Published: March 2nd, 2023

The native token of Maker DAO, MKR, saw a significant increase in price after the DeFi protocol rejected a $100 million loan proposal from Cogent Bank. As a result, the MKR/USDT price reached its highest level since October 27, 2022, and a 90% increase from its lowest point this year.

MakerDAO is one of the leading lending protocols in the blockchain industry. Its stablecoin, Dai, is an algorithmic stablecoin that trades at $1 and has a market cap of more than $5 billion. Therefore, investors often find this network trustworthy, where eliminating the volatility is easy.

According to DeFi Llama, MakerDAO's total value locked (TVL) has risen to about $7.2 billion, the second-largest protocol after Lido. MKR is the native token for the MakerDAO ecosystem, with a current market cap of $874,776,802.

Currently, there are 977,631 MKR in circulation, which is 97% of the overall supply. The trading volume from the last 24 hours is also solid at $131,495,244, representing a 30% increase from the previous day.

Should you invest in Maker DAO (MKR)? Let’s see the full price projection from the MKR/USDT technical analysis-

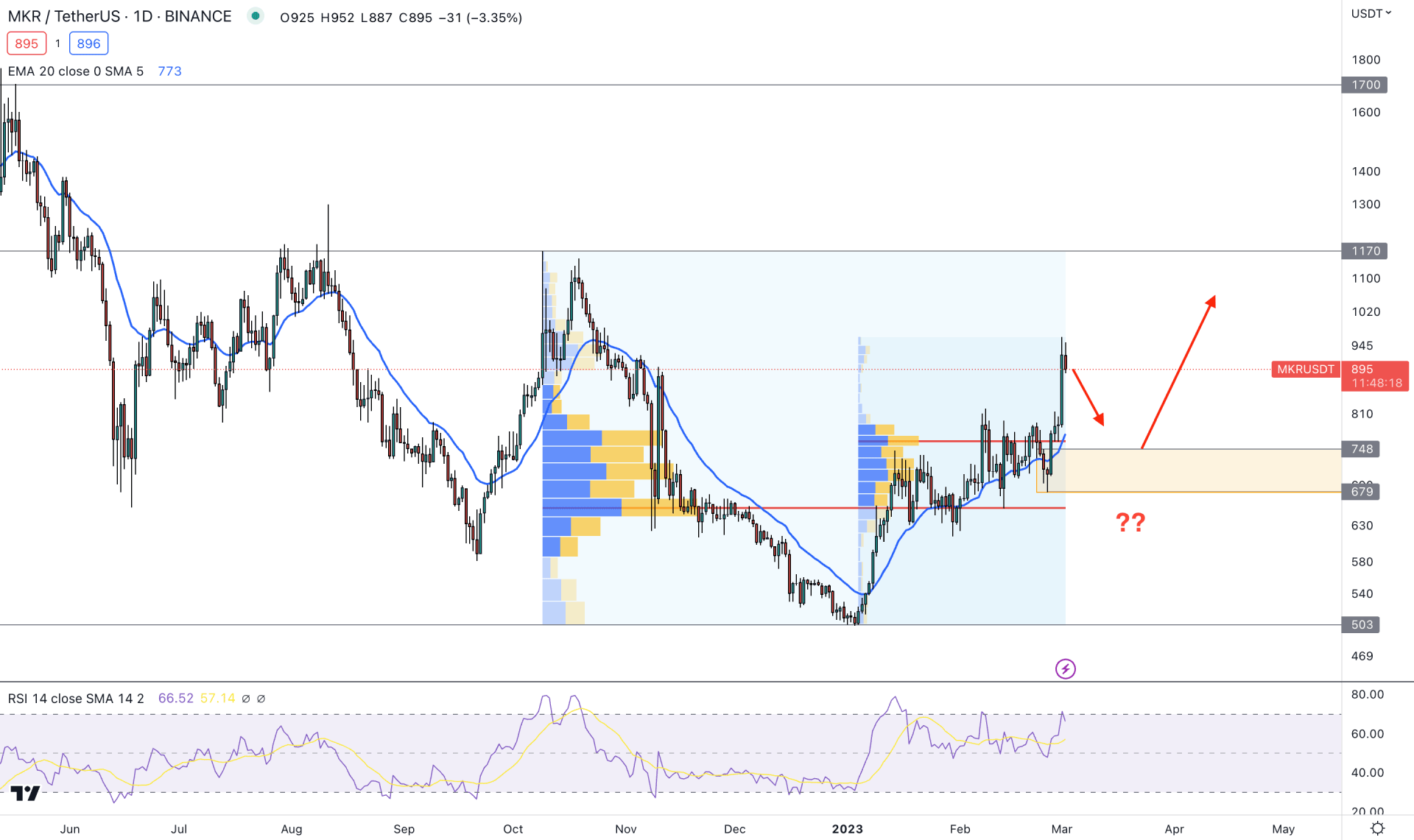

In the daily chart, the current market outlook is bullish for the MKR/USDT, which was initiated from the 503.00 swing low.

A downside pressure was seen from the 1170.00 level that came with a buy-side liquidity grab in 2022. Therefore, we can consider the 1170.00 level as a solid top and the 503.00 level as a bottom. The current price is trading at the premium zone from this area, which is a sign of a possible downside correction in the coming days.

The high volume trading level from October to February was spotted at 655.00 level. Another high volume level from 2023, low to high, is at the 760.00 level. As these high volume levels are intact, we may expect the price to grow after completing the profit-taking.

The existing buying pressure from the 503.00 swing low made a strong gap with the dynamic 20 EMA, which increases the possibility of a bearish correction. Moreover, the recent rally-base-rally formation made the 748.00 to 679.00 area a solid bottom. In that case, the price is more likely to offer a buying opportunity after completing the bearish correction towards this demand area.

The indicator window shows a buyer's presence in the market, as the current RSI has been above the 50% area for a considerable time. Therefore, the buying possibility is valid as long as the RSI remains above the 40.00 level.

Based on the daily outlook, bulls have a higher possibility of grabbing the wheel of this pair but after completing the sufficient correction. The first buying attempt may come after testing the dynamic 20 DMA. However, breaking below the 670.00 level with a bearish D1 candle could lower the price towards the 503.00 area.

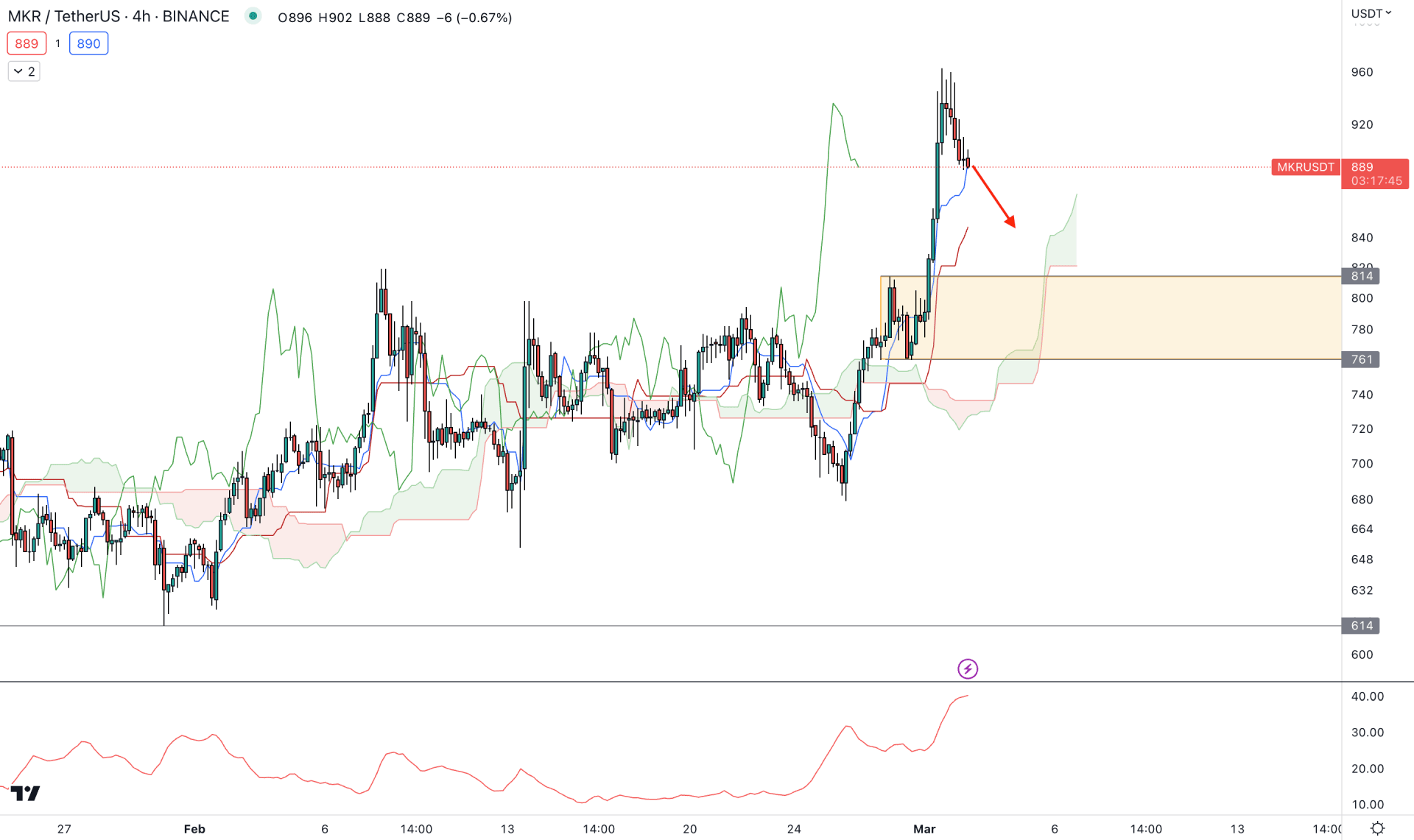

The buying possibility is potent in the MKR/USDT H4 chart, as the Ichimoku Kumo Cloud is below the current with a bullish rally-base-rally formation. The future cloud is also bullish, while the Senkou Span A and B gap is expanding.

The dynamic Tenkan Sen has appeared as an immediate support, but the Kijun Sen remains with a strong gap. The strength of the current bearish trend is strong, as shown by the ADX, which may drag the price below the Tenkan Sen support level.

Based on this price behavior, the buying possibility is intact as long as the price trades above the 761.00 level. Any bullish rejection from the dynamic Kijun Sen or 814.00 to 761.00 area could open a long possibility towards the target of 980.00 level.

However, breaking below the 760.00 level with a bearish H4 candle could lower the price towards the 614.00 area.

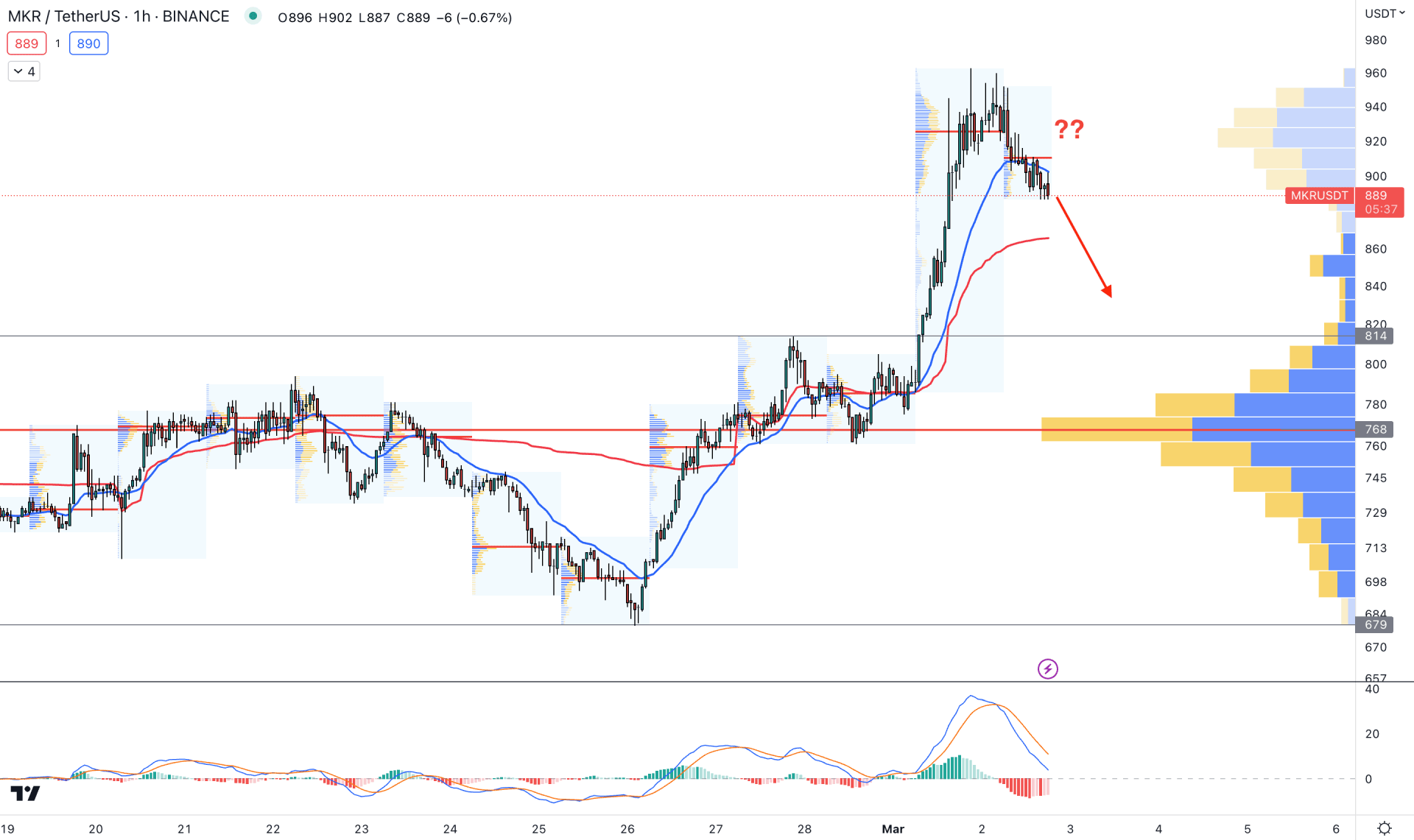

In the hourly chart, the buying opportunity is still valid but the break below the dynamic weekly VWAP is signaling that bears may increase their momentum in the coming hours.

The visible range high volume level is below the price at 768.00 level, while the dynamic 20 EMA is working as immediate support.

The MACD Histogram is below the neutral zone with a bearish crossover among MACD EMA lines.

Based on this structure, investors might see a rebound in the price from the dynamic 20 EMA or static 814.00 level. However, breaking below the 768.00 level with an H4 candle close could lower the price towards the 679.00 area.

Based on the current price outlook, MKR/USDT is likely to extend the buying pressure as the current trend is bullish. However, a sufficient downside correction is pending, and investors should wait for a valid price action in the intraday chart before opening a long position.