Published: December 16th, 2025

General Mills, Inc. (GIS) is expected to release its second-quarter financial 2026 earnings on December 17, where the current estimation is a decline of the profit.

At $1.02 each share, the average estimate for earnings has not moved over the last 30 days, where preceding four-quarter profits surprise was 7.6%.

The fundamental themes of General Mills' fiscal earnings for the second quarter are essentially the same. The company is putting long-term volume restoration ahead of short-term financial success, so even as fundamental brand health steadily improves, the forthcoming earnings are probably going to remain under pressure.

Value and price initiatives continue to have an impact on reported sales in North American retail. A large portion of General Mills' portfolio is still undergoing price adjustments and pack-size modifications, so the price/mix ratio should remain negative throughout the quarter.

Pet sales in North America continue to be a short-term source of margin pressure. In the quarter, the introduction of fresh pet food within the Blue Buffalo trademark started to have a more noticeable effect, resulting in increased marketing and launch expenses prior to a significant revenue contribution.

An essential sign of underlying need will be achievement in the primary pet sector, namely attempts to maintain the strength of cat treats and food while stabilizing dog food. Even while demand patterns in important areas are largely constant, international results are probably going to decline consecutively as certain first-quarter scheduling benefits slow down.

Although underlying indicators are gradually improving, the second quarter will probably continue to be challenging overall.

Let's see the complete outlook from the GIS technical analysis:

On the daily chart of GIS, the dominant market momentum remains bearish, with no significant bottom formation visible. At this stage, investors should closely monitor how the price reacts to this week's earnings report, as a potential high-volume breakout could open the door to a bullish rally.

On the higher timeframe, ongoing market pressure remains negative, as the price is trading within an inside-bar continuation pattern following a strong bearish monthly close in October 2025. However, minor bullish pressure is emerging from the 45.15 weekly support level, from which a corrective move is possible.

From a volume perspective, the price is trading within a seller-dominated zone, as the highest trading activity since February 2025 is concentrated around the 49.30 level. In the event of a bullish breakout, strong buying pressure accompanied by sustained consolidation above this level would be required before anticipating a bullish move.

On the price chart, the 200-day simple moving average is acting as a major resistance, with a steep downward slope above the 51.32 resistance level. Additionally, the 50-day exponential moving average is positioned just above the current price and serves as immediate resistance.

In the indicator window, the Relative Strength Index (RSI) signals a potential bullish recovery by moving above the 50.00 level. However, the strength of the trend remains weak, as the Average Directional Index (ADX) stays below the 20.00 threshold.

Based on this outlook, a bullish breakout above the 49.34 level, combined with an ADX reading above 20.00, would provide a valid setup to anticipate a potential rally toward the 62.60 level.

On the downside, the price remains below major resistance near the 50-day EMA, which could act as a rejection zone. A rejection from the 50-day EMA may extend the corrective move, potentially leading to the formation of a new swing low below the 45.15 support level.

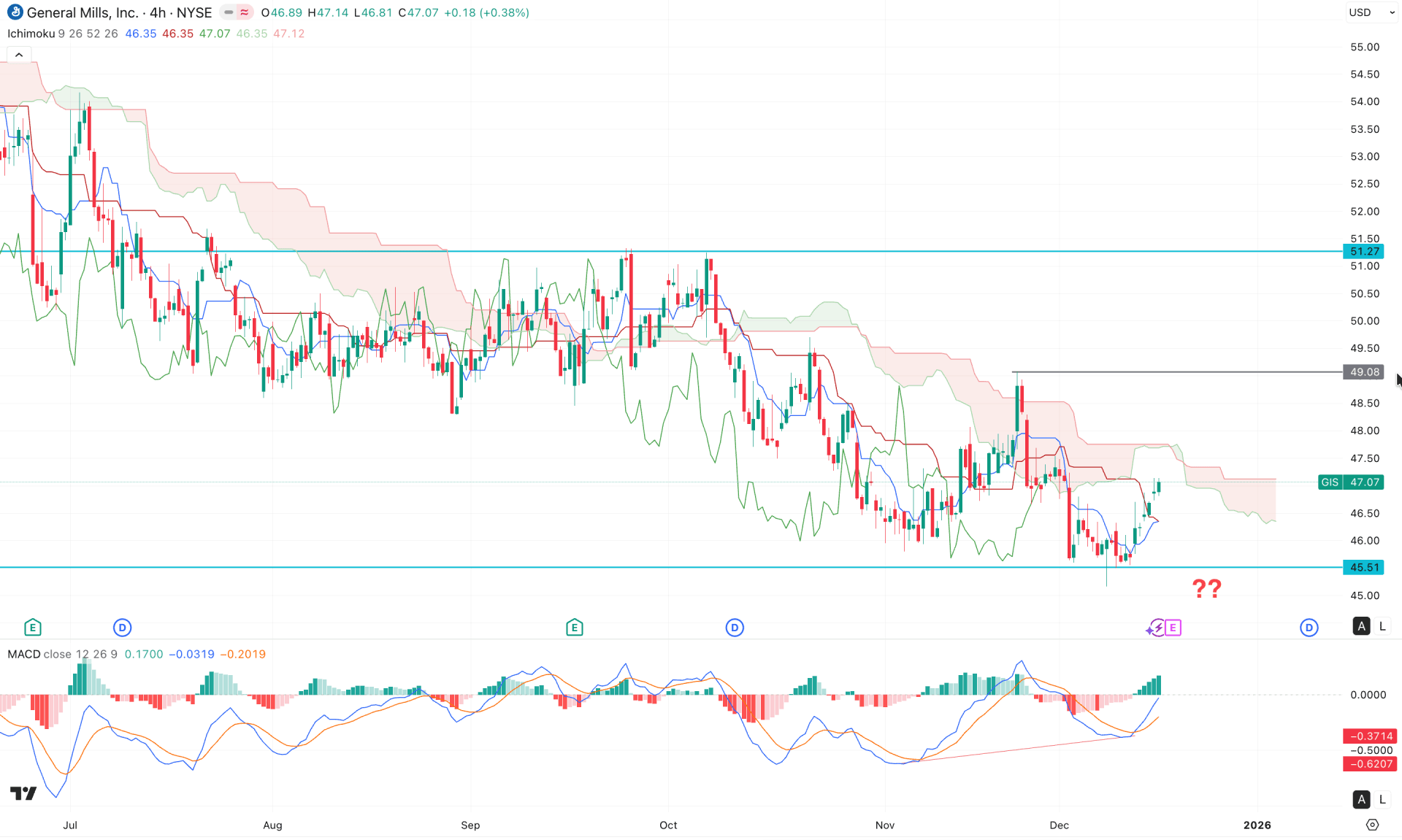

On the four-hour timeframe, corrective pressure is present as the price continues to trade below the cloud resistance area. The future cloud remains thick, supporting the bearish continuation, with Senkou Span A below the Senkou Span B. However, the flat Senkou Span indicates potential sideways movement in the medium term, suggesting that further confirmation is required before anticipating trend continuation.

In the secondary indicator window, a potential divergence has formed, with a bullish MACD signal-line crossover developing in negative territory. Additionally, the histogram has maintained a bullish bias, as the bars have remained above the neutral line for a considerable period.

Based on this outlook, a bullish breakout accompanied by a new swing high formation above the 49.08 level would validate the upside scenario, increasing the probability of a move toward the 60.00 psychological level.

On the downside, the price is trading above the immediate Ichimoku support. However, a bearish flip followed by a four-hour close below the 46.00 psychological level could resume the prevailing bearish trend, potentially driving the price toward the 40.00 area.

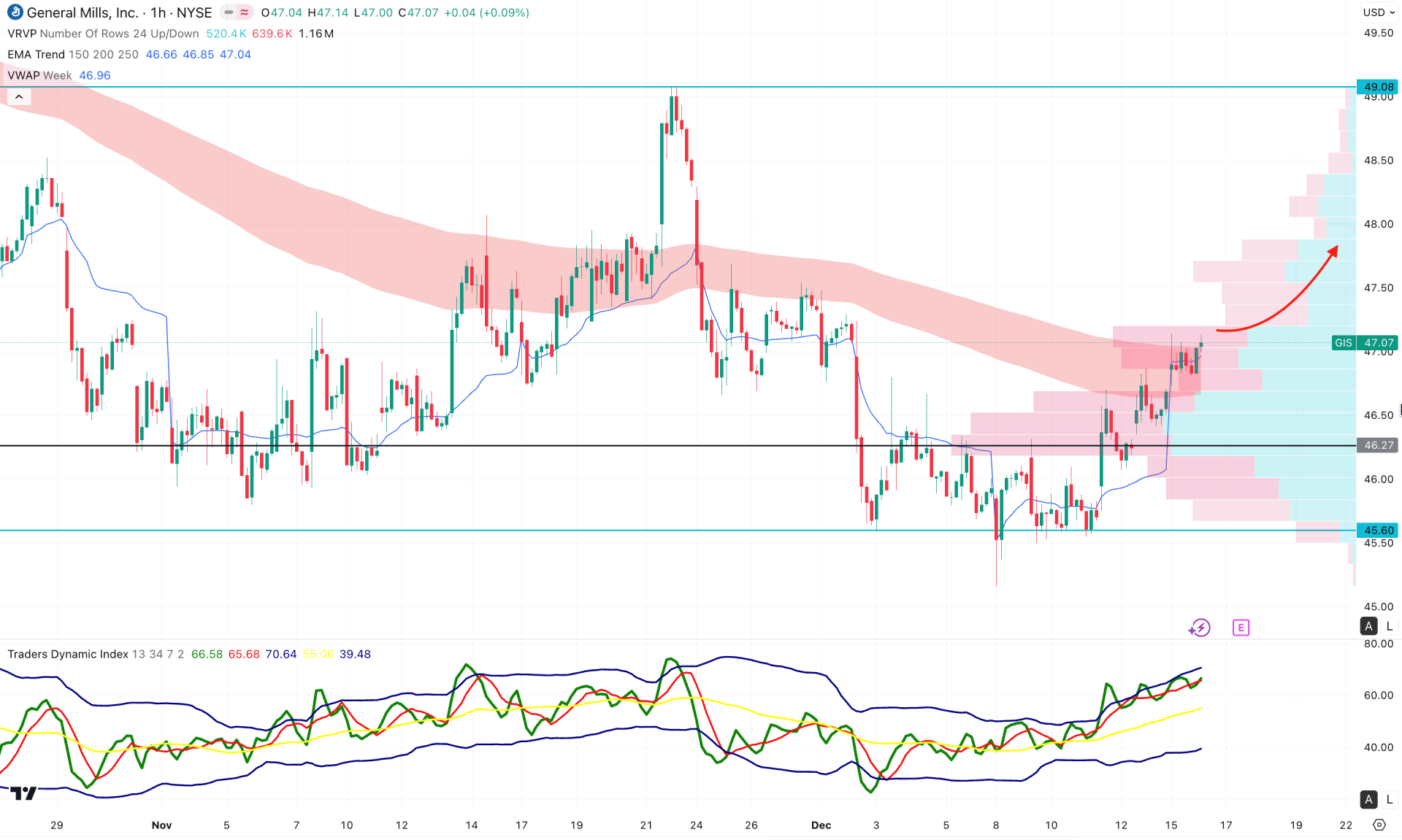

In the H1 chart, the most recent price is trading above the intraday high volume line, signalling bullish pressure. Moreover, the weekly VWAP line is below the current price, working as a major support.

In the secondary indicator window, the Traders Dynamic Index (TDI) is at the bullish peak, suggesting a strong buying pressure.

Based on this outlook, an intraday bullish continuation momentum is valid, where the main aim would be to test the 49.08 level. However, an immediate downside possibility is valid from the EMA wave area. In that case, a bearish H1 candle below the 46.27 level might lower the price towards the 40.00 area.

Based on the broader market outlook, GIS is more likely to form a bullish rally once a bottom is formed. As the daily trend is still bearish, close attention to the intraday chart is needed. A potential impulsive bullish break in the H4 chart could be the first bullish signal, where more confirmation could come from the daily high volume breakout.