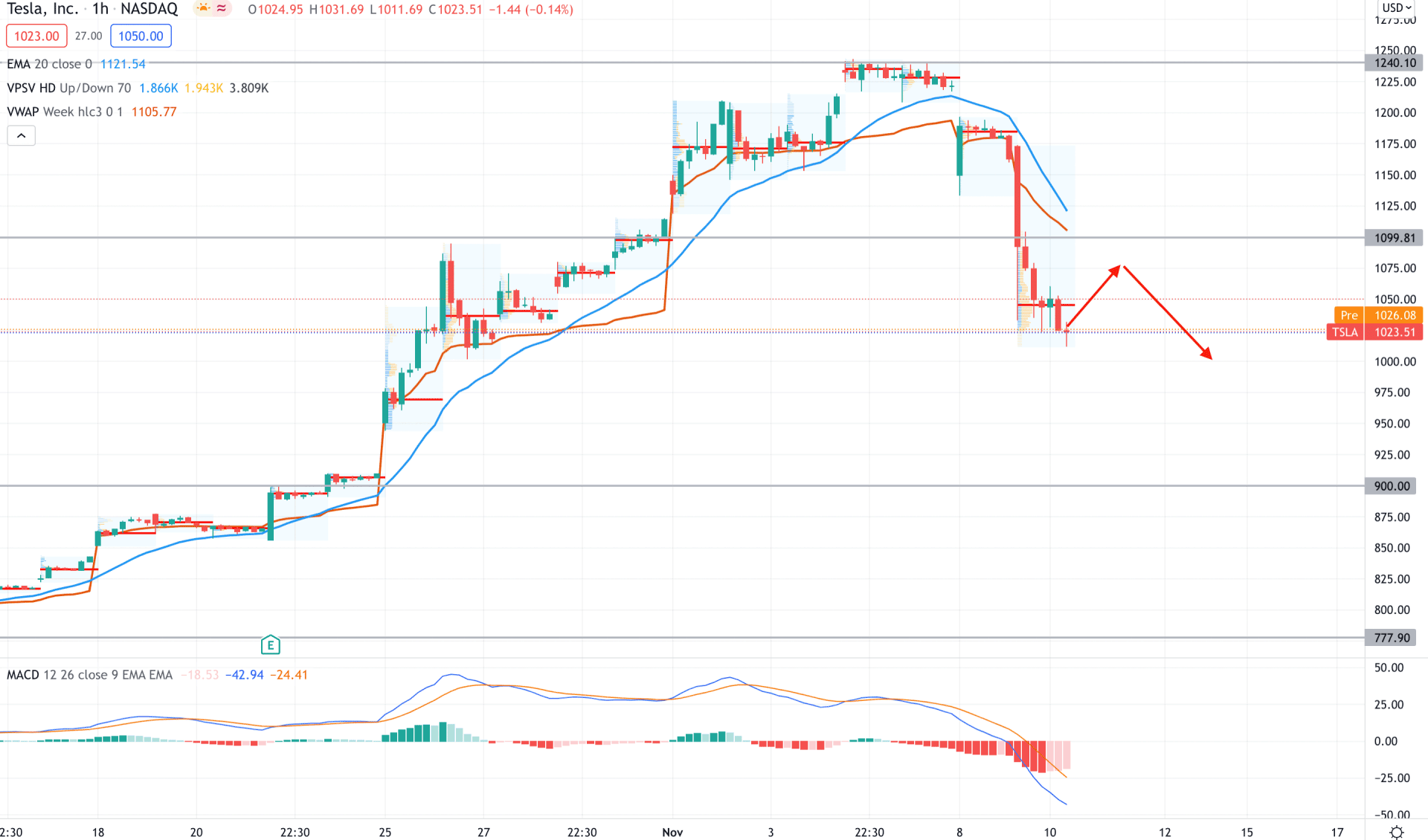

In the intraday chart, Tesla Stock [TSLA] moved lower below the 1100.00 intraday static level with a strong bearish pressure where the current price is below the dynamic 20 EMA and weekly VWAP. Moreover, the price made consecutive three lower lows in the intraday high volume levels, indicating strong selling pressure.

In the indicator window, MACD Histogram is bearish and correcting higher, where a new bearish Histogram would increase the selling pressure in the chart. Based on the intraday context, the overall market momentum is bearish as long as the price trades below the 1100.00 resistance level. In that case, the primary bearish target is towards the 900.00 area. On the other hand, a rebound and H1 close above the 1100.00 level may invalidate the current sentiment.

As per the current market condition, Tesla Stock [TSLA] has a higher possibility of extending the bearish pressure in the coming days. Investors should closely monitor how the price reacts on the 900.00 key support level. Any bullish pressure from the 950.00 to 900.00 zone with a bullish daily candle above the dynamic 20 EMA would be a good opportunity for bulls towards the 1500.00 target level. In that case, the invalidation level should be below the 900.00 level with some buffer.