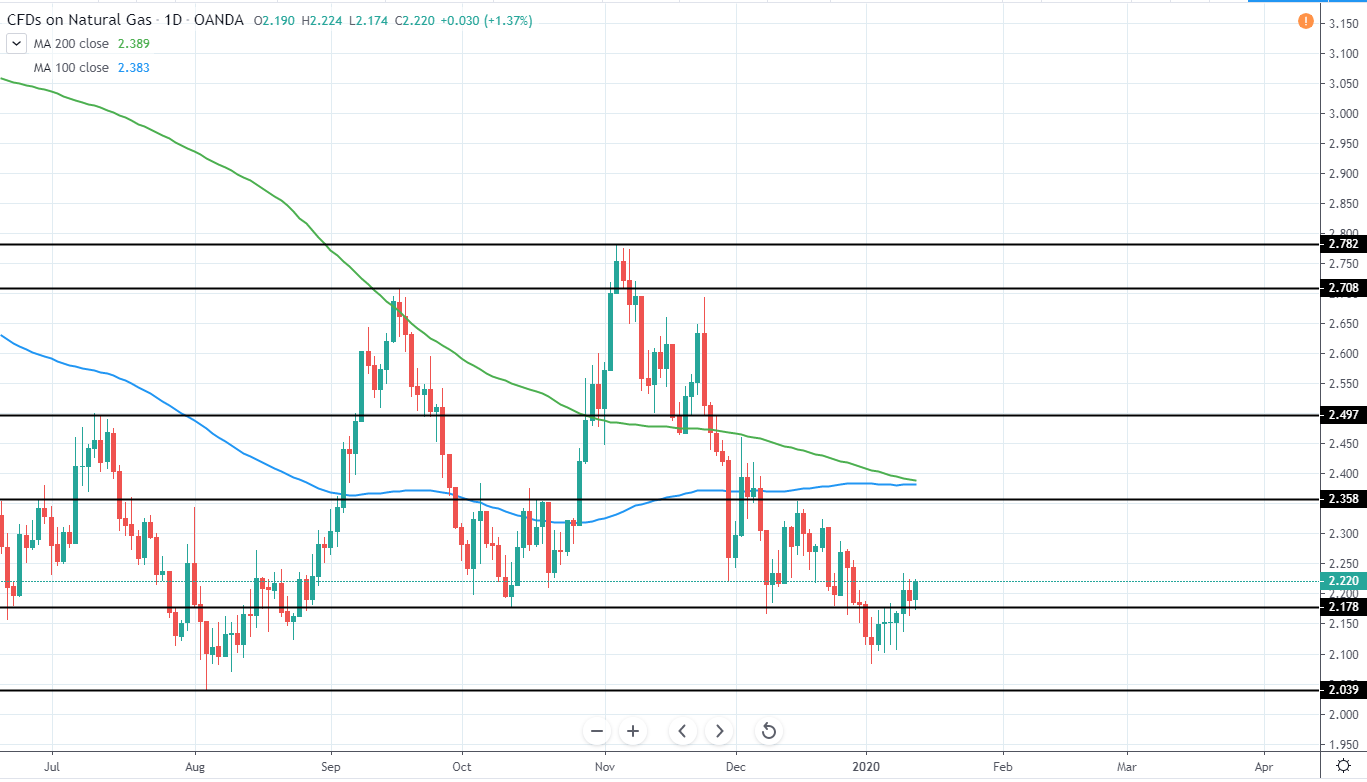

Gold has set another major high around 1611 USD on 8th of January after a very volatile move to the upside that was afterwards matched with even stronger rejection as the price closed very bearish. °

Since then we have seen further downside as the price looks to retrace the previous upswing from the low of 1445 USD to the high 1611 USD that resulted in a gain of almost 11.5%. The target for support can be seen around the previous highs of 1516 and 1532 USD in addition to 50-61.8% Fib retracement area around 1509-1528 USD.

Therefore, for now, it is best to stay neutral and wait for further price action development towards the support levels and first signs of a reversal back to the upside.

