Published: October 6th, 2022

The SEC v. Ripple lawsuit was won by the payment giant Ripple, triggering the concept of a bullish catalyst for the altcoin. David Gokhshtein, a Crypto podcaster, and the proponent put weight on Ripple’s win by observation on Twitter. As per several experts' opinions, the outcome of the SEC v. Ripple lawsuits can incur a potential price rally in XRP/USDT.

Ripple’s CEO, Brad Garlinghouse, did not seek to go to trial as he remained optimistic about the SEC v. Ripple case. Without a jury, there is enough evidence for any judge to decide whether XRP is a security, the executive argues.

Ripple’s CEO believed that the payment processor and SEC submissions should be enough to decide the judgment for Judge Analisa Torres. Ripple CEO believes the case fact is integral, and he shared his confidence with XRP holders in his FOX business appearance.

Goldstein, a former US congressional candidate, believes it might influence the unimpeachable rise of the entire Crypto market if Ripple wins the case. Judge Torres will decide on expert motions; the SEC’s objection judgment is still pending and will summarize the judgment earlier or on Mar 31, 2023.

Overall, Ripple is more likely to win the battle, which could lead to the XRP/USDT price increase in the coming days.

Let’s see the future price direction of Ripple from the XRP/USDT technical analysis:

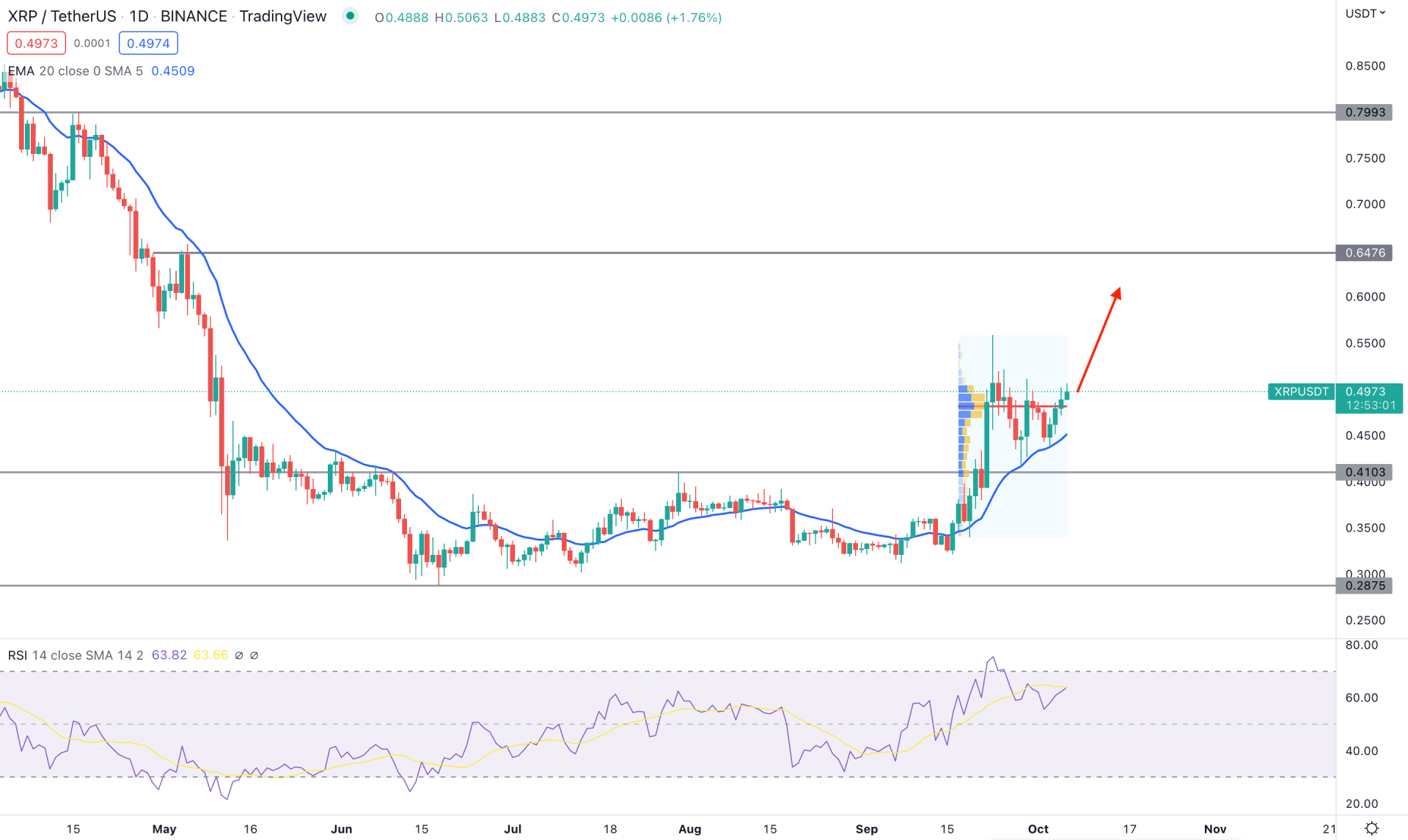

In the daily chart of XRP/USDT, the market sentiment has shifted from bearish to bullish as the price completed a consolidation phase for more than two months. Later on, bulls appeared in the market, and bullish pressure continued after making a strong daily candle close above the 0.4103 key resistance level. Therefore, the primary trading idea for this pair is to find bullish opportunities until it breaks below the 0.4100 psychological number.

Based on the fixed range high volume indicator, the highest trading volume from September low to high is just below the current price. It is a sign that the latest buying pressure above the 0.4100 level has a strong institutional traders' interest, which could work as a stable bullish trend.

The dynamic 20 DMA is a crucial area for this pair as the current price is being carried by the 20-day EMA, which could result in a range breakout above the 0.5000 zone.

The Relative Strength Index (RSI) works as a bullish signal in the indicator window, as the current RSI level is above 50%. In that case, the RSI could increase to 70%, which may work as a bullish factor for the price.

Based on the XRP/USDT daily chart, the overall market condition for this instrument is bullish, where any bullish rejection from the intraday chart would be a decent long opportunity. In that case, the primary target of the bull run is to test the 0.6476 level. On the other hand, breaking below 0.4100 will eliminate the bullish structure and open the possibility of reaching the 0.2875 level.

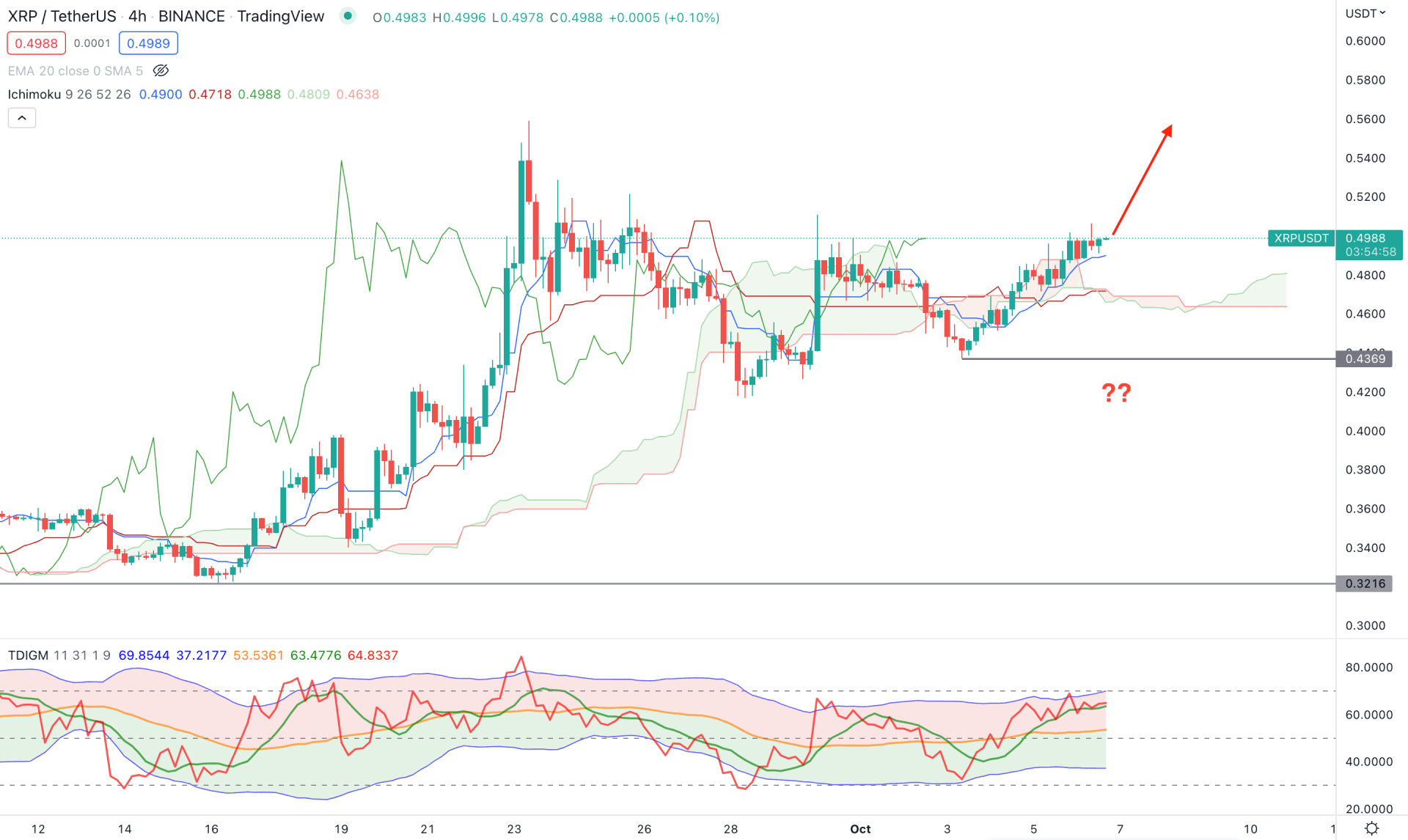

In the H4 timeframe, the broader market context is bullish as the recent price failed to hold its bearish position below the Kumo Cloud multiple times. Moreover, the existing market pressure is extremely bullish, while the future cloud supports bulls.

In the future cloud, the Senkou Span A is above the B, and the gap between these points is expanding. It is a sign that bulls are aggressive in the market where short term buying pressure keeps the Senkou Span A away from the B.

In the indicator window, the buying pressure is also visible from the Traders Dynamic Index indicator, where the current TDI line is near the overbought area.

Based on the current Ichimoku Cloud analysis, the buying pressure may extend as long as the dynamic Kijun Sen is below the price. In that case, bulls are more likely to reach the 0.5800 psychological number.

On the other hand, breaking below the 0.4369 level would alter the current market structure and lower the price towards the 0.3200 area.

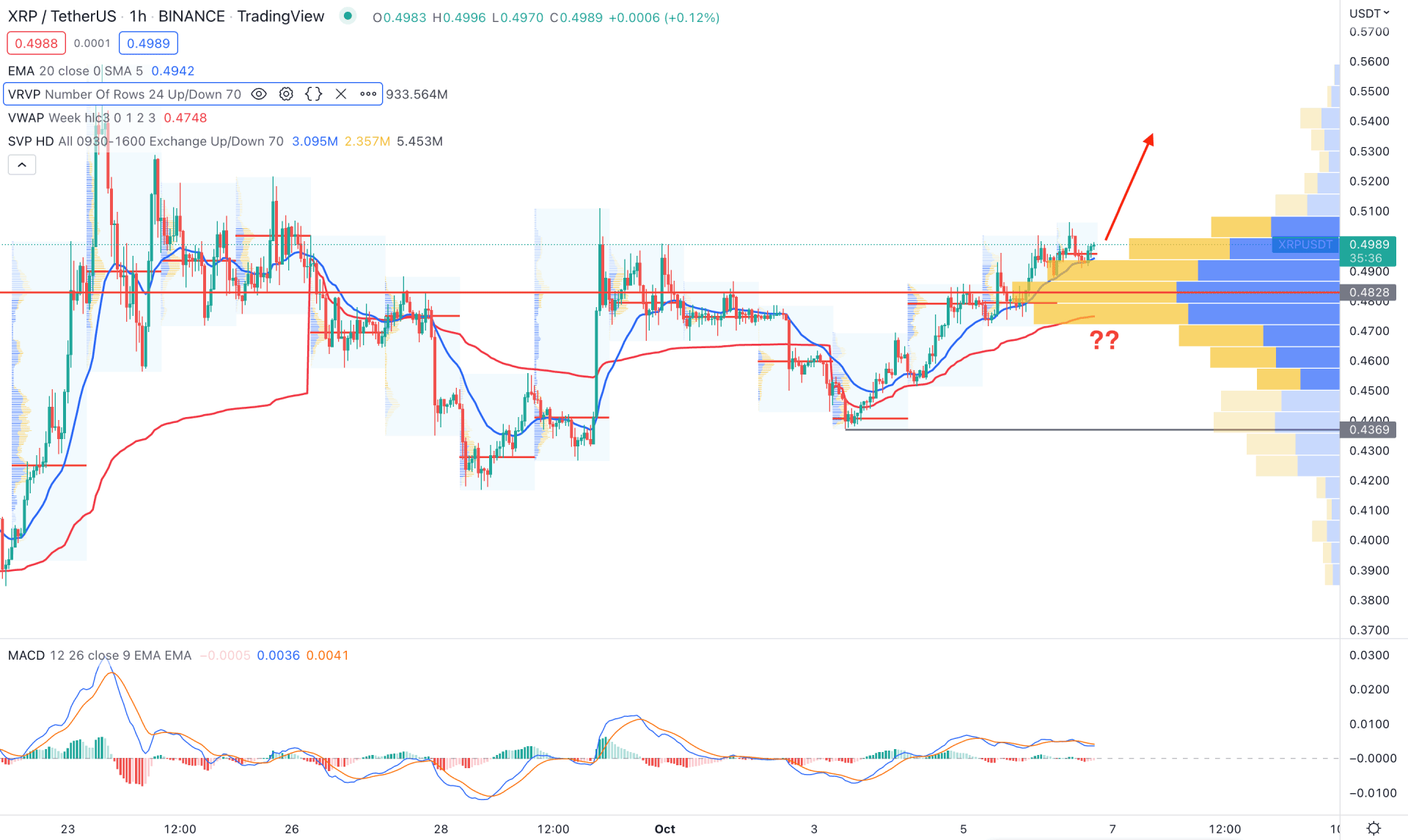

In the H1 chart, the bullish pressure is more likely to extend as the current price is above the visible range high volume level, while the dynamic 20 EMA and weekly VWAP are providing support.

The primary trading idea for this pair is to find a new swing high above the 0.5000 level and open a long position, targeting the 0.5800 area. However, breaking below the 0.4828 level with a bearish H1 candle could alter the current market condition and open a bearish opportunity toward the 0.4369 level.

Based on the current multi-timeframe analysis, XRP/USDT is more likely to increase where the main aim is to test the 0.6476 resistance level. As the price is trading above the 20 DMA support, breaking below this level could eliminate the bullish structure.