Published: September 24th, 2024

Jabil Inc (JBL) 's fourth-quarter fiscal year 2024 results are scheduled to be released on September 26 before the opening bell. The company's earnings were amazing for the most recent quarter, at 2.16%. It achieved an average trailing four-quarter revenue surprise of 3.10%.

In the final quarter of fiscal year 2024, the top global provider of electronics manufacturing services will probably see a year-over-year revenue decline. Macroeconomic difficulties and soft demand patterns in certain end markets will probably stymie top-line growth. Positives include initiatives to increase profits and free cash flow.

Jabil is prioritizing the integration of advanced machine learning and artificial intelligence in order to augment its portfolio offerings and optimize internal processes. The proliferation of AI in the cloud, networking purposes, and industrial automation end sectors, as well as the increasing need for AI facilities in data centers, are significant tailwinds. Combined with its extensive global operations and emphasis on end marketplaces and diversification of products, Jabil provides a high level of resilience in the face of macroeconomic conditions and geopolitical upheaval. Free cash flow and economic viability are increasing due to management's emphasis on operational effectiveness and efficient operation of working capital.

Softening demand in several important end markets, such as digital printing, medical care, renewable energy, and 5G, is negatively impacting net sales. The company's automobile vertical is also facing challenges due to overcapacity and excessive inventory levels in the Chinese automotive market.

Furthermore, there has been a delay of several quarters in the introduction of new platforms for electric vehicles. These factors probably hindered revenue during the last quarter of the 2024 fiscal year. The company's short-term top-line growth will be impacted by its plan to restructure and reshape its portfolio in order to withdraw from less promising markets.

According to the company, the newly launched product introduction line will incorporate technologies like accurate die bonding and fluxless flip-chip, which will allow for rapid growth from evidence of idea to mass production.

Let's find the upcoming price direction of this stock from the JBL technical analysis:

