Published: September 23rd, 2025

On September 25, Jabil, Inc. (JBL) is expected to release its fiscal 2025 fourth-quarter earnings. Sales and earnings are estimated by analysts to be $7.6 billion and $2.95 per share, respectively.

Over the last four quarters, the top electronics manufacturing services company has consistently exceeded earnings projections and has had a strong track record of financial surprises. On average, it produced a four-quarter profit surprise of 6.68%.

Jabil declared during the quarter that it would invest $500 million in Southeast America over the course of the following few years. The investment focuses on developing talent and expanding manufacturing capacity for the AI and cloud-based data center infrastructure market. The calculated investment will strengthen Jabil's position in the supply chain for AI hardware.

Additionally, Jabil will be better able to align its production and adjust to meet local demand from hyperscaler customers due to the specialization of its production facilities. Additionally, it will shield the business from uncertainties associated with tariffs and geopolitical volatility.

In terms of valuation, Jabil is undervalued relative to its industry peers. According to the price-to-earnings ratio, the company's shares are presently trading at 20.02 times earnings, which is higher than the industry mean of 17.91 but lower than the industry average of 25.4.

Let's see the complete price outlook from the JBL technical analysis:

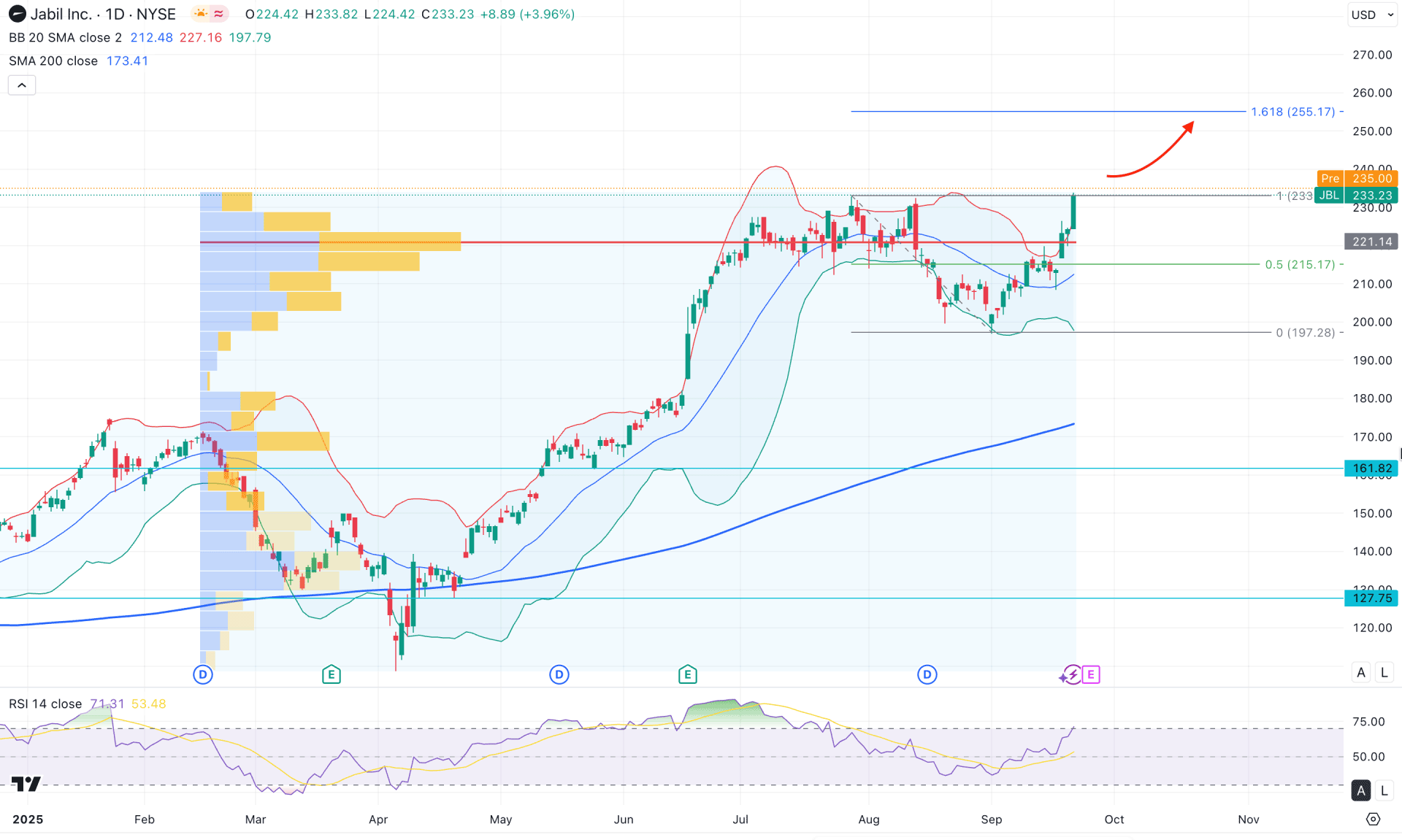

On the daily chart of Jabil stock, the broader market momentum is bullish. The price has been pushing higher since April 2025, from where a new yearly high was formed. As the most recent price action is forming a base near the yearly high area, increased bullish pressure could emerge.

Looking at the higher timeframe, the ongoing buying pressure followed a significant bearish correction in August 2025. During that month, the price moved lower, creating a new monthly low, but failed to sustain the bearish momentum. As a result, the price has been pushing higher and is now approaching the all-time high area. Investors should closely monitor how the price reacts at this level.

In terms of volume, the ongoing buying pressure appears strong, with the highest volume activity level from February 2025 now near the current price. Moreover, the most recent daily candle closed above the high volume line, supported by multiple consecutive bullish daily closes. As long as the high-volume level at 221.14 holds, investors can expect continued bullish momentum.

On the daily chart, the most recent bullish continuation occurred after a potential bearish range-bound breakout, which likely triggered a significant liquidity grab on the sell-side. As the price rebounded near the highs, this may indicate that bears at that level have been wiped out or profit-taking has already occurred.

In the main indicator chart, a bullish reversal candle formed near the mid-level of the Bollinger Bands, triggering a high-volume breakout above the upper Bollinger Band. Meanwhile, the overall market momentum has shifted to bullish, as shown by the 200-day Simple Moving Average, which now has a bullish slope and remains below the 200.00 psychological level.

In the secondary indicator window, a rebound is seen in the Relative Strength Index (RSI), which has reached the 70.00 overbought zone. This suggests that bullish momentum is likely to continue as long as the RSI remains above the 50.00 neutral level.

Based on the overall market structure, JBL stock is more likely to extend its bullish momentum beyond the current all-time high and potentially reach the 255.17 Fibonacci extension level.

However, entering a long position near this premium price area requires caution, as significant sell-side liquidity may be present above the 233.00 zone. In such a case, a bearish exhaustion signal—such as a daily close below the mid-Bollinger Band—could present a short-term short opportunity, targeting the 190.00 level.

On the other hand, since no significant selling pressure has been observed near the top, further confirmation is needed before anticipating a trend reversal. For a long-term short setup, investors should look for a stable breakdown below the 197.28 key consolidation level. Ultimately, the 127.75 level would be the final downside target, following a break below the 161.82 key support.

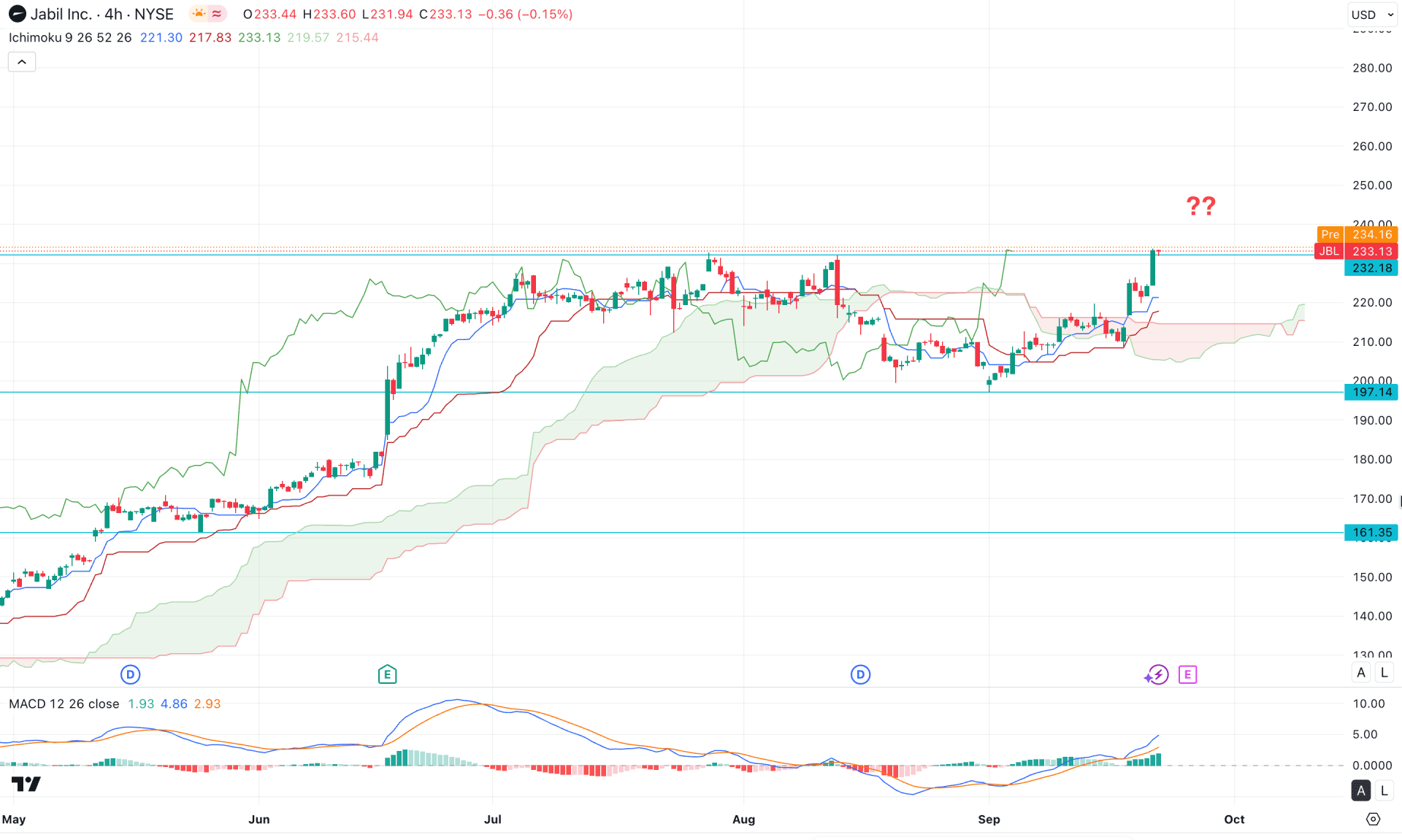

In the H4 timeframe, a bearish correction is over as the price failed to hold the momentum below the Ichimoku Kumo Cloud. After forming a bottom at the 197.14 level, the price rebounded and formed a stable position above the Kumo support. Moreover, the Future Cloud has flipped the position, where the Senkou Span A is hovering above the Senkou Span B.

In the secondary indicator window, the MACD Histogram maintained a stable position, where the Signal line has reached the upper peak area. As no bearish crossover is visible in the MACD Signal line, we may consider the ongoing buying pressure valid.

Based on the overall market structure, the buying pressure above the dynamic Kijun Sen level might extend the momentum above the 260.00 area.

On the other hand, a mean reversion is pending, where the price needs to rebound at the dynamic area before offering a long approach. A bearish break below the Kumo Cloud, accompanied by consolidation below the 197.14 level, might create a short opportunity, targeting the 160.00 area.

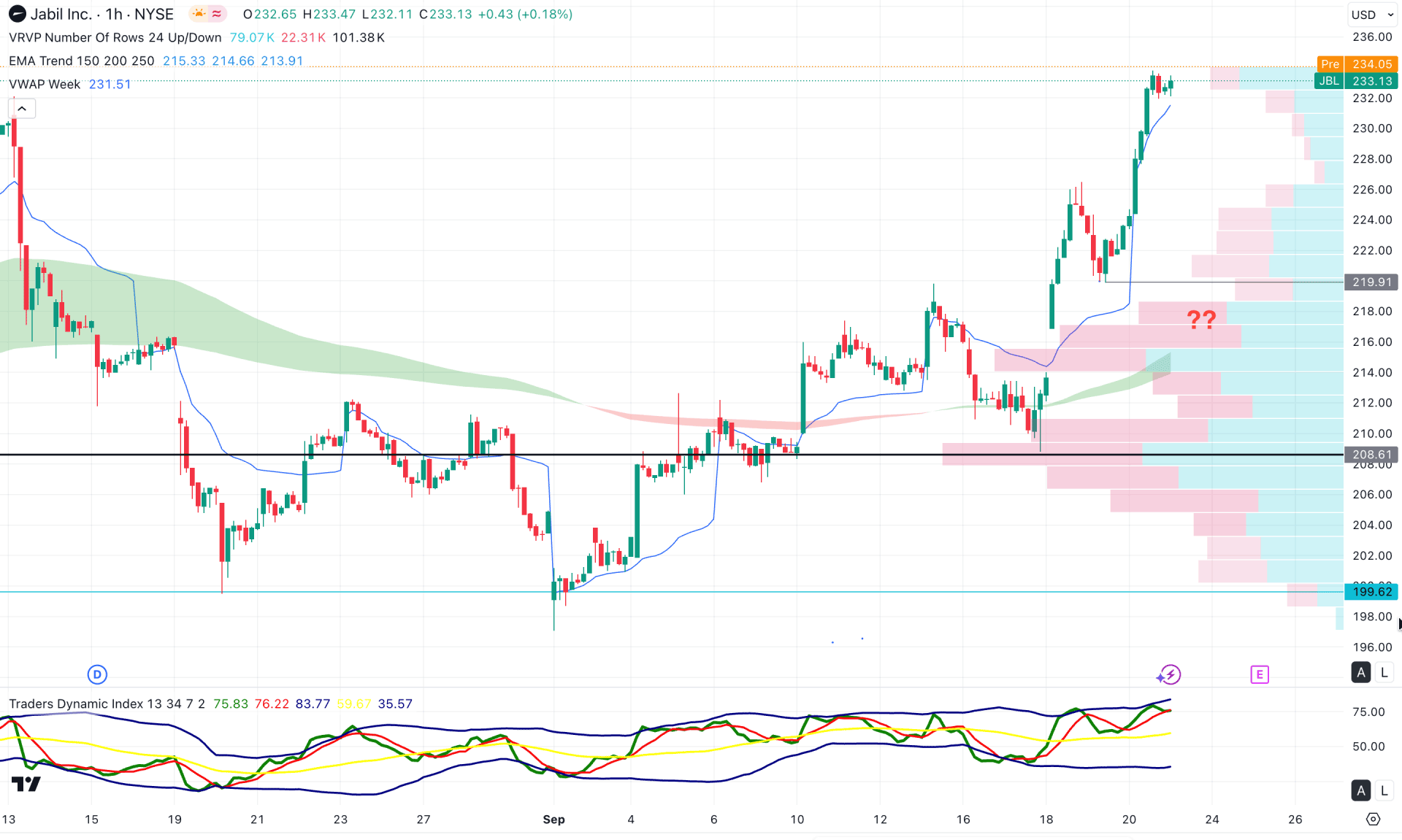

In the hourly timeframe, the current price is trading within a bullish momentum as near-term dynamic lines are below the current price. However, the price is also overextended from the dynamic weekly VWAP line, which suggests a potential bearish correction as a mean reversion.

Based on this outlook, a potential bearish correction is pending, signalled by the upward peak in the Traders Dynamic Index (TDI) indicator. A potential bullish continuation opportunity is valid as long as the dynamic VWAP line is below the current price.

However, an extended selling pressure below the 219.00 level might activate the bearish opportunity, targeting the 200.00 level.

Based on the overall market momentum, JBL is more likely to extend the upward pressure, where the upcoming earnings report could be a fuel. An upbeat result, with a bullish trend continuation price pattern could offer a decent long opportunity.