Currently, the total market cap of crypto is 196.4 billion USD with a 24h Volume of 56.56 billion and BTC Dominance of 66.6% according to coinmarketcap.com.

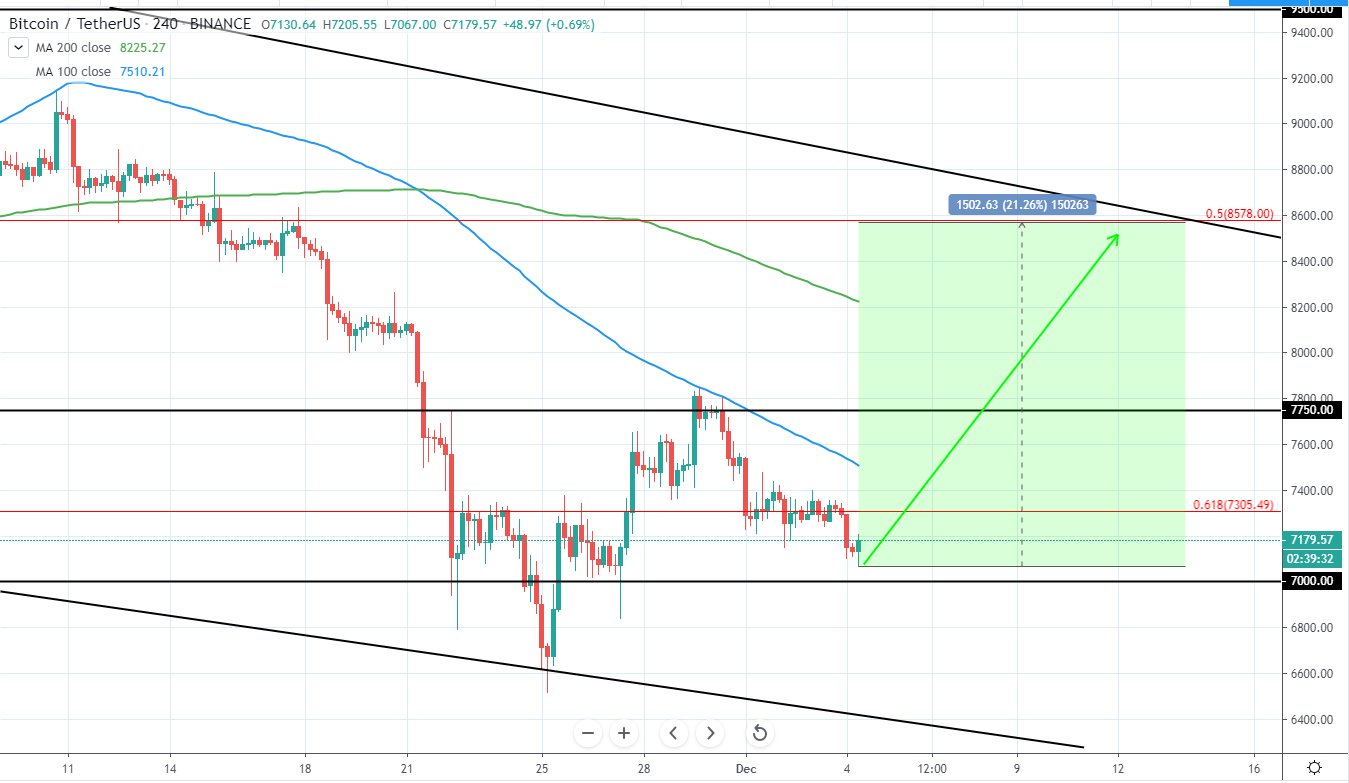

Bitcoin has a market cap of 130.8 billion USD and trades around 7,233 USD on Binance as it experienced further decline after some consolidation.

Important support of 7k USD is seen close by and, therefore, if the price continues trading above it, we can expect more upside to come in the upcoming days with the target to reach still being around 8.4-8.6k USD which would mean upside of around 20-22% if reached. Entering long position right now would provide good risk/reward as the price has retraced significantly from the previous minor upswing that lasted from 25 until 29 of November as the price made a new low around 6.6k and reached just above 7.8k USD and tested 100 period moving average blue line with a rejection.

