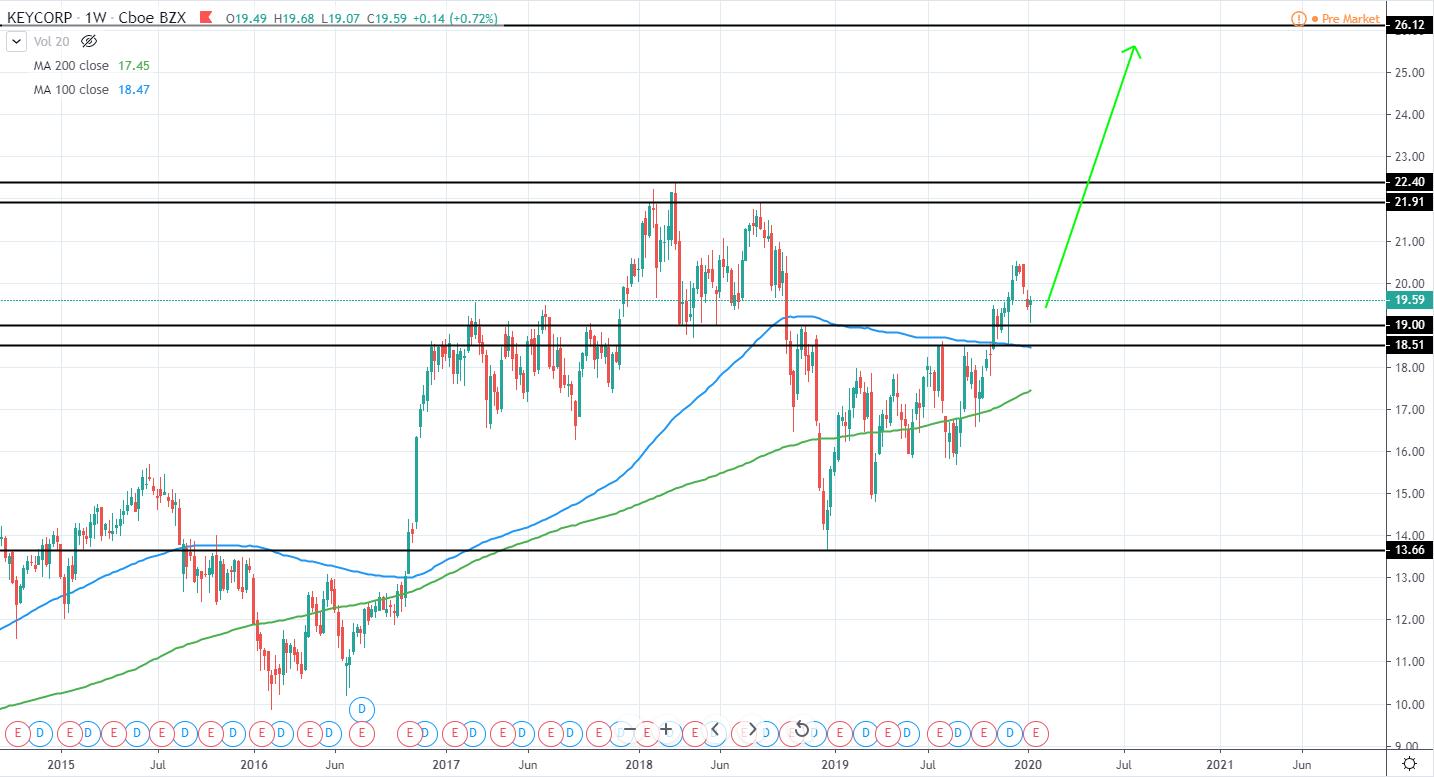

AutoZone, Inc. (AZO) currently trades around 1,154 USD with a market cap of 27.24B USD as it looks to reverse back to the upside after reaching 61.8% Fib retracement from the previous upswing as well as retesting minor support of 1,115 USD and the area between 100 and 200 day moving averages.

The overall trend still continues being very bullish for the past 2 years and since the previous high was considerably higher than the one before, we expect the bullish momentum to continue. Therefore, a long position can be taken right now in

the expectation that a new higher high will be set in the upcoming months, meaning a gain of at least 10.5% from the current price and likely even more.

