Published: December 24th, 2025

Supported by strong U.S. economic growth and the possibility of supply-chain interruptions from Russia and Venezuela, oil prices increased somewhat for a sixth day on Wednesday.

According to U.S. data, the largest economy in the world expanded at its quickest rate in two years in the last three months because of record spending by consumers and a notable increase in exports.

Nevertheless, Brent and WTI costs are expected to fall by roughly 16% and 18%, respectively, this year — their biggest drops since 2020.

According to research, the market has been supported by Russia's and Ukraine's continuing assaults on their shared energy infrastructure. However, the biggest reason driving higher oil prices on the supply side has been disruptions to Venezuelan exports.

Following the U.S. seizure of the gigantic tanker Skipper early this month and the targeting of two other boats over the weekend, more than twelve filled ships are in Venezuela awaiting new instructions from their owners.

Due to the Christmas holiday, official inventory data will be released by the U.S. Energy Information Administration on Monday, which is later than usual.

Let's see the upcoming price direction from the UKO/USD technical analysis:

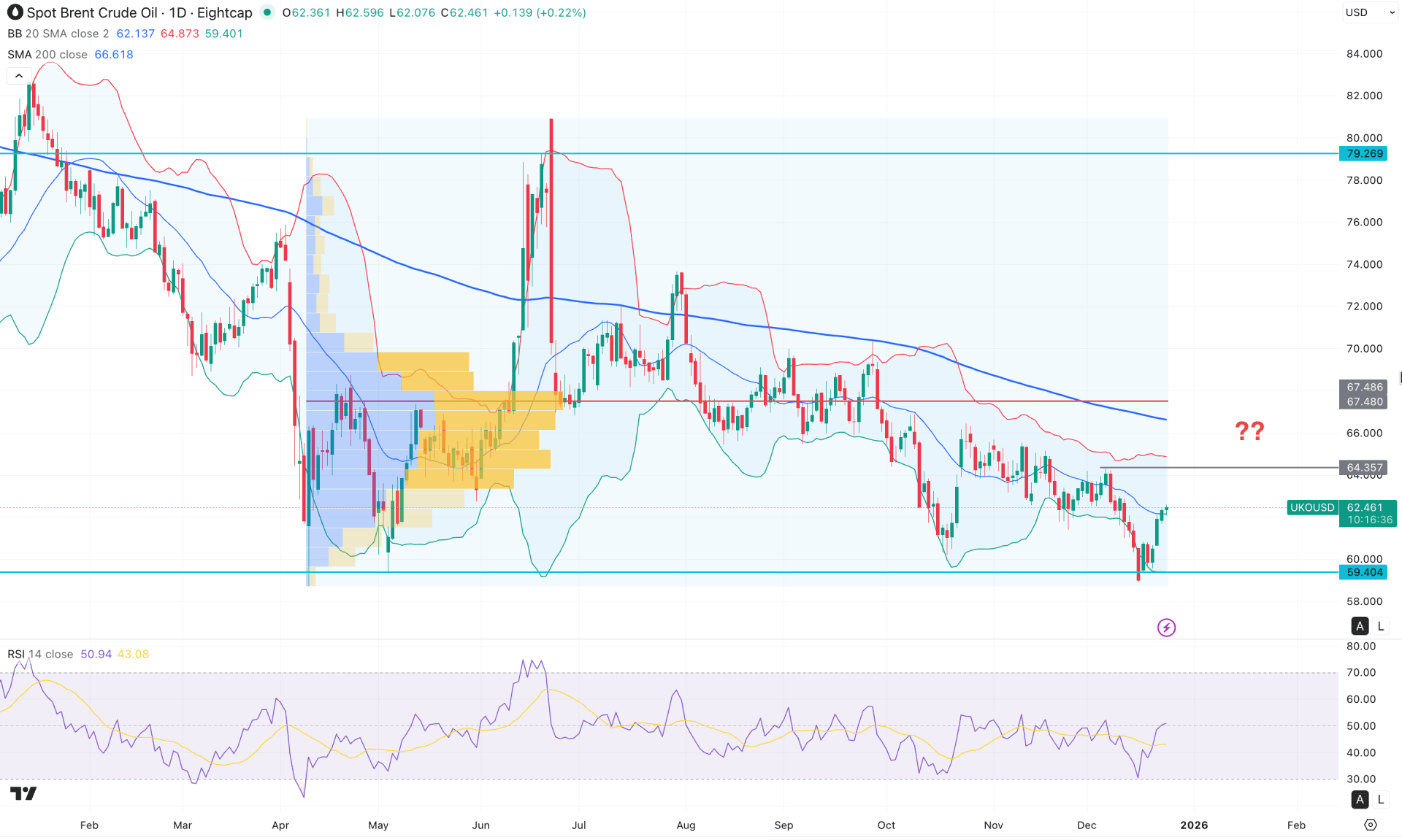

On the daily chart of UKO/USD, ongoing bearish pressure is evident as the price continues to move lower within the stable bearish structure. However, the most recent price action has reached a key liquidity zone below the May 2025 low, from which a strong bullish reaction has emerged. Although a confirmed bottom has not yet formed, investors should closely monitor how the price reacts from this recent low, as a sustained rebound could validate a bullish trend formation.

From a higher-timeframe perspective, the monthly chart reflects strong selling pressure, with five consecutive bearish monthly candles visible. That said, the most recent candle is showing minor buying interest after reaching the crucial 59.40 support level. Despite this, the price remains below the November 2025 low, which must be decisively breached to confirm bullish momentum. Meanwhile, the weekly timeframe presents a similar structure, with no clear trend established and price action confined within a corrective bearish phase.

On the main price chart, volume remains skewed toward sellers, with the highest volume node from April 2025 located around the 67.48 level, which is significantly above the current price and may act as a supply zone.

Additionally, the 200-day Simple Moving Average maintains a steep downward slope above the overall price structure, suggesting a strong dynamic resistance ahead.

The price is also facing minor resistance near the mid-Bollinger Band, from where short-term corrective pressure is becoming visible.

However, momentum indicators paint a relatively constructive picture. The Relative Strength Index (RSI) has rebounded from the 30.00 oversold level and has surpassed the 50.00 neutral mark, indicating improving momentum. At the same time, the Average Directional Index (ADX) has flipped higher and moved above the 20.00 threshold, signaling strengthening trend conditions.

Based on the broader market structure, UKO/USD is still trading within a consolidation phase. A strong bullish recovery above the 64.35 level could validate a medium-term bottom and confirm a bullish continuation setup. In such a scenario, the price may stabilize and advance toward the 70.00 psychological level.

Conversely, multiple resistance levels above the current price could cap upside attempts. Failure to sustain above the near-term support zone may expose the price to renewed selling pressure. A breakdown below 62.43 could accelerate downside momentum, potentially opening a bearish opportunity targeting the 58.00 psychological level.

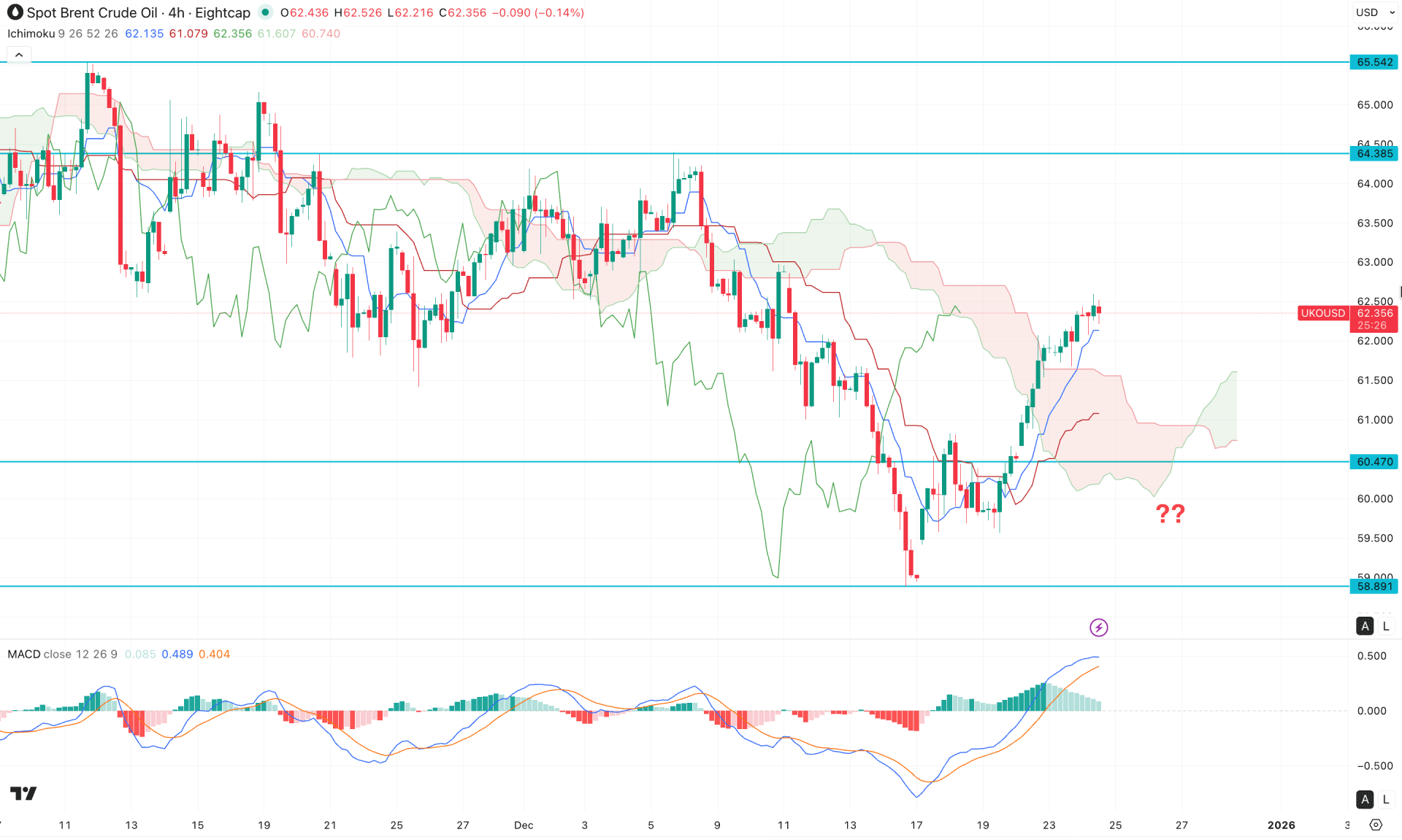

On the four-hour timeframe, a bullish rebound is visible on the UKO/USD chart, with the most recent price trading above the Ichimoku Cloud. Moreover, the future cloud has flipped bullish, with Senkou Span A positioned above Senkou Span B.

Meanwhile, the dynamic lines remain below the current price and are sloping upward, signaling a potential bullish continuation.

However, momentum indicators suggest some caution. The MACD histogram has failed to sustain buying pressure and is compressing toward the neutral zone. The signal line has peaked near the upper band, indicating that bullish momentum may be losing strength.

Based on this outlook, a notable corrective pullback remains possible despite the recent breakout, as the cloud structure is not yet fully supportive. In this scenario, the price may retrace toward the Kijun-sen level near 61.08. A sustained move below 60.47 could open a short-selling opportunity, with downside targets near the 58.00 psychological level.

Conversely, a strong bullish rebound from the cloud area, supported by stable price action, could extend buying pressure and drive the price above the 64.38 resistance level.

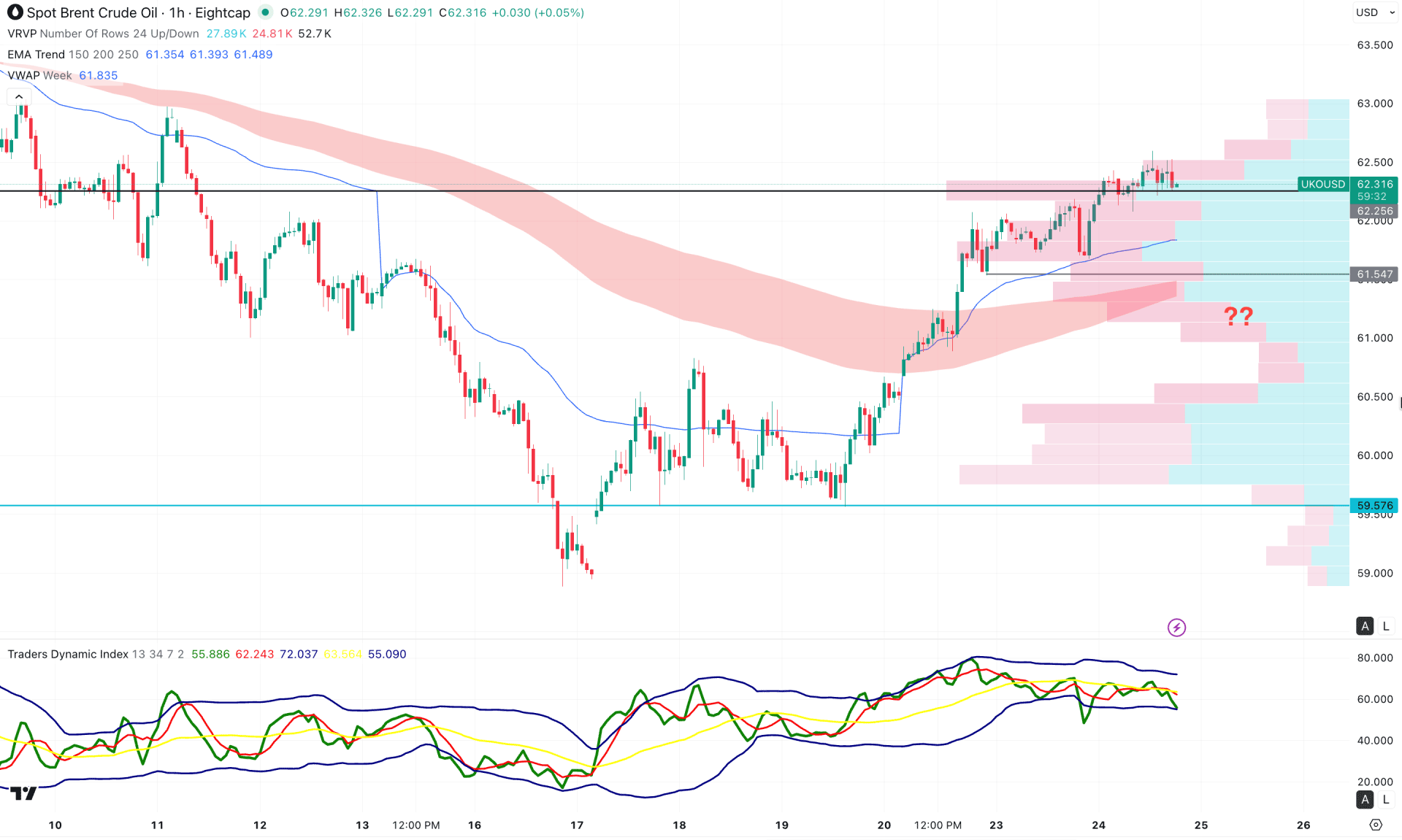

On the hourly timeframe, the most recent price is trading near the previous peak, signaling an intraday extension phase. A potential bullish continuation is evident, as the Exponential Moving Average (EMA) wave and the weekly VWAP are positioned below the current price and are sloping upward. However, the high-volume line aligns closely with the current price, suggesting an extended move and increasing the likelihood of profit-taking near the daily high.

In the indicator window, the Traders Dynamic Index (TDI) has flipped bullish and is rising from the lower band area, indicating strengthening bullish pressure in the market.

Based on this outlook, a moderate downside correction remains possible. Failure to hold above the weekly VWAP could trigger a short-term bearish opportunity, with downside targets near the 60.50 level.

Conversely, holding above the 61.50 support level, followed by an immediate bullish rebound, could allow the prevailing trend to resume and push the price toward the 63.00 resistance level.

Based on the overall market momentum, UKO/USD is still trading within the bearish trend, where a valid confirmation is needed before anticipating a trend change. Primarily, the price is having an intraday bullish pressure, where a decent downside correction could create an opportunity to join the bull market from a lower price.