Alternatively, position could be entered once the 100 week MA is broken, however, it would not provide as good as risk/reward ratio.

BTC/USD 4H:

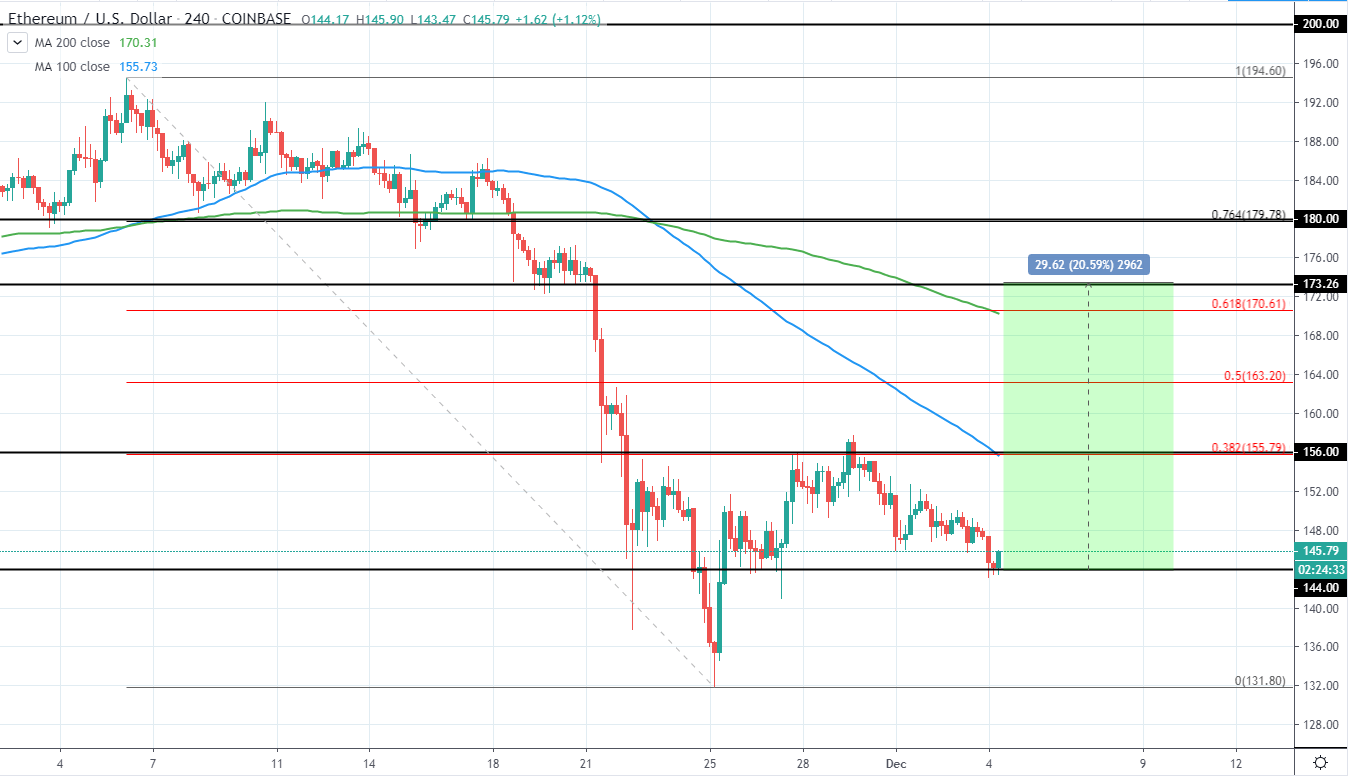

Ethereum currently has a market cap of 15.96 billion and trades at 146.74 USD on Coinbase as it has further retraced during the past days and has reached 144 USD support, which currently does seem to offer support.

If the price can stay above this levels today and move higher above 150 USD, we can expect the upcoming days to be bullish with potential target seen around 173 USD, which if reached, would mean an upside of around 20.5% from the current low in addition to 61.8% Fib retracement from the previous downswing.

When reached, this area could further be used to look for a short entry as the overall trend is still bearish and further downside towards 124-125 USD next major support will likely be seen in the weeks following.

ETH/USD 4H:

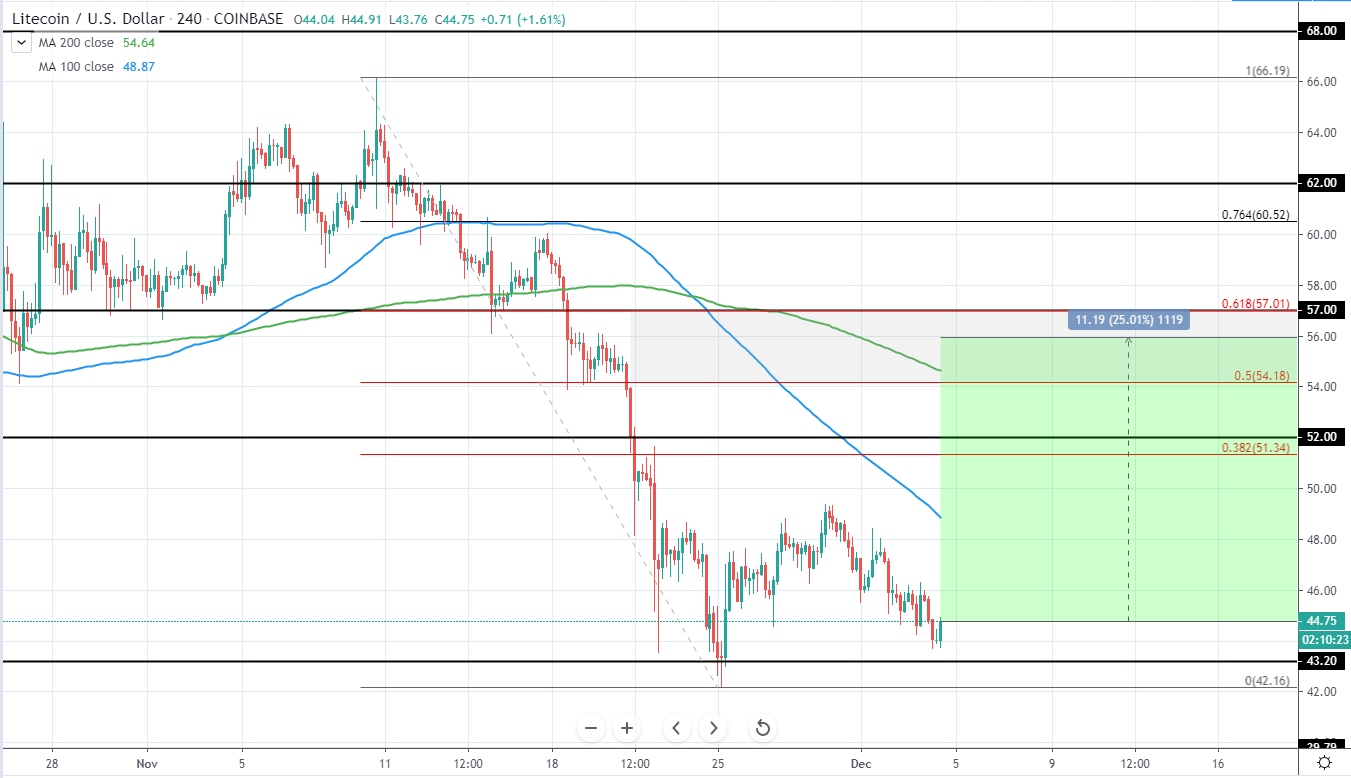

Litecoin has a market cap of 2.88 billion USD and currently trades around 45.2 USD on Binance and retests the previous low once again.

Since the price of Litecoin has extended to the downside substantially during the middle of November as it lost 36.3% from 66.19 to 42.16 USD, we can expect a retracement to come in the upcoming days. This means a counter-trend trade long opportunity is currently present, however, further rejection would need to be seen before.

Potential target for the next move to the upside can be seen around 54-57 USD and would provide around 25% gain from the current price and would mean a Fib retracement of around 50-61.8% from the previously mentioned bearish move in the middle of November. From this area also we can start to look for short position entry as the overall trend is still bearish and we can expect a further drop to come in the upcoming weeks, however, until then, retracement back to the upside is expected.

LTC/USD 4H:

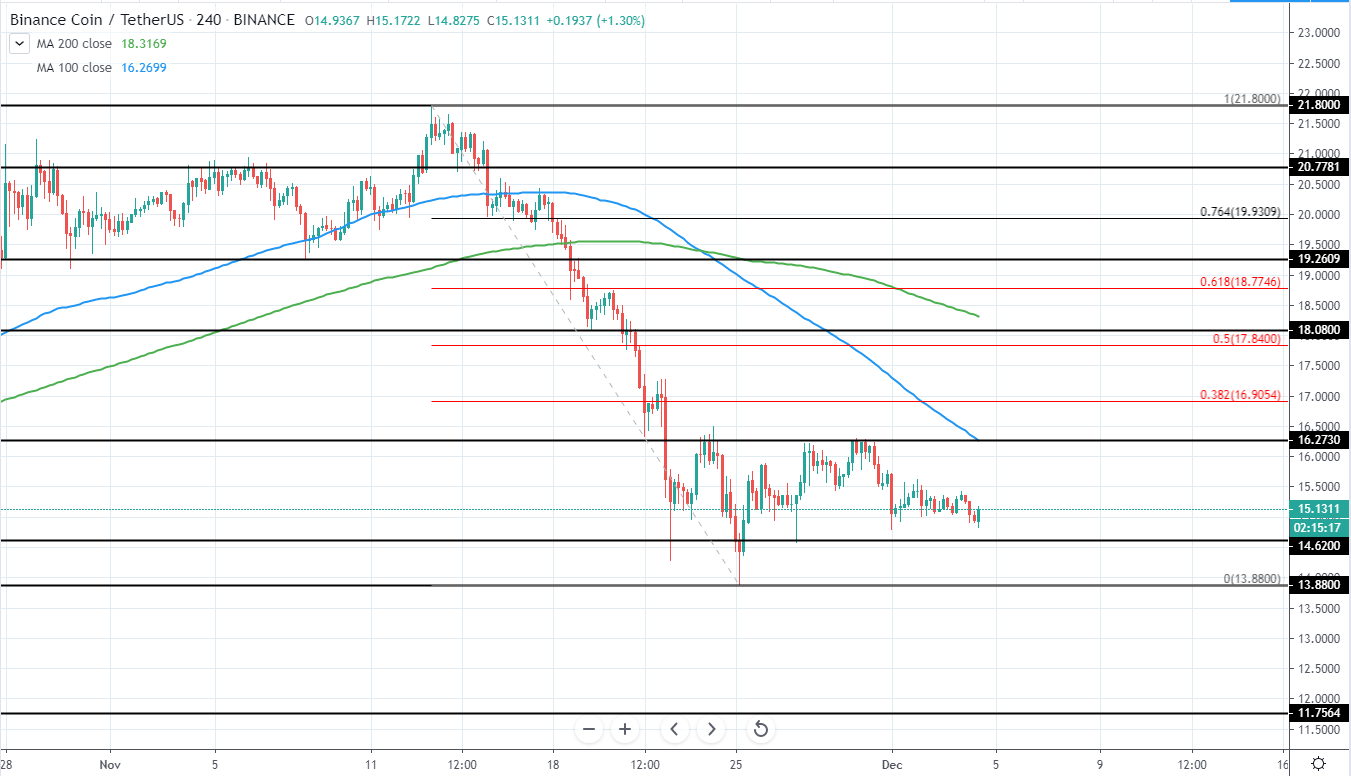

Binance coin has a market cap of 2.36 billion USD and trades around 15.2 USD on Binance as it continues to consolidate around 14.5-16.25 USD area for the past days after a substantial decline was seen in the middle of November as the price lost 36.33% from the high of 21.8 to the low of 13.88 USD.

This leads to believe that the current consolidation will serve as a base for move to the upside in the upcoming days as the price looks to retrace some of this bearish momentum. Potential target for the retracement can be seen around 17.5-19 USD as several important levels are located in this area. First, 200 period moving average green line is currently located around 18.3 USD, second 18 USD previous minor support/resistance horizontal level and third, it is the are between 50-61.8% Fib retracement.

Therefore, If the price can move above 15.5 USD minor high, a long position could be entered in expectation for further upside to come.

BNB/USD 4H: