Published: May 21st, 2025

Autodesk ADSK is expected to release its fiscal 2026 first-quarter earnings on May 22. The non-GAAP EPS could be between $2.14 and $2.17, and first-quarter financial 2026 revenues between $1.60 and $1.61 billion.

Several things could impact first-quarter fiscal performance. First, there are opportunities and risks associated with Autodesk's continuous go-to-market strategy optimization, especially in advertising, customer satisfaction, and operations. Second, consumer spending decisions are still influenced by macroeconomic uncertainty, which may hinder the expansion of new businesses. Third, the company's transition to a CRO adds a factor to performance in the short run.

Autodesk's Construction division is growing rapidly; last quarter, it added about 400 new logos and saw an acceleration in revenue. Additionally, the business is reallocating resources to focus on cloud, platform, and AI developments, which may eventually improve its competitive position.

Investors should balance the underlying non-GAAP margin of operation, which is predicted to reach 39–40% for fiscal 2026, against the potential for margin expansion. The administration has promised to provide more information about future margin expansion during an analyst day scheduled for the third quarter.

Investors may find it advantageous to hold onto their present positions in light of these conflicting signals until they better understand how well Autodesk manages its organisational changes and implements its optimisation strategy. Only then should they increase their exposure to the stock.

Let's see the further outlook of this stock from the ADSK technical analysis:

