Published: April 28th, 2021

After a year of closure, Disneyland and Disney California Adventure Theme Parks opened this month. The positive decision for the Disney stock came with the vaccine development and slowdown in infection. Besides, travel-related stocks have shown some growth, which indicates further development in the leisure and entertainment sector.

Besides Disneyland in the US, Walt Disney in Hong Kong and Shanghai are open, while Theme Parks in Paris and California are closed. The California Disneyland was supposed to open on 2 April 2021 but delayed due to the increase in virus infection.

Currently, Disney Stock is trading above the $181.00 event-level but can it push higher? Let’s find the upcoming price direction from the Disney Stock technical analysis!

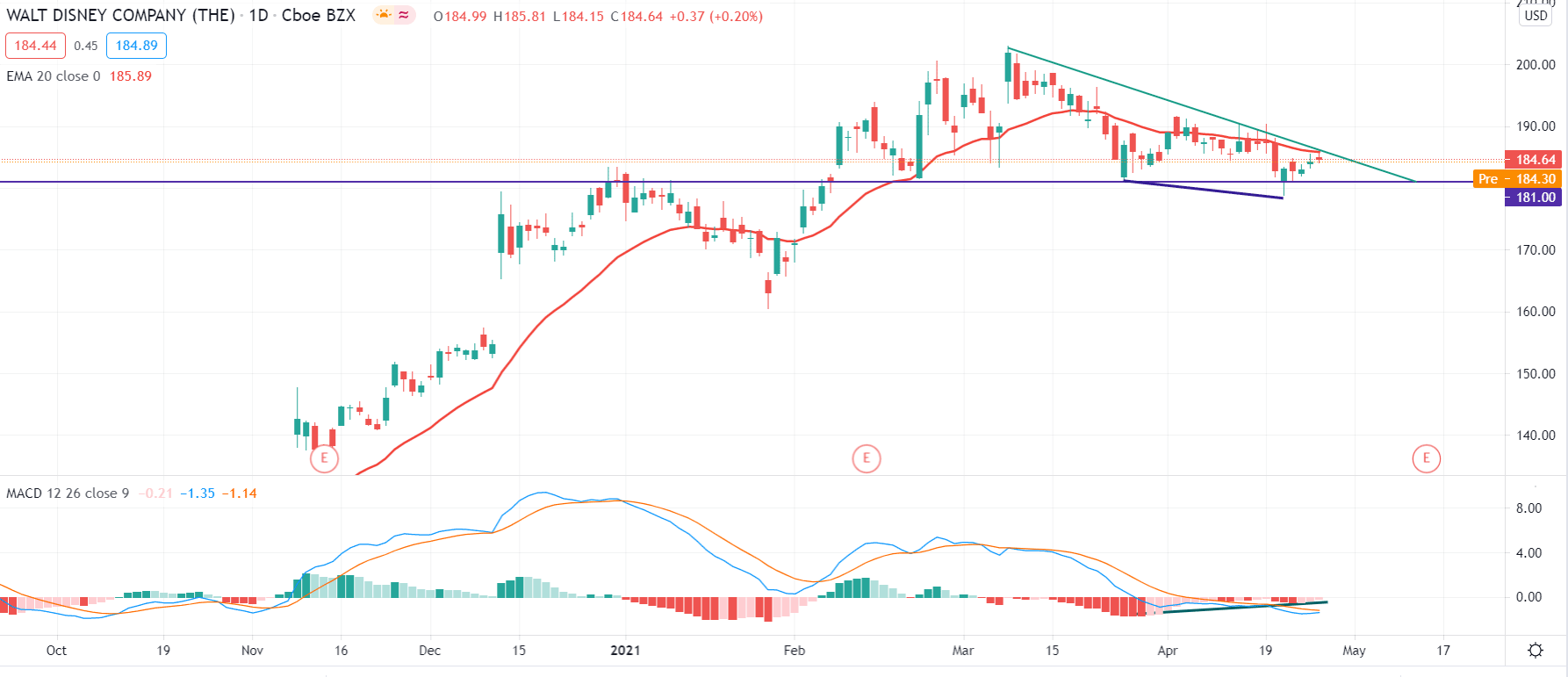

Based on the daily chart, the overall price outlook is bullish as the price is moving up from left to right by creating higher highs. Moreover, the price remained stable above the $181.00 event-level from early February, pushing the price higher to the all-time high of $202 level.

In the image above, we can see the daily chart of Disney stock where the price started to move lower from the all-time high with a corrective speed. However, the bearish pressure failed to take the price below the $181.00 event-level and a bullish daily candle above the $181.00 level increased further bullish possibility in the price.

However, the price is still within the trendline resistance along with the Dynamic 20 EMA. Therefore, buyers’ should wait for the price to move above the $186.31 level with an impulsive bullish pressure. On the other hand, a potential Hidden Divergence between the price and MACD indicates a possible price reversal in the coming days.

Overall, based on the daily timeframe, investors should wait for a daily close above the trendline resistance. Conversely, if the price comes down and has a bearish daily close below the $181.00 event level, it may move lower towards the $168.55 level.

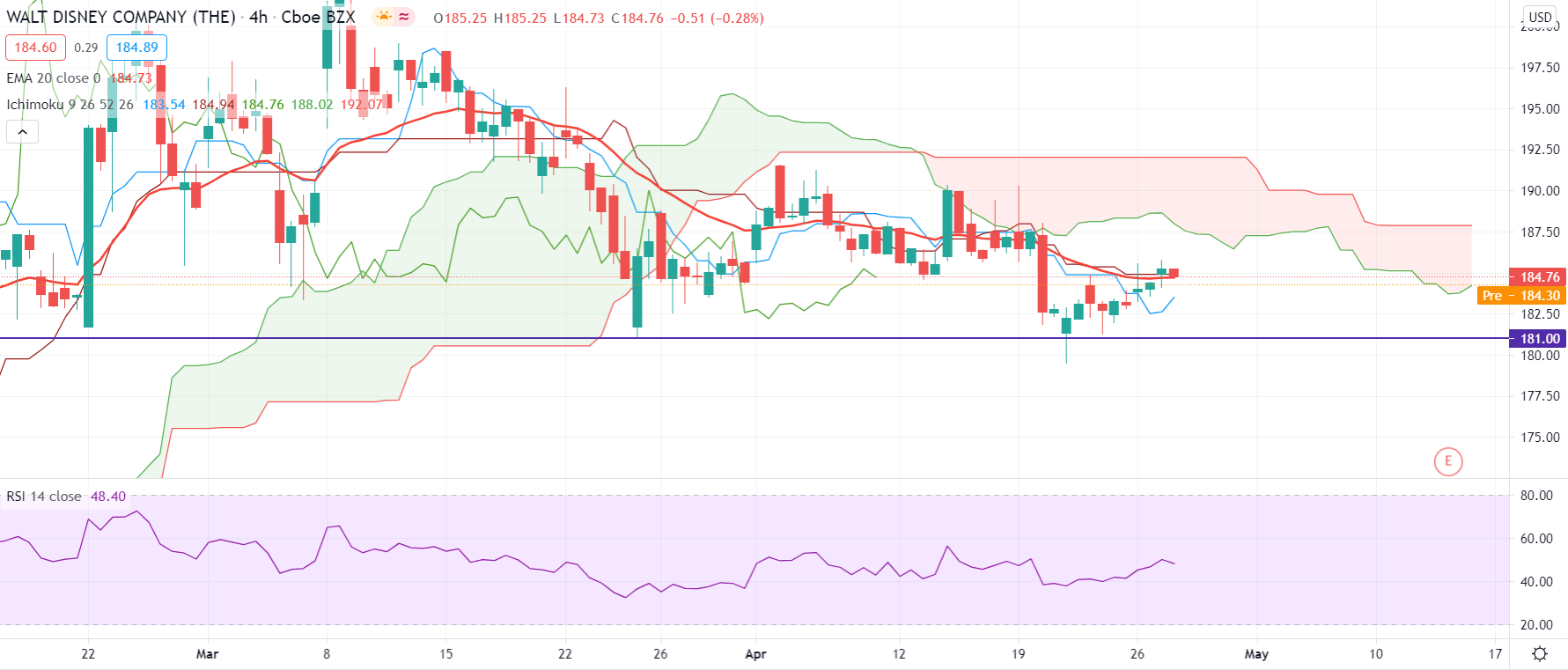

Based on the Ichimoku Cloud on the H4 timeframe, the price is moving within a corrective momentum as the Kumo Cloud is above the price, but Tenkan Sen and Kijun Sen are not supportive. Therefore, investors should wait for a clear direction by finding the price above the Kumo Cloud to follow the price trend.

In the above image, we can see the H4 chart of Disney Stock where Tenkan Sen is below the Kijun Sen but move up. Therefore, if the Tenkan Sen moves above the Kijun Sen, it will extend the correction and lead the price to test the $190.00 intraday resistance. However, Chikou Span is below the price and heading downwards while Senkou Span A is below Senkou Span B and moving up, in the future cloud.

Based on the findings of the H4 chart, investors should wait for an H4 close above the $190.00 level for a bullish entry. RSI is still supportive for bulls as it is above the 50 levels and moving up. Conversely, if the price comes below the $181.00 level, investors should wait for a daily close. In that case, the price may come lower towards the $168.55 support level.

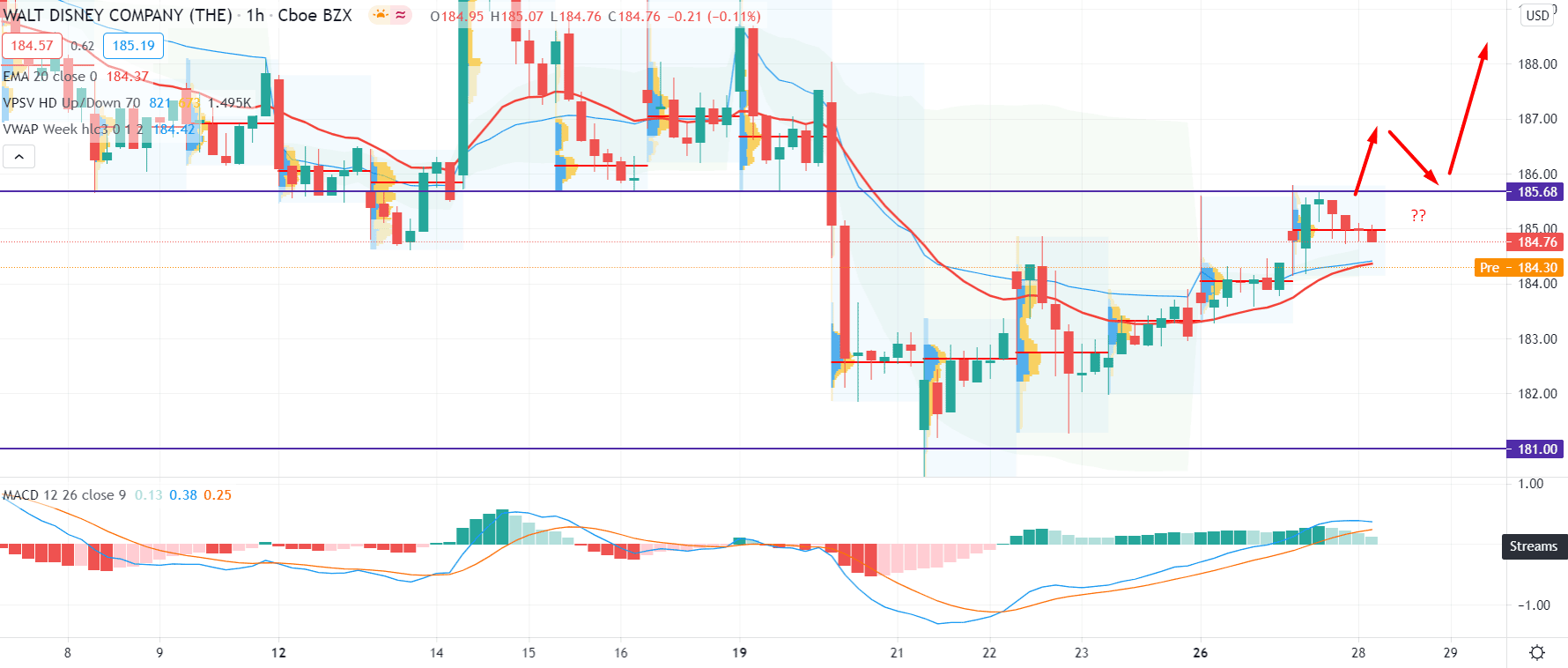

Based on the intraday chart, Disney Stock is trading above the high volume area of $184.00 level. Moreover, the session volume makes new highs from the last four sessions, pointing out that bulls are active in the price. However, the price needs to overcome the $185.68 event level with an H1 close to increasing the bullish possibility.

In the above image, we can see that the price is trading above the dynamic level of 20 EMA on the H1 chart, showing an intraday support to bulls. Moreover, weekly vwap is also below the price and pointing minor support to the price.

Based on the H1 chart, any bullish rejection from the $185.68 level with an H1 close below the 20 EMA may take the price lower towards the $181.00 level. On the other hand, bulls need to take the price above the $185.68 level with an impulsive bullish pressure to continue the current bullish trend where the primary target would be $190.00 level.

As of the above discussion, we can say that the price has a higher possibility to continue the bullish trend where the primary target would be $190.00 level and $198.00 level. However, bulls need to take the price above the daily trend line resistance to ensure bullishness.

Conversely, the $181.00 level may work as an important event level for sellers’. Any strong bearish daily close below this level would increase the selling possibility, which may drag the price down towards the $168.55 level.