AZO Daily:

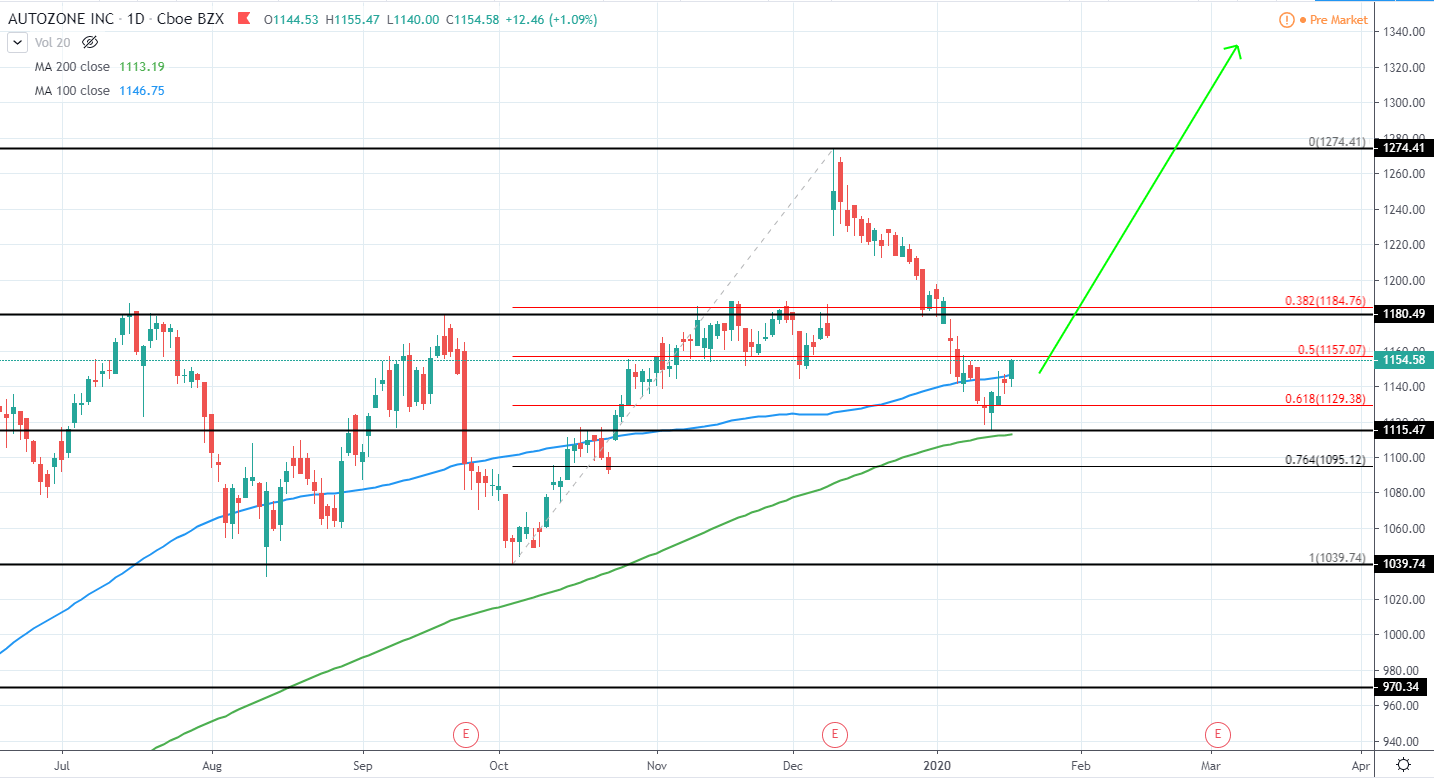

YUM! Brands, Inc. (YUM) currently has a Market Cap of 31.88B USD and trades around 105.4 USD as it closed very bullish last week after reaching 50% Fib retracement from the previous upswing in November and reversing around 97 USD – close to the 100-week moving average.

The overall trend continues being very bullish as the price continues setting higher highs with no indication of potential slowdown and the current retracement seems to have been completed. Therefore, a long position can be taken from the current price level with the expectation that a new significant higher high will be made in the upcoming months.

