Published: November 16th, 2022

In May, Algorand was selected as the official blockchain partner of FIFA, another well-positioned project to benefit from the global event. FIFA praised Algorand as being a “green blockchain technology company” and “founded by Turing Award-winning cryptographer Silvio Micali”, in the original partnership announcement.

The World Cup is conceivably the second-largest global sporting event after the Olympics. So cryptocurrency companies can reckon it as an ideal event to present their case globally to increase efforts on adoption and awareness significantly.

The FIFA World Cup 2022 is scheduled to occur from Nov. 20 to Dec. 18 in Qatar. Additionally, in terms of helping to launch crypto into the mainstream, it could be one of the most significant events of the year due to the heavy crypto-related sponsorships.

Algorand’s ability to offer low-cost transactions and high-speed in a world of increasing environmental concerns and costs. While FIFA is attracted by having a standard environmental footprint in the protocol.

Algorand will deliver the official blockchain-supported wallet solution for FIFA, alongside assisting in developing the organization's digital assets strategy as part of the partnership.

The current circulation supply of this token is 7.1 billion, while the total supply is 10 billion. The trading volume in the last 24 hours for this token was reported as $249,228,620, which is 70.88% higher than the previous day.

Let’s see the future price of the Algorand token from the ALGO/USDT Technical analysis:

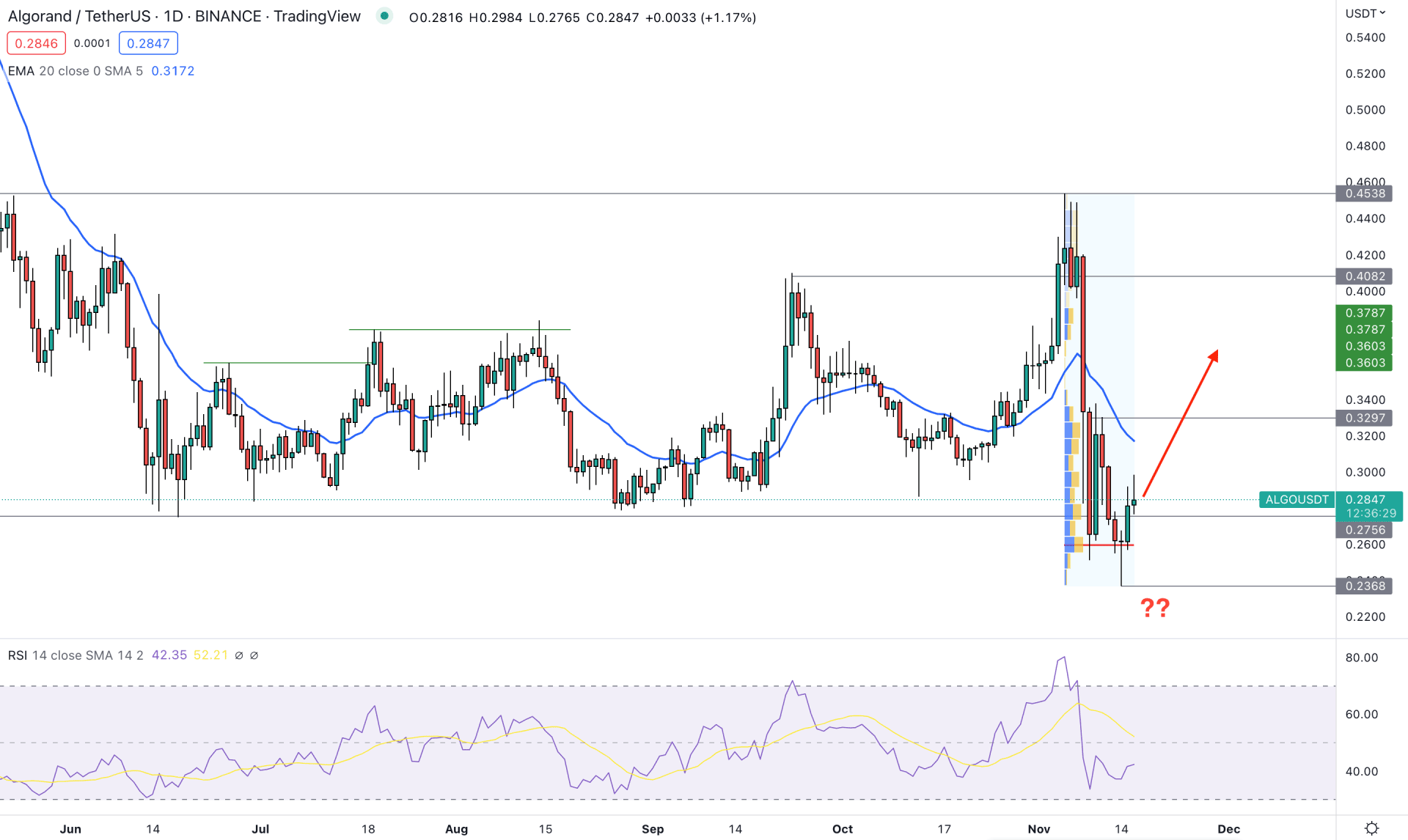

In the ALGO/USDT daily chart, the selling pressure started to lose momentum from June 2022 with several higher high formations. Moreover, the broader market outlook has become corrective, where the consolidative momentum increases the possibility of a trend reversal.

In the most recent days, the bullish possibility was opened as the price formed a bullish rejection from the 0.3000 demand zone, followed by a bullish break of structure. However, bulls from that zone were eliminated as there was a massive crash from the 0.4538 resistance level.

The current price is trading below the 0.2755 critical level, indicating a sell-side liquidity grab from the market. In this situation, investors need closer attention as the lower price will attract bulls, but it is not backed by a strong support level.

Based on the fixed range high volume level, the highest volume from 0.4538 high to 0.2368 level was found at 0.2595 level, which is below the current price. Moreover, the 20-day Exponential Moving Average is above the price, while the RSI is yet to reach the 30% level.

Based on the daily outlook, a bullish daily candle above the 20-day EMA could open a long opportunity, where the ultimate target is the 0.4538 level. Conversely, a bearish pressure below the 0.2360 level could extend the loss towards the 0.2000 area.

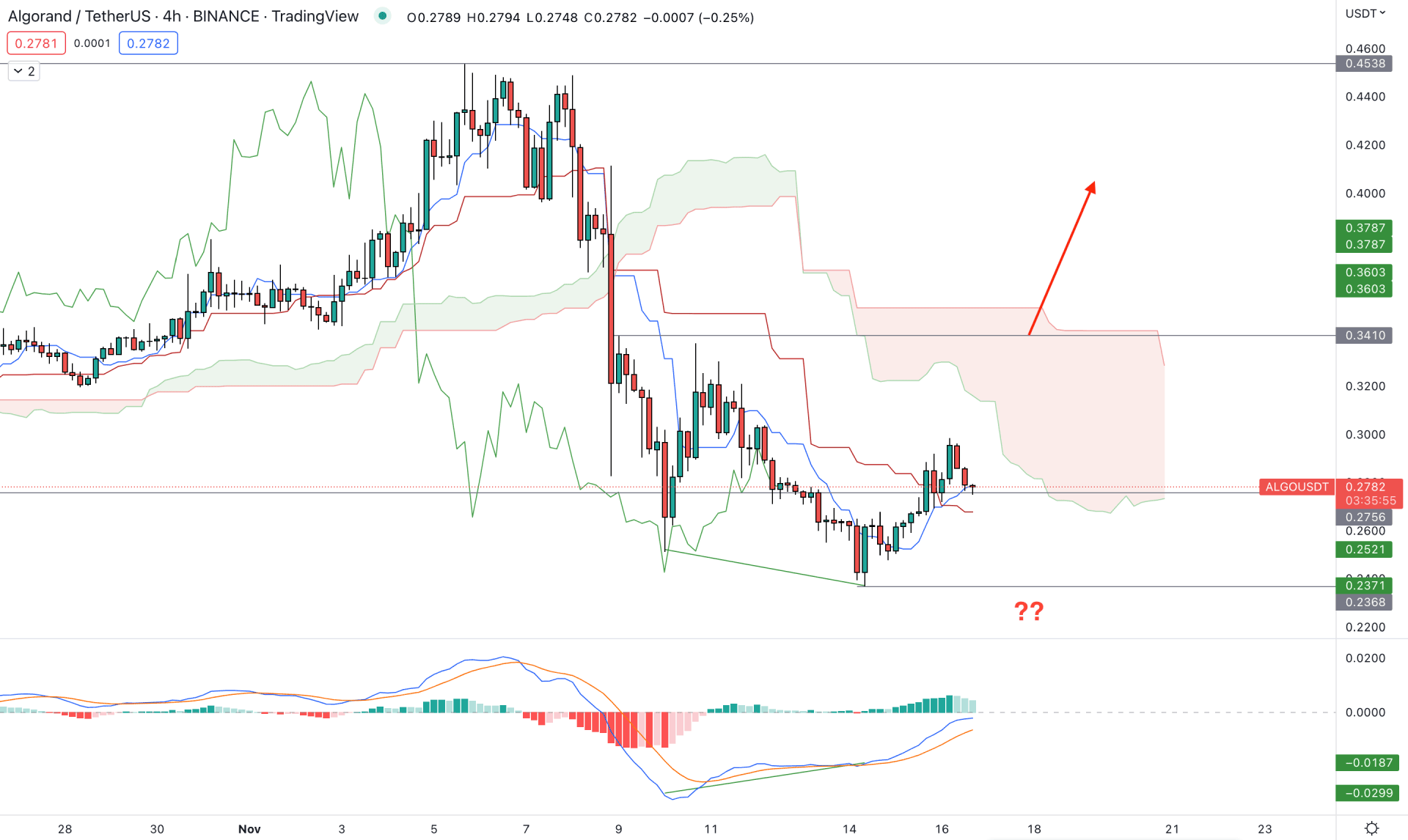

In the intraday H4 chart, ALGO/USDT trades in a price area from where a breakout is needed before opening a trading opportunity. Although this token's daily and macro outlook is bullish, the H4 structure is corrective as it trades below the dynamic Kumo Cloud.

In the future cloud, the selling pressure is solid from Senkou Span A and B’s position, while Tenkan Sen and Kijun Sen formed a bullish crossover followed by a MACD divergence.

Based on the H4 outlook, a bullish H4 candle above the dynamic Kijun Sen and 0.3410 static level could open a long opportunity, targeting the 0.4538 level.

The alternative approach is to wait for a bearish H4 close below the Tenkan Sen and aim for the 0.2000 area.

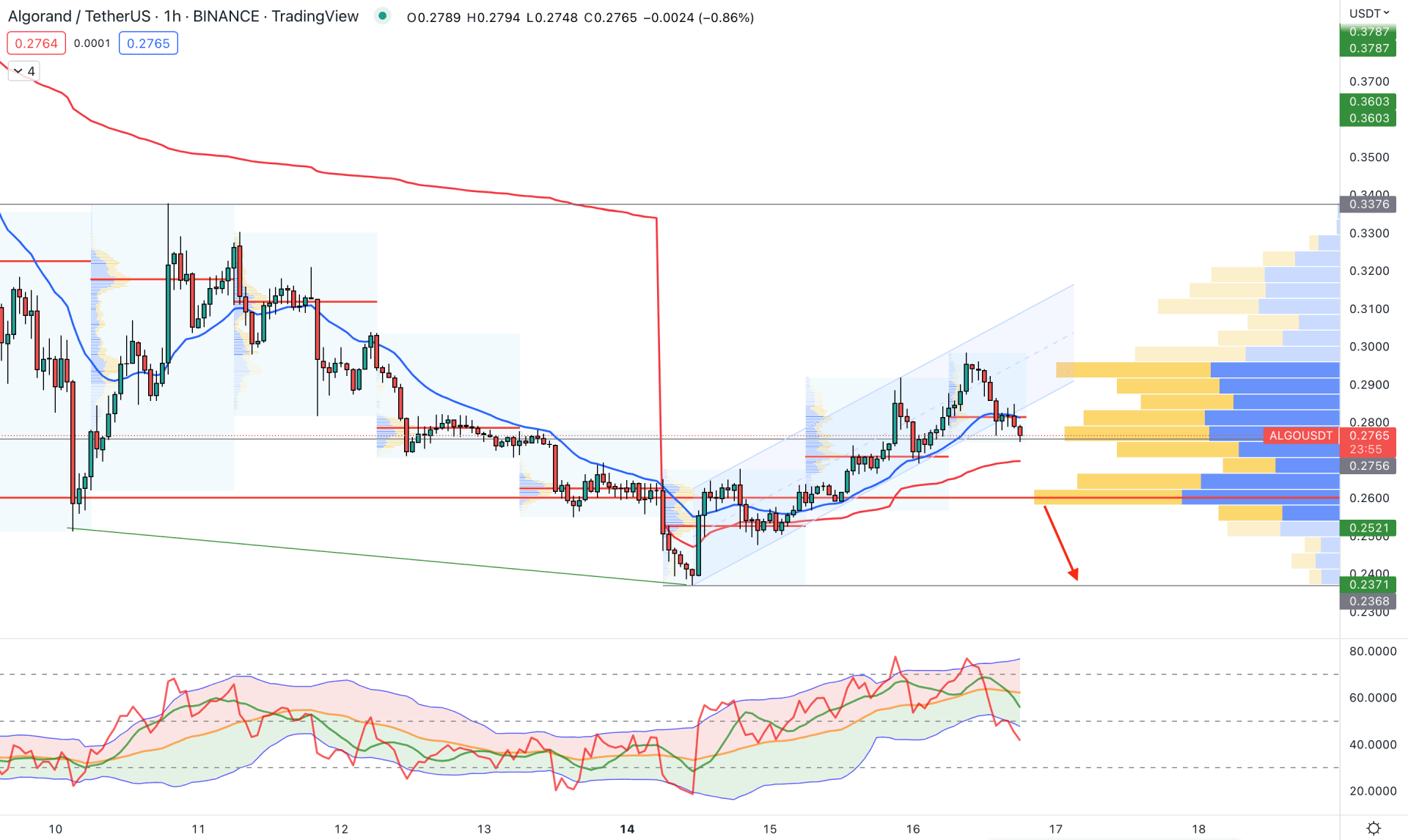

In the H1 timeframe, the bullish pressure is potent as the current price trades above the 0.2600 visible range high volume level.

The dynamic 20-day Exponential Moving Average and weekly VWAP are below the price and working as immediate support levels. Moreover, the current price is trading below the ascending triangle support while the Traders Dynamic Index (TDI) is at an oversold area.

Based on this structure, an immediate bullish recovery from the dynamic 20 EMA support could open a long opportunity in this pair, where the primary target is the 0.3376 level. On the other hand, breaking below the 0.2600 level with a bearish H1 close might extend the loss towards the 0.2000 area.

For long-term HODLers it would be the perfect time to buy this token based on its fundamental outlook. However, the best approach is to wait for the daily price to move above the 20 DMA, which could open a conservative approach to buying this instrument.