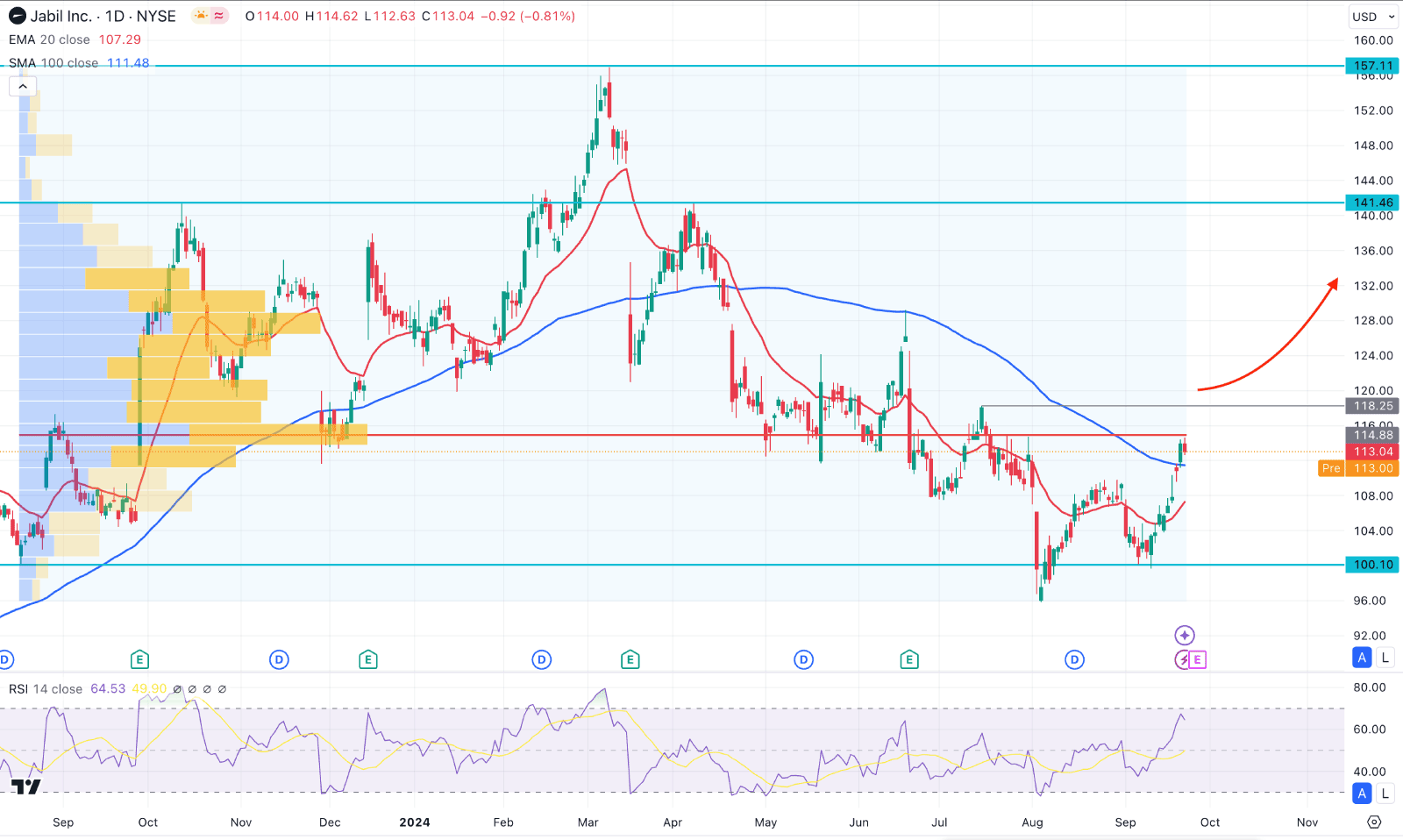

In the daily chart of JBL, the price showed extensive selling pressure from the crucial high formed in March 2024.

In the broader context, the latest monthly candle closed as a bullish hammer, suggesting a potential bullish continuation. Moreover, the ongoing monthly candle is hovering above the August 2024 high, suggesting an additional bullish signal.

In the volume structure, the largest activity level since September 2023 is just above the current price and working as a resistance. In that case, investors should monitor how the price reacts from this resistance as a valid break could signal a trend reversal.

In the main chart, the ongoing buying pressure is valid above the 20-day Exponential Moving Average. Moreover, the latest daily candle closed above the 100-day SMA, which signals an additional buying pressure.

Despite the bullish continuation from the dynamic line, the crucial resistance of 118.75 is still protected. In that case, valid buying pressure might be needed above this line before expecting a trend reversal.

In the secondary window, the 14 day Relative Strength Index (RSI) moved above the 50.00 line and yet to test the 70.00 overbought level.

Based on the daily market outlook, the bullish continuation is potent, where a valid break above the high volume line could open the room for reaching the 141.46 level.

On the other hand, a struggle to break above the 120.00 line should be monitored. A bearish reversal with a daily close below the 104.00 line might open a bearish opportunity, aiming for the 80.00 area.

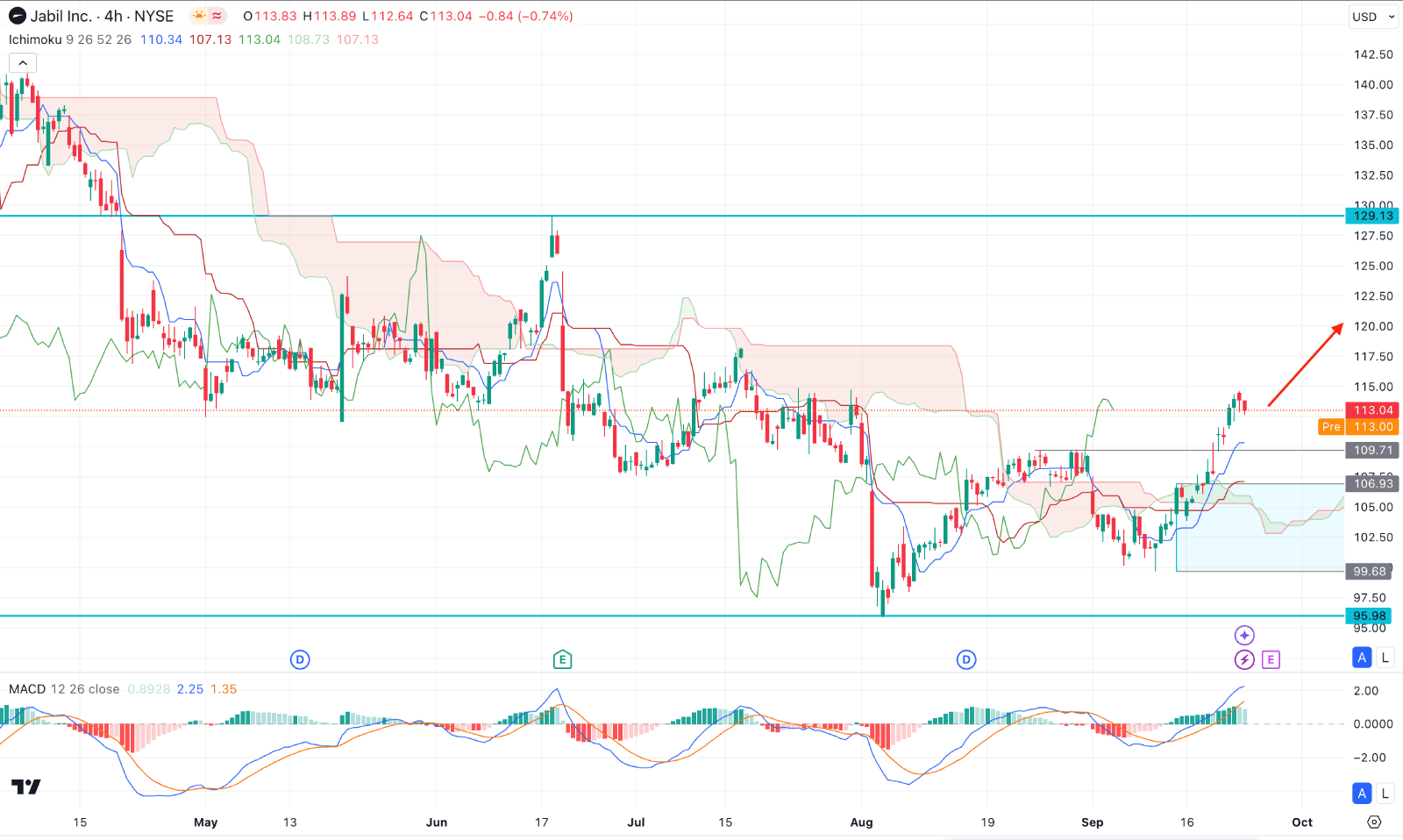

In the H4 timeframe, JBL has shown a decent bullish pressure as the current price hovers above the Cloud zone for the first time since July 2024. Primarily, it is a sign that bulls have joined the market and are holding their position for more gains.

On the other hand, the future cloud has flipped its position by moving the Senkou Span A above the Senkou Span B. Moreover, there is a bullish crossover in the dynamic line as the Tenkan Sen has moved the Kijun Sen line.

Based on the H4 outlook of JBL, a minor downside correction is pending as the MACD Histogram remains sideways. In that case, a bullish continuation might resume after finding a bottom from the 106.93 to 99.63 zone.

On the other hand, an immediate bullish continuation with a failure to sustain the buying pressure above the 109.71 level could resume the bearish correction below the 95.00 level.

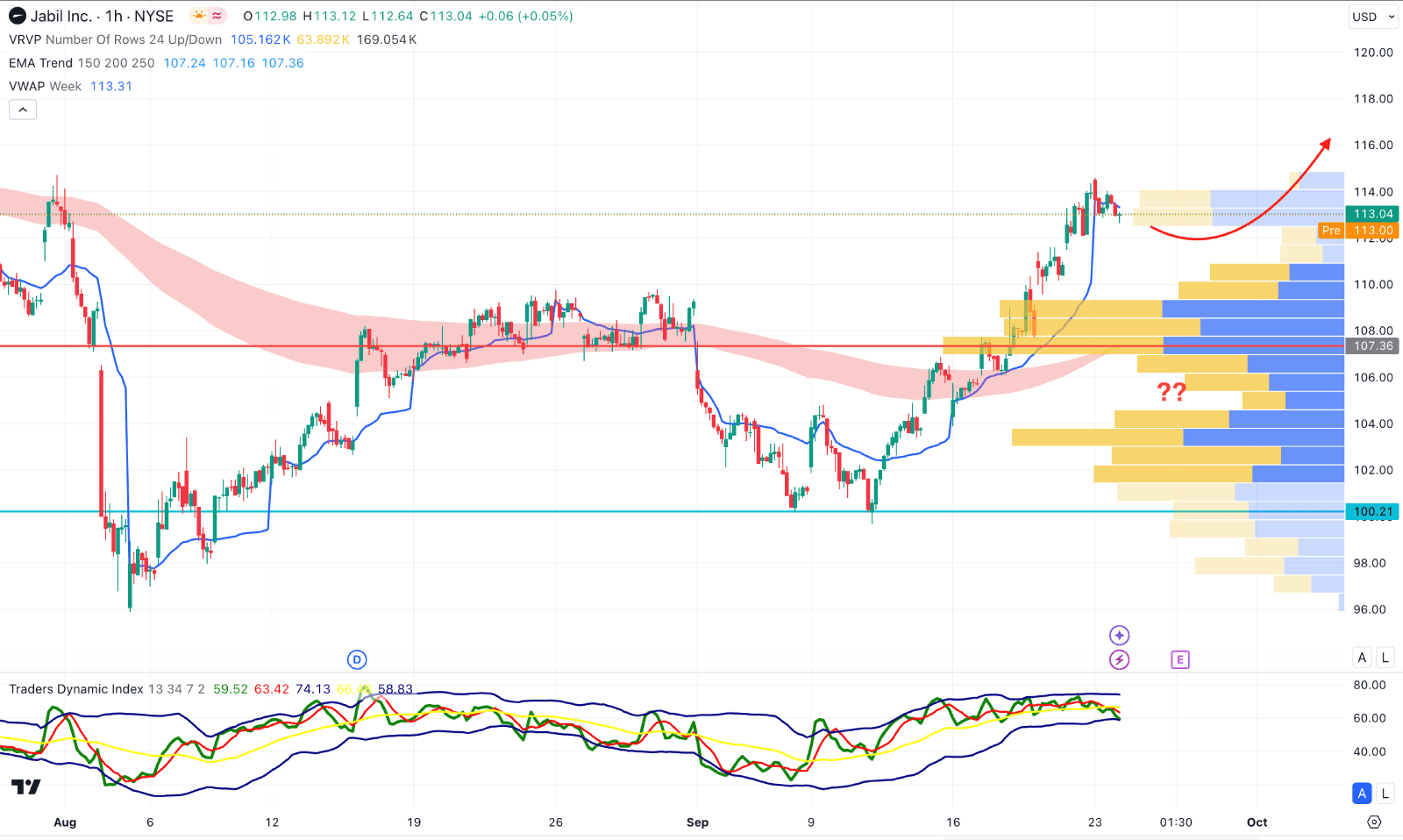

In the hourly time frame, JBL is trading within a bullish pressure as the visible range high volume line is below the current price. The MA wave consists of Moving Average 150 to 250 aimed higher and crossed over the high volume line.

However, the Traders Dynamic Index (TDI) failed to sustain the buying pressure above the 50.00 neutral point and reached the bottom area.

In that case, investors might expect a downside correction as a mean reversion, but the upward possibility is valid as long as the high volume level is below the current price. Any immediate downside pressure with an hourly close below the 104.00 level might extend the downside pressure below the 95.00 area.

Based on the ongoing market pressure, JBL is more likely to extend the upward pressure after having a valid breakout above the near-term daily resistance. Investors should closely monitor the upcoming earnings report as any positive forecast could boost the share price.