YUM Weekly:

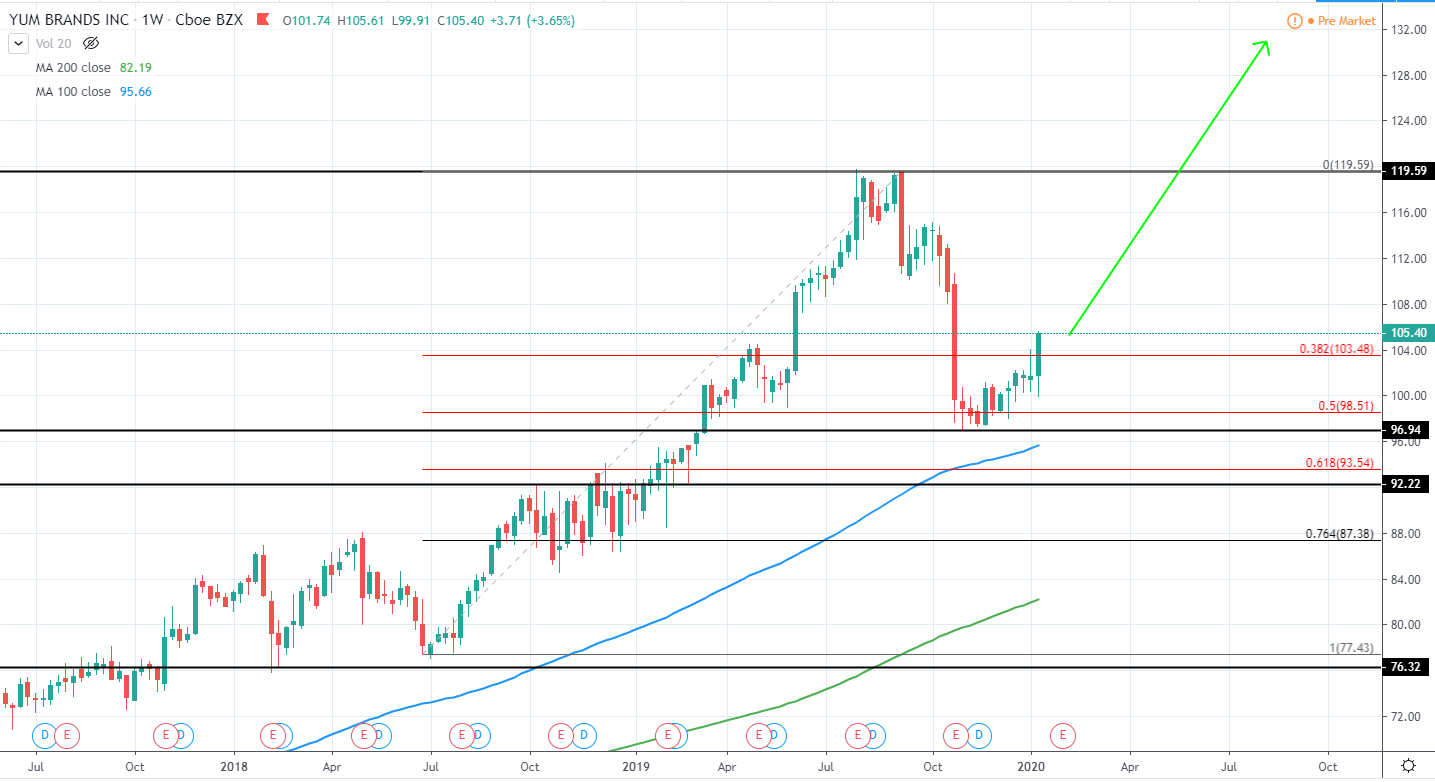

Public Service Enterprise Group Incorporated (PEG) currently has a Market Cap 29.9B USD and trades around 59.16 USD as it has retraced towards 58 USD support during the past months after a new all-time high was set around 63.68 USD.

The overall trend continues being very bullish for more than a decade now with no signs for an upcoming slowdown. Therefore, the current retracement and bullish close last week can be used to enter a long position once again in the expectation that a new all-time high will be made in the upcoming months with a potential gain of at least 7.5% if the current all-time high is reached.

