Published: February 12th, 2025

At the forefront of decentralized trading, PancakeSwap now supports Arbitrum, Linea, and Base in addition to the Orbs-powered protocols dLIMIT and dTWAP. With this update, PancakeSwap's sophisticated trading features are expanded beyond its current BNB Chain deployment, providing improved order execution across several networks.

The combination of dLIMIT and dTWAP gives traders access to advanced tools for trading strategy optimization. While dTWAP orders divide significant transactions into smaller deals over time to reduce slippage and market impact, dLIMIT orders enable customers to set execution costs, guaranteeing that deals only get finished under specified conditions.

These capabilities allow users to carry out complex kinds of orders in a decentralized structure by introducing trading algorithms and tactics that are frequently employed in central finance in addition to DeFi. Following the successful deployment of Orbs-powered protocols on other significant DEXs, such as QuickSwap, SpookySwap, and THENA, the growth to Linea, Arbitrum, and Base follows.

With $54 billion in trading activity over the last month, PancakeSwap has solidified its position as a significant omnichain DEX. By volume, the system is also the biggest user of Orbs' trading system.

Let's see the future price direction of this coin from the CAKE/USDT technical analysis:

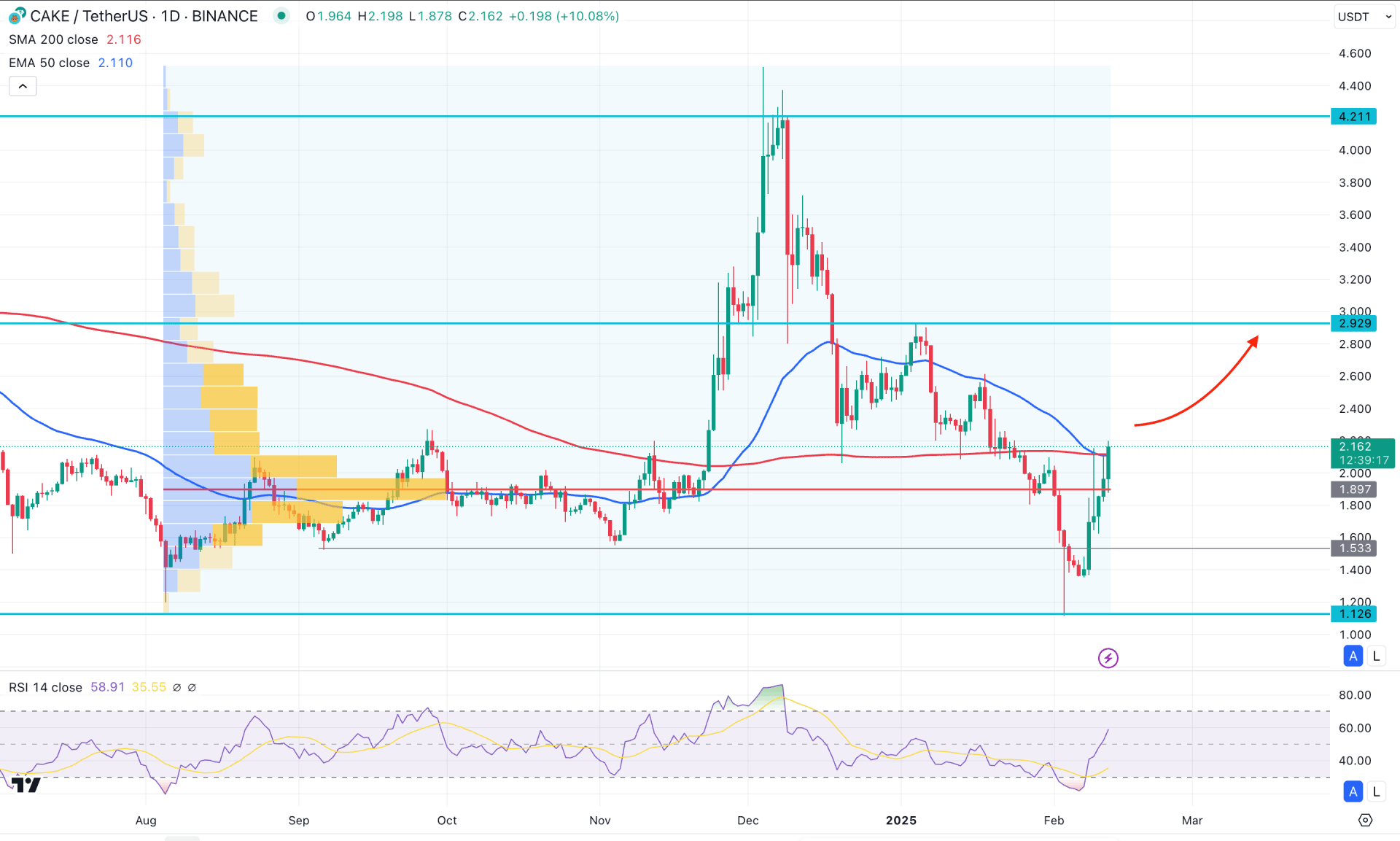

In the daily chart of CAKE/USDT, a strong sell-side liquidity sweep is visible at the bottom, which might work as a strong bullish signal. Moreover, multiple violations in the near-term resistance levels could work as an additional long signal.

