Published: April 15th, 2021

EURUSD becomes very volatile as soon as it reached the 1.1990 resistance level. Moreover, the price is baked by a strong bullish pressure came from 1.1700 level. So can EURUSD bulls take the price above 1.1990? Let’s find the price direction from the EURUSD Technical Analysis.

EURUSD is one of the major currency pairs that represent both the US and Eurozone economies. Therefore, any significant economic events in the Eurozone or the US directly affect the EURUSD price. Among important releases, we will see the US retail sales today that may come at 5.8% from the previous value of -3.0%. Therefore, any better-than-expected result might create an immediate bearish pressure in the EURUSD price. In that case, if the price remains below the 1.1990 resistance level, the bearish pressure may extend more.

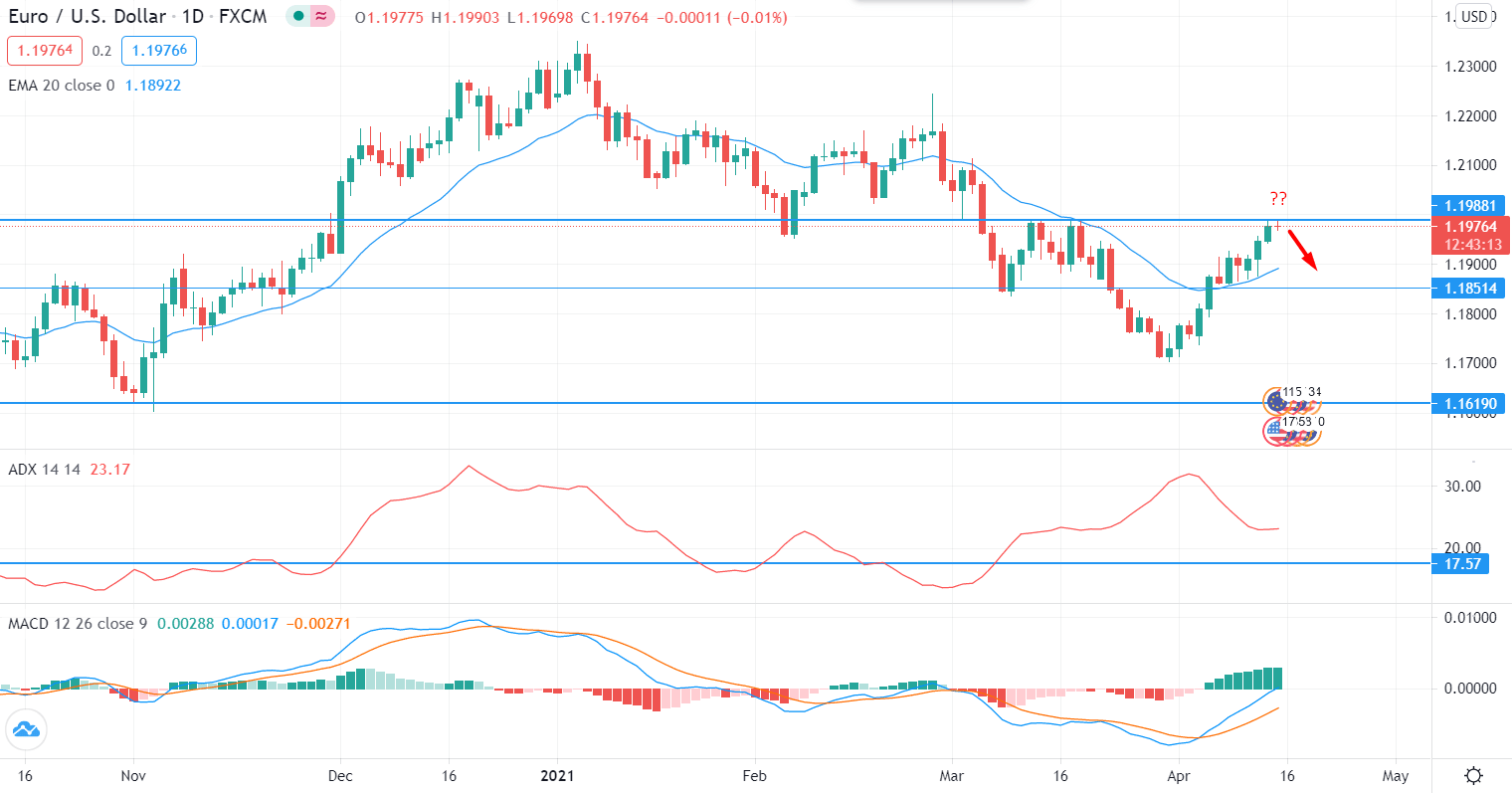

In the daily chart, the price moved to the 1.1990 resistance level with an impulsive bullish pressure. Moreover, the recent daily candles are still bullish, saying that the price has a higher possibility to continue the bullish pressure.

In the above image, we can see the daily chart of EURUSD where the price barely touches the 1.1990 resistance level. Earlier, the price moved above the dynamic level of 20 EMA as soon as it has taken the 1.1850 event level. However, the bullish pressure from the 1.1850 level extended the gap between the price and 20 EMA on the daily chart, indicating a bearish pressure due to the mean reversion.

On the other hand, MACD is still bullish, but the Histogram failed to create a new High. Therefore, a bearish daily close from the 1.1990 resistance level with a lower MACD histogram may indicate a bearish pressure towards the 20 EMA area at 1.1893. Furthermore, the ADX is flat and has a higher possibility to move up, pointing out an impulsive bullish or bearish pressure.

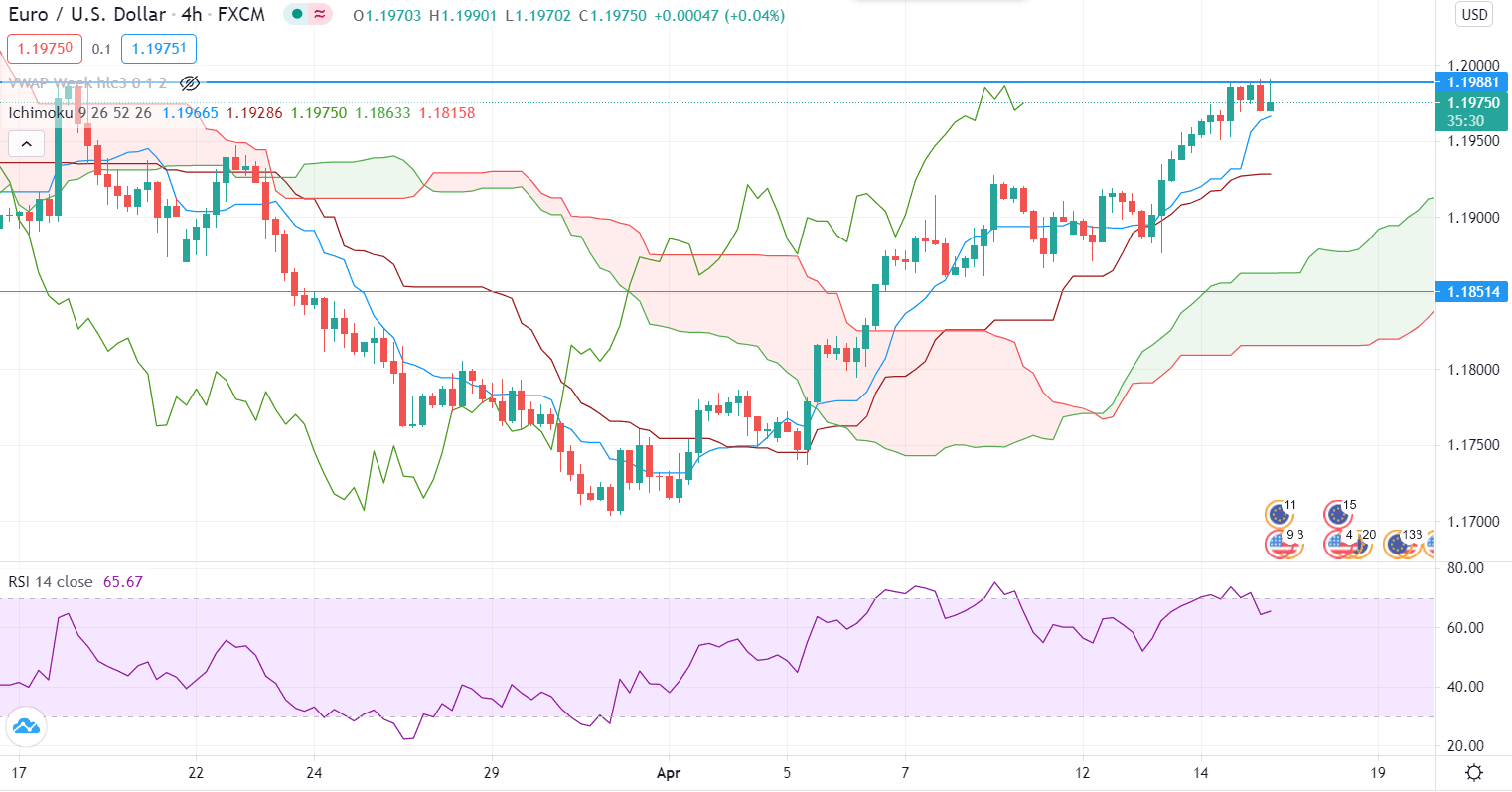

In the EURUSD h4, the price already showed bullish rejection with a bearish H4 close covering the previous bullish candle. Therefore, if the price break below the recent H4 low, it may move lower in the coming session.

In the above image, we can see the H4 chart of EURUSD where the price is getting minor dynamic support from the Tenkan Sen. However, the price is extended higher from the Kumo Cloud and facing resistance 1.1990 level. Therefore, if the price comes below the Tenkan Sen and has an H4 close, it may move lower towards the 1.1850 event level.

Besides, Chikou Span is also facing a residence with the price, and any new low of the Chikow Span Span swing may take it to the 1.1900 area. On the other hand, RSI is still bullish and moving down from the 70 levels, considered a strong overbought area.

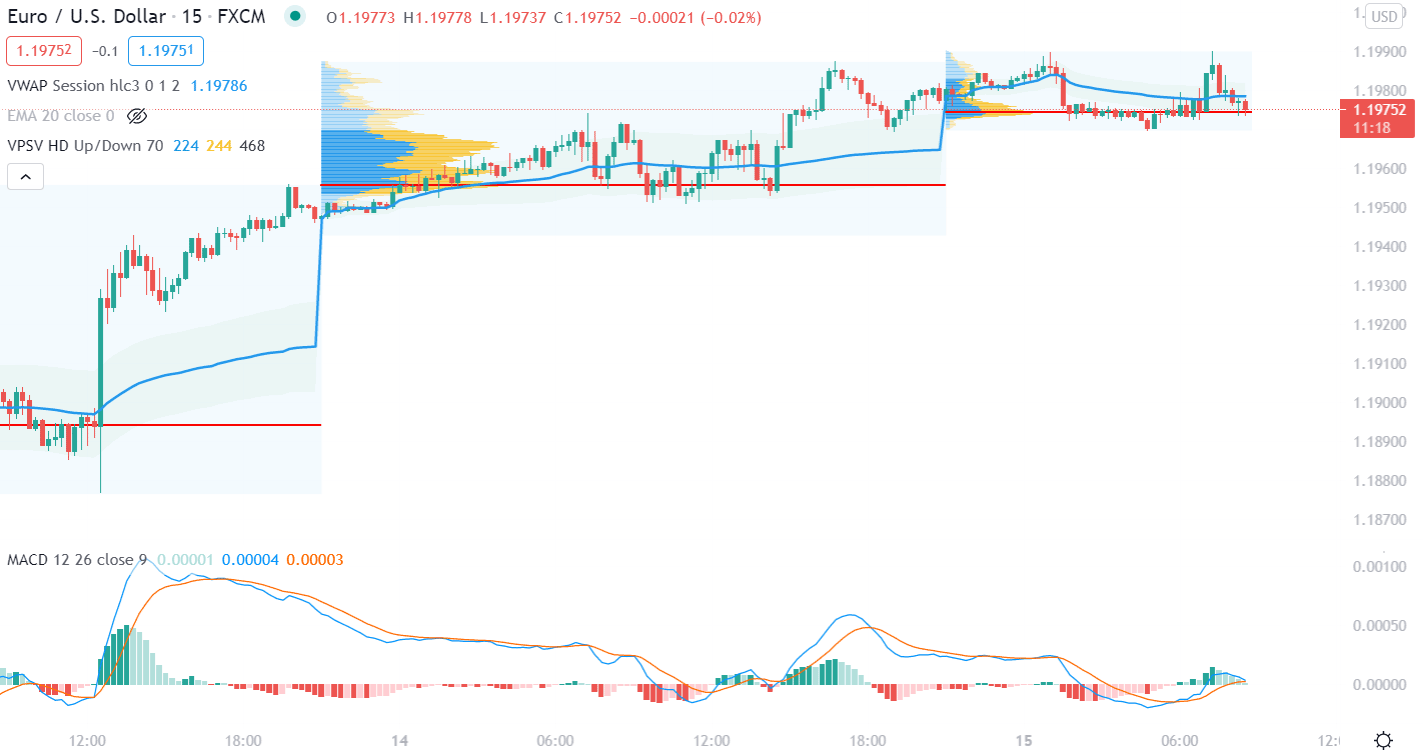

In the EURUSD intraday chart, the high volume area was found at 1.1975 area. Therefore, an hourly close below the 1.1975 area may increase further bearish pressure in the price.

Here we can see the m15 chart of the EURUSD, where the potential intraday double top area at 1.1990 level is backed by a high volume neckline at 1.1975. Therefore, as long as bulls are holding the price above the 1.175 level, there is a possibility of further bullish pressure.

On the other hand, a strong H1 close below the high volume 1.1975 level may initiate the bearish pressure where the primary target would be 1.1850 event level. Moreover, in the m15 chart, the MACD Histogram is squeezing to the zero levels with a potential regular divergence, indicating a bearish pressure in the price.

As of the above discussion, we can say that the EURUSD has a higher possibility to continue the bullish pressure as long as the price is holding above the 1.1975 area. Moreover, a bullish daily close above 1.1990 may extent the bullish pressure towards the 1.200 key level. On the other hand, a strong bearish hourly close below 1.1975 may create some bearish pressure where the primary target would be 1.1850 event level.

Besides, high-impact news from the US where a better than expected result might increase the price’s bearish possibility. However, investors may see volatility during the new release, while strong money management is required to overcome the volatility.