PEG Weekly:

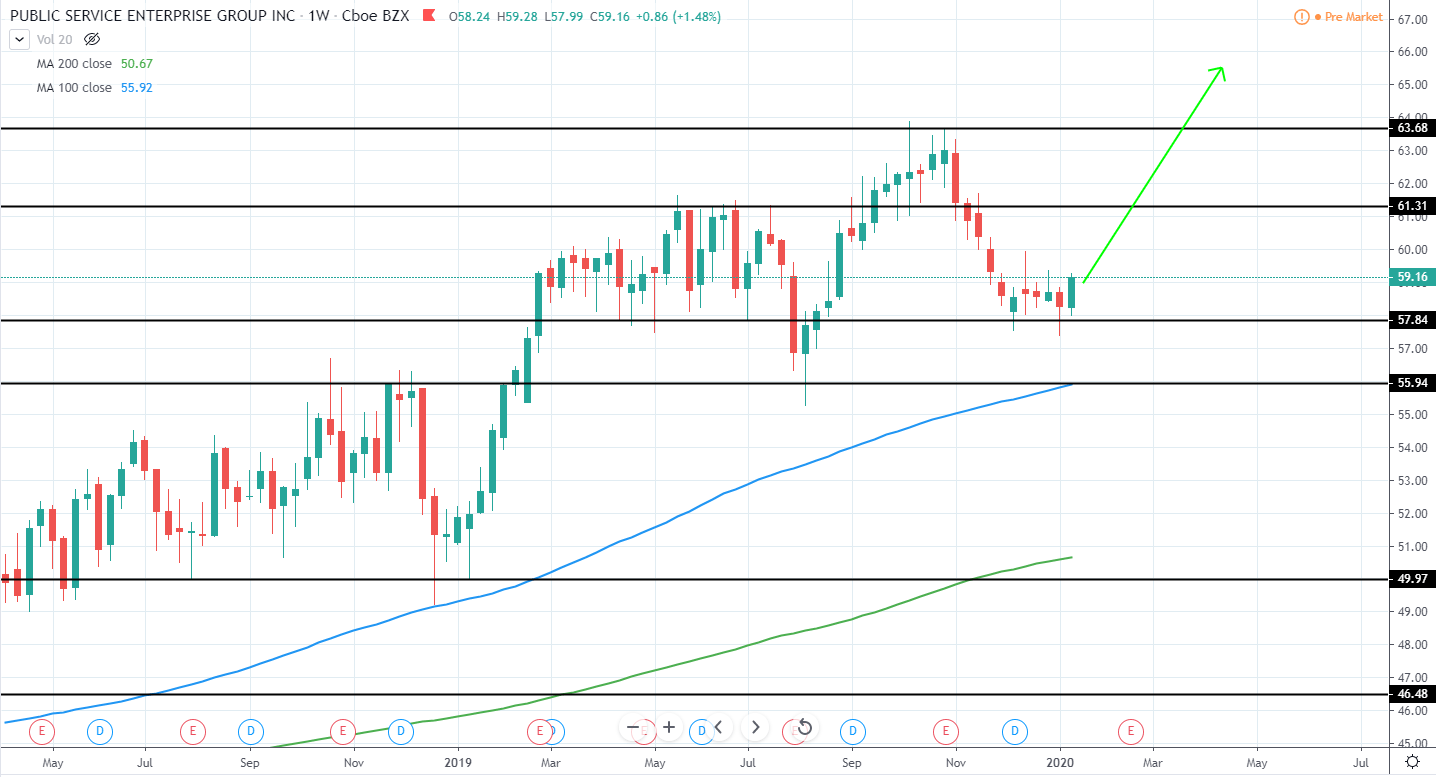

KeyCorp (KEY) currently has a Market Cap 19.29B USD and trades around 19.59 USD as it retested previous resistance around 19 USD as support and closed very bullish last week.

The overall trend has been bullish for the past decade as both higher highs and lows are continuously being made and currently the price looks to move higher once again after several months of consolidation was completed with a clear break above 19 USD resistance.

Therefore, a long position can be made from the current price levels in the expectation that a new several-year high will be made. A potential target can be seen around 26 USD and would mean a gain of around 33% from the current price.

KEY Weekly: