Currently, the total market cap of crypto is 204.6 billion USD with a 24h Volume of 54.65 billion and BTC Dominance of 66.8% according to coinmarketcap.com.

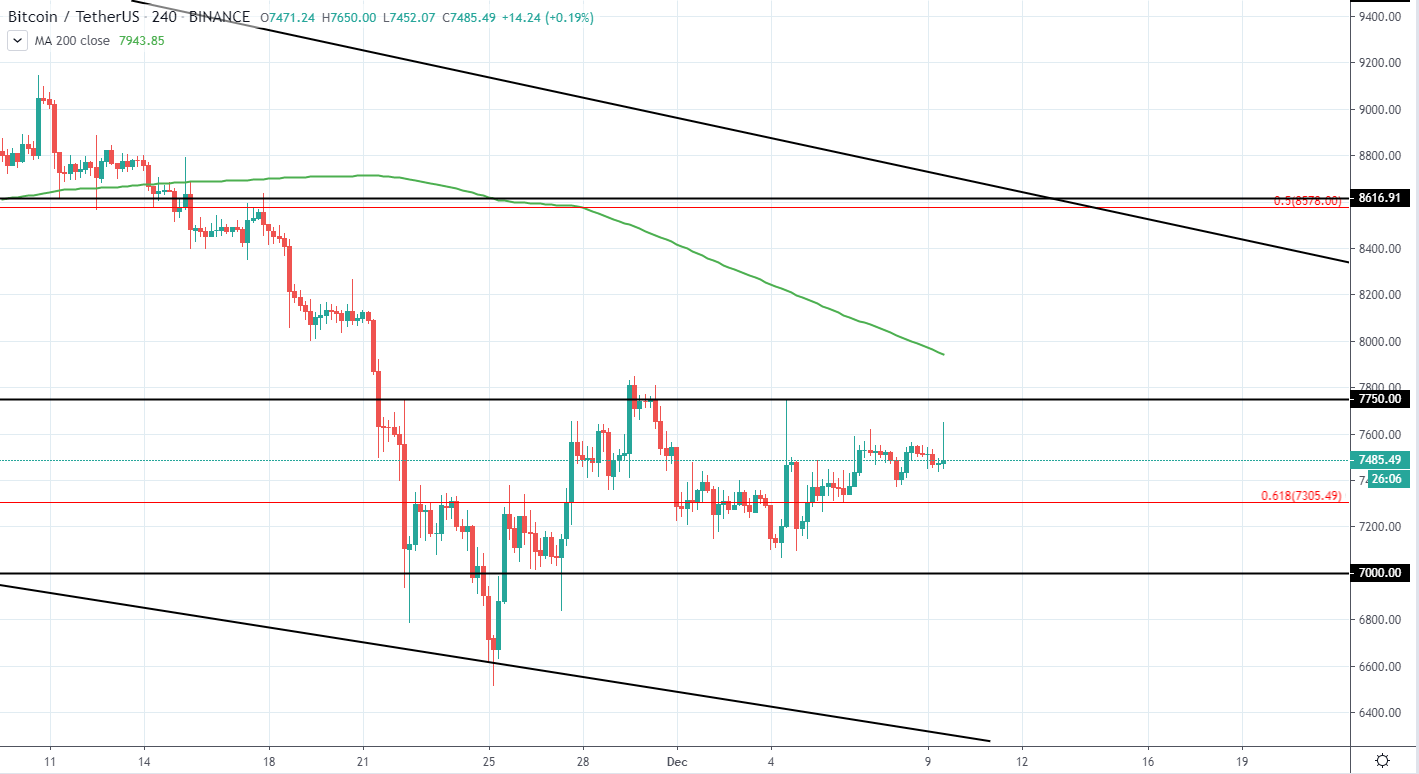

Bitcoin has a market cap of 136.75 billion USD and trades around 7,558 USD on Coinbase as it continues trading sideways in an increasingly tighter range after 7750 USD resistance was sharply rejected and further a higher local low was made.

Currently, the price shows signs of rejection for further upside and likely we will see more downside in the upcoming 24 hours and another higher low made unless the price breaks out of the current range. Therefore, a short-term short position could be taken with a potential target of around 7.2k USD, meaning a potential move of around 3.75% from the current price.

Alternatively, break above 7750 USD can be used as a bullish signal with the next target still being around 8.6k USD, which if reached from the breakout would mean a potential gain of around 11%.

BTC/USD 4H:

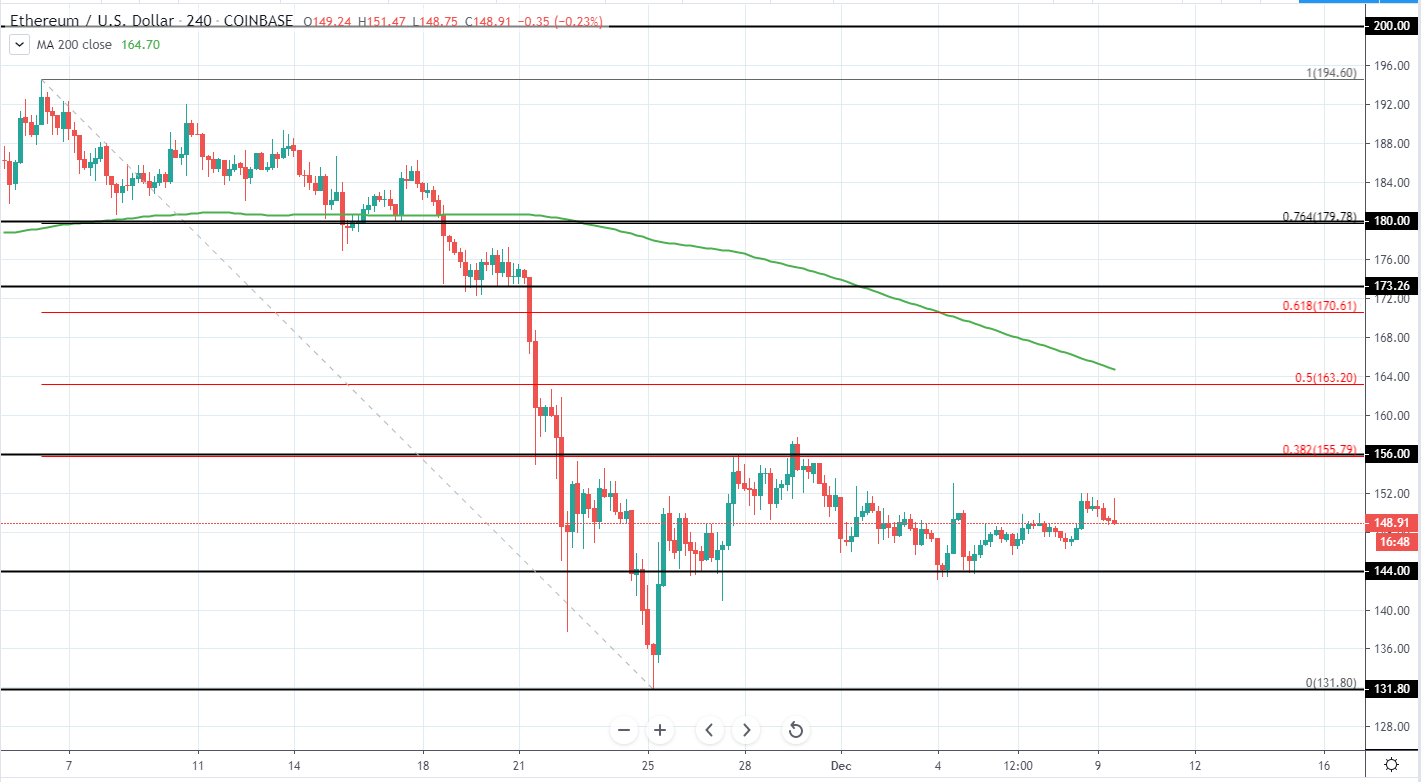

Ethereum currently has a market cap of 16.37 billion and trades at 149 USD on Coinbase as the price continues moving sideways with slightly lower highs being made.

This indicates that likely we will see further bearish momentum along with the overall trend which is still very bearish. The first target can be seen around 132-136 USD support, which sharply rejected further downside at the end of November and, if reached, from the current level, would mean a move of around 8-11%.

Alternatively, move above 156 USD would indicate further upside to come, however, for now, it is too soon to be looking at potential bullish momentum.

ETH/USD 4H:

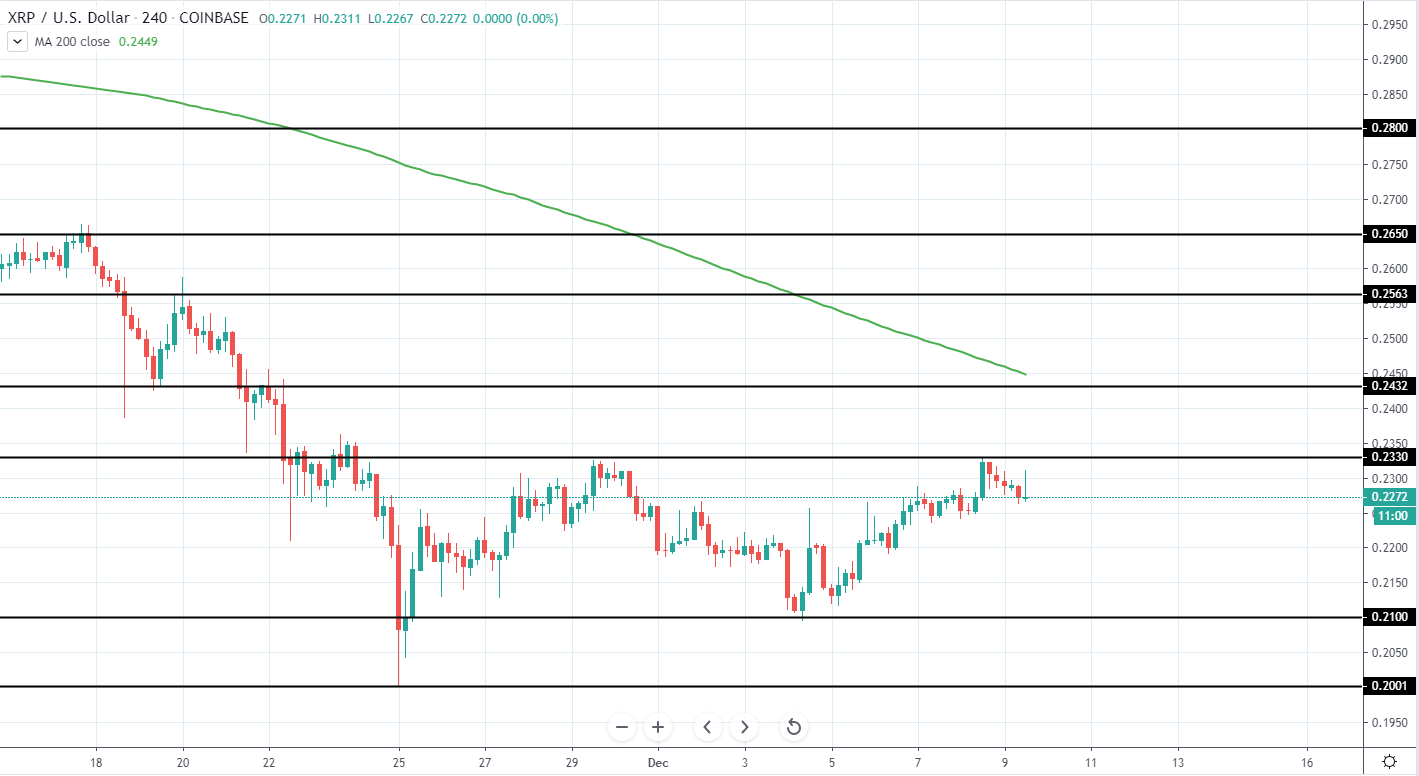

Ripple currently has a market cap of 9.92 billion and is trading around 0.23 USD on Binance as it rejected further upside after testing 0.233 USD previous resistance.

The overall trend is still very bearish and considering current consolidation, there are no indications of further upside to come in the upcoming 24 hours.

A short position, therefore, could be made around the current price levels as the next support can be seen around 0.20-0.21 USD and would mean a potential downside of around 7.5-11.5 USD when reached. Alternatively, the price could make a new higher low around 0.215 USD and therefore, price action needs to be monitored around this level for potential signs of rejection.

XRP/USD 4H:

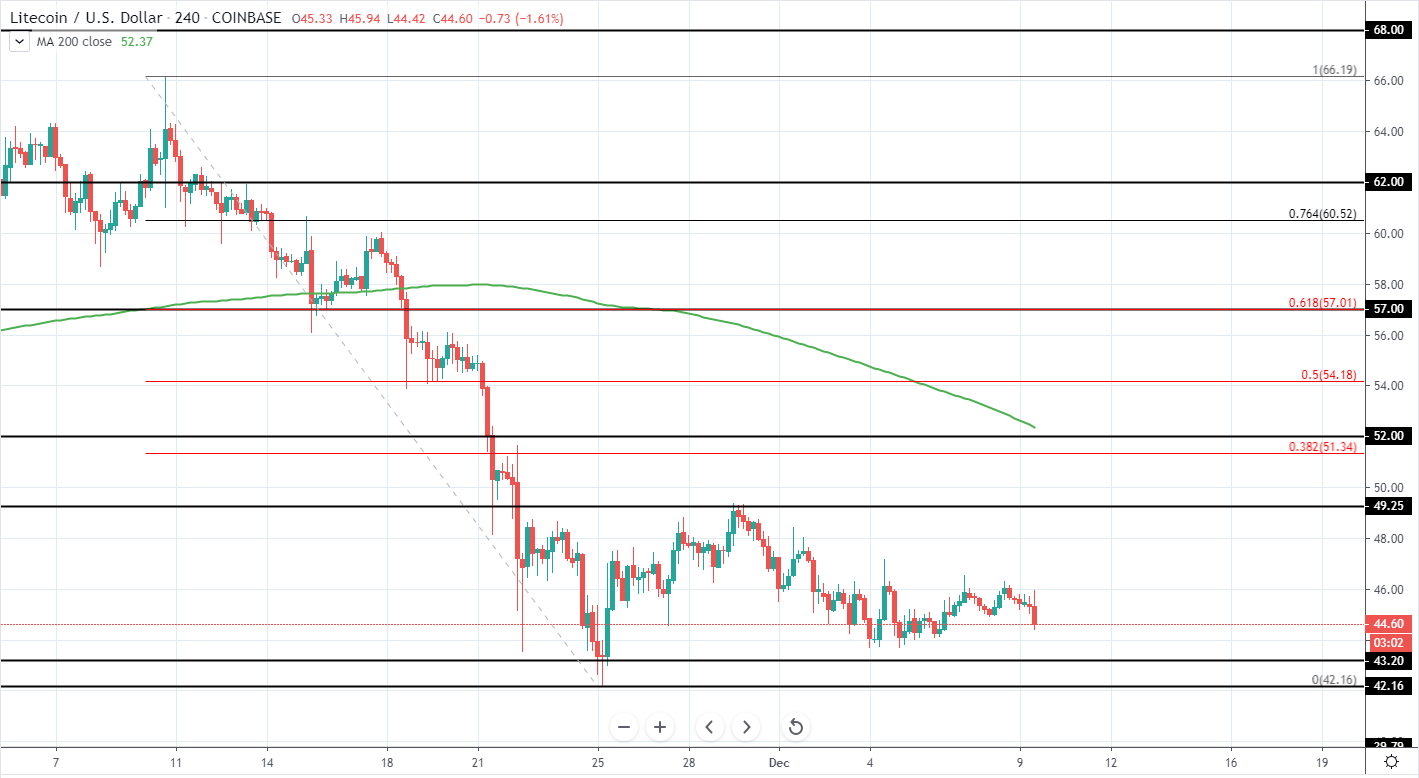

Litecoin has a market cap of 2.9 billion USD and currently trades around 45.6 USD on Binance as it peaked around 49.25 USD and continues to slowly move lower ever since as it looks to test previous support around 42.16-43.2 USD.

The overall trend is still very bearish and a drop from 66.19 to 42.16 USD was seen in the past weeks. Since the price has declined so much a short position would not be advisable for now, however, further bullish momentum needs to be formed in order to enter a long position.

Therefore, for now, we remain neutral for the price of Litecoin

LTC/USD 4H:

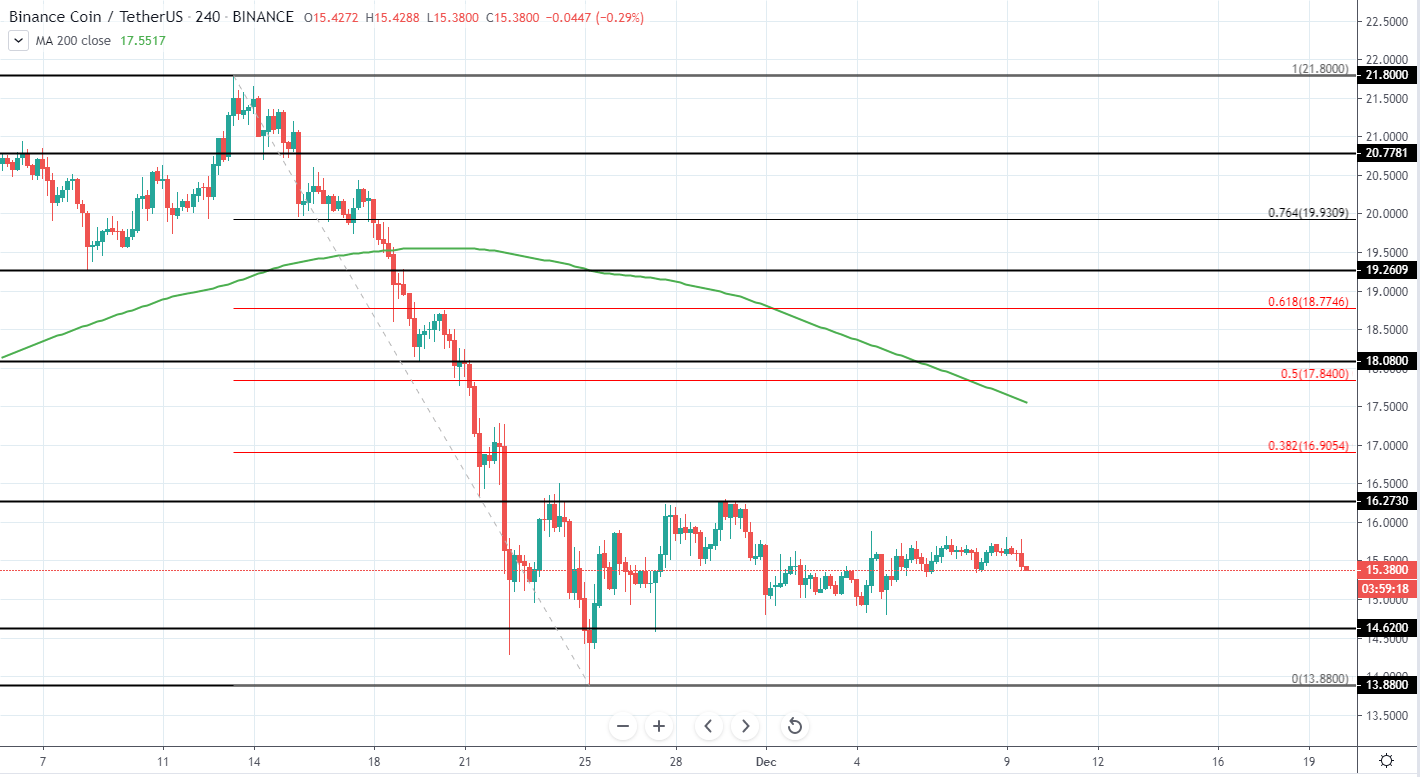

Binance coin has a market cap of 2.43 billion USD and trades around 15.4 USD on Binance as it continues to trade sideways for the past weeks after dropping from 21.8 USD high to 13.88 USD low and losing 36.35% and so far not having a significant retracement back to the upside.

Slight downside can be seen in the upcoming hours as the price likely looks to test 15 USD local low, however, would not offer much in term of risk/reward in addition to the fact that the price has not had a significant retracement means that we should stay neutral for now unless another higher low is being made, which could be used as an opportunity to enter a long position.

Therefore, for now, it is best to stay neutral for BNB.

BNB/USD 4H: