Published: May 25th, 2023

According to blockchain data, Justin Sun, the originator of the Tron network, initiated a transaction involving 6,802 MKR tokens. This transaction is worth approximately $4.3 million at the current token pricing of $633.96 USD per token.

The tokens were transmitted from Sun's wallet to Binance's account using an intermediary wallet.

This transfer occurred during the Endgame governance structure restructuring of MakerDAO. The protocol's founder, Rune Christensen, directs this reorganization, which divides the decentralized autonomous organization (DAO) into smaller, self-governing entities known as SubDAOs.

MakerDAO is also introducing upgraded variants and new names for its DAI stablecoin and MKR governance token as part of this initiative. In addition, there is a trend toward investing a greater proportion of reserves in real-world assets.

In related news, a provider of cryptocurrency ATMs has settled with the banking authorities of Connecticut, recovering $86,000 for customers.

Maker (MKR) functions as the governance token for the Ethereum-based MakerDAO and Maker Protocol. The initiative's primary objective is to facilitate the operation of DAI, a community-managed, dollar-pegged digital currency.

Let’s see the upcoming price direction of MakerDAO from the MKR/USDT technical analysis:

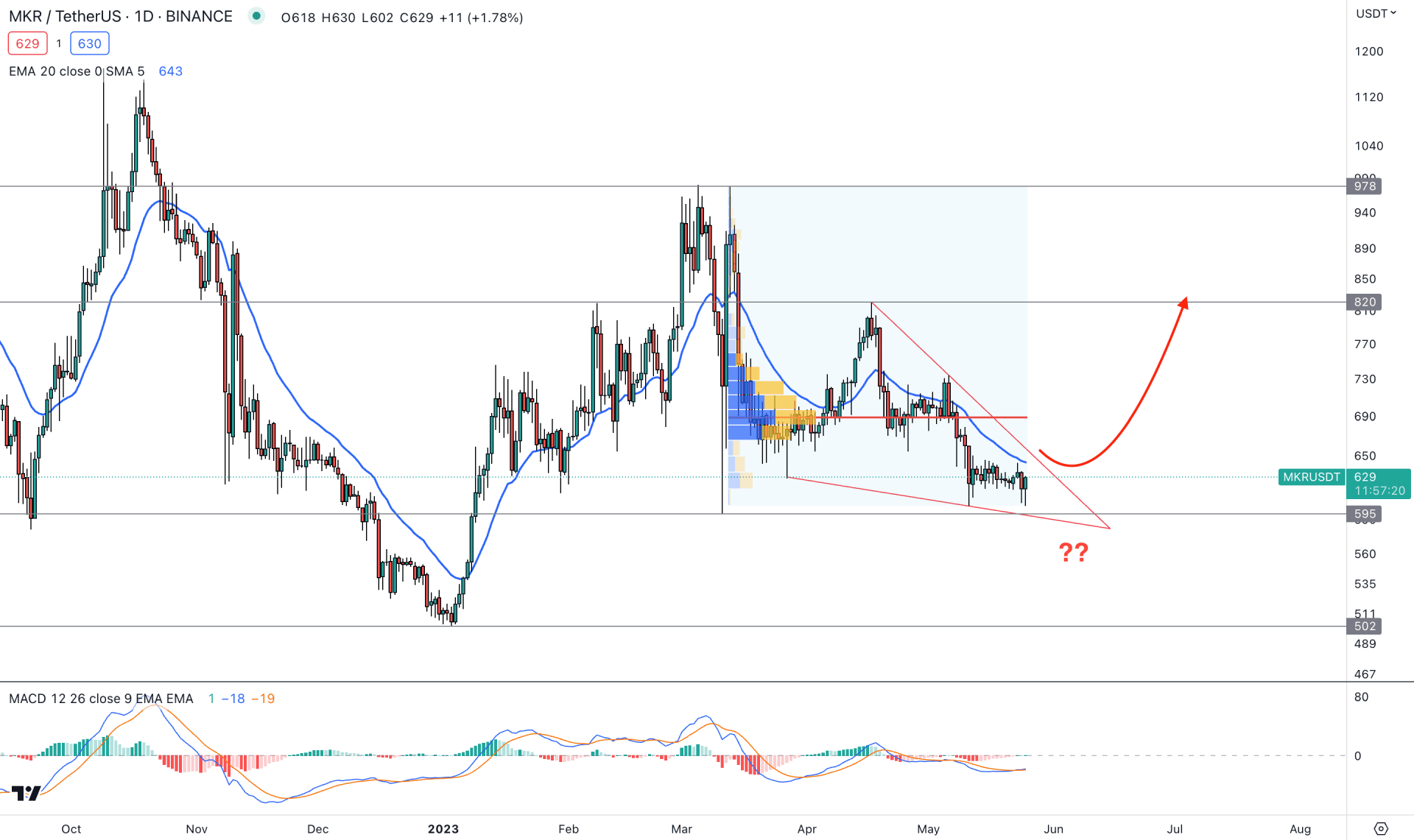

In the MKR/USDT daily chart, an extreme correction is seen as the current price is facing triangle support. Therefore, the primary trading approach in this pair is to look for a bullish break from the triangle, which could offer a decent long opportunity.

In the earlier price action, a strong bullish pressure is seen from the 502.00 support level, which ended at the 978.00 level. In this range, the current price is trading below the 50% Fibonacci Retracement level, which would be a potential buyers’ territory. In this context, any bullish opportunity is potent in this pair as long as the price trades above the 502.00 level.

We may consider the 689.00 level as crucial if we see the volume structure. Based on the high volume level indicator, the highest activity has been seen at the 689.00 level since 13 May 2023. A strong bullish break is needed before forming a stable trend because the high volume level is above the triangle resistance.

In the main price chart, the most recent price is trading sideways, where the 595.00 support level is still protected. The dynamic 20 EMA is above the current price with a corrective momentum. The indicator window shows a corrective price action from the flat MACD EMA’s. Moreover, the MACD Histogram is flat at the neutral level, with a potential bullish crossover in EMA’s.

Based on this structure, a valid break from the triangle area is needed. Moreover, a D1 candle above the 689.00 high volume level would be the conservative buying approach, but any early opportunity needs to be validated from the lower timeframe price action.

On the bearish side, a D1 candle below the 595.00 level could initiate a sharp fall toward the 502.00 key support level.

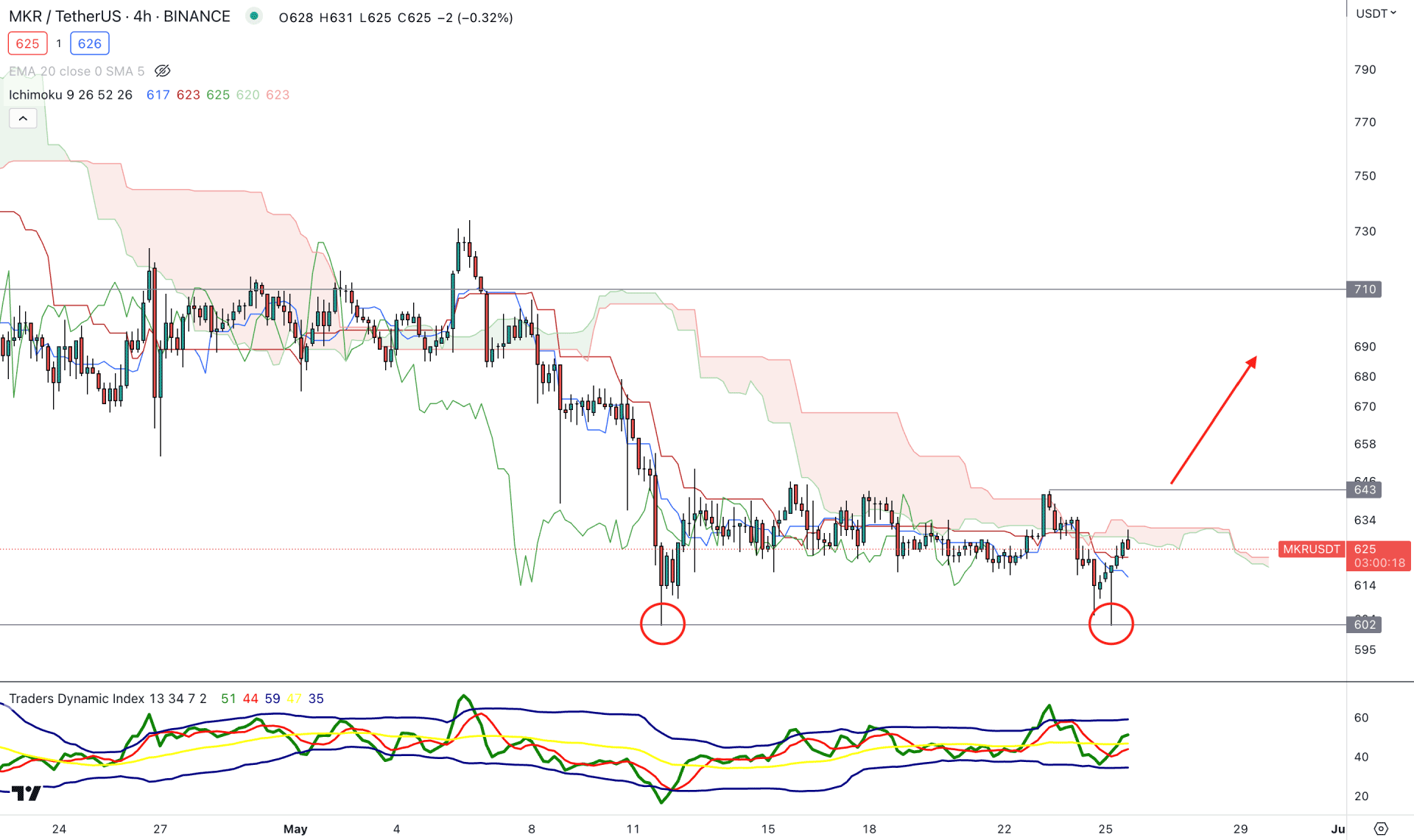

The H4 chart shows a potential double bottom pattern at the 602.00 near-term support level. However, proper validation of the pattern should come with a new high formation above the 643.00 level.

The current Senkou Span A is below the Flat Senkou Span B level in the future cloud. It is a sign that bears control the price, but the momentum is slow.

An early bullish signal is visible in the indicator window as the current TDI level is above the neutral 50.00 line.

Based on the H4 structure, a valid break above the 643.00 level is needed with an H4 close, which could open the room for reaching the 710.00 level.

The alternative trading approach is to look for short opportunities if a new H4 candle comes below the 600.00 level, invalidating the double bottom pattern.

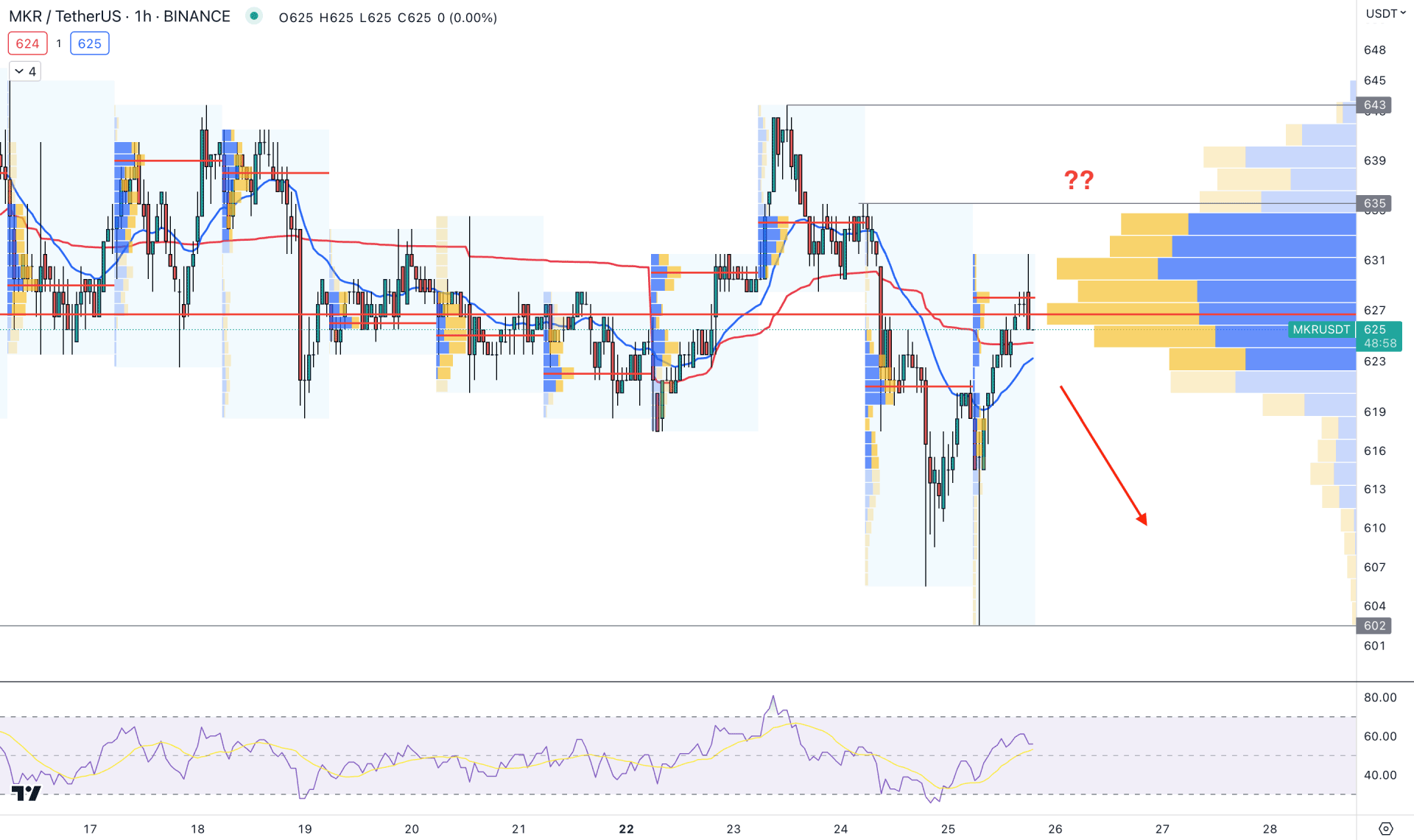

In the hourly chart, a corrective price behavior is visible, where the current visible range high volume level is closer to the price.

The recent downward pressure is supported by several lower low formations, but the dynamic 20 EMA and VWAP are still below the current price.

The indicator window shows a corrective momentum, but no selling signal is seen as the current level is above the 50.00 line.

Based on the H1 outlook, a new H1 candle below the dynamic VWAP could limit the gain for this trading instrument, where the primary aim would be to test the 602.00 support level.

On the upside, multiple barriers are visible, where a fresh new high above the 643.00 level could create an impulsive momentum in this pair.

Based on the current market outlook, MKR/USDT is more likely to show an impressive bullish trend, but proper validation is needed from the recent price pattern. A close attention is needed on the lower timeframe price action as a new swing high in the H1 chart could be an early buying opportunity.