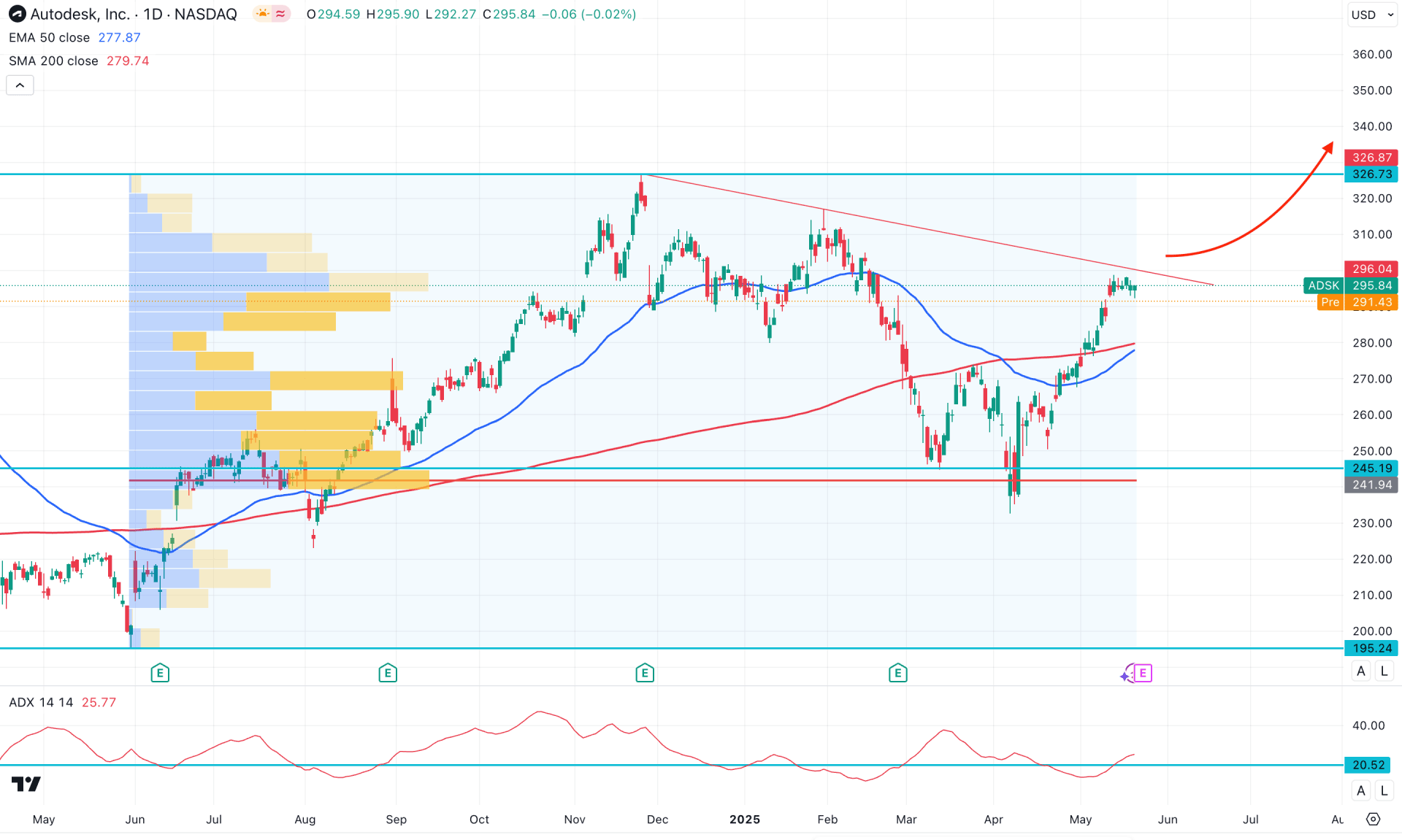

On the daily chart of ADSK, the recent price action shows a strong bullish reversal after grabbing liquidity from the March 2025 low. However, the current price is approaching a crucial trendline resistance, where further confirmation is needed before considering a long opportunity.

Looking at the higher time frames, a bullish continuation is visible on the monthly chart, supported by a range breakout with a proper retest. The weekly chart reflects similar momentum, with five consecutive bullish candlesticks recently. However, the price is now encountering resistance on the higher timeframe, where additional confirmation is needed to validate a bullish breakout.

On the other hand, the most significant activity level from May 2024 lies below the current price, from where multiple bullish daily candles have formed. Following a high-volume breakout, the price trades sideways at the top, suggesting that a decent downside correction is likely before the measurable uptrend resumes.

From a price action perspective, the 50-day EMA is still below the 200-day EMA, where both lines are beneath the current price. In this case, a consolidation within the 291.43 to 275.00 area could offer a bullish continuation opportunity, supported by the rising 50-day EMA.

Meanwhile, the Average Directional Index (ADX) indicates a strong market trend. The current ADX line has rebounded from the 20.00 level, which is considered satisfactory.

Based on this outlook, investors might expect the bullish momentum to continue as long as the 200-day SMA remains below the current price. However, a confirmed breakout above the trendline resistance, with a strong move above the 300.00 level, could trigger an aggressive long approach targeting the 326.00 level. However, a deeper pullback toward the 270.00 to 250.00 area could present another long opportunity.

Meanwhile, the price is currently trading just below the trendline resistance. A bullish breakout with an immediate rebound could offer a short-term opportunity, with the main target being the 245.19 support level.

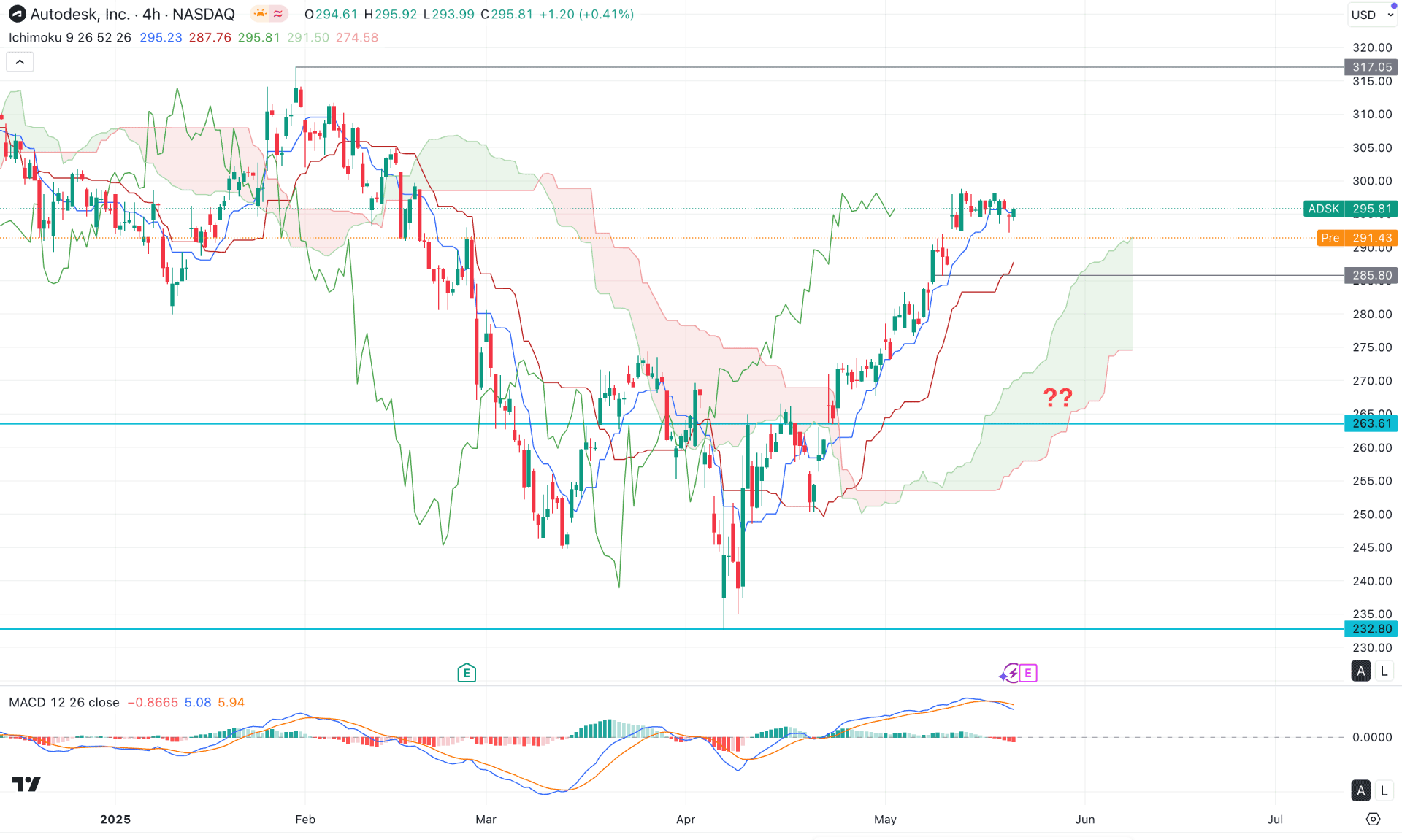

In the 4-hour timeframe, the recent price showed a solid bottom before forming a range breakout. As a result, the price is hovering above the dynamic Ichimoku Cloud, suggesting a stable bullish market. Moreover, the Senkou Span A and Senkou Span B are aiming higher, signalling a confluence of buying pressure.

On the other hand, the MACD Histogram has flipped the position and aimed lower, followed by a bearish crossover in the Signal line.

Based on the H4 outlook, the price is trading at the premium zone, from where a downside recovery is possible. However, the major market trend remains bullish as long as the price trades above the Cloud area.

In that case, a bullish recovery from the 285.00 to 270.00 zone could be a long opportunity, targeting the 320.00 level. However, an extended selling pressure below the 263.31 static support level might lower the price towards the 232.80 level.

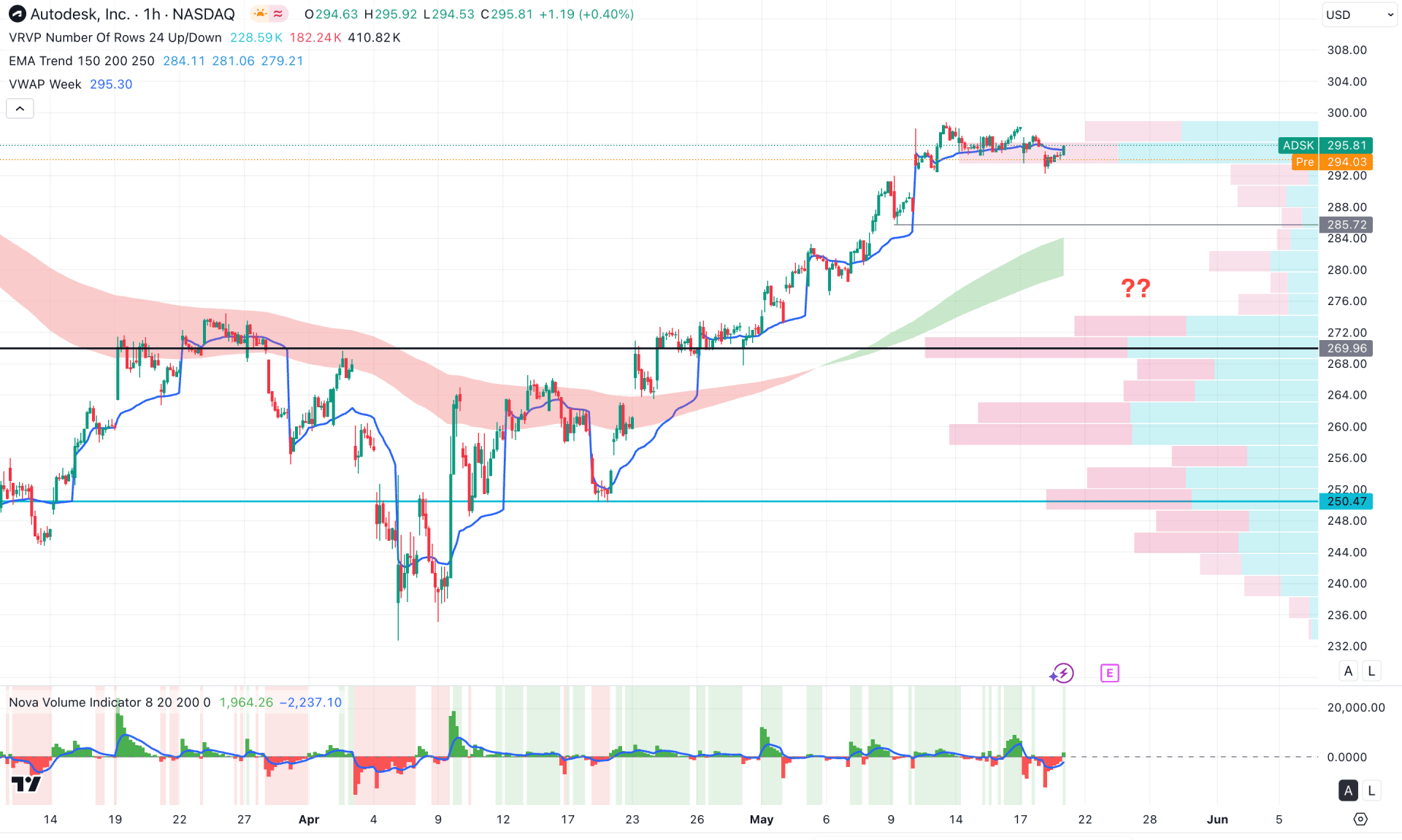

In the hourly time frame, the current price hovers at the session high, from which more confirmations are needed before anticipating a bull run.

The dynamic moving average wave is below the current price and is working as an immediate support. Moreover, the intraday high volume line is also below the current price, supporting the bull run.

On the other hand, the Volume Histogram suggests eliminating sell volume from the market where emerging buying pressure is present.

Based on this outlook, a bearish hourly candle below the 285.72 level could offer a short-term bearish opportunity, targeting the 269.96 level. However, the major market trend remains bullish, signalling a bullish rebound from the reliable hourly bottom.

Based on ADSK's current market outlook, the upcoming earnings report could be a crucial event to watch. Any upbeat result could validate the pattern after the trendline breakout as the current price trades within a bullish pre-breakout momentum.