In the higher timeframe, the price is still trading at the bottom as the long consolidation from 2022 is still intact. If we consider the bottom and top of the last three years, the price is trading at the discounted zone. In that case, a cheaper price with a higher volume could be a decent long opportunity. However, investors should wait for a valid price action considering the dynamic lines before going long.

On the other hand, the volume looks positive as the recent bullish recovery came with a breakout above the 1.897 high volume line.

In the daily chart, strong selling pressure below the 1.533 low with an immediate rebound above the 2.104 level signals a valid bullish V-shaped recovery. Moreover, the dynamic 50-day Exponential Moving Average and 200-day Simple Moving Average are close together, just below the current price. In that case, the classical technical approach is to find long opportunities after a stable market above those dynamic lines.

Moreover, a descending channel breakout is visible, where a minor downside retest is pending. In that case, investors should monitor how the momentum holds above the near-term high line. The 14-day Relative Strength Index has flipped the position and moved above the 50.00 neutral point, which is a sign of valid buying pressure in the market.

According to the daily market outlook, the crucial target point of the current bull run would be the 2.929 level. Moreover, overcoming this line could open the door to reaching beyond the 4.211 key resistance level.

The alternative approach is to find indecisive momentum above the 50-day Exponential Moving Average and a bearish daily close below the 1.533 line. In that case, the upward momentum will be invalidated, and the price could reach beyond the 1.000 support line.