GOLD Daily:

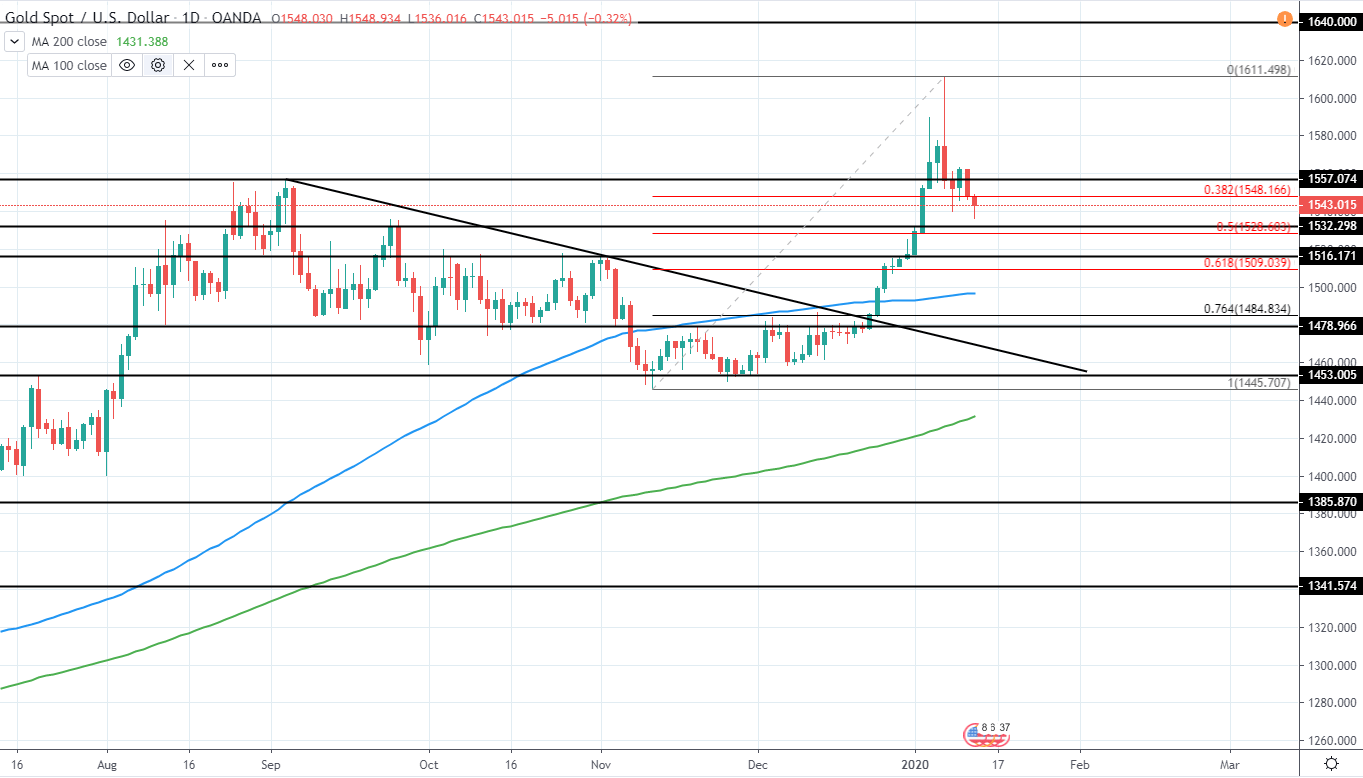

Silver has also made another higher local high as it peaked around 18.86 USD after reversing from a slightly lower low of 16.62 USD, which indicates that the current several month retracement is likely finished and further upside will be seen once the price completes the current retracement and sets another higher low.

A potential area where this could happen can be seen around 17.3-17.7 USD as it is the area where 50-61.8% Fib retracement area is located in addition to 17.32 USD previous support/resistance level as well as 100 day moving average blue line at 17.6 USD.

For now, however, it is best to stay neutral and wait for further price action development it the form of a new higher low that would confirm the potential attempt for trend reversal back to the upside.

SILVER Daily:

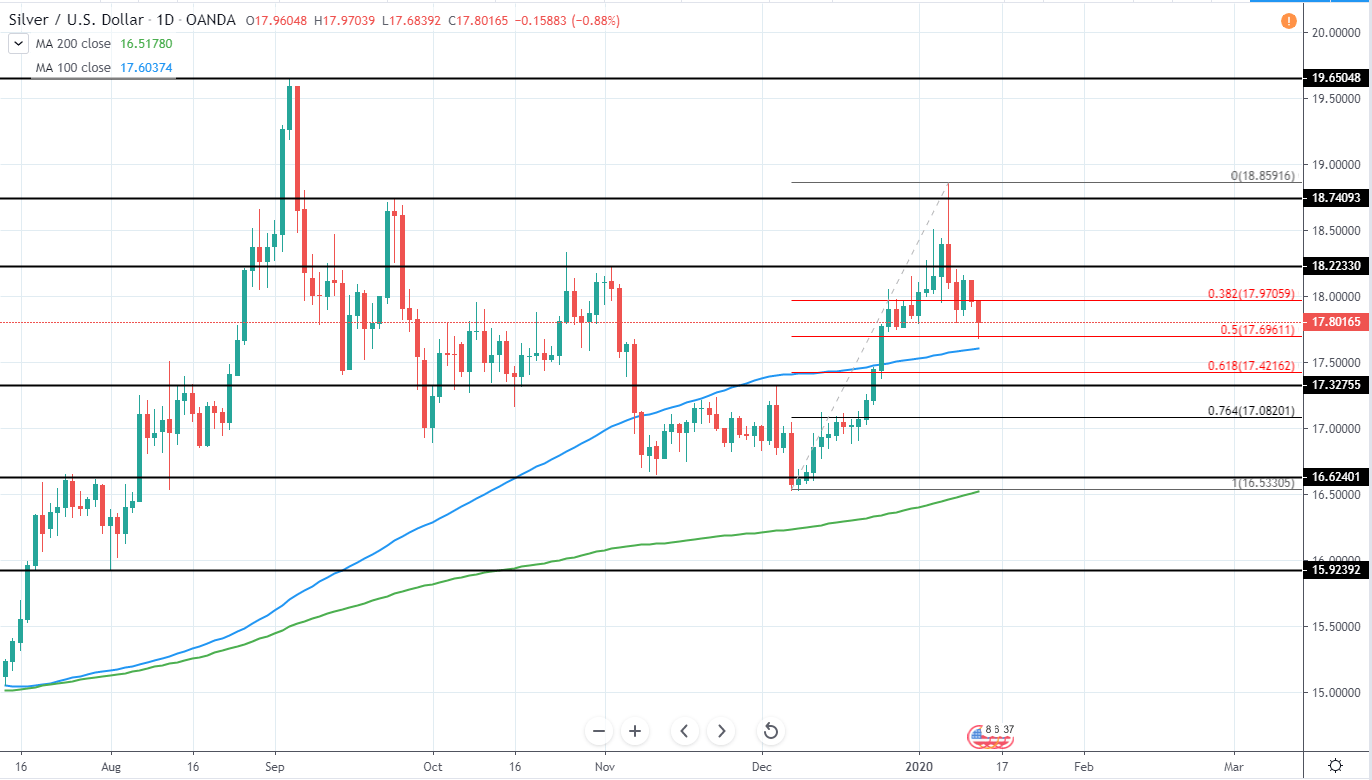

WTI has seen strong rejection to the downside during the past days as it peaked around the previously mentioned resistance area around 63.33-66.6 USD and set a higher high at 65.62 USD in a very volatile trading session.

Currently, the price has reached a minor support/resistance area around 58-59 USD and made a slight bounce from the 200 day moving average green line. This likely indicates that we could see some upside in the upcoming days as the price looks to retrace some of the downside and set a lower high before likely continuing to the downside even further.

Alternatively, this is another higher local low and could be potentially used in order to enter a short-term long position, however, considering how strongly the price rejected further upside at the beginning of January, caution is advised.

