Published: August 5th, 2021

Pfizer (PFE) said they expect a surge in full-year Covid-19 vaccine sales of $33.5 billion, which pushed the Pfizer stock higher since July. In the meantime, the company may ask for emergency authorisation of bolster shot this month while planning to start testing the specific shot of delta variant. Moreover, the company beat the expectation on quarterly earnings where the adjusted earnings came at $1.07 per share, 73% higher than the last year. Furthermore, the revenue rocketed by 92% to $18.98 billion, beating the expectation.

The revenue growth and future possibility of increased vaccine sales may have a bullish impact on Pfizer stock.

Let’s see the upcoming price direction from the Pfizer Stock [PFE] technical analysis:

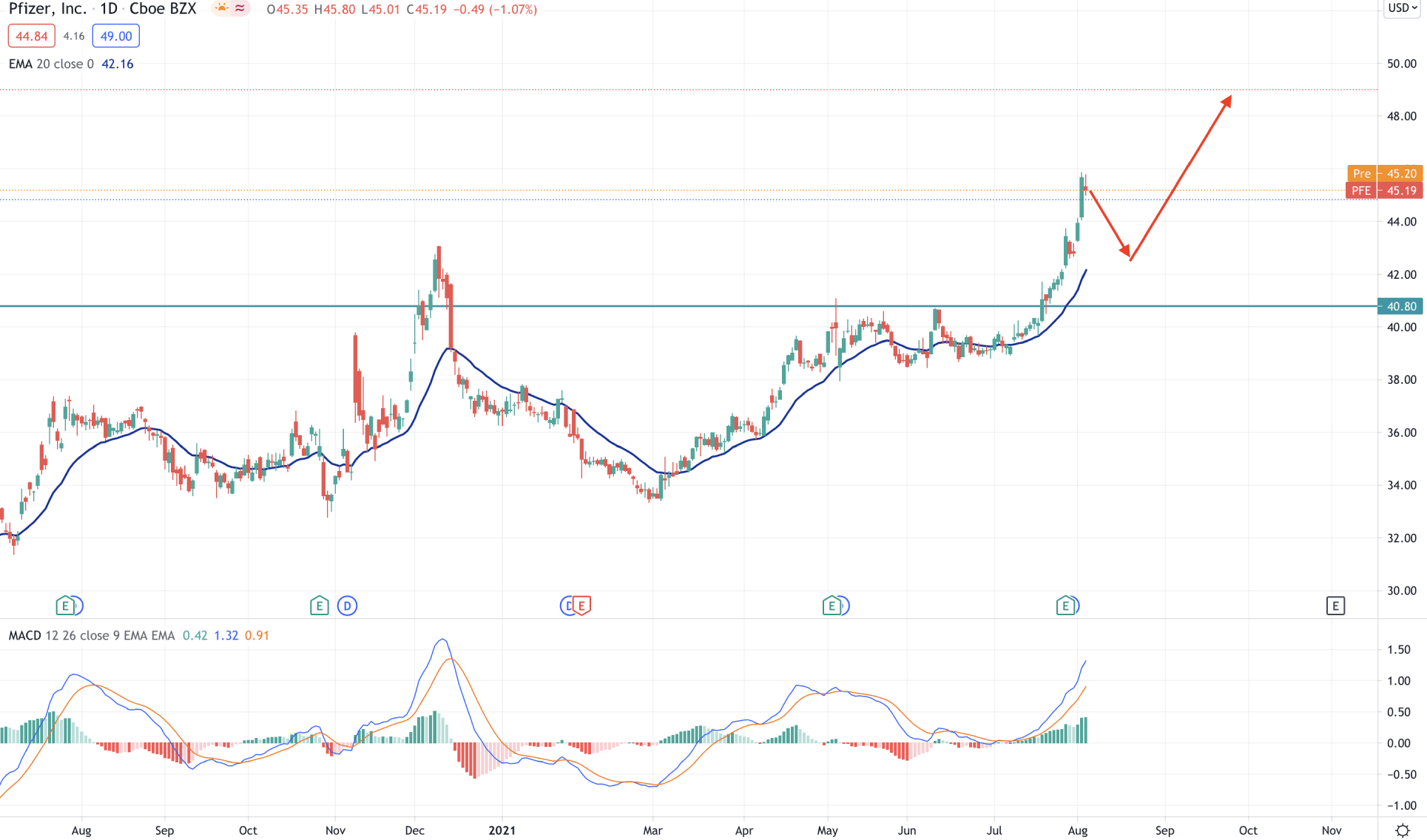

Pfizer stock started to grow after the Covid -19 low and made a new high in December 2021. Later on, the price moved lower and formed a double bottom pattern from where the current bull run started. Later on, Between May and June, the price tried to breach the 40.60 level multiple times but failed. Lastly, the price moved above the 40.60 level and 2020 high with an impulsive bullish pressure.

Therefore, as long as the current bull run remains active above the 40.60 level, we may expect another surge in the price after a correction.

In the above image, we can see the daily chart of Pfizer, where the price is trading above the static 40.60 level. Moreover, this week's movement was extremely bullish that created a gap between the price and dynamic 20 EMA. Therefore, a mean reversion is pending where the price may come lower with a corrective speed before showing another bullish swing.

In the indicator window, MACD Histogram is bullish and making new highs. However, the MACD SIgnal line moved to the 1.50 reversal point that may initiate a correction. Based on this structure, we may see a bearish correction in the price, and any rebound from dynamic 20 EMA may take the price higher towards the 60.00 level.

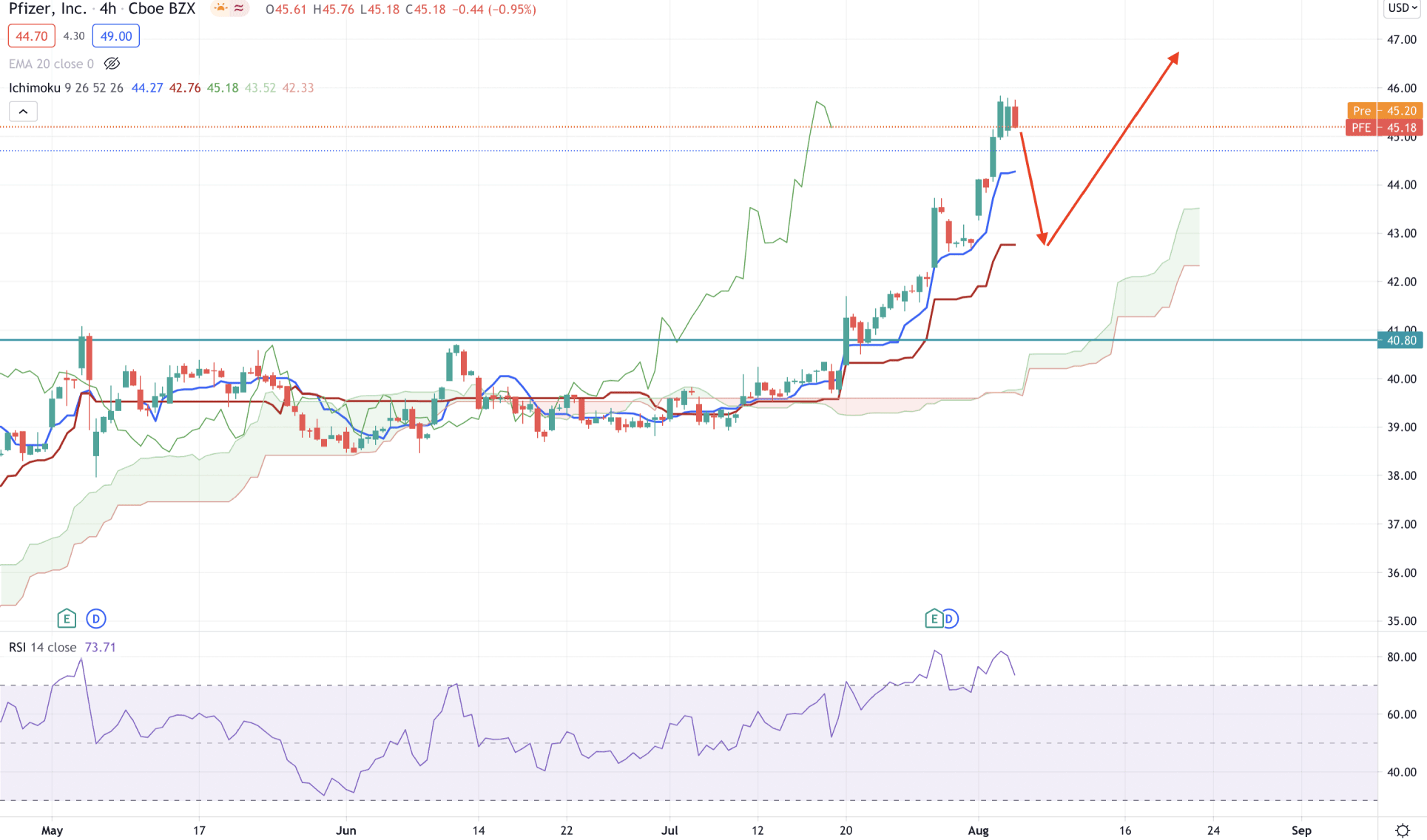

Based on the Ichimoku Kinko Hyo, buyers are extremely strong in the H4 chart as the price moved above the Kumo Cloud with an impulsive pressure. Moreover, Senkou Span A is above Senkou Span B in the future cloud and aiming higher. However, the gap between the price and cloud resistance has expanded, which may increase the possibility of bearish correction.

In the above image, we can see that the price moved higher above the dynamic Tenkan Sen and Kijun Sen, where Tenkan Sen is above the Kijun Sen. However, the gap between the Kijun Sen and price has expanded while the RSI moved to the 80 areas. Therefore, the price has a higher possibility of correcting lower in the coming session.

Based on the H4 chart, the bullish price action is more likely to continue after finding an intraday swing low. However, a stable bearish H4 close below the 40.80 level may start a broader correction to the price.

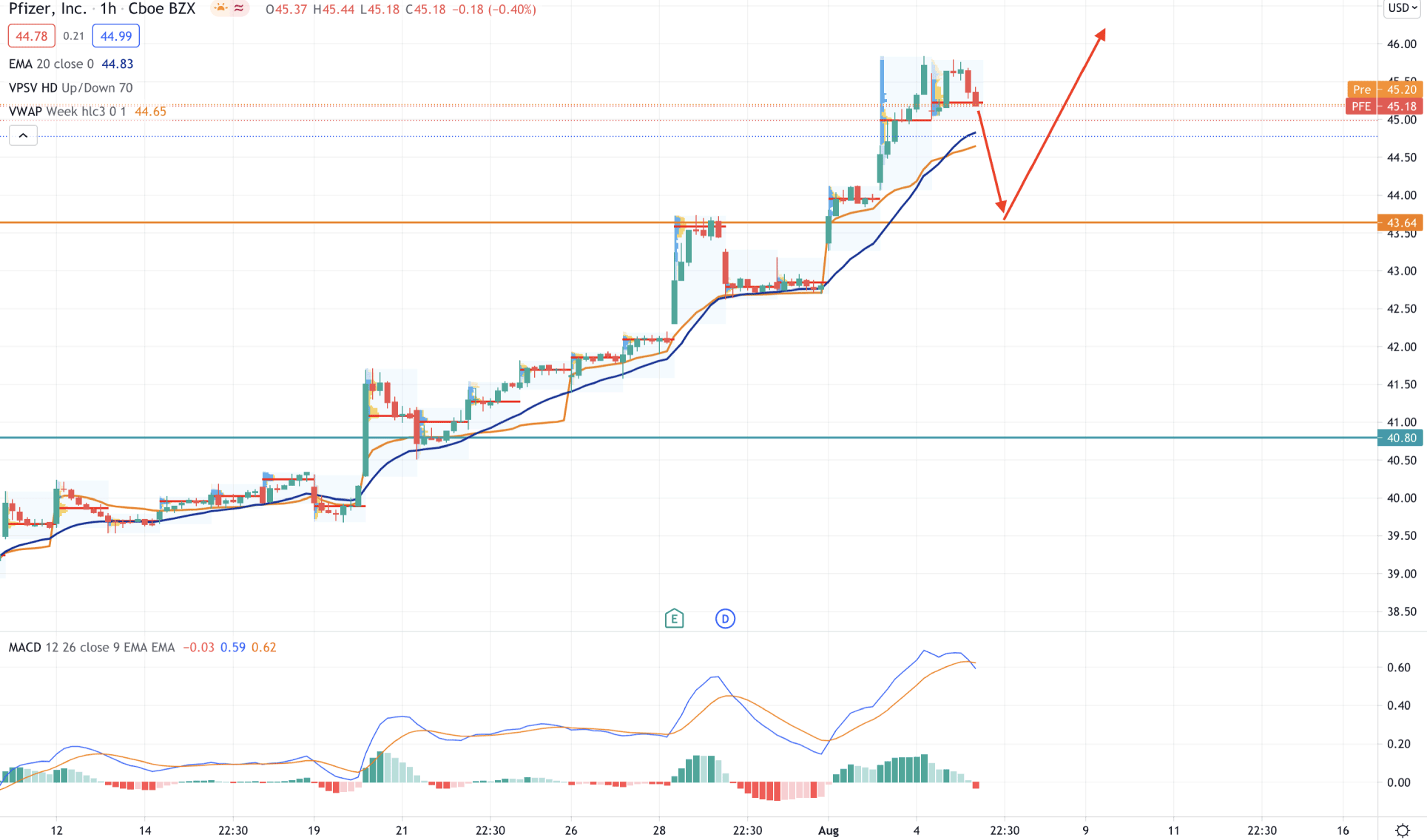

In the intraday chart, Pfizer stock is moving within a long bullish trend where the price broke the 40.60 level with a considerable intraday pressure and reached 46.00 psychological level. However, the most recent candles are struggling to make new highs and move below the intraday high volume level of 45.23. Therefore, as long as the price is trading below the 46.00 swing high, it may come lower towards 43.64 support level.

In the above image, we can see the H1 chart of Pfizer, where the price is above the dynamic 20 EMA and vwap. Therefore, if the price moves lower and rebounds from the vwap or static 43.64 level, we expect that the bullish trend will continue. Conversely, an intense selling pressure below the 40.60 level may alter the current market structure.

As of the above observation, we can say that the Pfizer stock may correct lower, although the overall market momentum is bullish. So, a rebound from the dynamic Kijun Sen from oh H4 chart would increase the buying possibility with the target of $60.00 level.

On the other hand, a massive bearish H4 close below the 40.60 level may make the current buying possibility invalid and take the price lower towards the 38.55 level.