Published: October 12th, 2020

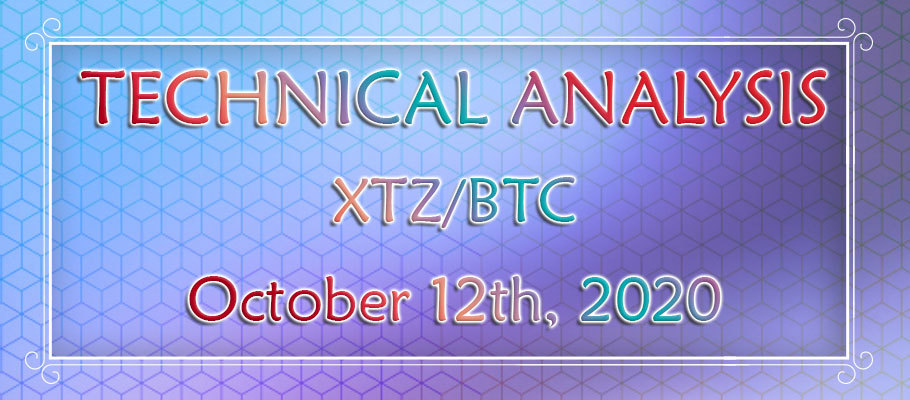

On the weekly chart, the Fibonacci retracement was applied to the overall uptrend, which took place between September 1019 and February 2020. It shows that the key supply/demand area is located at 50% Fibs, which is 0.0002470 level. Previously it has been acting as the resistance as well as the support, where price bounced off 4 consecutive times. This emphasizes the importance of this level, which remains a key resistance.

Another Fibonacci retracement indicator was applied to the last wave up, where XTZ/BTC topped out back in February while reaching 0.0004073 high. It shows that 61.8% Fibs exactly corresponds to the above-mentioned resistance level at 0.0002470. It also shows that price has rejected the 78.6% Fibs at 0.0002033, with a weekly closing price being right at this support level.

Therefore, as long as the price remains above the recently produced low at 0.0001850, XTZ/BTC will likely move up, in order to re-test the key resistance area near 0.0002470. This suggests the potential growth of 23% in the coming weeks, or maybe months.

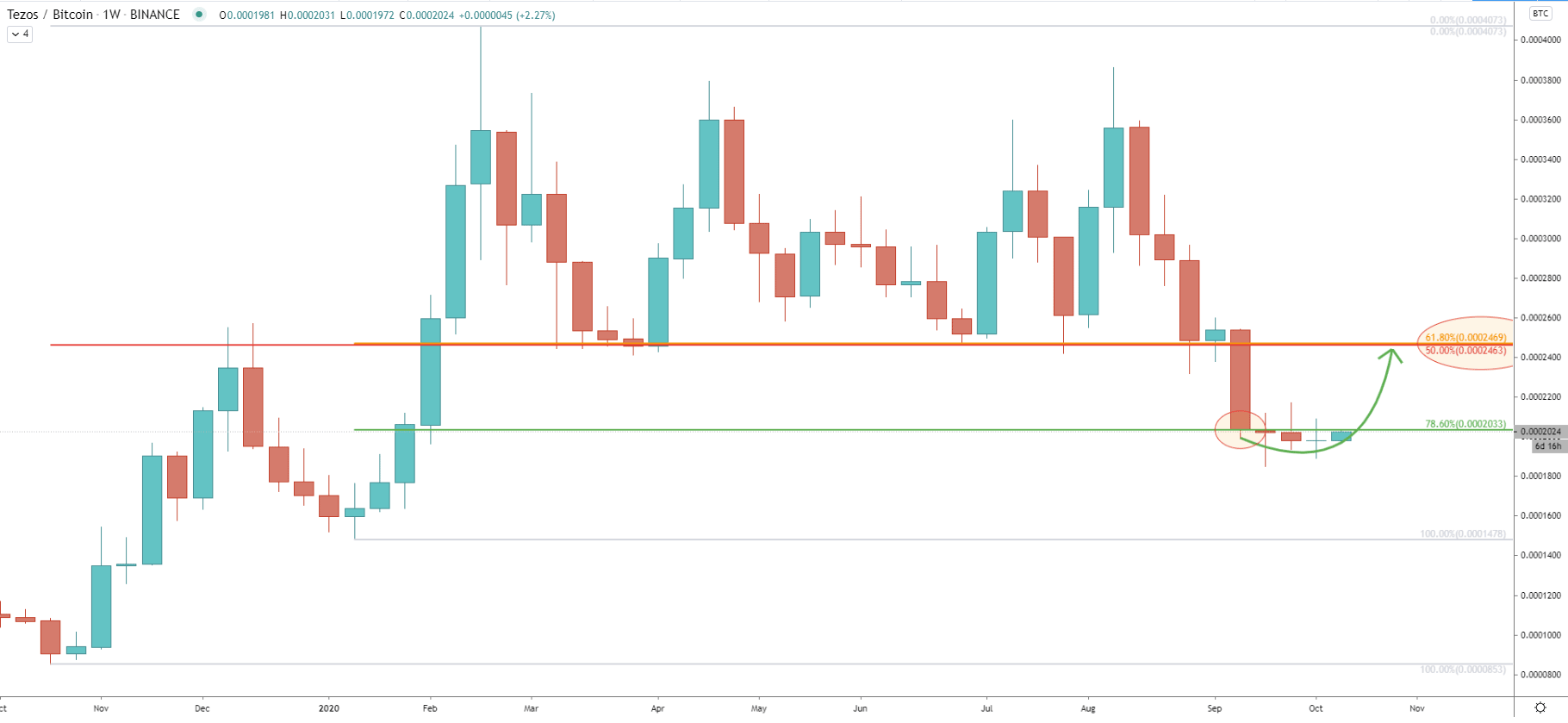

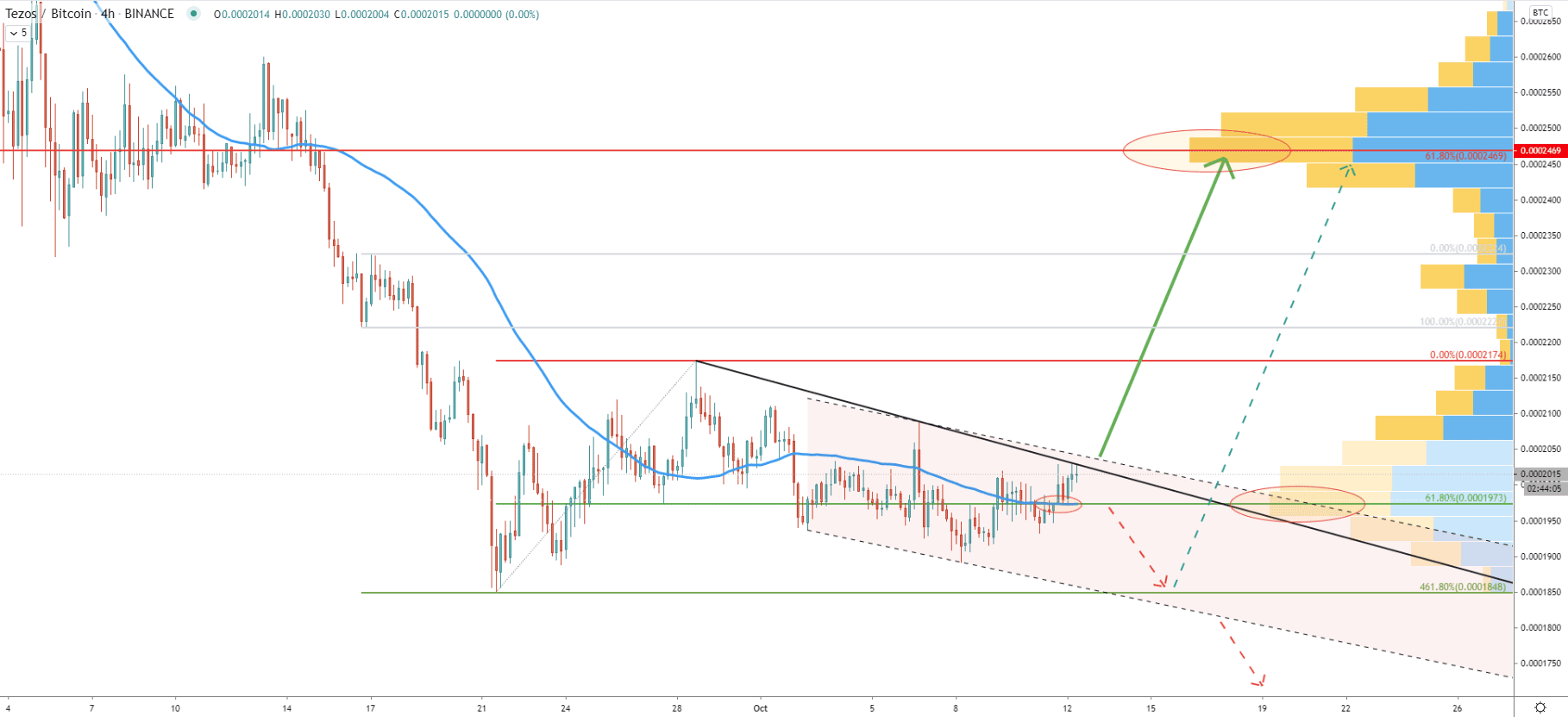

In February this year Tezos topped out and up until September price has been range trading between 0.00038 resistance and 0.00024 support areas. In September price broke below the range as well as confirmed the break below the 200 Exponential Moving Average, suggesting a long-term downtrend. Nonetheless, the price has reached, and cleanly rejected the 0.0001848 support level. This is a 461.8% Fibonacci retracement, applied to the minor upside correction after the major support breakout. It might be one of the confirmations that XTZ/BTC has reached the bottom of the downtrend, and now it is either time for a strong correctional move up or even a trend reversal.

After nearly a month of consolidation, Tezos produced a double bottom and then rejected yet another Fibonacci retracement level, this time 427.2% at 0.0001884. These are some strong bullish indications, which will not be ignored by the buyers.

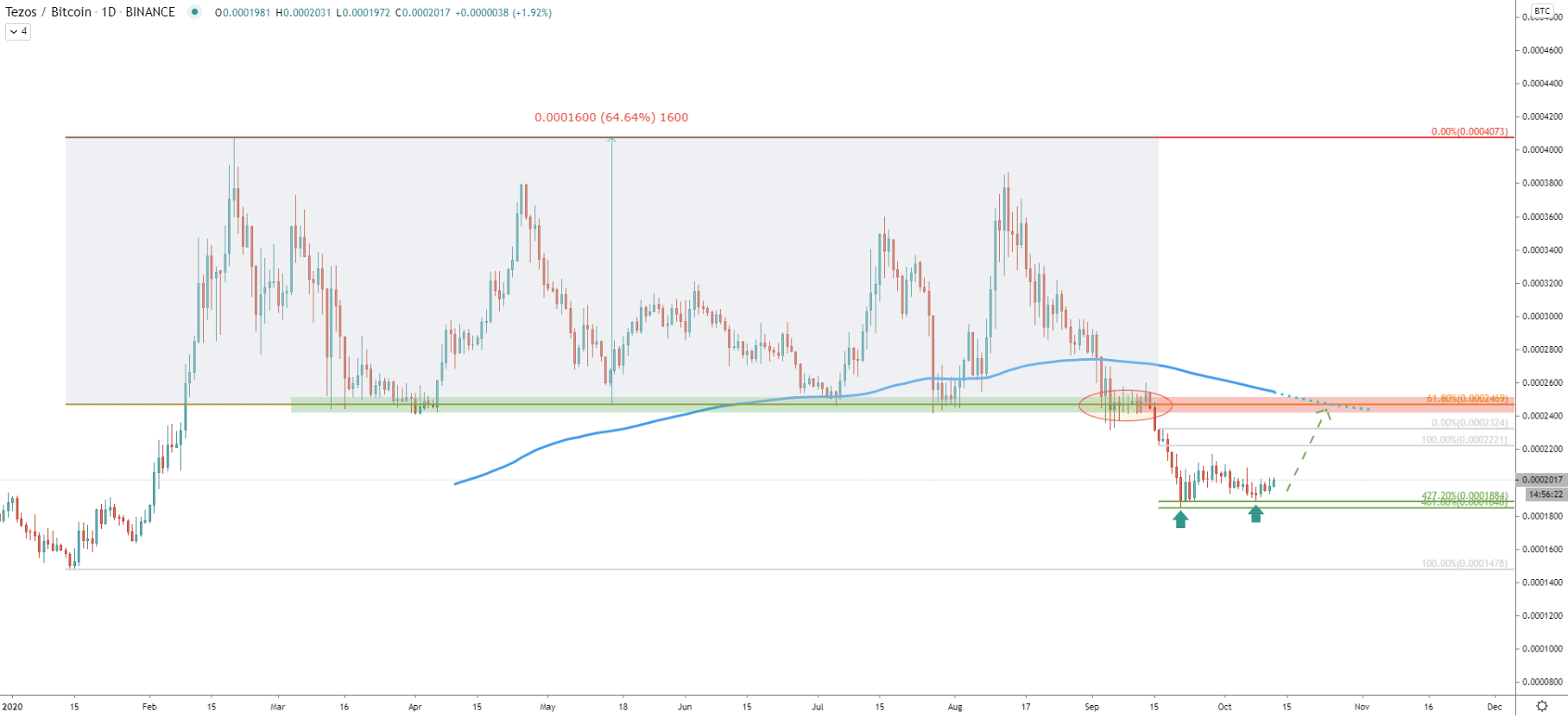

Throughout the entire downtrend, the price has been squeezed consistently, while remained below the downtrend trendline and above the support trendline. On September 21, XTZ rejected the 461.8% Fibs as well as the support downtrend trendline. This has resulted in the break above the downtrend trendline, which didn’t push the price up as most probably were expecting.

Instead, Tezos has entered a consolidation phase and found strong support at 0.0001941. This level has been rejected throughout this month, showing how strongly bulls are defending it. Seems that the time for an uptrend has come and there could be a strong growth with the coming few weeks. This is because 200 Simple Moving Average is corresponding to the 0.00024 resistance, which on this chart is also confirmed by 227.2% Fibs.

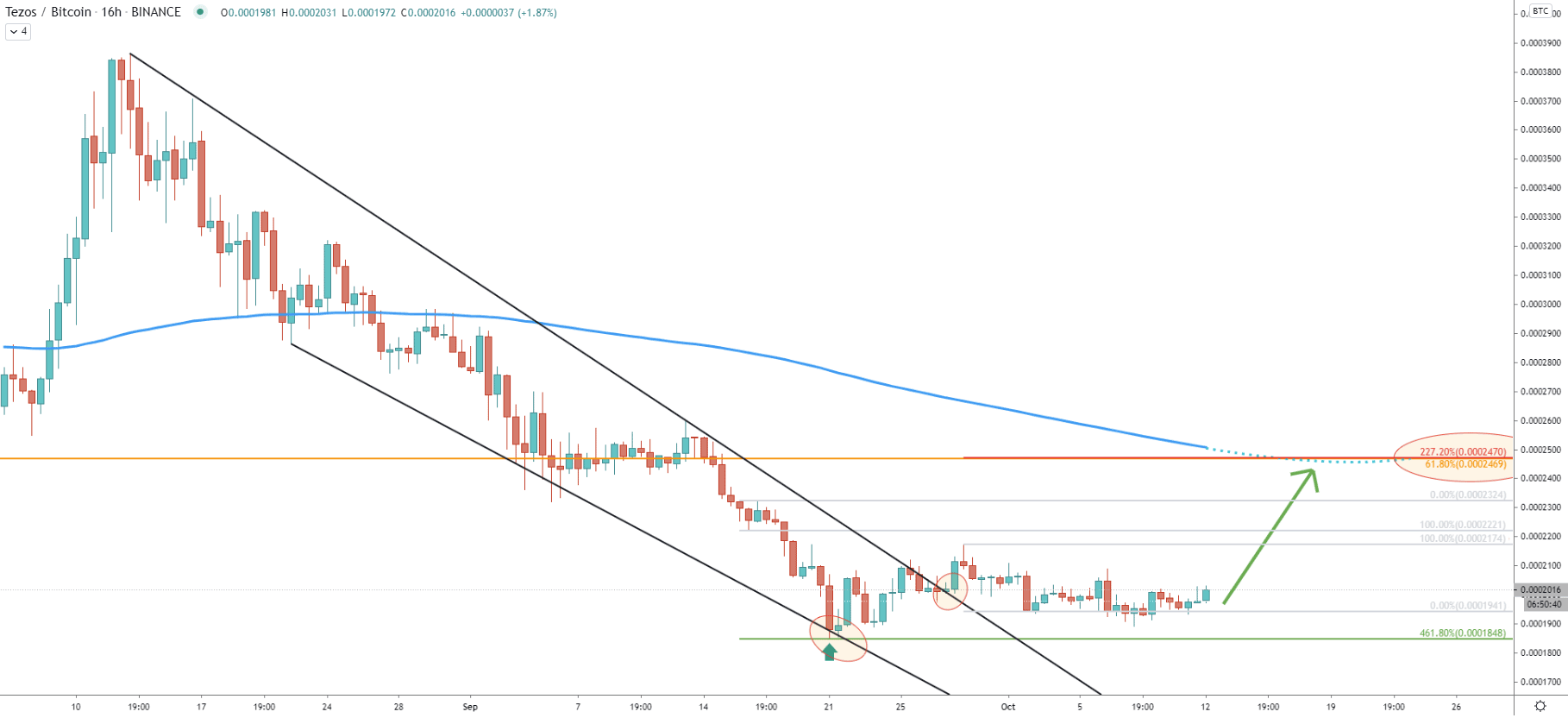

The 4-hour chart shows key supply and demand areas based on the Volume Profile indicator. This indicator provides levels where the most trading volume has been recorded. As can be seen, 0.0001973 is a very strong demand level, which exactly corresponds to the 61.8% Fibonacci retracement. What is very interesting, is the clean rejection of this support along with the bounce off the 50 Exponential Moving Average. In the short term, as long as price remains above 0.0001973, XTZ/BTC will remain extremely bullish, although it must break above the current resistance. This resistance is confirmed by the downtrend trendline and the top of the descending channel. When/if both of them will be broken, the doors for a strong rally will be wide open.

The Volume Profile indicator also shows that the key supply level is located at 0.002469, which exactly corresponds to the previously mentioned resistance at the 61.8% Fibonacci retracement level.

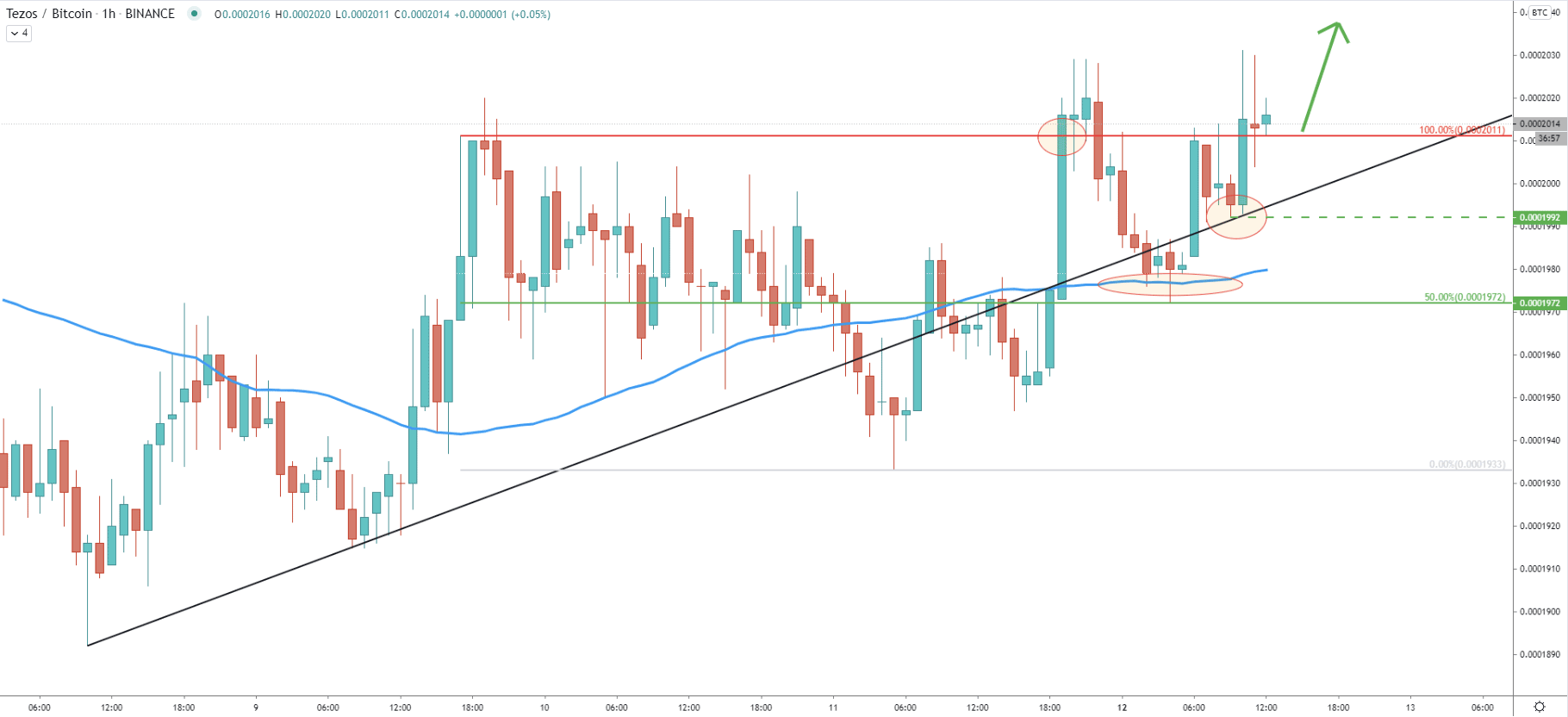

On the hourly chart, XTZ/BTC has bounced off the 200 EMA as well as the 50% Fibonacci retracement level at 0.0001972. After that, there was a clear rejection of the uptrend trendline, while the previous resistance was broken.

At this point it is likely that Tezos price will move down, to produce the spike below the 0.0001992 support, in order to collect all the sell orders (stop losses). Then, if there will be no hourly break and close below, the price could start moving up exponentially.

Tezos vs Bitcoin cryptocurrency pair seems to have reached the very bottom of the downside corrective move. Right now, support levels are being respected and price starting to produce higher highs and higher lows after the formation of the double bottom. This is the time when whales could be stepping in for the long run.

As per the weekly and 16-hour chart, there are 3 different Fibonacci retracement levels which are all located at 0.0002470. This is expected to be the nearest medium to the long term resistance level and the potential upside target.

As per the 4-hour chart, the key support is located at 0.0001973 and is confirmed by the 61.8% Fibs as well as the 50 EMA. Break and close below this level can result in some selling pressure, pushing the price down to the 0.0001848 support. This will not invalidate the bullish forecast, but can only extend the consolidation phase. Only a daily break and close below the 0.0001848 will suggest a very strong bearish pressure after which, the downtrend continuation can be expected.

Support: 0.0001973, 0.0001848

Resistance: 0.0002029, 0.0002470