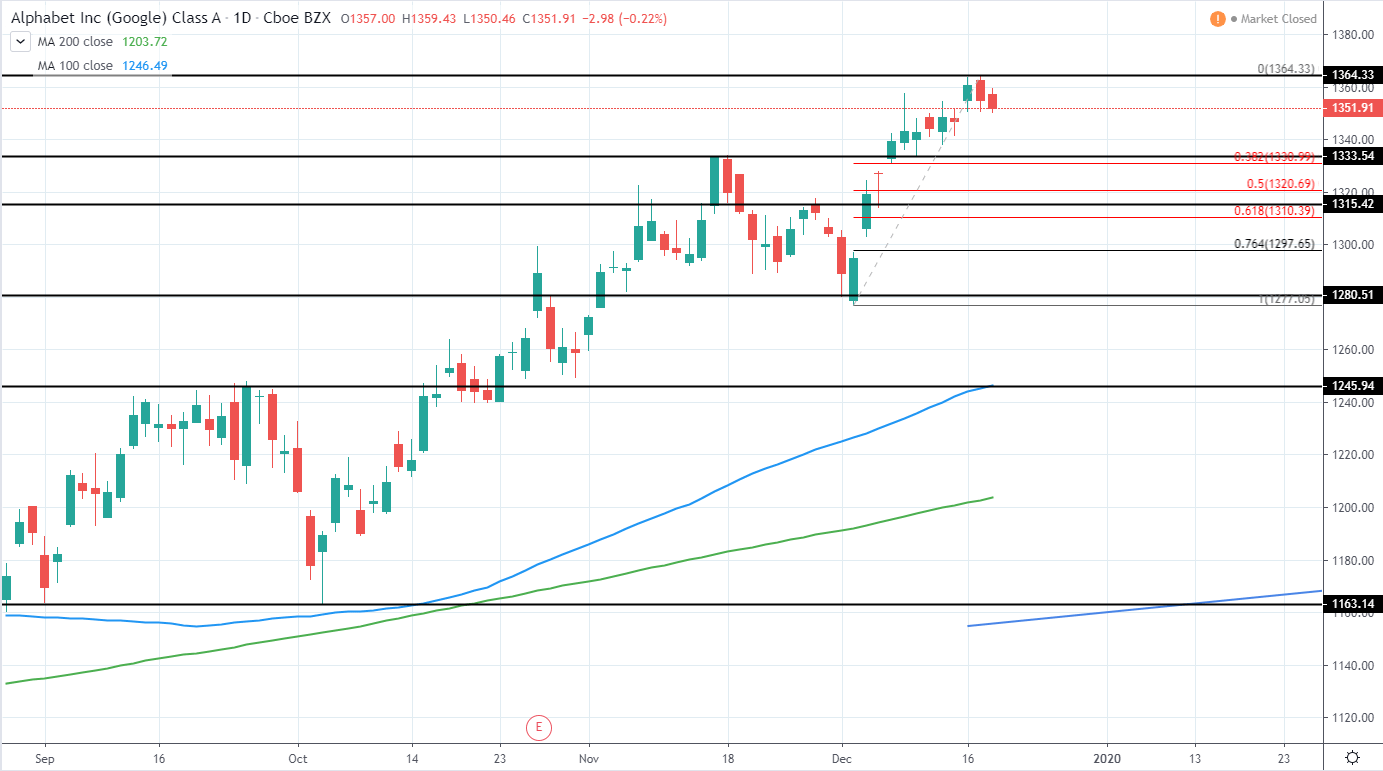

Alphabet, Inc. (GOOGL) currently trades around 1,351 USD with a market cap of 928B USD as it continues to trade in a very strong uptrend as has set a new all-time high around 1364 USD and shows first sings of retracement.

This can be used in order to reentry the market, with the target area for entry being around 1315-1333 previous support, now turned resistance, levels. Additionally, 50-61.8% retracement from the previous upswing can be seen around 1310-1320 USD and will likely offer additional support.

Therefore, for now, we are bearish, as a retracement is needed, however, likely this will be completed next month and we can look for another entry to the upside then.

GOOGL Daily:

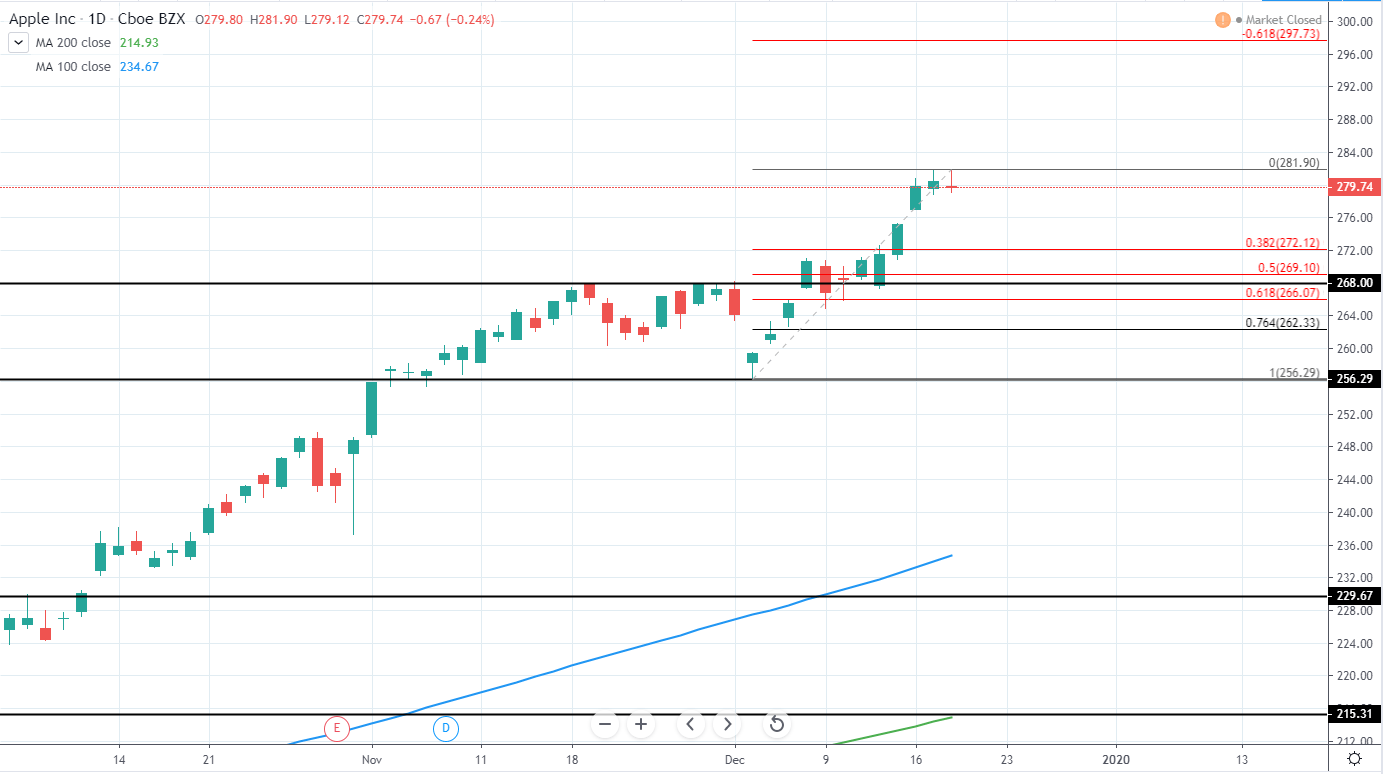

Apple, Inc. (AAPL) currently has a Market Cap 1.3T USD and trades around 279.74 USD as it set another all-time high around 281.9 USD and saw a bearish price action during the last trading session.

The overall trend is still very bullish, however, currently, the price has extended significantly without a retracement and therefore pullback is needed with the area, where the risk/reward ratio for entry would start to be good again, seen around 268 USD previous swing high that was set in November. Additionally, this support level is between 50-61.8% Fib retracement from the previous move and further provides confluence for support.

Therefore, until a retracement is seen, we remain bearish for the stock a snot much further upside can be expected.

AAPL Daily:

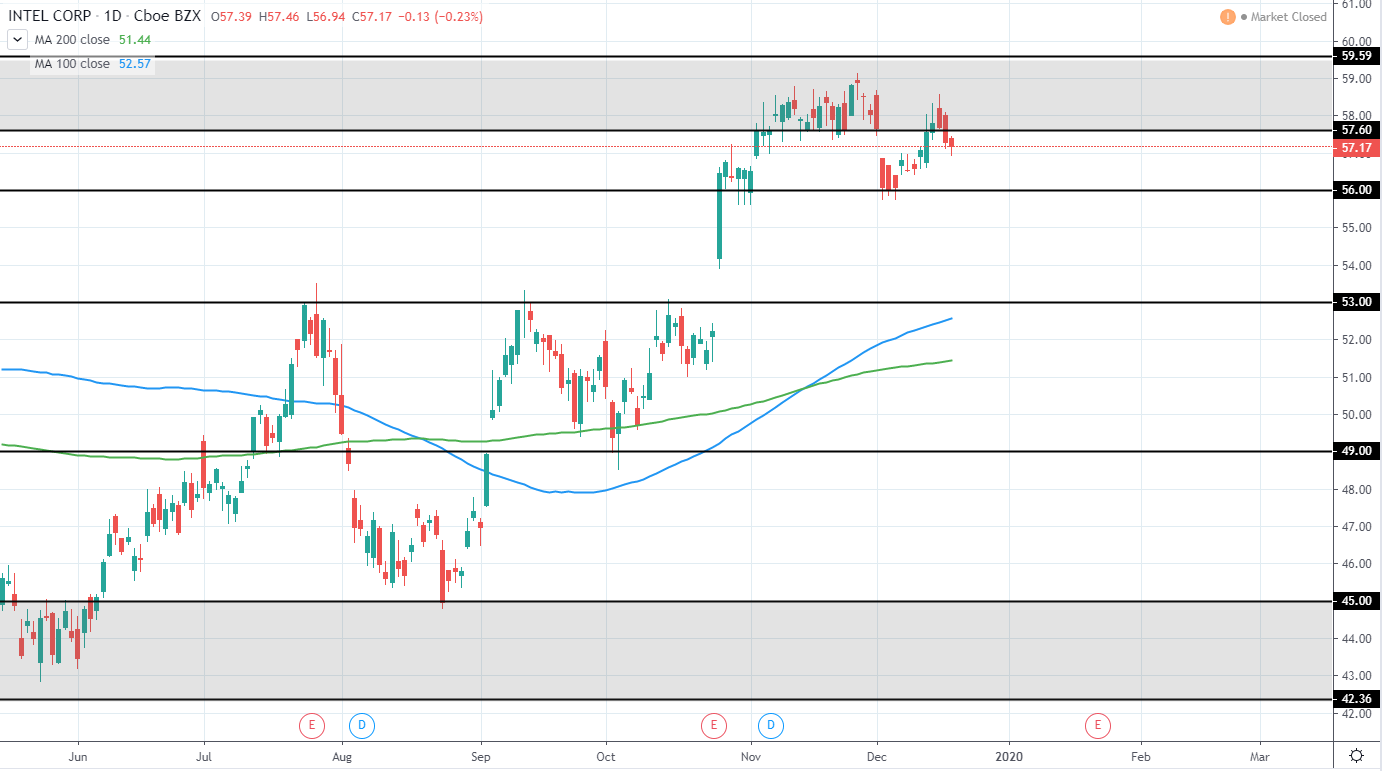

Intel Corporation (INTC) currently has a Market Cap 249B USD and trades around 57.17 USD as it set another lower high earlier this week and peaked around 58.57 USD local high.

This indicates that we will likely see further downside in the upcoming weeks as the price rejects major resistance area around 57.5-59.6 USD once again and likely looks to move towards several year range low around 42-45 USD. If reached from the current price, this would mean a downside of around 21-26% and a very good risk/reward short opportunity. Additional confirmation for the upcoming downside would be made if the price broke the current swing low of 56 USD.

Therefore, we are very bearish for the price if INTC and a short position could be taken either from the current price levels or once 56 USD minor support is broken.

INTC Daily:

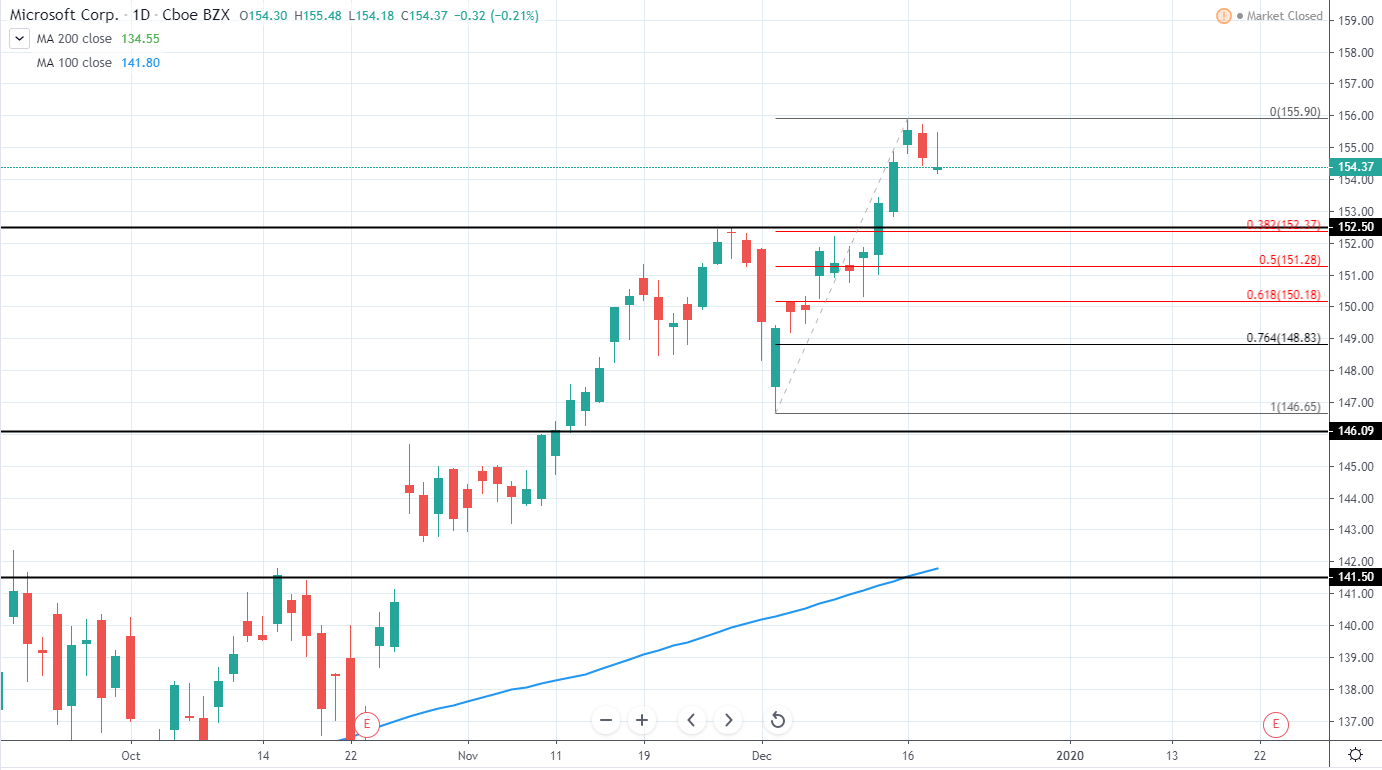

Microsoft Corporation (MSFT) currently has a Market Cap 1.2T USD and trades around 154.37 USD as it continues to trade in a very strong uptrend and has set a new all-time high once again around 155.9 USD. The last 2 trading sessions saw quite a bearish price action and likely we will see a continuation of retracement for the upcoming days.

Support area can be seen around 50-61.8% retracement from the previous upswing and would mean a good risk/reward entry around 150.18-151.28 USD. Additionally, this area served as a minor consolidation zone during the 6-11th of December and would likely provide support.

Alternatively, a not so deep retracement could be made toward the previous all-time high of 152.5 USD set at the end of November, however, since it would not provide as good entry in terms of risk/reward, clear signs of rejection are needed in order to enter a long position.

MSFT Daily: