Published: February 23rd, 2023

The Filecoin token FIL experienced a significant increase in value in recent days. This surge in value generated a great deal of excitement on social media regarding the upcoming launch of the Filecoin Virtual Machine in March. The FVM is a platform that will introduce smart contracts and enable developers to design decentralized applications on the Filecoin network.

The network first announced the launch of the FVM in September at the FIL Singapore conference. They promised that the software platform would support various user programmable applications.

Through the Ethereum Virtual Machine (EVM), Filecoin network could create a cross-chain bridge with other networks. Its compatibility with EVM and layer 2 blockchains will reduce user gas fees and increase transaction speed.

The DeFi community has gained a significant following following a series of major cryptocurrency firm collapses that have shaken investors' confidence in centralized exchanges. DeFi projects, including developing layer 1 blockchain protocols, have become increasingly popular.

Should you invest in Filecoin toke (FIL)? Let’s see the complete price direction from the FIL/USDT technical analysis:

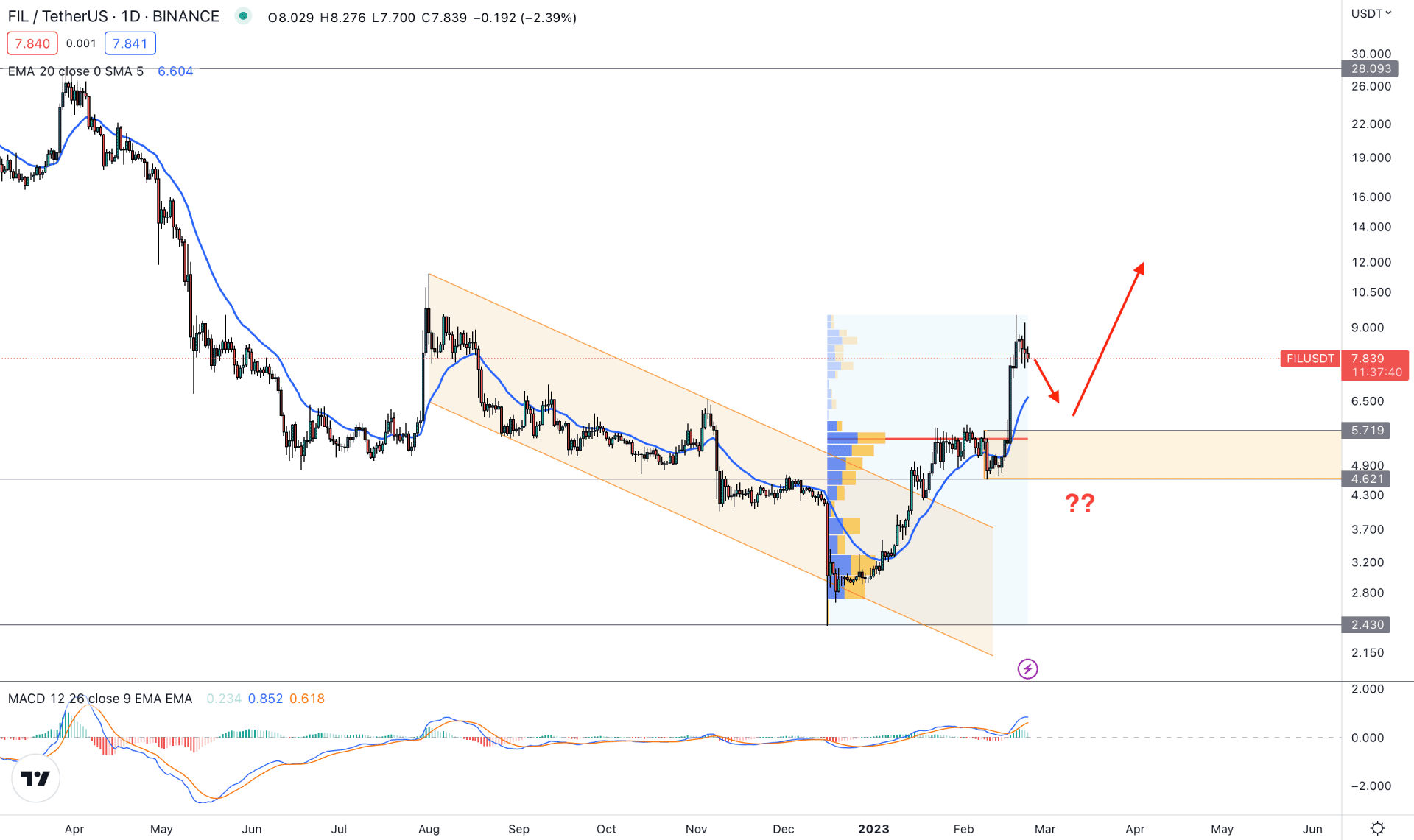

In the FIL/USDT daily chart, the broader outlook was bearish, which was initiated from the April 2022 swing high. The price showed a strong selling pressure by moving below the 4.00 psychological number. However, the buying pressure faded with the exhaustion at the 2.43 swing low, from which a bullish counter-impulse came. As the current price is trading with a bullish rally-base-rally formation, further upside pressure may come at any time.

The bullish momentum is also supported by a descending channel breakout with an exhaustion. Moreover, the latest high volume level from December- February is below the price. It is a sign that buyers are still interested in this instrument and they can reaccumulate after a considerable correction.

In the main chart, the price is trading above the 5.71 to 4.62 critical demand zone from where another buying pressure may come. The gap between the 20 EMA and the price has extended, which could increase the possibility of a downside correction as a mean reversion.

The indicator window shows a bullish possibility, where the current MACD EMA level is above the neutral line with a positive Histogram.

Based on the current price structure, the broader outlook of Filecoin is bullish but a minor bearish correction is pending as a profit trading. In that case, the primary target for the selling pressure is to test the dynamic 20 EMA.

Bulls should wait for the price to complete the correction where the ideal buying possibility needs a valid rejection from the near-term demand zone. On the other hand, breaking below the 4.60 low with a bearish D1 candle could lower the price towards the 2.43 support level.

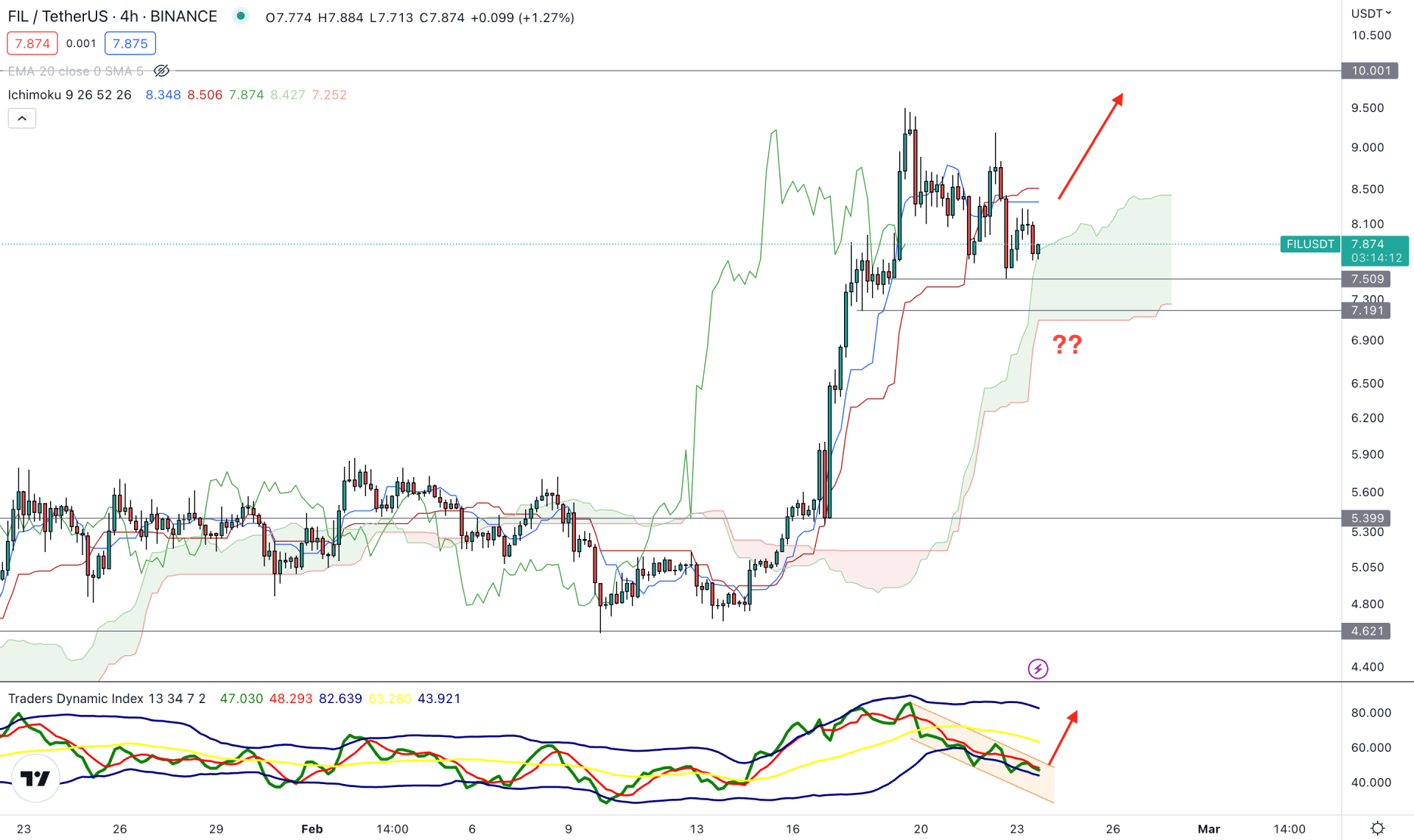

In the H4 timeframe, the broader outlook of FIL/USDT is extremely bullish as the current price is stable above the dynamic Kumo Cloud. A strong bullish breakout and multiple higher highs above the cloud support is seen, which is a sign of a strong bullish momentum.

In the future cloud, the gap between the Senkou Span A and B has expanded, which is a sign of a strong bullish trend. Moreover, the Traders Dynamic Index (TDI) showed a corrective pressure, within a descending channel from where a bullish breakout could increase the buying possibility.

Based on this structure, any bullish rejection from the 7.50 to 7.19 area could offer a long opportunity, targeting the 10.00 resistance level. In that case, a bullish candle above the Kijun Sen could be a conservative buying approach.

On the other hand, a bearish H4 candle below the 7.00 level could lower the price towards the 5.39 support level.

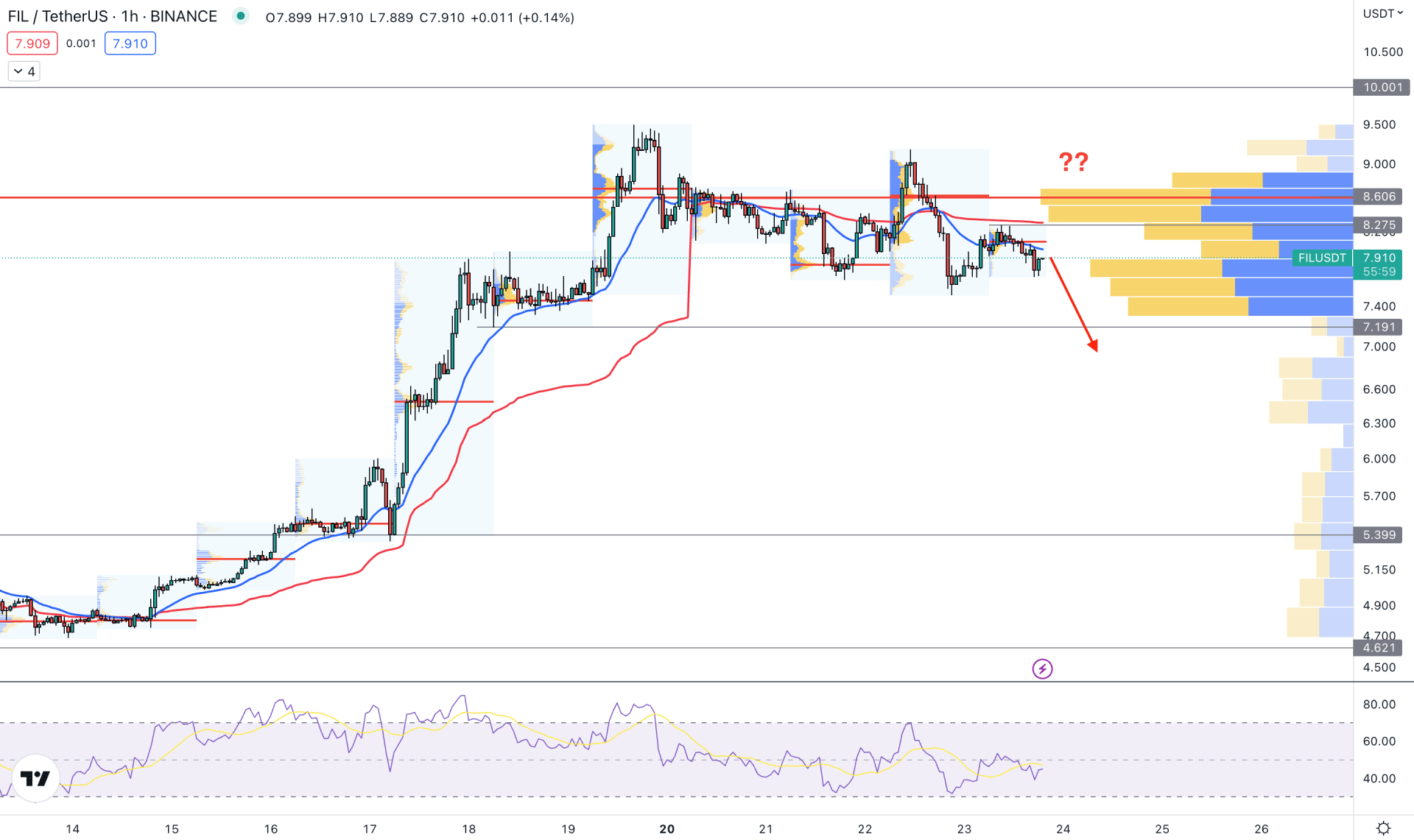

In the hourly chart, a selling pressure is seen, which is a sign of a profit taking from the long term bull run. The visible range high volume level is at 8.60 level, which will be the primary barrier for bulls. As long as the price trades below the 8.60 level, any bearish trading opportunity could provide a higher winning ratio.

The dynamic 20 EMA is above the price, working as a resistance while the RSI is moving down below the 50% neutral level.

Based on the current H1 outlook, the current selling pressure could extend towards the 7.19 level in the coming hours. However, an immediate recovery above the 8.60 level is needed before aiming for the 10.00 resistance level.

Based on the current multi-timeframe analysis, FIL/USDT is more likely to extend the current bullish momentum in the coming days. However, a minor downside possibility is still pending and bulls should wait for a perfect buy formation from bearish pressure.