Published: December 1st, 2022

The native cryptocurrency of the Cronos EVM Chain and the Crypto.com chain is CRO. Before being named CRO, it was formerly known as Crypto.org Coin.

Crypto.com is an open-source, permissionless, and public blockchain that aims to drive mass blockchain technology adoption through NFTs, Defi, and payments. The platform called itself a “next-generation public blockchain”.

Rafael Melo, Kris Marszalek, Gary Or, and Bobby Bao are the co-founders of the platform in 2016 and it is now operated as a mobile application and desktop.

The first-ever Ethereum-compatible blockchain built on Cosmos SDK technology is the Cronos EVM Chain. It is a Layer 1, permissionless, open-source blockchain that aims to scale GameFi, Defi, and overall Web3 communities by allowing builders to port crypto assets and apps instantly while benefiting from high throughput, low transaction fees, and fast finality.

The CRO token is used for staking and powers the blockchain which offers users numerous rewards, alongside helping maintain decentralization and the security of the platform.

The current circulating supply of this token is 25.26B CRO, which is 83% of the maximum supply. The current market cap of this token is $1,640,168,654, which helped it to rank at 29th position on the Coinmarketcap listing.

Let’s see the future price of Cronos from the CRO/USDT technical analysis:

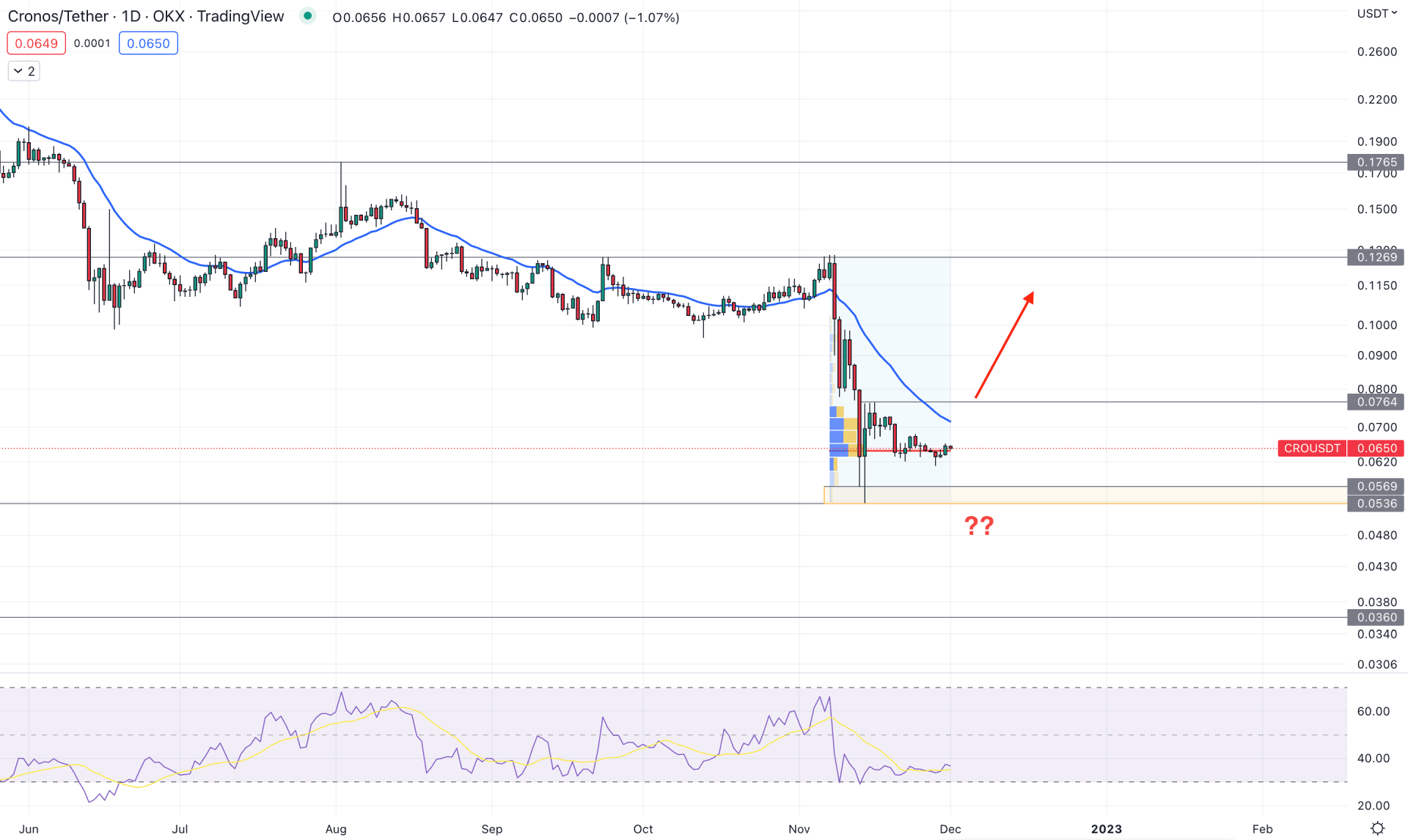

In the daily timeframe, the bearish pressure indicates that the current time is not suitable for exchanging tokens. The massive selling pressure from the bankruptcy of FTX and the possible business closure of Bitfront incurred a strong selling pressure in the CRO price.

In most recent days, the price moved down from 0.1269 high to 0.0536 low with an impulsive bearish pressure that might influence bulls to think twice before buying this token. However, the bearish pressure from the 0.1269 high failed to come with institutional traders’ support, which could relieve some pressure on bulls.

Based on the fixed range high volume indicator, the highest trading volume level from 0.1269 to 0.0536 area is at 0.0646 level, which is just below the current price. The higher trading volume at the bottom indicates a buyers’ attempt in the market, which could offer a long opportunity.

The dynamic 20-day Exponential Moving Average level is above the price, working as a resistance level, while the Relative Strength Index (RSI) is hovering between 50% to 30% area.

Based on the current daily outlook, strong buying pressure with a daily candle above the 0.0764 static level is needed to form a breakout and aim for the 0.1765 level.

On the other hand, the broader market outlook for the token is still bearish and further selling pressure below the 0.0536 level would be an alarming sign for bulls.

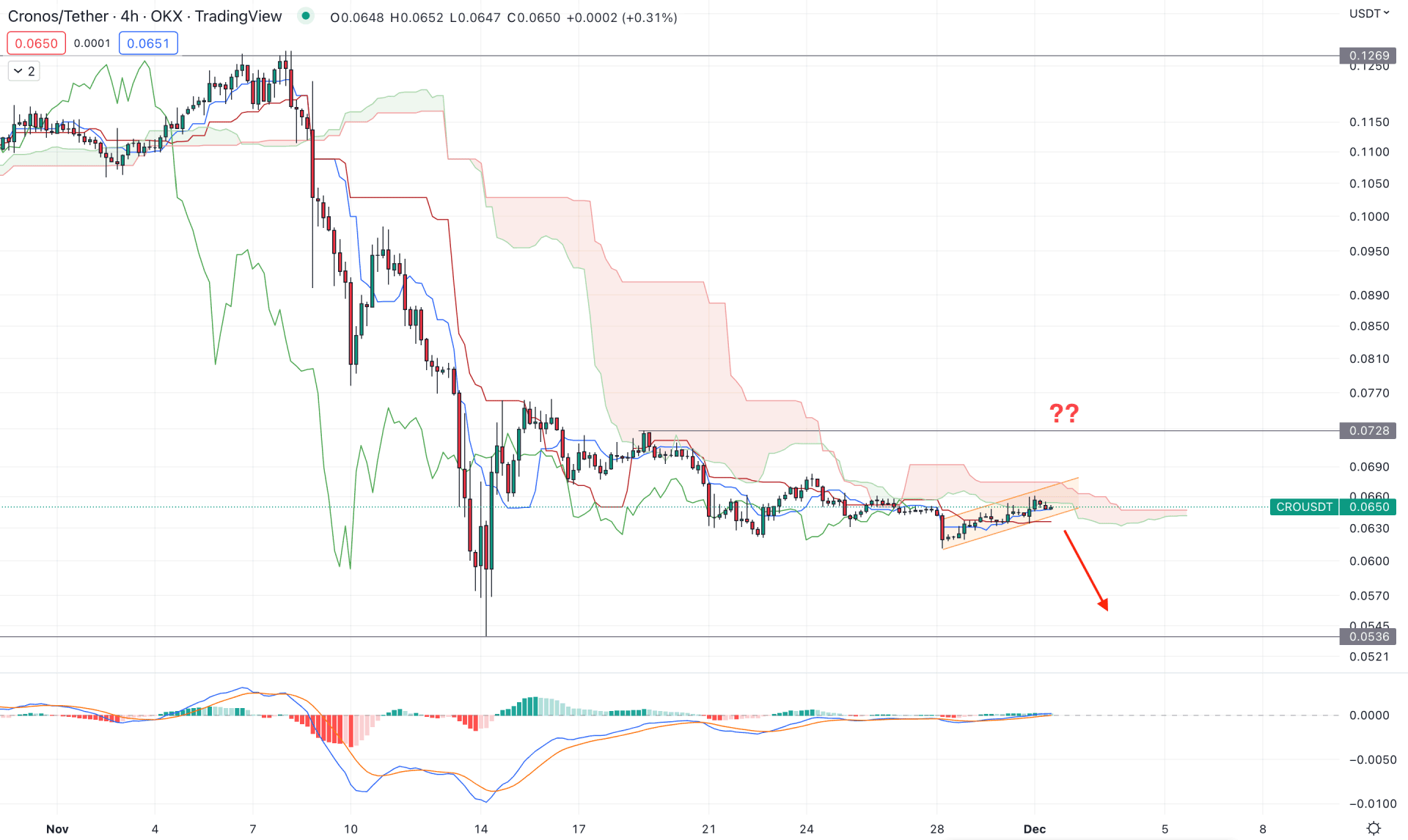

In the H4 timeframe, sellers’ dominance is clearly visible as the current price is trading below the dynamic Cloud resistance. However, the future cloud is almost flat, where the gap between the Senkou Span A and B is narrowing.

On the other hand, bears are holding momentum below the Cloud resistance for a considerable time, where the current price is trading within the ascending channel. In that case, a strong bearish channel breakout could offer a short opportunity, depending on the market context.

The indicator window shows a corrective price structure as the MACD Histogram is near the neutral line. Moreover, the dynamic Tenkan Sen and Kijun Sen are above the price, working as a resistance.

Based on the current outlook, a bearish H4 candle below the channel support could offer a high probable short opportunity, targeting the 0.0536 level.

On the other hand, bulls need a strong change in volume with an H4 close above the 0.0728 level, which could increase the possibility of reaching the 0.1269 target level.

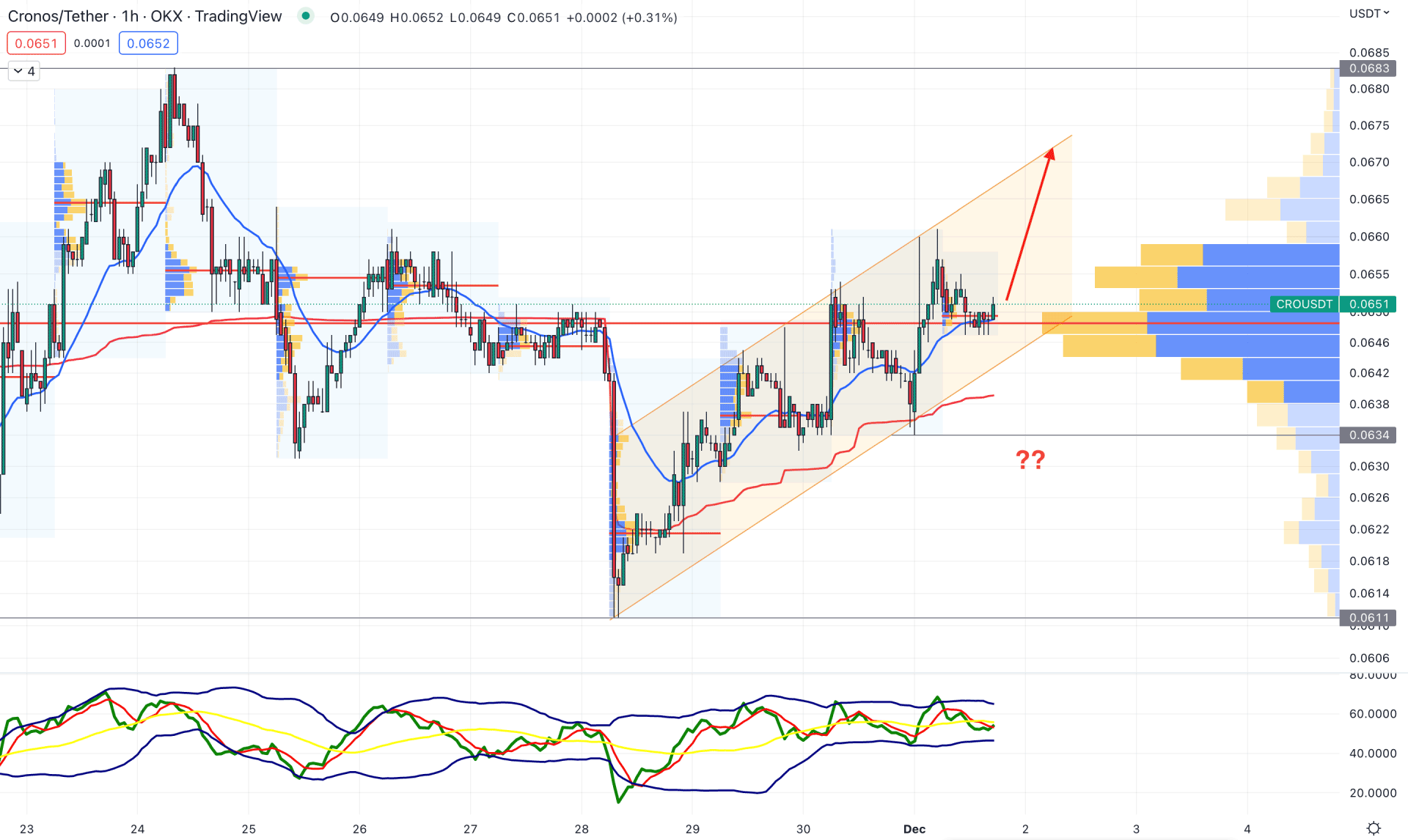

In the intraday chart, the buying possibility is still valid although the current price is trading within an ascending channel. The visible high volume level is below the current price, while the dynamic 20 EMA is acting as a support level.

The indicator window shows a neutral structure, where the current TDI level is at the 50% area. Moreover, the weekly VWAP is below the price, which is a sign of buyers’ presence in the market.

Based on the H1 timeframe, the buying possibility towards the 0.0683 level is valid as long as the price trades above the dynamic 20 EMA level. On the other hand, a bearish H1 candle below the weekly VWAP is needed before aiming for the 0.0600 area.

Based on the above finding, bulls should wait for a strong breakout, with a daily candle above the 0.0764 level to validate the bullish trend. On the other hand, the H4 channel breakout might provide a decent short opportunity in the coming days.