Published: January 15th, 2026

The Euro (EUR) remains weak despite cautionary comments from European Central Bank (ECB) authorities, suggesting that the central bank is in a hurry to raise interest rates.

Luis de Guindos, vice president of the European Central Bank, stated on Wednesday that geopolitical uncertainties greatly increase downside risks to growth and that current market pricing fails to adequately account for the heightened level of global uncertainty.

Risks to the forecast remain balanced, according to Mārtiňš Kazāks, President of the Bank of Latvia and a member of the ECB Governing Council. He cautioned that uncertainty is still high, particularly the possibility of non-linear shocks. He added that the European Central Bank remains in a strong position and is pursuing its inflation objective.

On the other hand, Japan's currency strengthened after declining during the previous few weeks due to concerns about intervention. Seiji Kihara, Japan's chief cabinet secretary, stated on Wednesday that excessive one-way intervention in the Japanese yen could prompt government intervention.

However, with the leader Sanae Takaichi's trade continuing to gain momentum, the rebound in the Japanese yen is expected to remain limited.

According to a recent report, market analysts are pricing in Takaichi's victory in the premature emergency election, which she is anticipated to declare next week following the dissolution of the lower house of parliament. Takaichi's victory will enable her to secure backing for her fiscal plan, which is expected to include increased spending. This is a positive development for Japanese stock markets and a challenge to the Japanese yen's value.

Let's see the future price direction from the EURJPY price analysis:

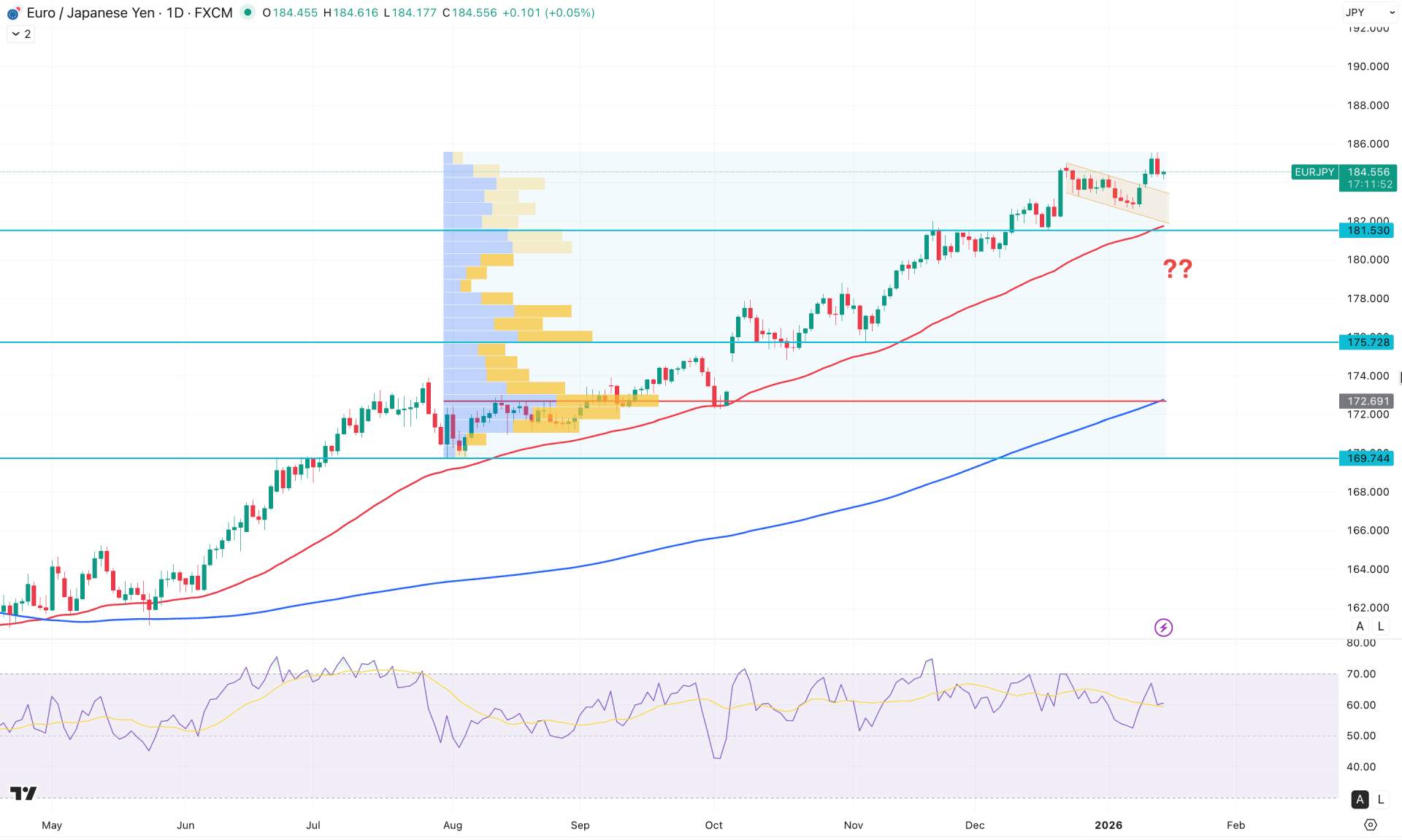

In the daily chart of EURJPY, the overall market structure is bullish as the price keeps moving higher from the May 2025 bottom. Moreover, the price reached a multi-year high, with no sign of bullish exhaustion.

At the higher timeframe, the five consecutive bullish months signal an impulsive bullish trend, from which further upward pressure could emerge. In the weekly timeframe, the price is also trading higher within a bullish trend, from where upward pressure could come.

In the volume structure, the largest activity level since July 2025 is at the 172.69 level, which is below the current price. Primarily, the price is aiming higher above the high-volume line, from which any bullish opportunity could arise.

In the main chart, the 200-day Exponential Moving Average is below the entire bullish structure, suggesting a long-term bullish trend. The medium-term trend is also bullish, as the 50 Day EMA is trending upward from the 181.53 support level. Although the medium and short-term momentums are bullish, a potential downside correction is pending as a mean reversion to the 200-day SMA area.

In the secondary window, the Relative Strength Index (RSI) exhibits a volatile pattern with no significant drop below the 50.00 level. Moreover, a strong divergence with the price swing is visible, suggesting a potential top formation. The Average Directional Index (ADX) became flat above the 40.00 line, suggesting a pending downside correction within a trend.

Based on the overall market structure, EURJPY is aiming higher from the descending channel breakout. Primarily, the price is holding the bullish momentum and can extend above the 188.00 level. However, the latest two-bar reversal candlestick pattern at the top is a minor bearish signal, which might offer a long trade at a discounted price.

An extended selling pressure with a bearish daily close below the 50-day EMA could extend the downside correction. In that case, the price could aim lower and test the 175.74 key support level.

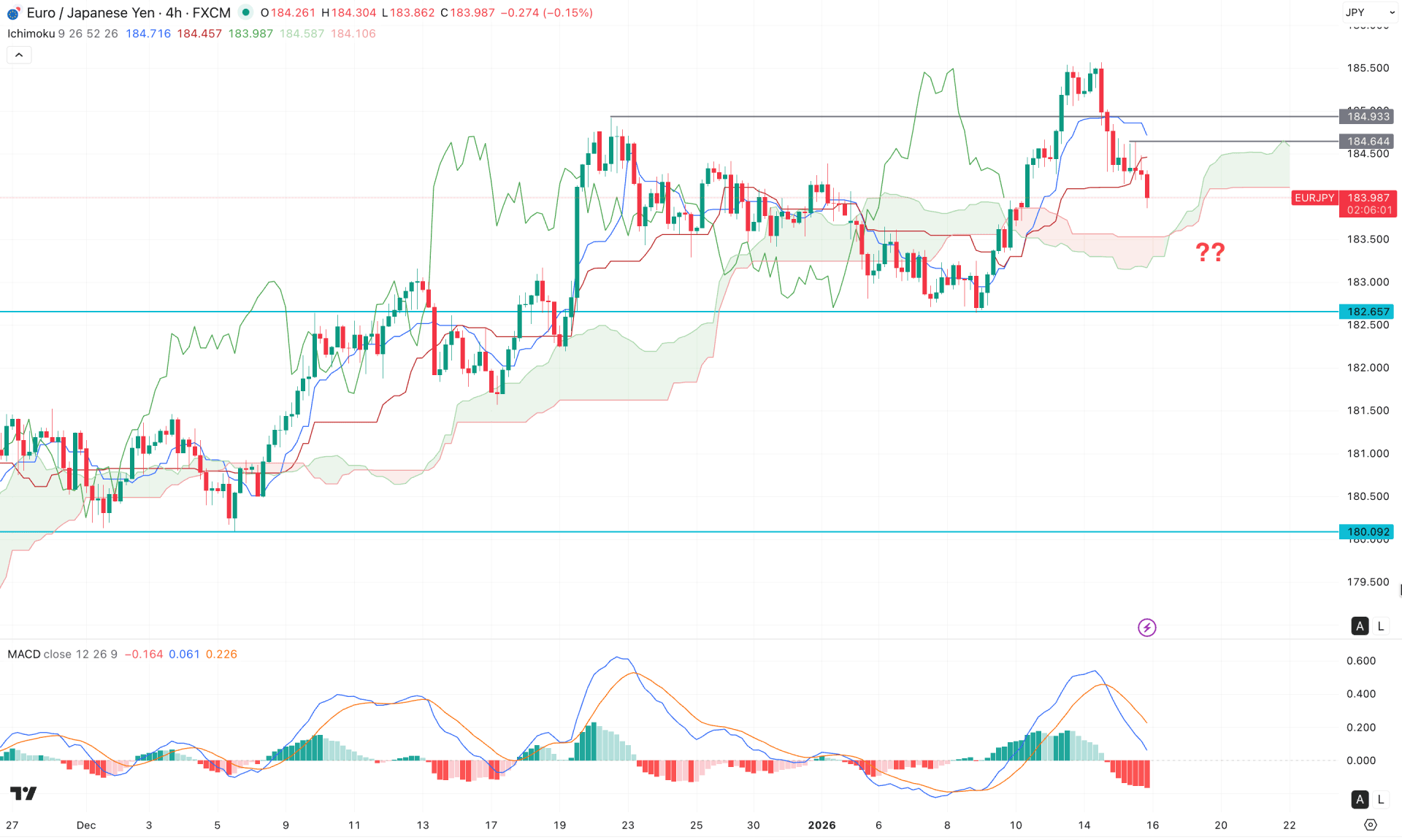

In the H4 timeframe, the recent bullish reversal above the Kumo Cloud area has weakened as the price failed to hold the buying pressure above the 184.93 swing high. As a result, a bearish H4 candle has come below the dynamic Kijun Sen line, suggesting an extended downside correction.

In the secondary window, the MACD Histogram has flipped the position below the neutral line, while the Signal Line has formed a bearish crossover.

Based on this outlook, the current structure suggests an additional downside pressure towards the Ichimoku Cloud zone. A bearish H4 candle below the cloud low could be a potential short opportunity, targeting the 180.09 support level.

On the other hand, any immediate bullish reversal with an H4 close above the Kijun Sen level might resume the existing trend. In that case, the main aim would be to test the 185.50 level before heading towards the 187.00 area.

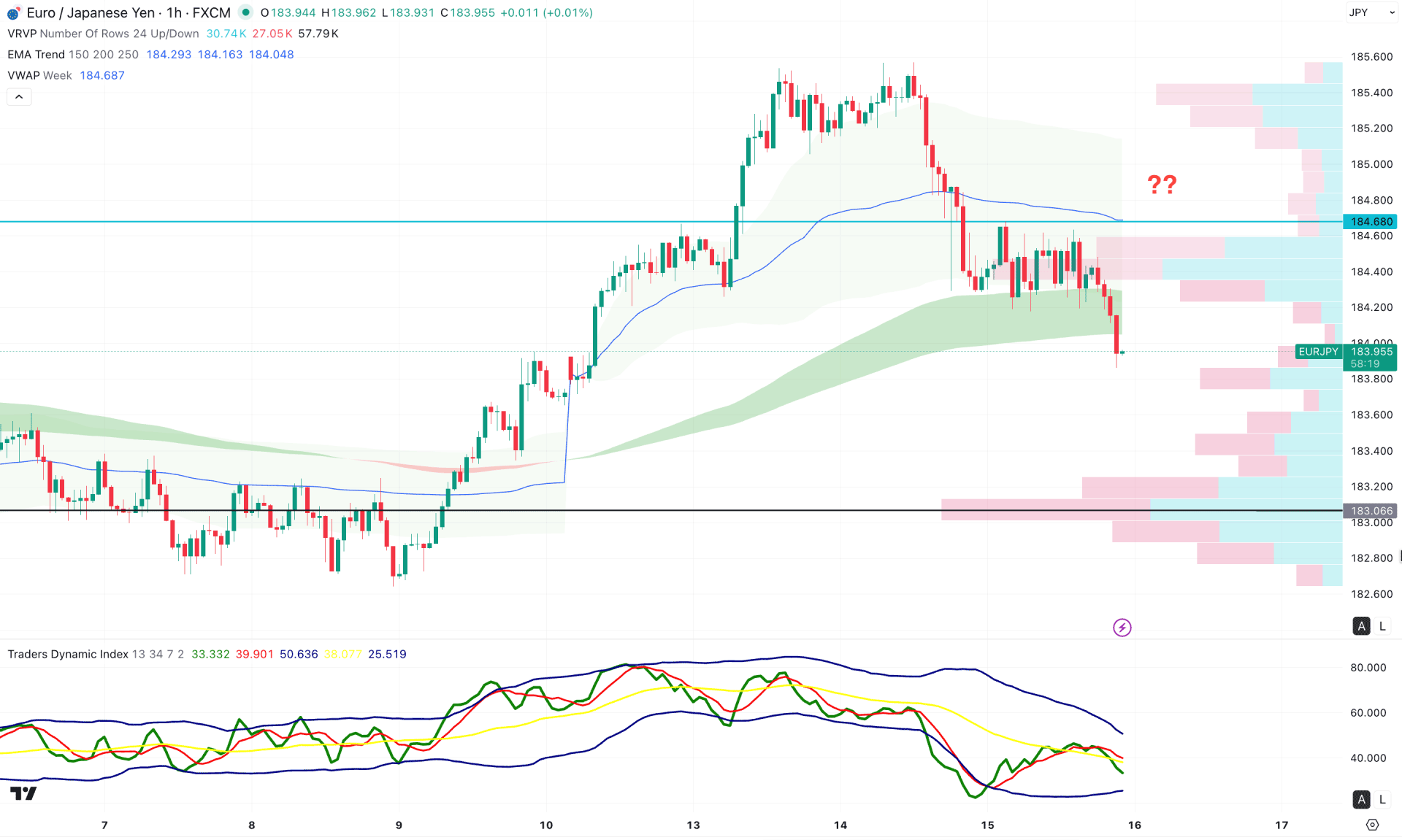

In the hourly timeframe, the price is heading lower within a drop–base–drop formation. A bearish hourly candle is present below the Exponential Moving Average wave. Additionally, the weekly VWAP line is positioned above the current price, signaling selling pressure.

In the indicator window, the Traders Dynamic Index is heading downward after a bearish crossover from the 50.00 level.

Based on the overall market structure, the intraday market momentum is bearish, and additional selling pressure could emerge in the coming hours. As the price has formed a new swing low below the VWAP line, the primary target would be a test of the 183.06 support level.

On the other hand, an immediate bullish reversal with an hourly close above the 184.68 resistance level could present a high-probability long opportunity, with the primary target at the 185.50 level.

Overall, EURJPY is trading with short-term bearish momentum while the major market trend remains bullish. Investors should closely monitor the downside correction. A solid bottom formation accompanied by a valid bullish reversal candlestick could provide a potential long opportunity in line with the dominant trend.