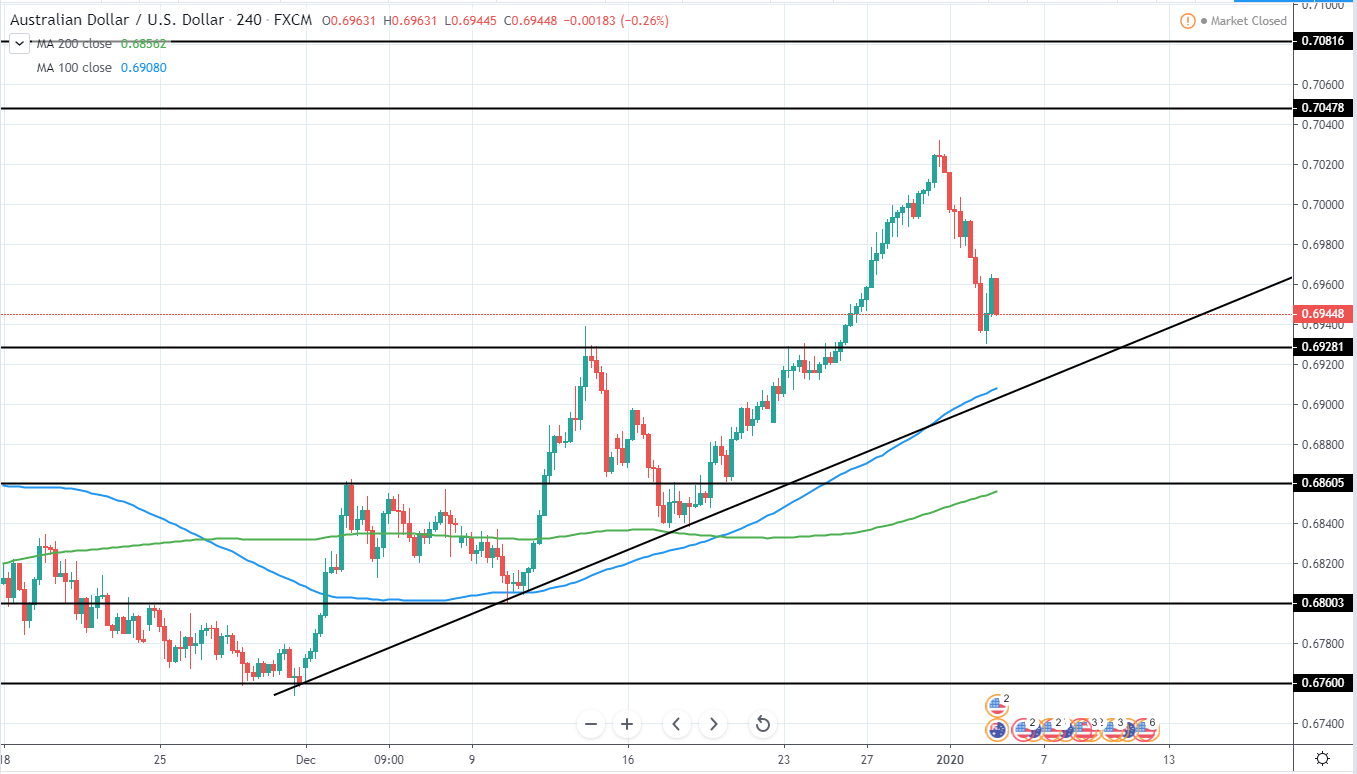

EUR/USD has set another higher high last week and peaked at 1.12393 USD, after which a retracement towards 200 day moving average was seen as the price retested previous high as a resistance.

On Friday we saw a decent rejection as the price closed back above 200 day MA, therefore, indicating that a new higher low around 1.1125 USD has been set and we will likely see further upside to come in the upcoming weeks. A long position,

therefore, can be entered, in the expectation that the next resistance around 1.133 USD will be reached this month with a gain of around 1.55%, meaning a very good risk/reward trade setup if a stop is placed below the 1.1125 USD low.

Therefore, we are bullish for the price of EUR/USD in the upcoming weeks and a long position could be entered.

EUR/USD Daily:

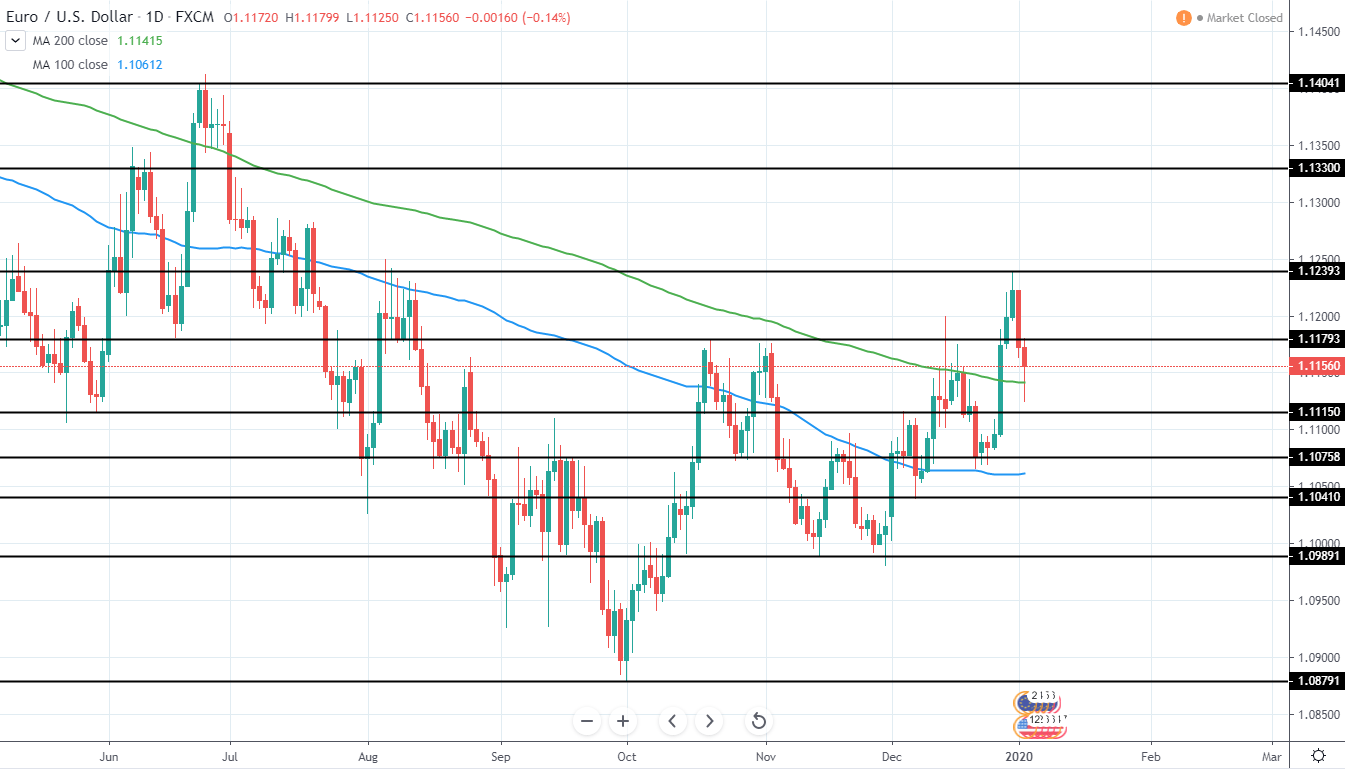

USD/JPY has moved lower last week and has slightly and briefly broken below 107.886 JPY previous low as well as 100 day moving average blue line in addition to rejecting further upside several times during the past 2 months as the 109.65 JPY resistance could not be broken.

Therefore, we can start becoming bearish and expect a potential for a good short setup once the price retraces back to the upside and sets a lower high below 109.65 JPY

For now, however, it is best to stay neutral and wait for further price action development as the current downside momentum has extended quite far away from the previous high.

USD/JPY Daily:

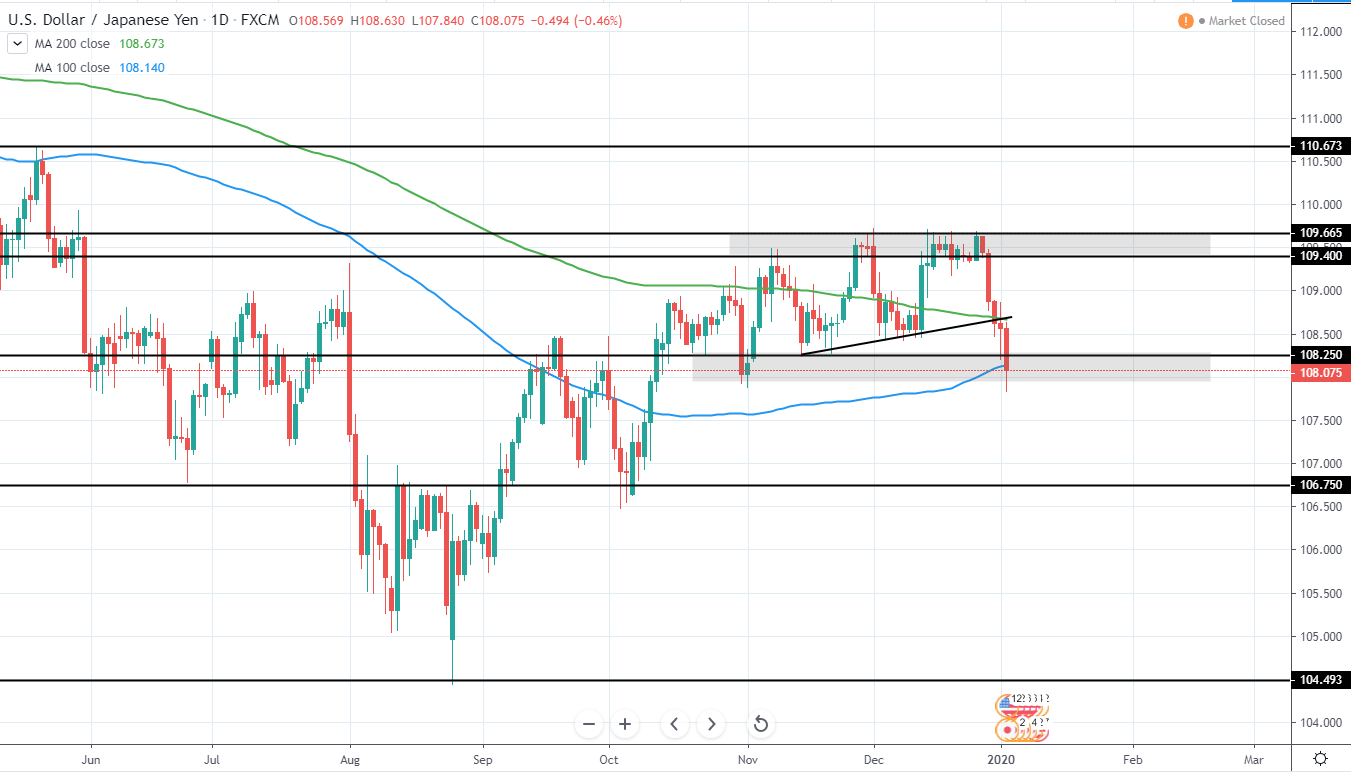

GBP/USD tried to move higher once again last week after setting a new several month high around 1.35 USD and strongly rejecting back towards the previous consolidation area around 1.277-1.3 USD, however, still making a higher low, indicating that the trend is still bullish.

Despite this, we could potentially see a trend reversal back to the downside after such a strong rejection in the middle fo December, however, this still needs to be confirmed with a lower low, after which a move to the upside and a lower high below 1.33 USD could be used in order to short the market.

Until then, it is best to stay neutral and wait for further price action development.

GBP/USD Daily:

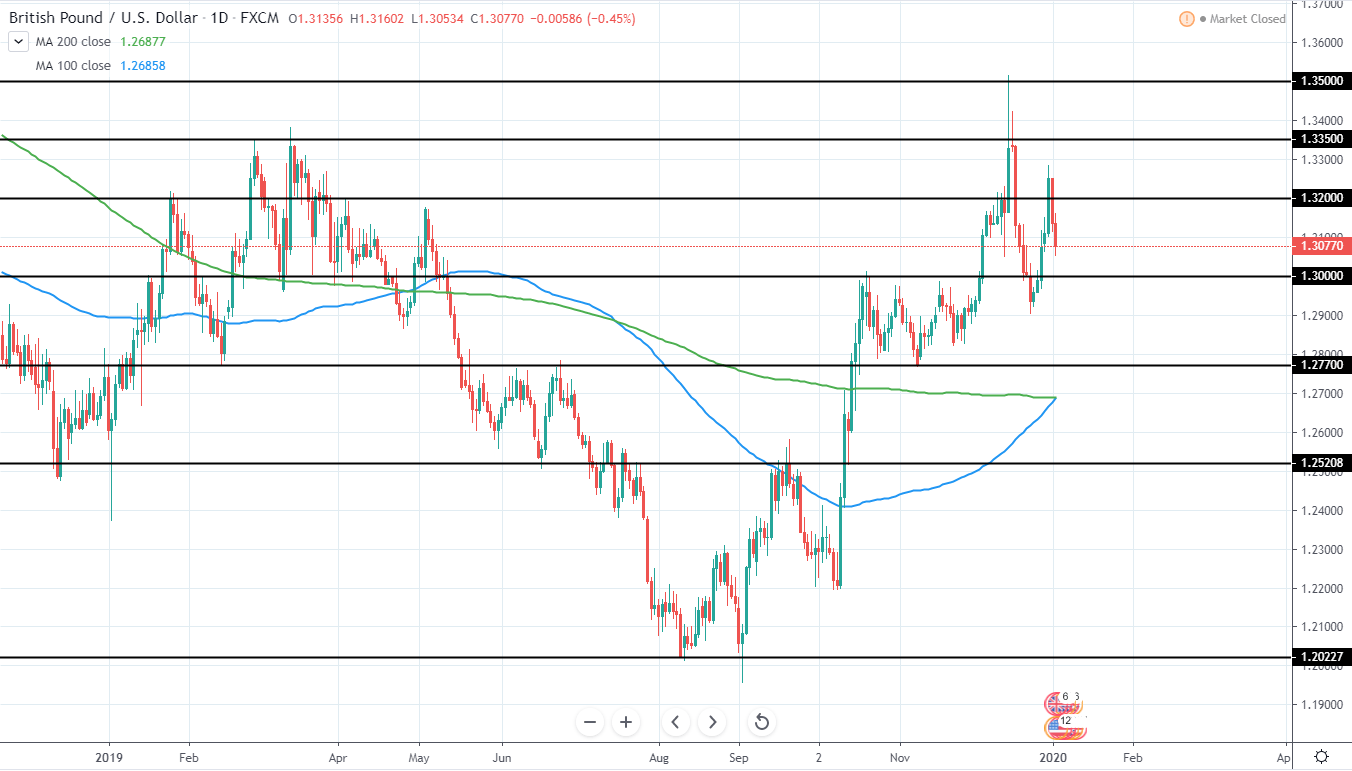

AUD/USD has set a new higher high around 0.703 USD and currently retraces back towards several week ascending support trend line and the previous high of 0.693 USD, that now acts as a support. Additional support can be seen as 100 period moving average blue line that trades around the trend line for the past weeks.

Therefore, once the price can stabilize and start showing signs of bullishness, a long position entry could be made in expectation that the current high, as well as resistance levels around 0.795 and 0.708 USD, will likely be reached in the upcoming weeks, which would mean a potential gain of around 1.5 and 1.95% respectively.

Alternatively, a more aggressive approach could be taken by longing the market right now, as first signs of rejection have been made in the second half of Friday since a bounce from 0.693 USD was seen and the price is still relatively close to the previous all-time high resistance turned support and an overall decent retracement from the previous upswing has been made already.

AUD/USD 4H: