Published: September 17th, 2024

Analysts anticipate that FedEx (FDX), a major player in shipping, will release its first-quarter fiscal 2025 earnings after the chime on Thursday, showing increases in both revenue and profit over the previous year.

In the initial quarter of fiscal 2024, analysts surveyed by Visible Alpha predicted a net income of $1.16 billion on earnings of $21.96 billion, a rise from $1.08 billion and $21.68 billion, respectively.

Based on Visible Alpha's records, analysts are generally upbeat about FedEx's stock, recommending it with 11 "buy" ratings, just one "hold" rating, along with a "sell" rating each. The average price target for the stock is $323.50, which is almost 13% higher than Friday's close.

FedEx unveiled its fiscal 2025 projections in its fourth-quarter findings, released in June. It predicted revenue growth in the low to mid-single digits, but analysts anticipate growth of slightly over 2% from $87.69 billion in the previous year. Additionally, the company's earnings per share (EPS) came between $18.25 and $20.25, exceeding analysts' expectations of $19.87 by 6% to 18% over the $17.21 generated in the fiscal year 2024.

Later this month, FedEx's agreement alongside the U.S. Postal Service (USPS) will come to an official end, and shipping surpasses UPS (UPS) will assume the role of USPS's legal air freight carrier, thus depriving FedEx of a source of income. FedEx announced in April that it could not come to "mutually agreeable terms" concerning the USPS and that it would "implement adjustments" regarding its shipping system in order to make up for the volume decrease and boost profitability even more.

FedEx declared in April 2023 that it would reorganize and reduce expenses by approximately four billion dollars by 2025. The strategy has mainly paid off, as FedEx has generally reported significant profit increases in spite of revenue reductions or marginal gains over the past quarters.

Following the decline in shipping needs following the pandemic-fueled peak, FedEx sought to reduce costs, and UPS also reported revenue declines due to lower volumes. FedEx reported last quarter that it increased its cost-cutting estimates from $1.8 billion within fiscal 2024 to approximately $2.2 billion over fiscal 2025.

Let's see the further aspect of this stock from the FDX technical analysis:

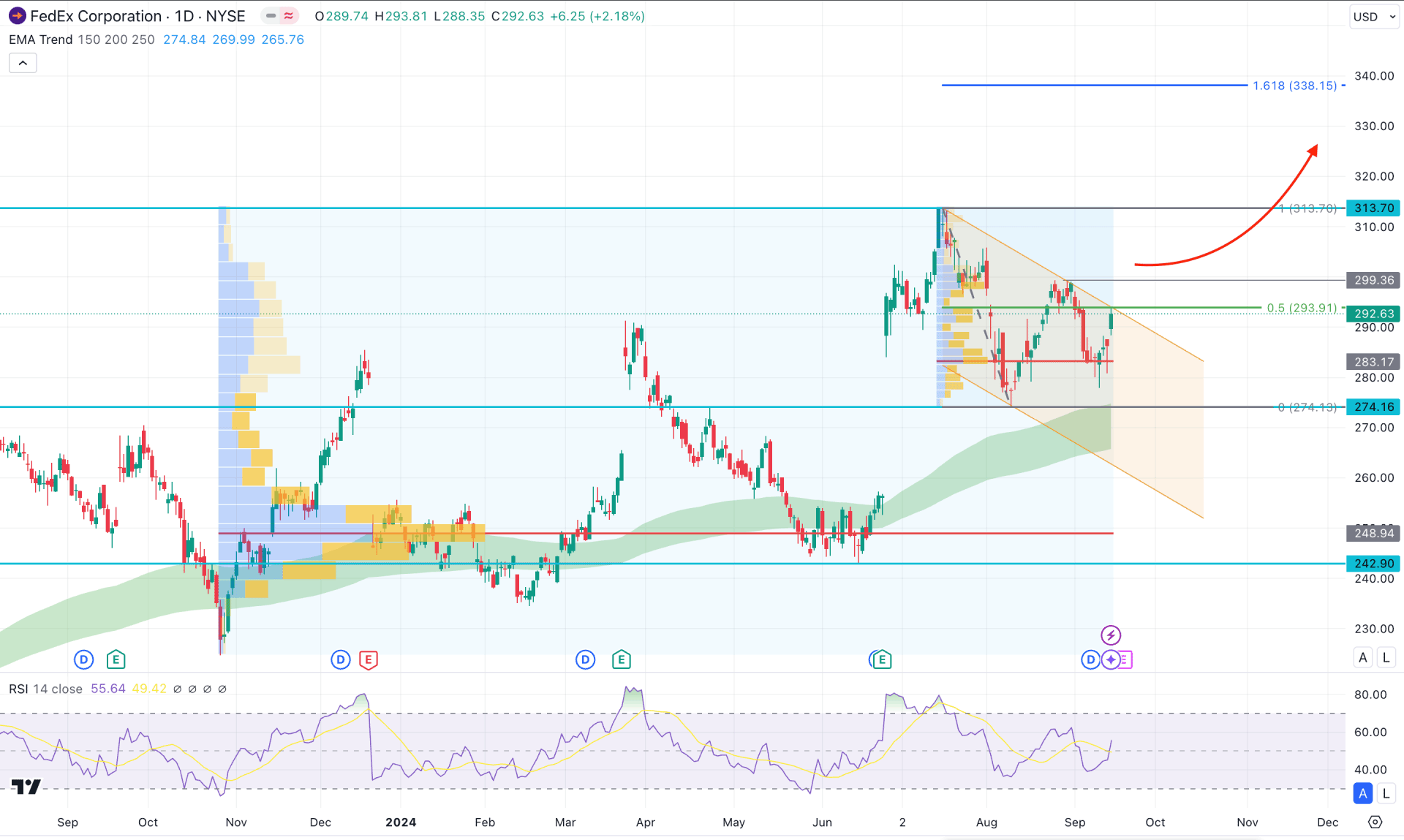

In the daily chart of FedEx, the broader market outlook is bullish, where the most recent price is trading within a descending channel.

In the higher timeframe, the price showed a decent recovery after forming an all-time high in June 2021. However, the bottom is formed at the 142.20 level from where the long-term bullish trend is initiated. As the price reaches near the all-time high level, we may expect a push to bulls in the coming days.

Looking at the volume structure, the recent price showed a mixed sentiment, where the largest volume level since November 2023 is way below the current price. We may anticipate a sufficient downside correction in this stock as the current price hovers above the line with a strong gap. However, another high volume level since July 2024 is just below the current price and is working as an immediate support. It signals that bulls support the near-term price and can extend the upward pressure at any time.

In the main chart, a descending channel is seen where the recent price trades below the crucial channel resistance. In that case, a failure to move beyond the channel resistance could be a bearish factor in this stock, even if the major market trend is bullish.

In the secondary window, the 14-day Relative Strength Index (RSI) remains above the neutral 50.00 level with an upward slope.

On the bullish side, a valid break above the channel resistance could open the room for reaching the 338.15 Fibonacci Extension level. However, the 299.36 to 313.70 area would be a crucial zone as a failure to sustain the buying pressure in this area might initiate an extensive correction at the channel support.

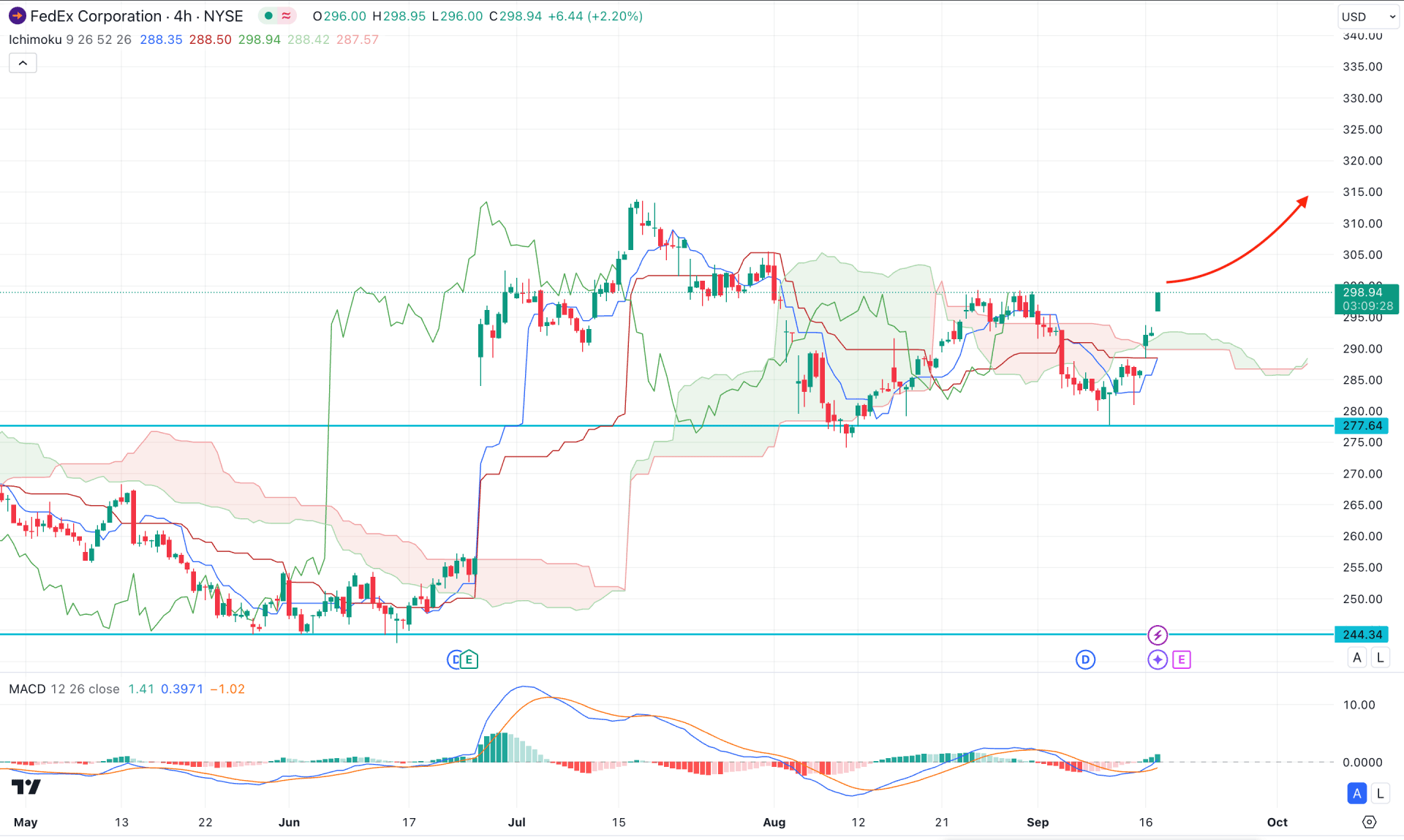

In the H4 timeframe, the current price is trading above the Ichimoku Cloud zone with strong bullish pressure. Also, the buying pressure has come after having a corrective downside momentum at the cloud low.

In the indicator window, the MACD Histogram keeps moving higher, where the Tenkan Sen and Kijun Sen are below the current price.

In that case, the upward trend is clear, which might extend the momentum above the 330.00 level in the coming hours.

On the other hand, a failure to hold the price above the cloud zone with a bearish H4 candle below the 277.64 level might lower the price below the 244.34 level.

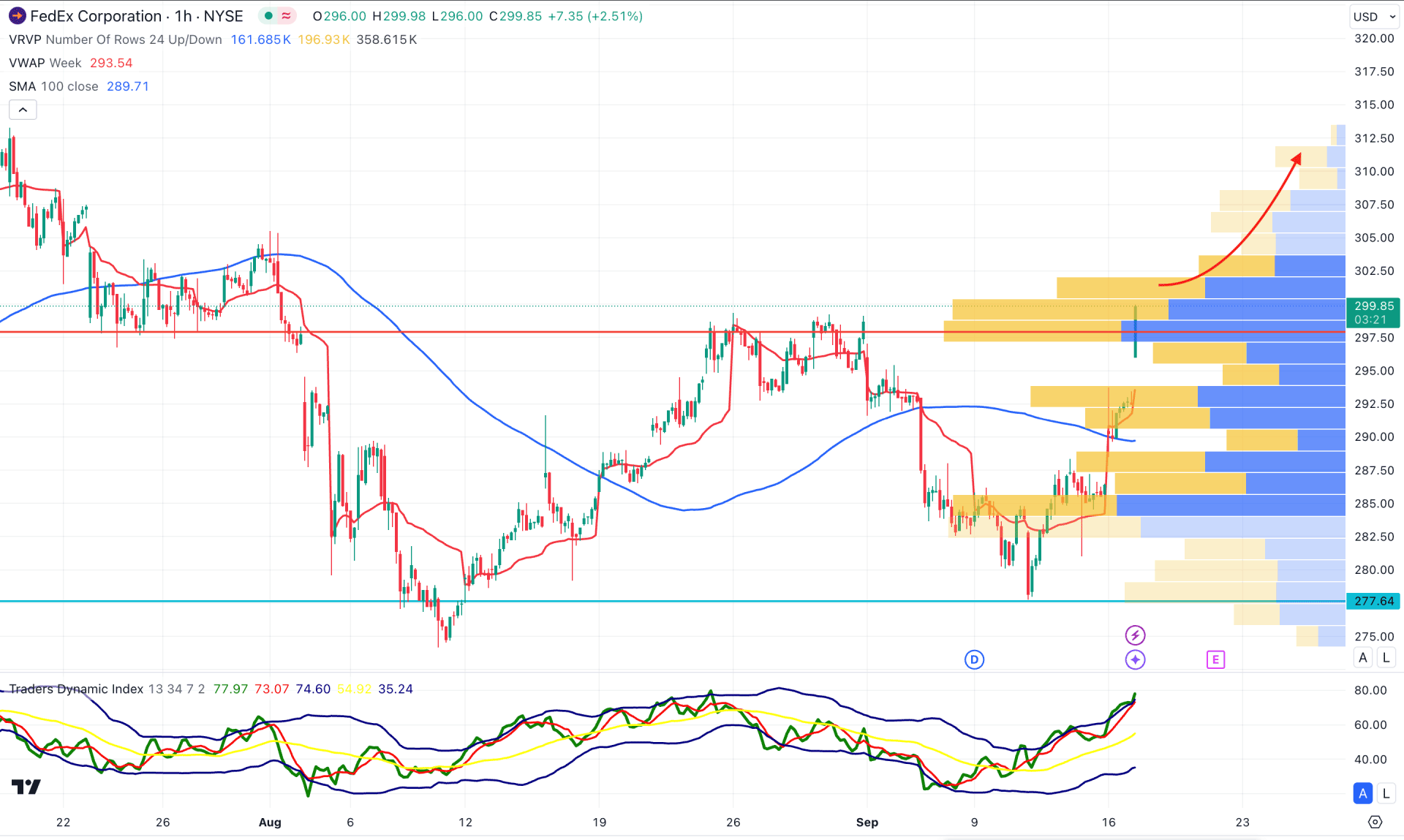

In the hourly chart, an intraday bullish pressure is visible, where the most recent price hovers above the dynamic 100 Simple Moving Average line. Moreover, the weekly VWAP shows an upward slope and moved above the 100 SMA level, signaling an additional bullish factor.

Based on the hourly price structure, an immediate bearish rebound below the 297.50 level might lower the price toward the 285.00 level before creating a long opportunity. However, an immediate bullish continuation is possible, which might find resistance from the 330.00 area.

Based on the current market outlook, FDX is more likely to extend the bullish trend after forming a valid descending channel breakout. As the intraday buying pressure is active, a stable market above the 300.00 area might resume the bullish trend.