Published: March 12th, 2025

Memory and storage devices are designed, produced, and sold by Micron Technology Inc. (NASDAQ: MU) to various international markets. The requirement for data storage and processing, which is rising due to artificial intelligence (AI), cloud computing, and HPC, is the foundation of the business's achievement. As a result, there is a huge need for memory chips for expanding AI infrastructure.

In its first quarter 2025 earnings call, Micron Technology Inc. (NASDAQ: MU) revealed $8.71 billion in sales, $11.74 million more than anticipated. The demand for sophisticated DRAM and NAND storage will rise in response to AI models' increasing complexity and size, offering memory chip manufacturers like Micron Technology substantial development potential. Nvidia CEO Jensen Huang also highlighted MU's HBM as essential to the Blackwell framework during the company's January CES briefing.

As the company's tech becomes more widely available, the announcement of AI produced in China would boost its acceptance. Due to their affordability, the requirement for artificial intelligence chips and associated memory systems should rise. Micron Technology Inc.'s (NASDAQ: MU) share price is below the $100.00 level. The consensus estimate for the typical twelve-month trading cost is $130.15, representing a 39.9% increase.

Moreover, the U.S. government has acknowledged the semiconductor industry's strategic significance and has taken action to encourage its expansion. The Science and CHIPS Act of 2022 is an excellent illustration of this assistance, which allocates substantial funds for native semiconductor research and manufacturing.

The state of the world economy also affects the semiconductor industry's performance. Economic downturns may result in a decline in the semiconductor market as consumer interest in electronic devices declines.

On the other hand, economic expansion can increase the requirement for semiconductors and open doors for US businesses. Analysts are optimistic that the tech industry will continue working better now that President Donald Trump has been elected to the White House.

Let's see the future price outlook for this stock from the MU technical analysis:

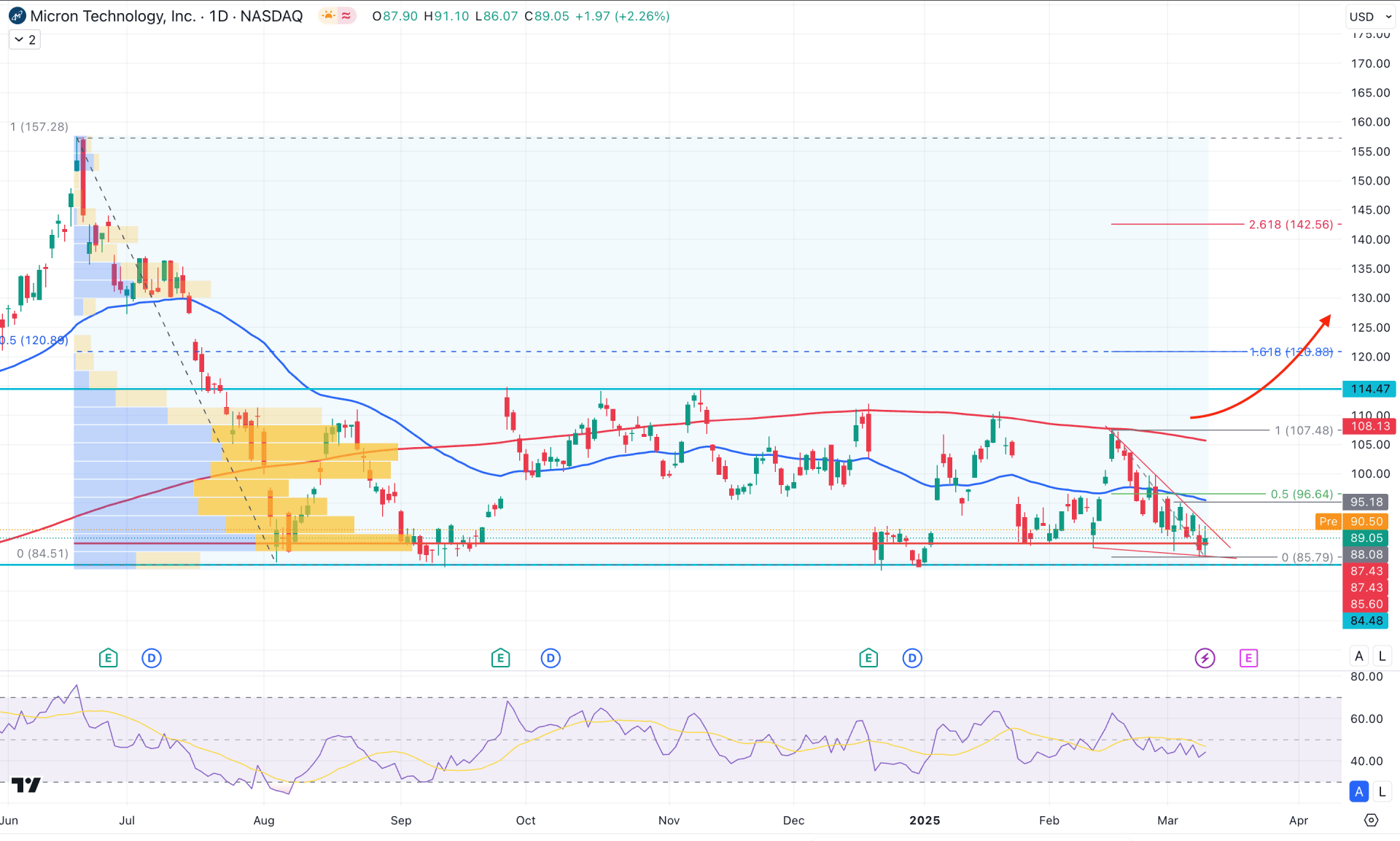

In the daily chart of Micron Technology stock (MU), the overall market momentum is corrective where an extended consolidation is observed after the bearish pressure from the June 2024 peak. As the "drop-base-drop" formation is visible, investors should monitor how the price breaks out from the range before identifying a stable trend.

Extensive volatility has been observed in the monthly time frame since September 2024, with no clear direction. The latest candle is trading below the February 2025 opening price, signaling an ongoing bearish pressure. The weekly chart shows the same pattern, with four consecutive bearish candles visible. Although a minor bullish correction is pending, establishing a stable trend might not be sufficient.

The 200-day Simple Moving Average is pointing downward and acting as a major resistance level. The 50-day EMA shows the same momentum with a death cross continuation signal. As long as the 200-day SMA line holds, we may expect a continuation of the bearish trend.

The Relative Strength Index (RSI) hovers between 50.00 and 30.00 in the indicator window, indicating no clear direction. Since no bottom has been formed, investors might expect a range breakout in the main price before establishing a stable trend.

Based on the daily market outlook, the primary strategy is to look for short opportunities. In this case, a breakout above the trendline resistance with sufficient selling pressure from the 95.18–100.00 zone could signal a bearish trend.

On the other hand, overcoming the 200-day SMA with consolidation above could eliminate the bearish possibility. In that case, the price might extend the bullish momentum toward the 142.56 Fibonacci extension level.

Additionally, the 88.08 support level would be another crucial price to monitor, as significant liquidity is present below this line. Therefore, any immediate selling pressure below this level, followed by a rebound above the 50-day SMA, could offer another long opportunity toward the predetermined price level.

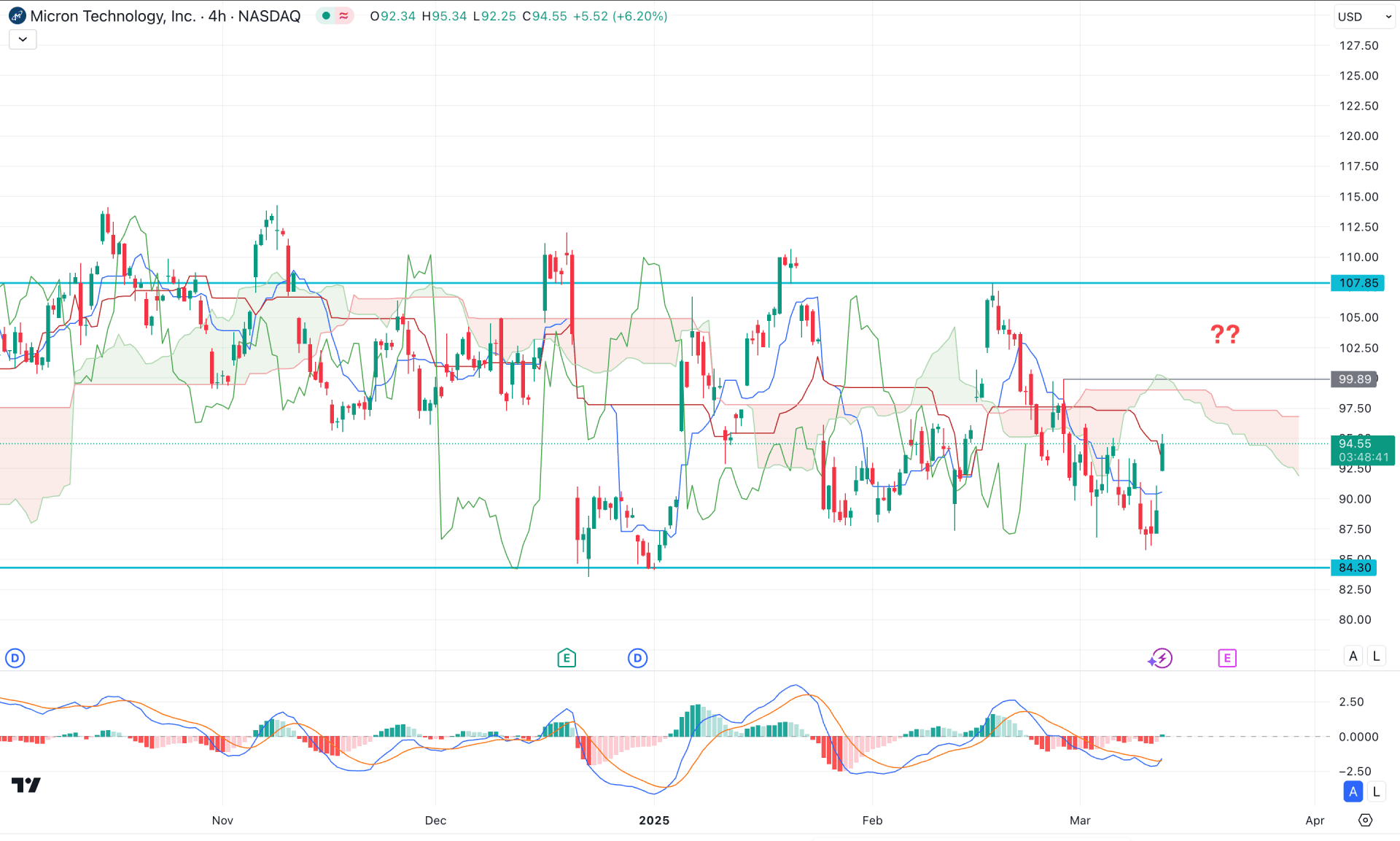

In the H4 timeframe, the current price trades within a consolidation where no clear trend is visible. In the most recent chart, the price is trading within the dynamic Tenkan Sen and Kijun Sen lines, which suggests another sign of consolidation.

In the future cloud, the Senkou Span A and B are aimed lower and have a strong thickness. It is a sign of a bearish continuation in the major trend until the Ichimoku Cloud zone is violated.

Based on the H4 outlook, a bottom is visible in the MACD Signal line as a bullish crossover has formed. In that case, overcoming the 99.89 high could be a primary long signal. However, a stable market above the 107.85 level with a consolidation could be a conservative long approach aiming for the 125.00 level.

On the other hand, a bearish recovery below the dynamic Kijun Sen line might lower the price toward the 80.00 psychological line.

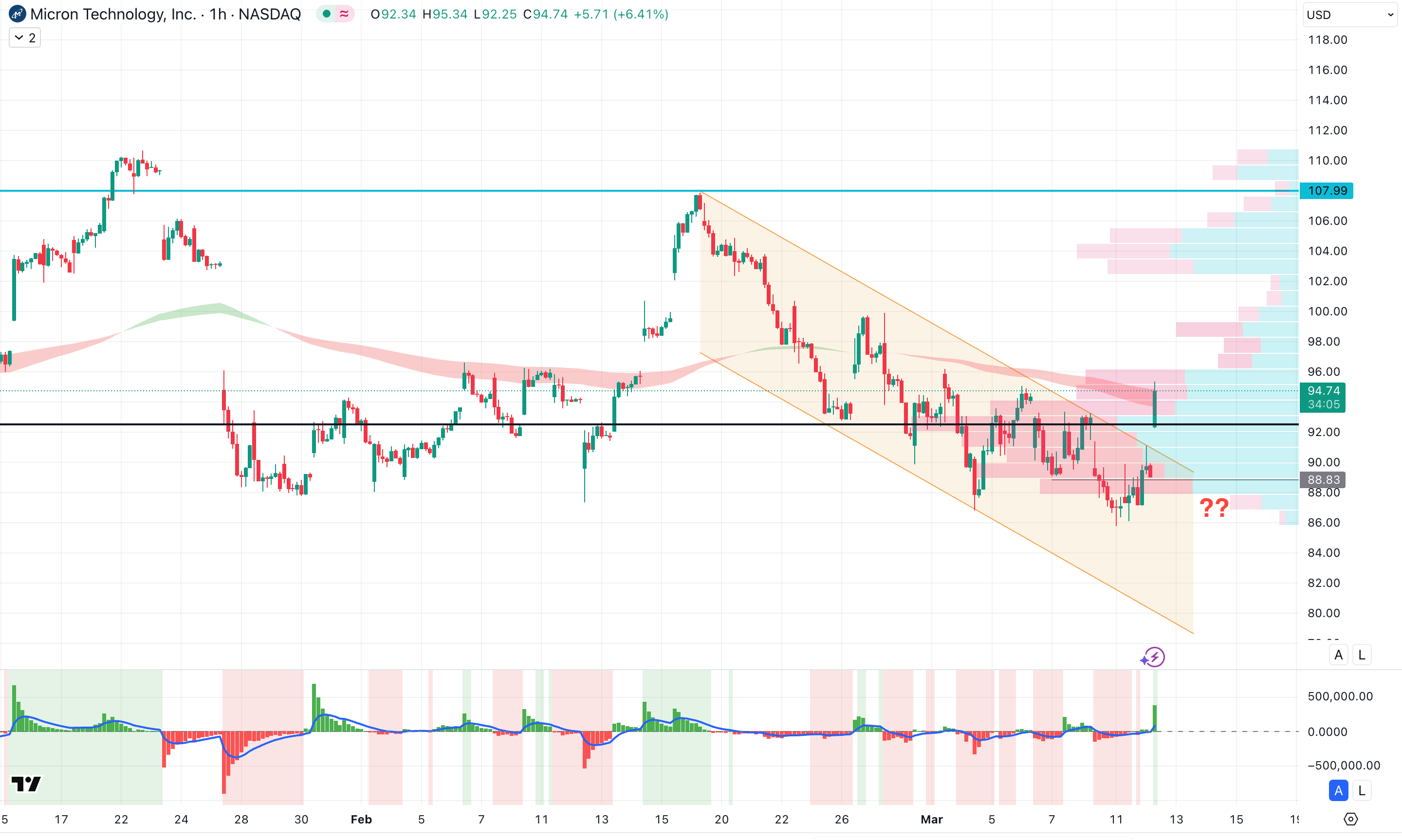

The price has fully recovered from a descending channel in the hourly time frame. The Moving Average Wave acts as immediate resistance, but the visible resistance lies below the current price at the 92.65 level. In this case, investors should monitor the price's momentum, as consolidation above the cloud resistance could extend upward pressure in the coming hours.

Based on this outlook, the bulls might encounter resistance at the 107.99 level. A breakthrough above this line could lead to a significant shift, potentially pushing the price above the 120.00 area.

On the other hand, failure to maintain the price above the 88.83 level, combined with an immediate recovery below the trendline resistance, could extend the correction toward the 80.00 level.

Based on the current market analysis, Micron stock is trading within a consolidation phase. A valid bullish breakout is needed before confirming a potential rebound. Until then, several short-term investment opportunities are available, as any bullish price action from the bottom could be a short-term trading opportunity.