Published: April 11th, 2023

The upbeat report from the British Retail Consortium revealed a 4.9% rise in like-for-like retail sales and a 5.1% YoY increase in total retail expenditure. It has contributed to the superior performance of the Sterling Pound among the basket of currencies. However, traders hesitate to make bold movements due to Bank of England (BoE) members' contradictory statements regarding future policy.

This currency pair is enjoying price fluctuation for the Euro’s demand, fueled by expectations for an ECB rate hike and better-than-expected data.

In April, the Eurozone Sentix Investor Confidence index improved from -11.1 to -8.7, and the Current Situation Index increased for the sixth consecutive month. These factors suggest potential gains for the EUR/GBP cross, but traders should proceed cautiously as recent price action has been range-bound. Moreover, the breach and acceptance below the 100-day Simple Moving Average (SMA) could signal further downside.

BoE Governor Andrew Bailey's impending speeches on Wednesday and Thursday could provide additional market insight and direction.

Let’s see the upcoming price direction from the EURGBP technical analysis:

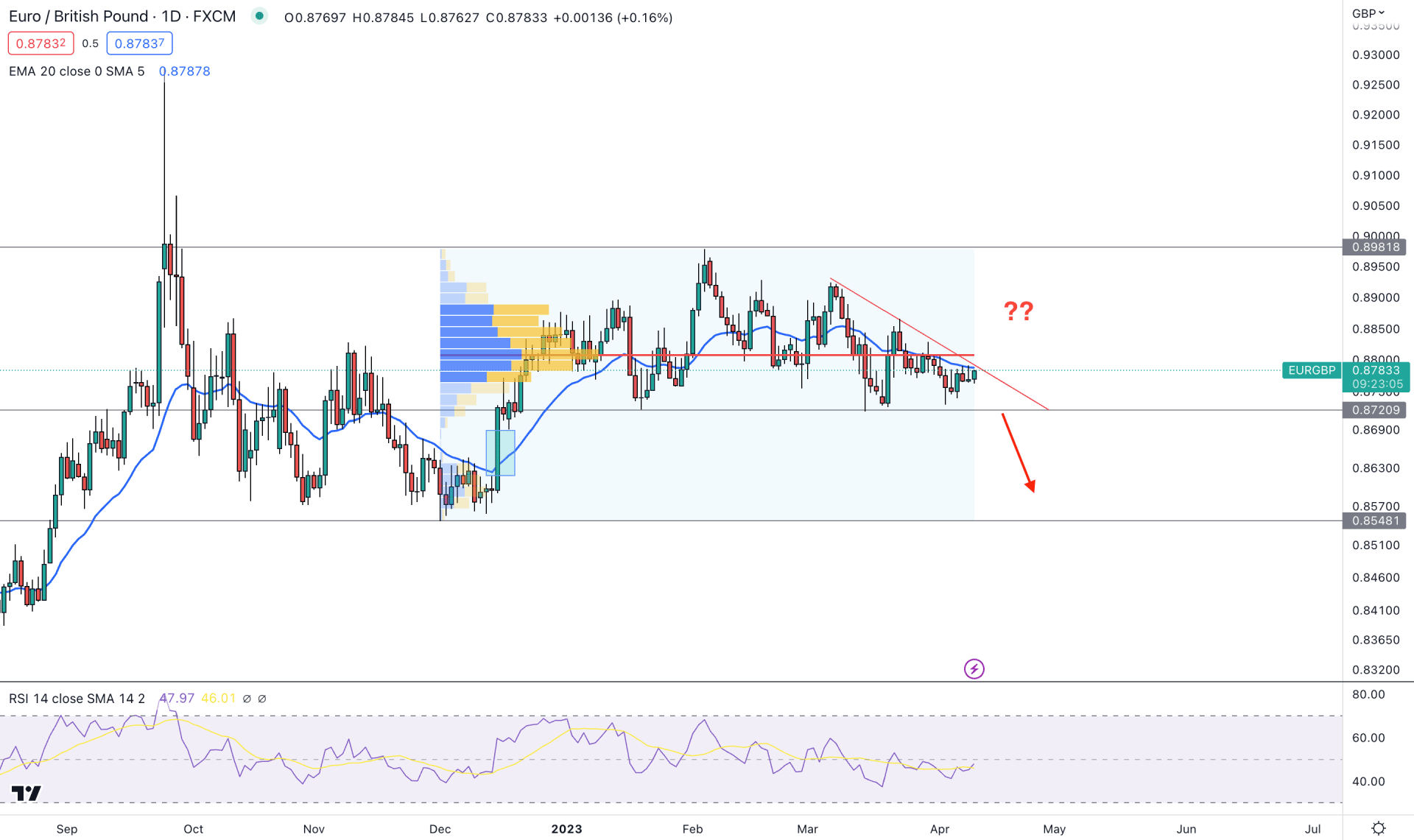

It is the fourth month since EURGBP remains corrective in the monthly chart. The sentiment is also visible on the daily price, where a breakout possibility is solid. After making a strong bullish break in December 2022, EURGBP topped at 0.8981 level but left some areas untested on 15 December. Therefore, the primary outlook of this currency pair is to come down and fill up the imbalance by testing the 0.8618 level.

Institutional traders’ interest is on the sellers’ side as the current Fixed range high volume level shows that the most active level since December 2022 is at 0.8800, above the current price. It is a primary signal that bear activity is solid in the market, and any downside breakout could drag the price down with impulsive pressure.

The main price chart has a descending triangle pattern where the price squeezes to the neutral zone. The dynamic 20-day Exponential Moving Average is above the current price, pushing a selling pressure on the price.

The current market sentiment is corrective in the indicator window as the RSI is near the 50.00 level. It is a sign of a potential breakout, where investors should closely monitor the near-term swing levels.

Based on the current daily outlook, investors should wait for a valid breakout in the EURGBP price before opening long or short positions. The ideal approach is to wait for a daily candle to close below the 0.8700 before targeting the 0.8548 support level.

On the other hand, a bullish trading opportunity needs a liquidity sweep from the 0.8729 swing low and a daily candle close above the 0.8790 level. In that case, an upside pressure could extend toward the 0.8950 psychological level.

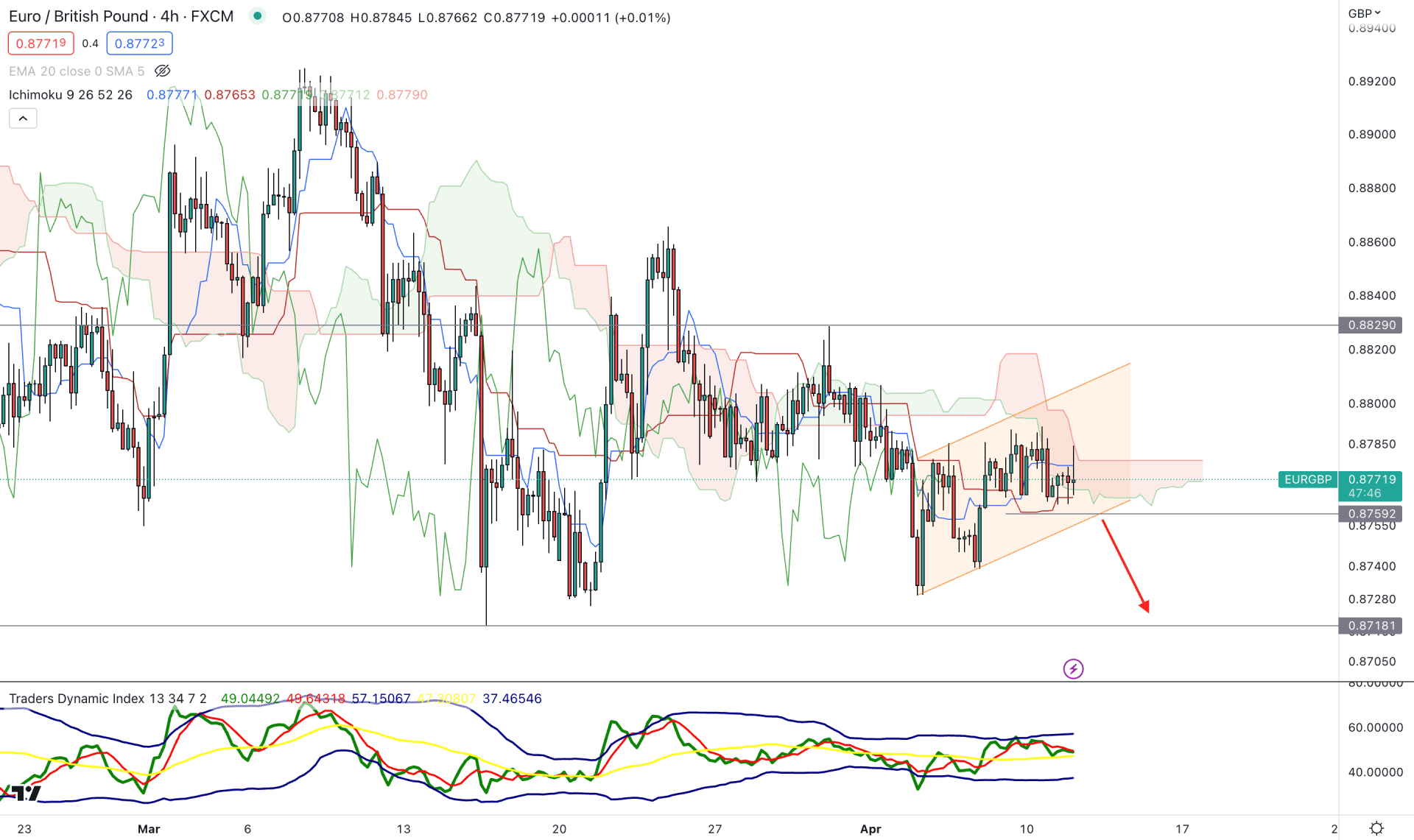

In the four-hour timeframe, the broader market outlook is corrective. The price shows multiple violations above or below the cloud area, which signals indecision.

The Senkou Span B is flat in the future cloud, which signals that long-term traders are indecisive. Moreover, the Senkou Span A is below B, but there is no lower low formation. It is a sign that short-term traders are active in the market, but the momentum is slowing. Also, the current price is within the Kumo cloud, which is a sign of a potential breakout.

In the indicator window, the current TDI level is at the 50.00 line, signifying neutral market momentum.

Based on the H4 structure, a strong bearish pressure with an H4 candle below the 0.8759 level would open a short opportunity in this pair, targeting the 0.8718 level. The alternative approach is to look for long opportunities after breaking above the 0.8800 psychological level.

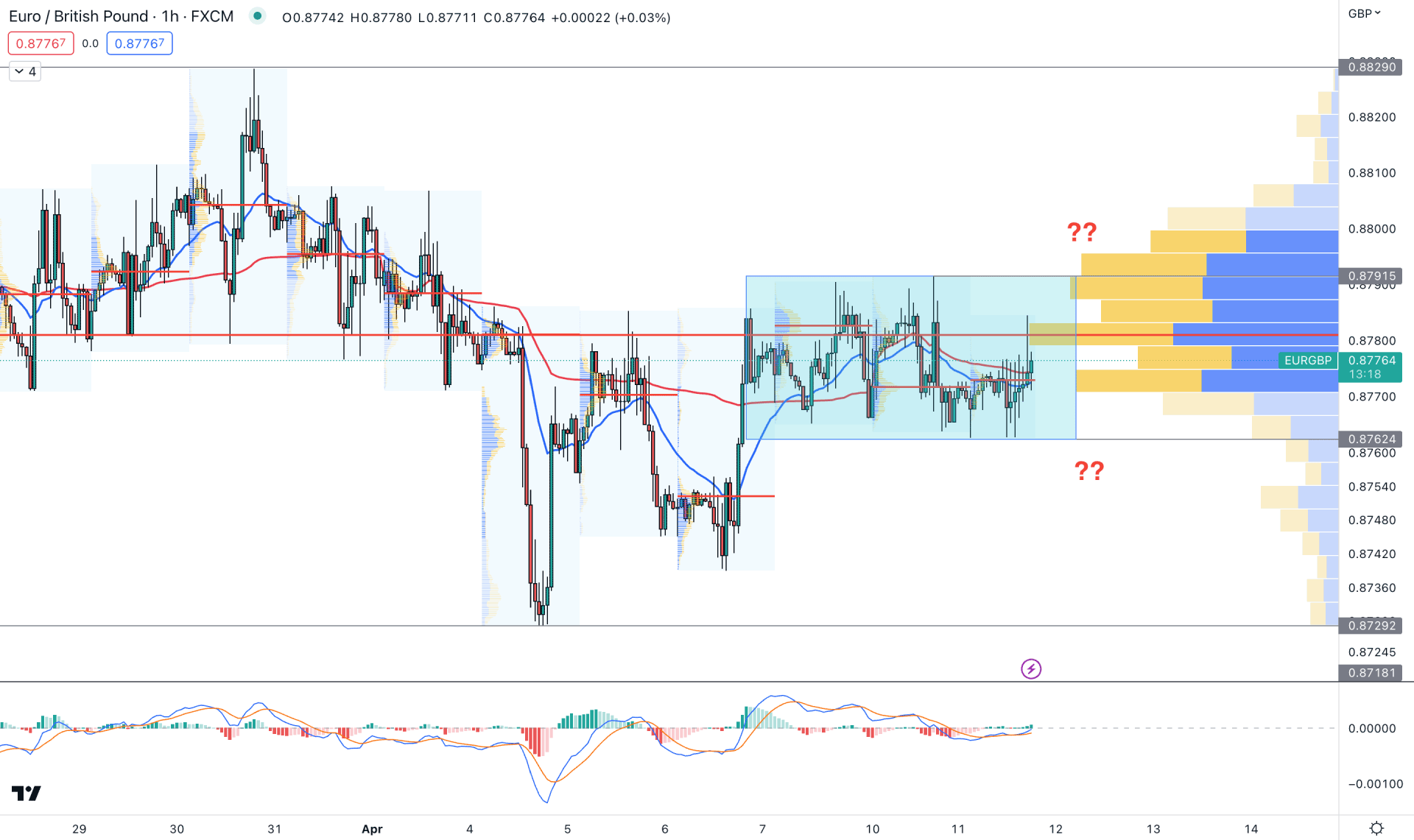

In the hourly chart, the current price is extremely indecisive, as shown by the rectangle pattern. However, the visible range high volume level is above the price, which could provide a benefit to sellers.

A bullish price action is seen above the dynamic 20 EMA and weekly VWAP, while the current intraday high volume level is below the market price.

Based on the intraday outlook, a downside pressure with an H1 candle below the 0.8762 would open a short opportunity, targeting the 0.8729 low. However, a liquidity sweep from the 0.8762 level with an immediate recovery above the 0.8781 high volume level would open a long opportunity, where the main aim is to test the 0.8850 level.

Based on the current market outlook, EURGBP is more likely to come down and fill up the imbalance left on 15 December 2022. In that case, investors should find an intraday liquidity sweep from a valid swing high to follow the long-term trend.