WTI Daily:

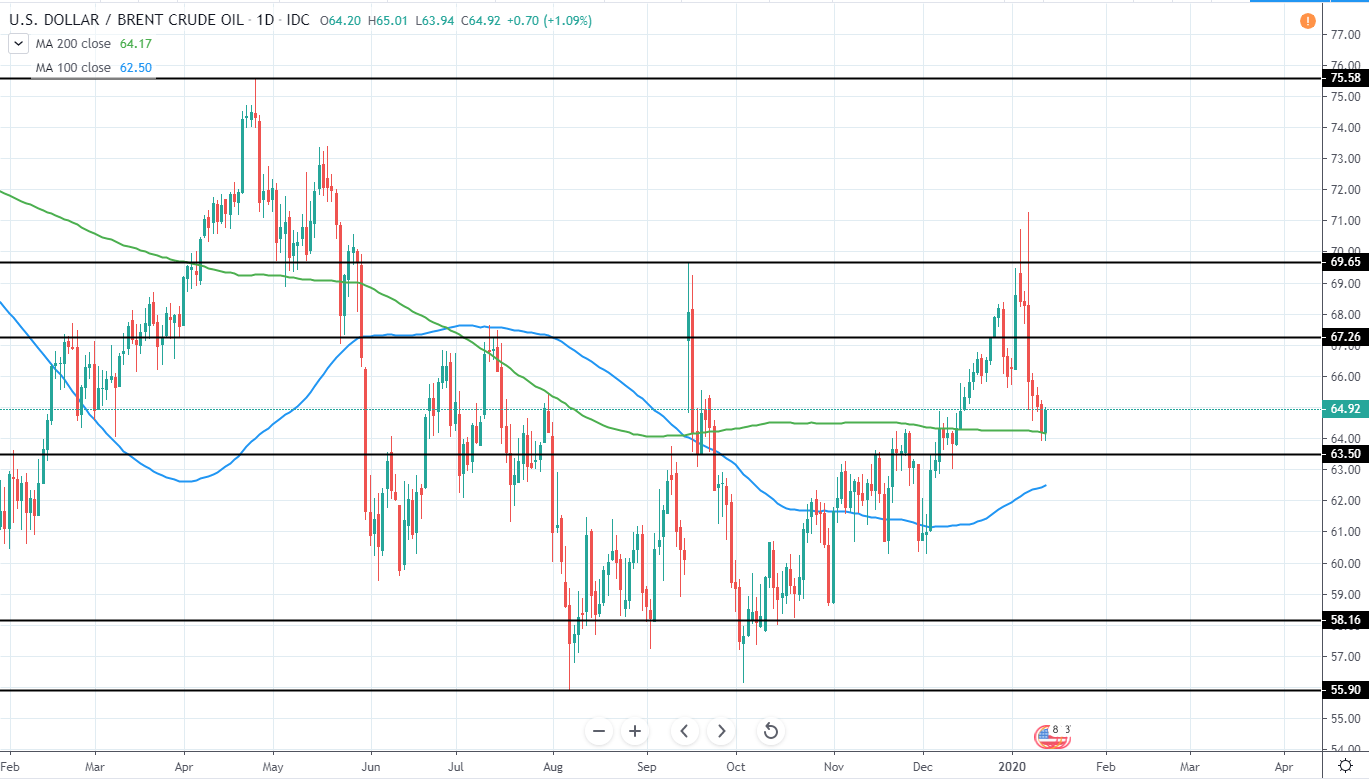

BRENT has had very similar price action as WTI as it set a higher high around 71.28 USD with 2 very volatile moves to the upside that were rejected both times shortly after.

Currently, the price has retraced towards 200 day moving average green line as well as support area around 63-64 USD and looks to close bullish for the first time in several days, potentially indicating another higher local low and another attempt to move higher.

Therefore, if the price can close clearly bullish, we expect further upside towards at least 67.5 USD minor resistance and possibly even further if bullish momentum does not lose its strength.

BRENT Daily:

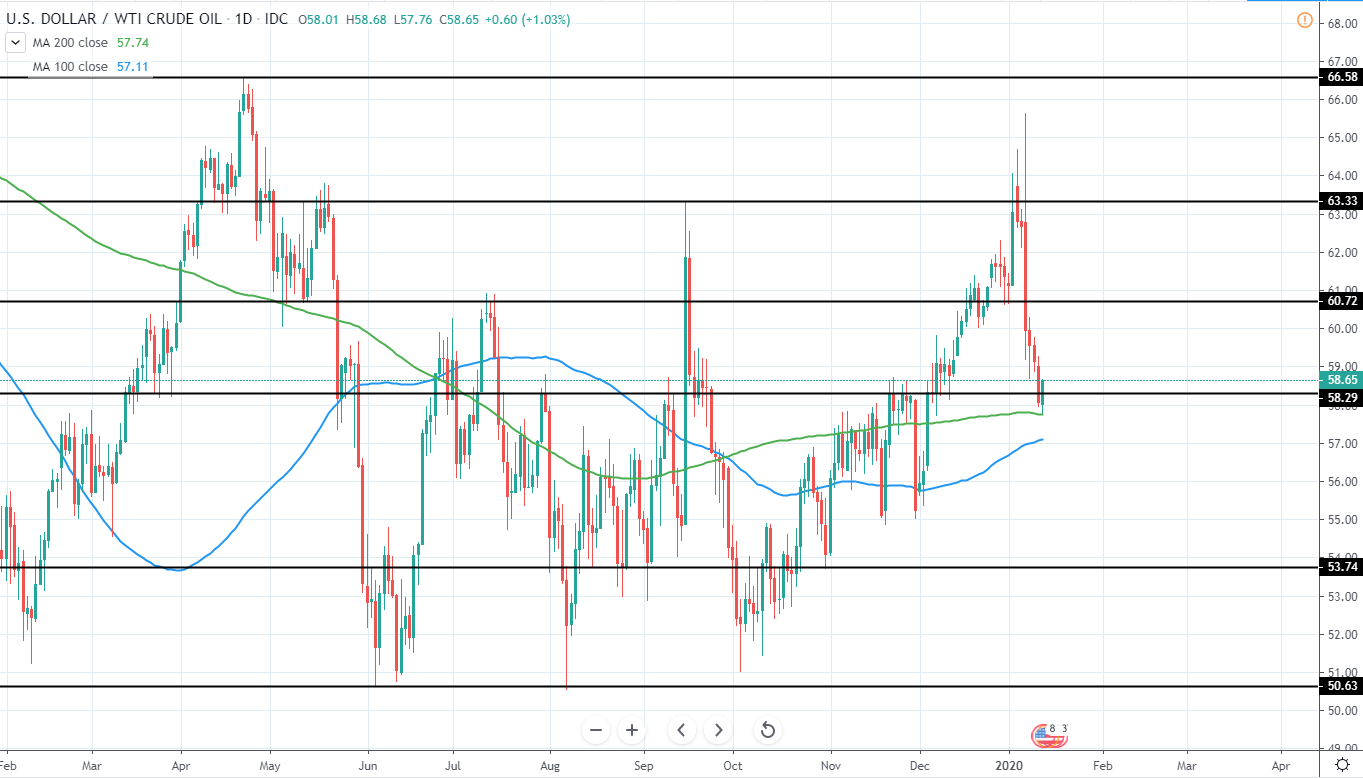

NAT GAS continues to consolidate around the previously set lower low around 2.1 USD and likely we will see further upside in the upcoming weeks as the current bearish momentum has come to an end and the price looks to retrace back to the upside.

Since the price also made a higher high during November, the overall trend is still unclear, however, we could look for another lower high to be set between 2.35 and 2.5 USD previous support/resistance levels with additional resistance likely provided by both 100 and 200 day moving averages, seen as blue and green line on the chart around 2.38 USD.

Until then, however, it is best to stay neutral and wait for further price action development.

NAT GAS Daily: