Published: November 29th, 2022

The November German ZEW survey reading surprisingly hit the upside. The German report appeared at -64.5 vs. Oct -72.2, and expectations jumped to -36.7 from -59.2, while Eurozone expectation came at -38.7, up from -59.7. It is impressively positive data; however, readings remained negative and near the lowest level. Q2 GDP second readings remained unvaried at 0.2% q/q and 2.1% y/y.

For the US, the October retail sales reached 1.3% m/m, posting a significant gain vs. Sep flat figure. The Control group came in at 0.7% vs. the previous month’s 0.6% m/m, declaring the Q4 GDP healthy contribution.

Ex autos category also came at 1.3% m/m vs. Sep 0.1% m/m, potential early Christmas shopping triggered upside. Housing starts declined to 1425k from Sep 1488k, while building permits reached 1526k from 1564k last month. NAHB sentiment survey reached 33, the lowest since 2012, excluding the 2020 pandemic drop. It declares high-interest rates are impacting housing activity.

The coming trading days for the US and Eurozone are going to be eventful as there are a lot of economic releases that will be published.

Can bears continue the broader bearish trend in the EURUSD pair? Let’s have a look at the complete price direction from the EURUSD technical analysis:

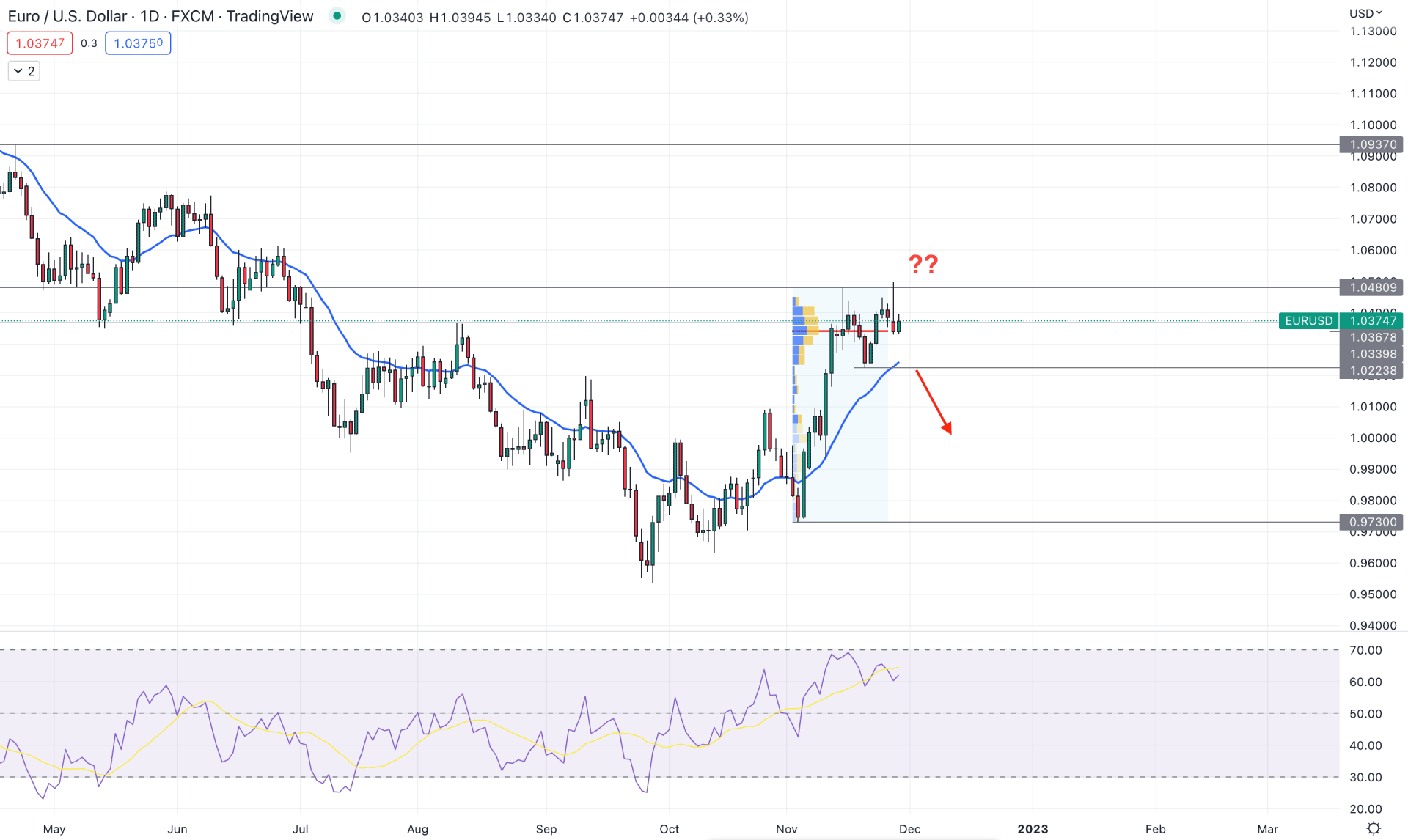

The EURUSD daily price is moving with a corrective momentum, whereas the most recent price is trading with a bullish counter-impulsive momentum.

The buying pressure from the 0.9730 swing low came by creating multiple solid demand zones, which need to be violated before forming a bearish trading opportunity. Moreover, the highest trading volume level from 0.9730 swing low to 1.0483 swing high is at the 1.0335 level, which is just below the current price. Therefore, as long as the price trades above the 1.0335 high volume level, bulls have a higher possibility of winning the battle.

On the other hand, the price is hovering at the high volume level for a considerable time, which is backed by multiple bearish rejection candlesticks above the 1.0480 level. The dynamic 20-day EMA is the main barrier to bulls, which needs to be overcome before indicating a bearish opportunity.

Based on the daily outlook of EURUSD, a bearish daily candle below the 1.0223 would trigger the bearish opportunity, where the ultimate target is to test the 0.9730 support level.

On the other hand, as the current price is trading above the 1.0335 high volume level, further upside pressure and a daily candle above the 1.0480 level could open a long opportunity towards the 1.0937 level.

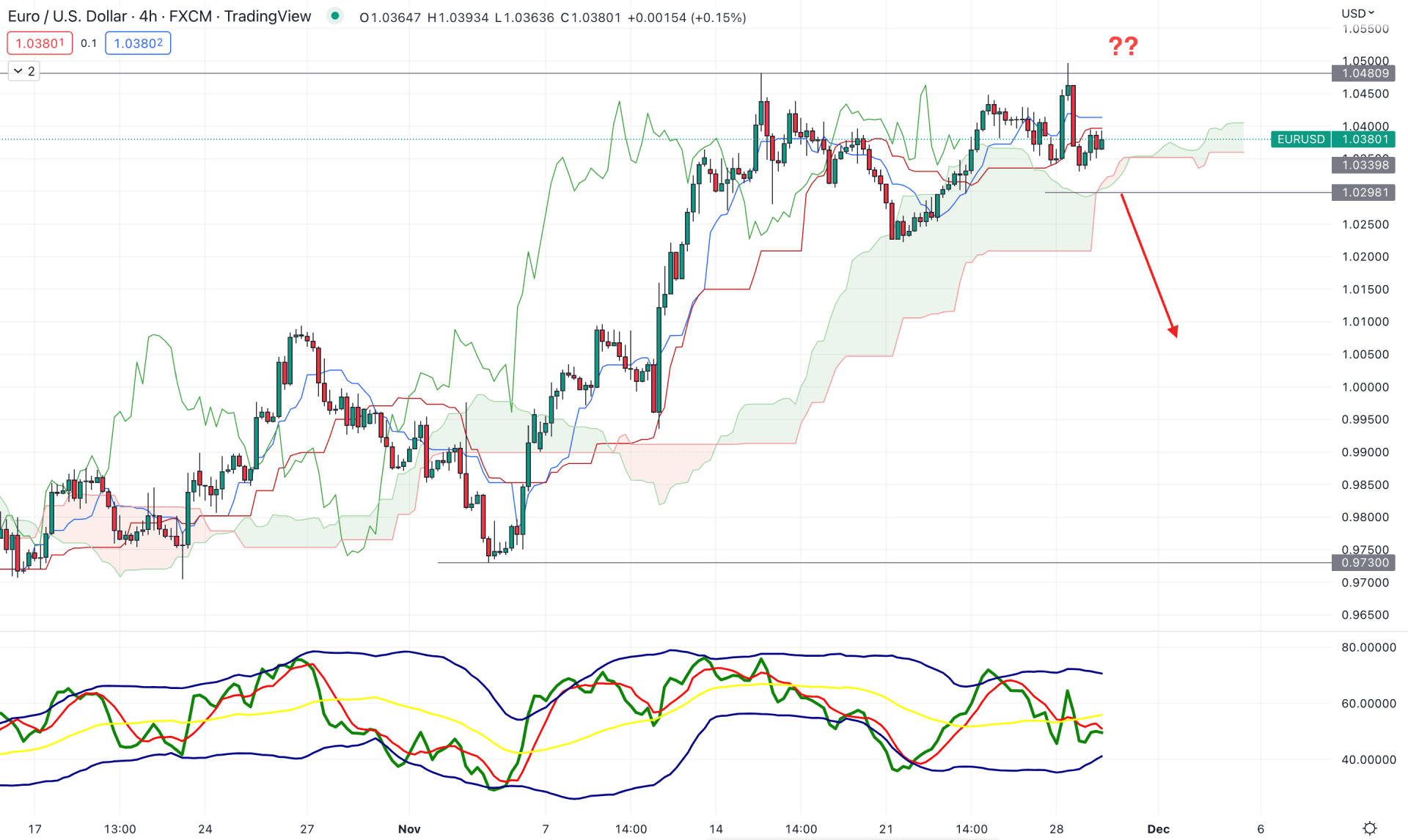

In the EURUSD H4 chart, the broader outlook is bullish as the current price is trading above the dynamic Cloud support. However, there are several bearish candlesticks formations above the cloud support, which could limit the gains for bulls.

In the future cloud, the Senkou Span A is above the B, while both lines are aiming higher. Moreover, the bullish possibility is limited from the Traders Dynamic Index position, where the current TDI line is below the 50.00 neutral point.

Based on the H4 outlook, a bearish breakout with an H4 candle below the 1.0298 level could open a short opportunity, targeting the 0.9400 level.

The alternative approach is to find a bullish trend continuation opportunity by forming a bullish rejection candlestick from the dynamic Kijun Sen.

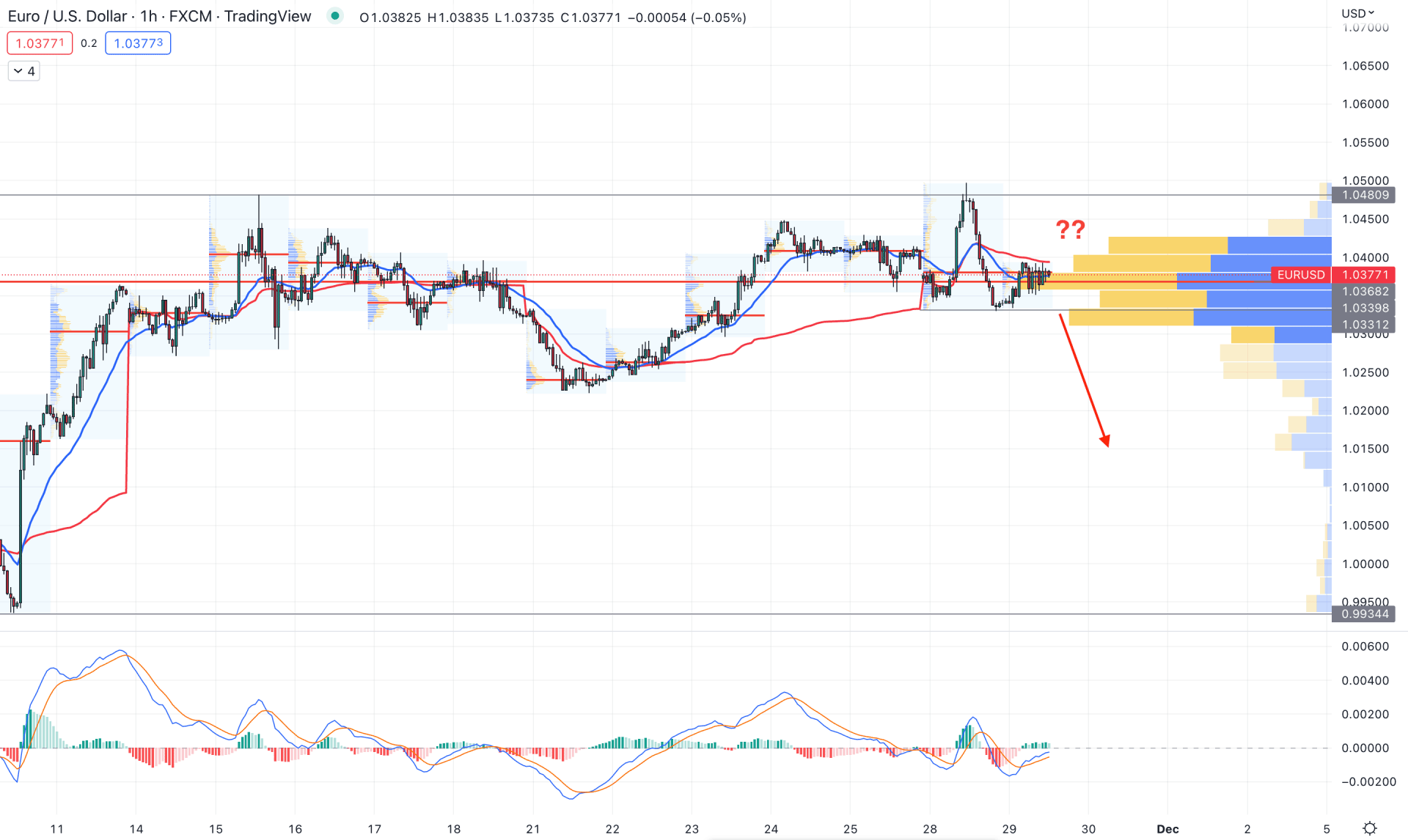

In the intraday H1 timeframe, the current outlook of the EURUSD price is corrective as it is building orders at the dynamic 20 EMA area. Moreover, the visible range high volume level is closer to the price, indicating a possibility of a breakout.

In the indicator window, the MACD Histogram is bullish, while MACD EMA’s have more room to move upside.

Based on this structure, bears need a candle close below the 1.0331 to open a short opportunity targeting the 0.9934 level. Moreover, any bullish rejection from the dynamic weekly VWAP would be a long opportunity, where the main aim is to test the 1.0650 level.

Based on the current multi-timeframe analysis, EURUSD bears need to form a new lower low before offering a long opportunity. Therefore, investors should closely monitor near-term price levels to find a suitable trading opportunity.