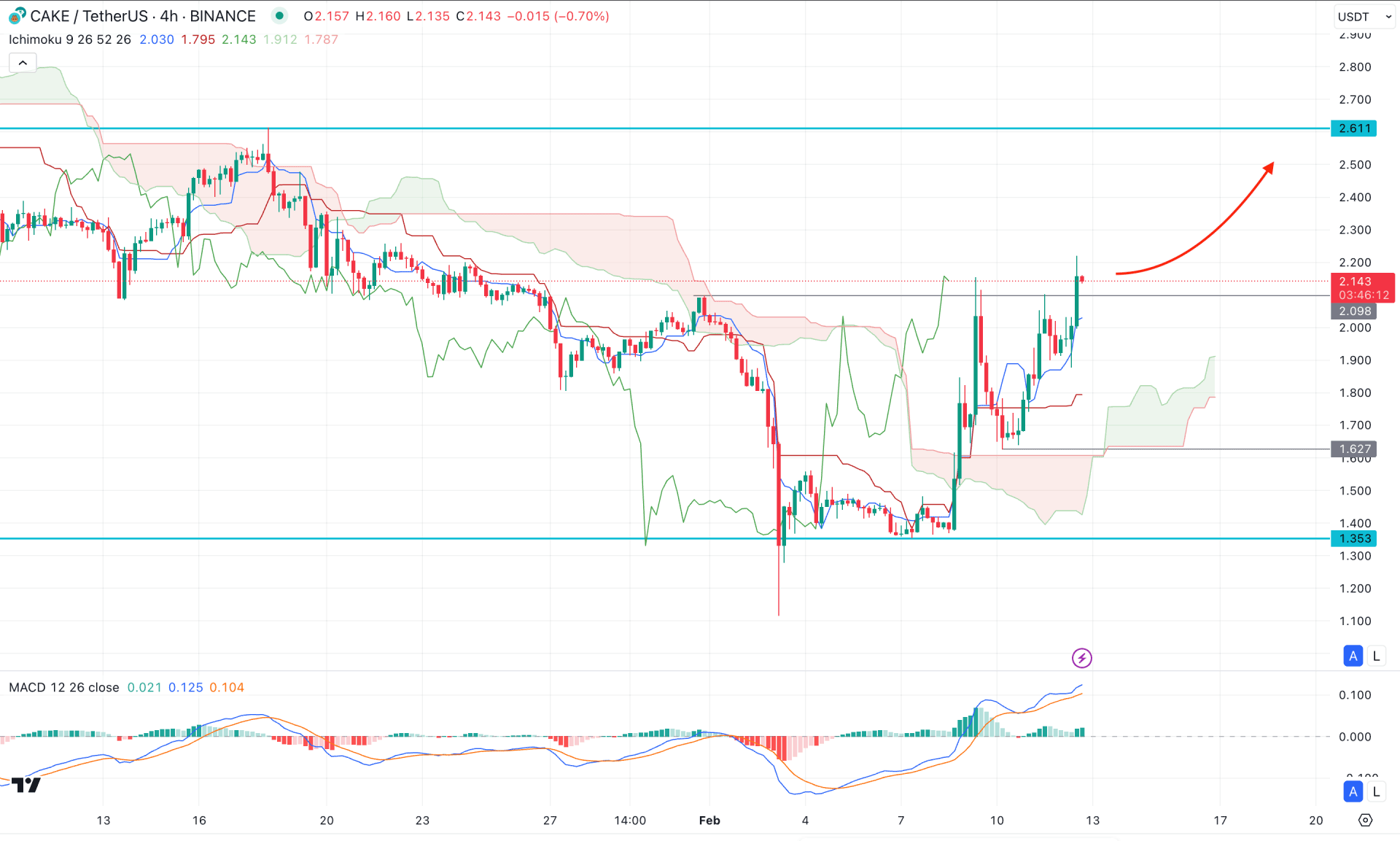

In the H4 chart of CAKE/USDT, a bullish cloud breakout is visible, supported by exhaustion at the bottom. This pair's main aim is to look for a long trade as long as the dynamic cloud support is below the current price.

In the Ichimoku Cloud structure, the Futures Cloud looks positive to bulls as both Shenkou lines are heading upwards. Moreover, the near-term dynamic Tenkan Sen and Kijun Sen are below the current price with a potential bullish crossover. It is a sign of an upward continuation, which might extend in the coming period

In the secondary indicator window, the MACD signal line is still narrowing at the bottom, while the signal line forms a bullish extension in the overbought area. It is a sign of a pending downside correction before following the major bullish trend.

Based on the current market structure, any minor downside correction could be a long opportunity in this pair. Any valid bullish reversal from the 2.000 to 1.670 area could increase the long opportunity towards the 2.611 level in the coming hours.

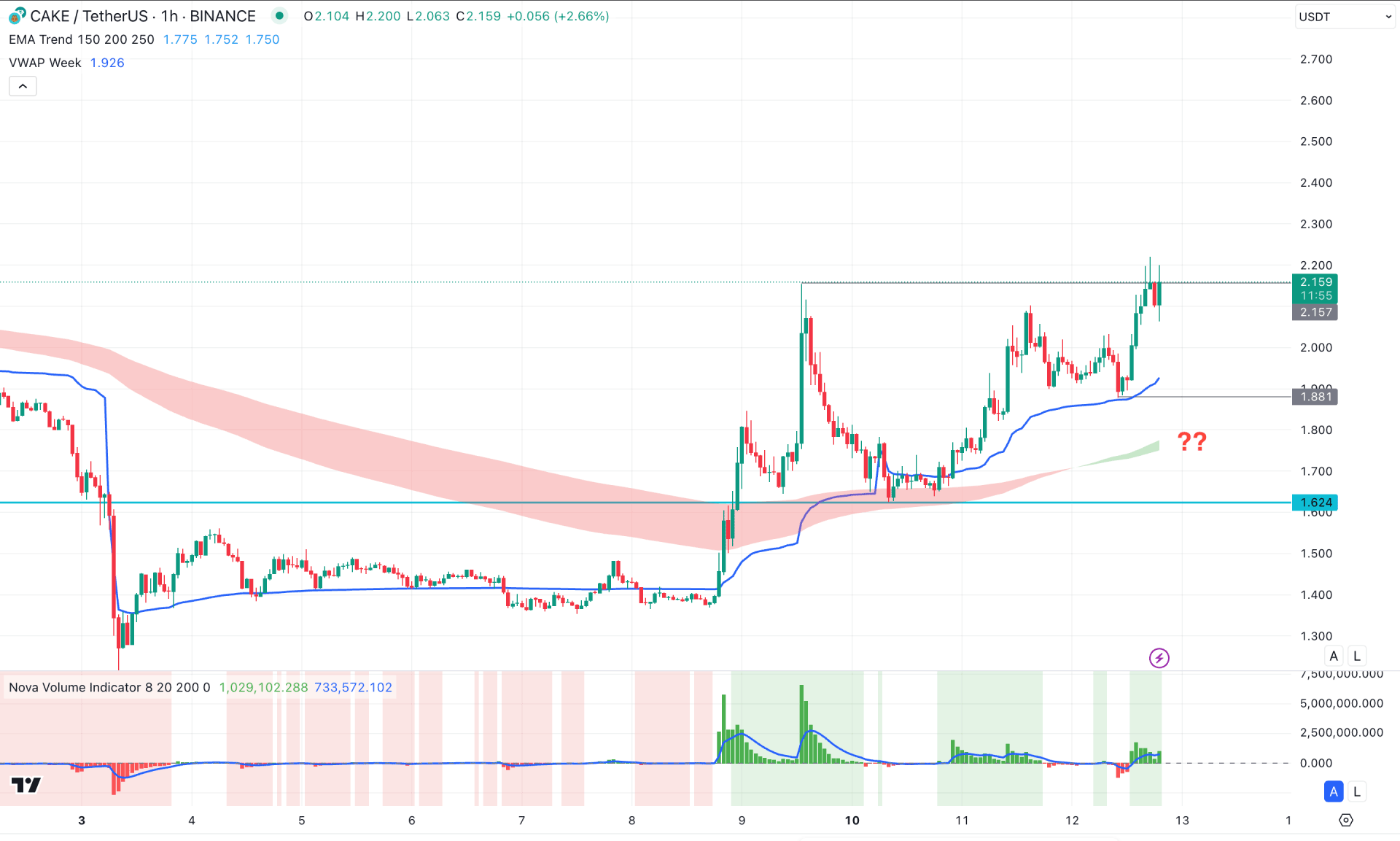

In the hourly time frame, the most recent price showed volatility after reaching the 2.157 high, which signals a struggle to hold the intraday momentum.

On the other hand, the moving average wave is below the current price, in line with the weekly VWAP line. As crucial dynamic lines are below the current price, we may expect a bullish continuation once the downside correction is over.

In the volume structure, the recent Histogram maintains upward momentum, with a possibility of bullish breakout.

Based on this outlook, the upward continuation is potent in this pair. The main aim is to test the 2.700 level in the coming hours.

On the other hand, a failure to hold the price above the 1.881 level could be an alarming sign to bulls, which could lower the price towards the 1.500 area.

Based on the current market structure, CAKE/USDT is more likely to extend its bullish momentum. As the sufficient sellers' hunt is over, investors might join the bull run from near-term swing low in the intraday chart.