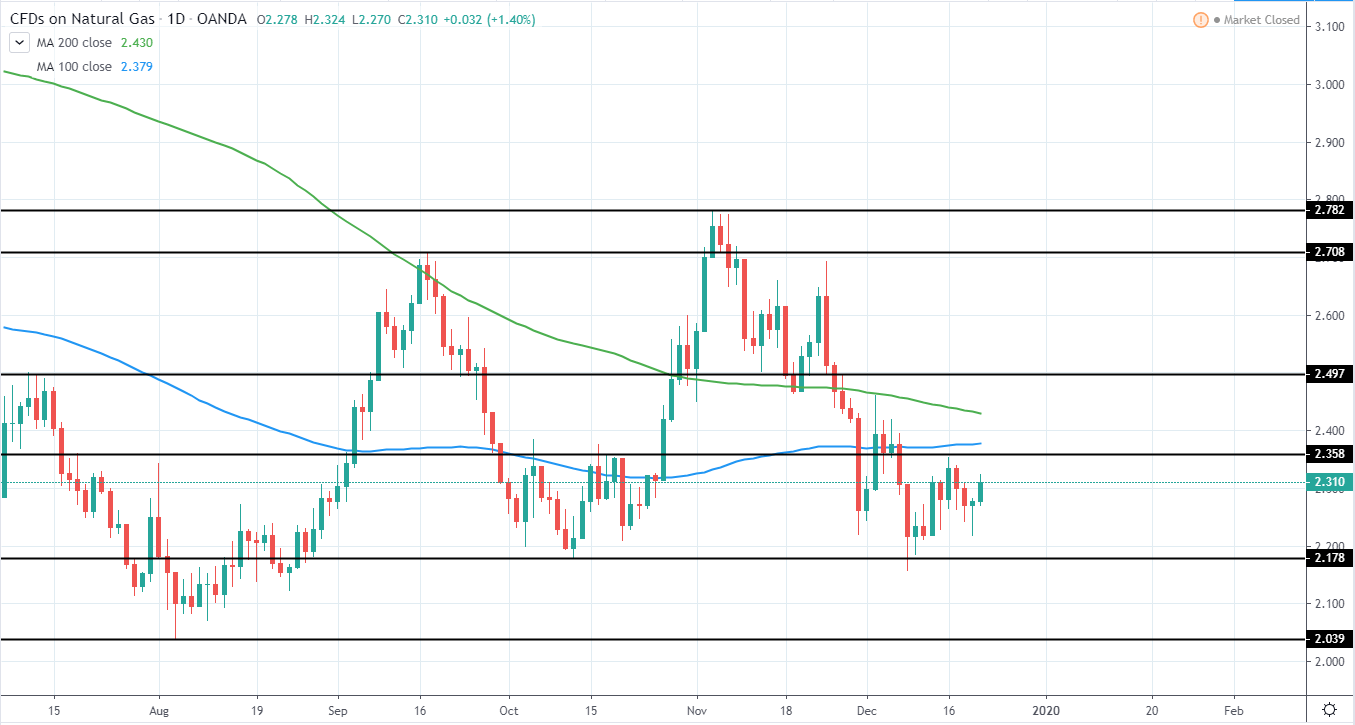

Gold continues to consolidate in a triangle pattern as it found support around 1450 USD after peaking around 1557 USD at the beginning of September. Additionally, 100 day MA blue line continues offering resistance and, together with several month descending trend line, will likely resist further upside and indicates a potential for a short position to be made.

Therefore, we are bearish for the price of gold in the upcoming weeks, unless price moves above both 100 day MA and descending trend line, with the next major support target seen around 1380-1400 USD, which would mean a potential downside of around 6.25% from the current price. Another potential target is located around 200 day moving average green line that currently trades around 1413 USD.

GOLD Daily:

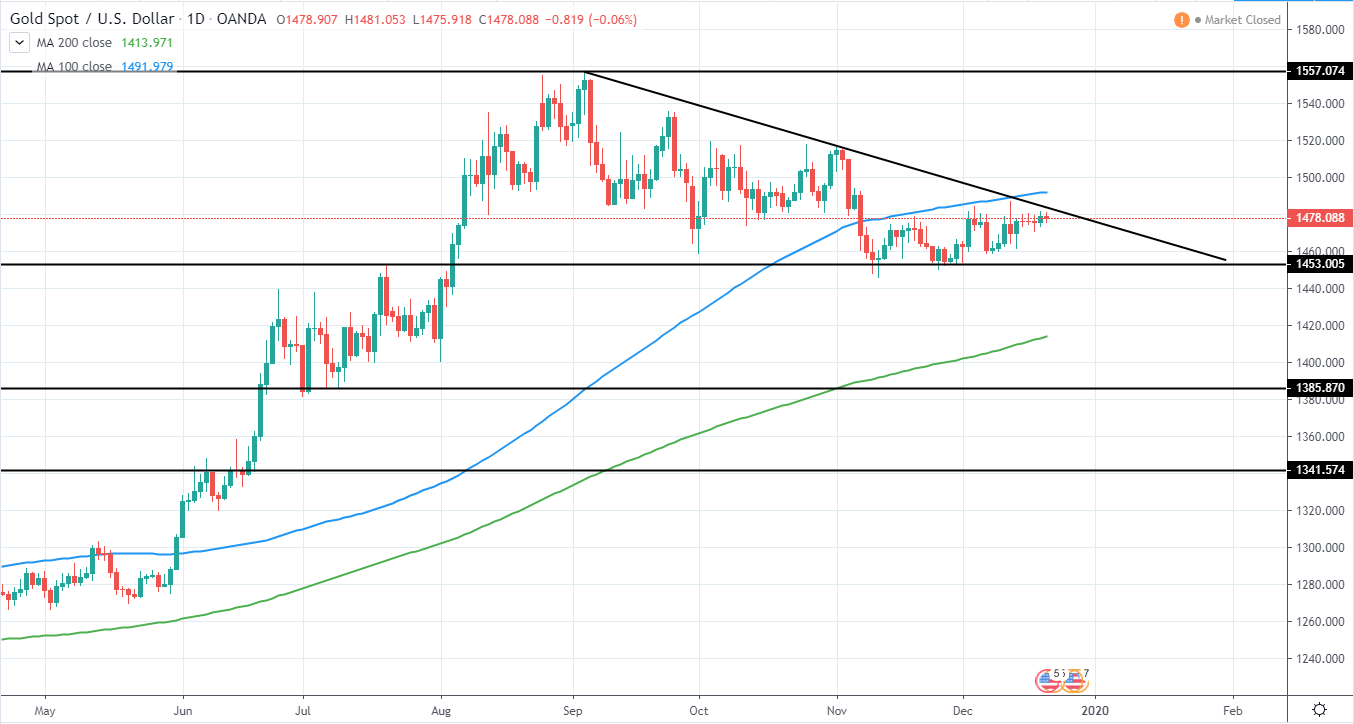

Silver currently is still located around 50% Fib retracement from the previous upswing and continues trading in bearish momentum. Previous high around 17.32 USD will likely be tested once again next week and, if broken, could be the first indication of potential trend reversal back to the upside.

If signs of rejection are seen around the resistance, a short position can be made with the target to the downside being around 16.5 USD previous low as well as 16.31 USD, where 200 day moving average is currently located.

Therefore, we are bearish for the price of silver in the upcoming weeks, unless a higher high is made above 17.32 USD.

SILVER Daily:

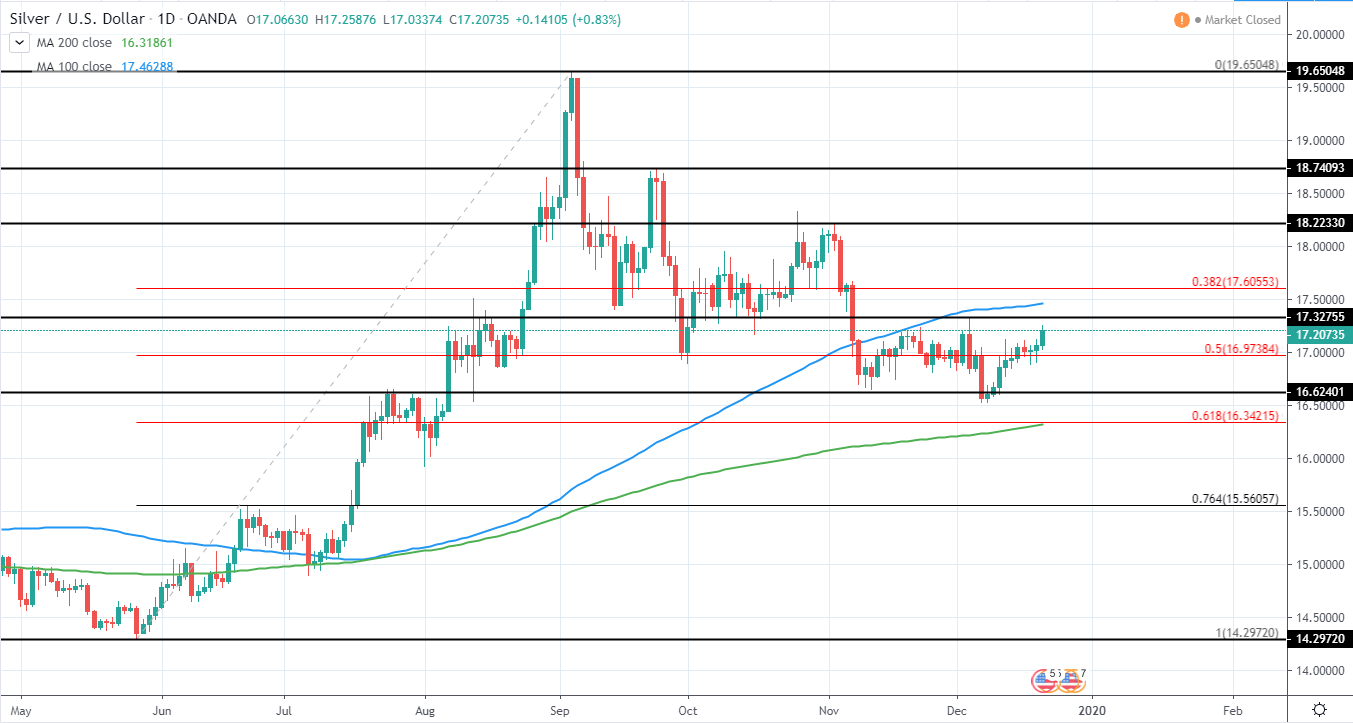

WTI continues to test several month range high above 60 USD and has shown first signs of bearishness as the price closed below previous day lows.

A Short position could be considered with a target to around 50.6-52 USD major range support, which would mean a potential drop of around 15.5% if reached from the current price and a good risk/reward setup if a stop is placed above 63.33 USD previous swing high.

Therefore, we remain bearish for the price of WTI and expect further downside to come in the upcoming weeks.

WTI Daily:

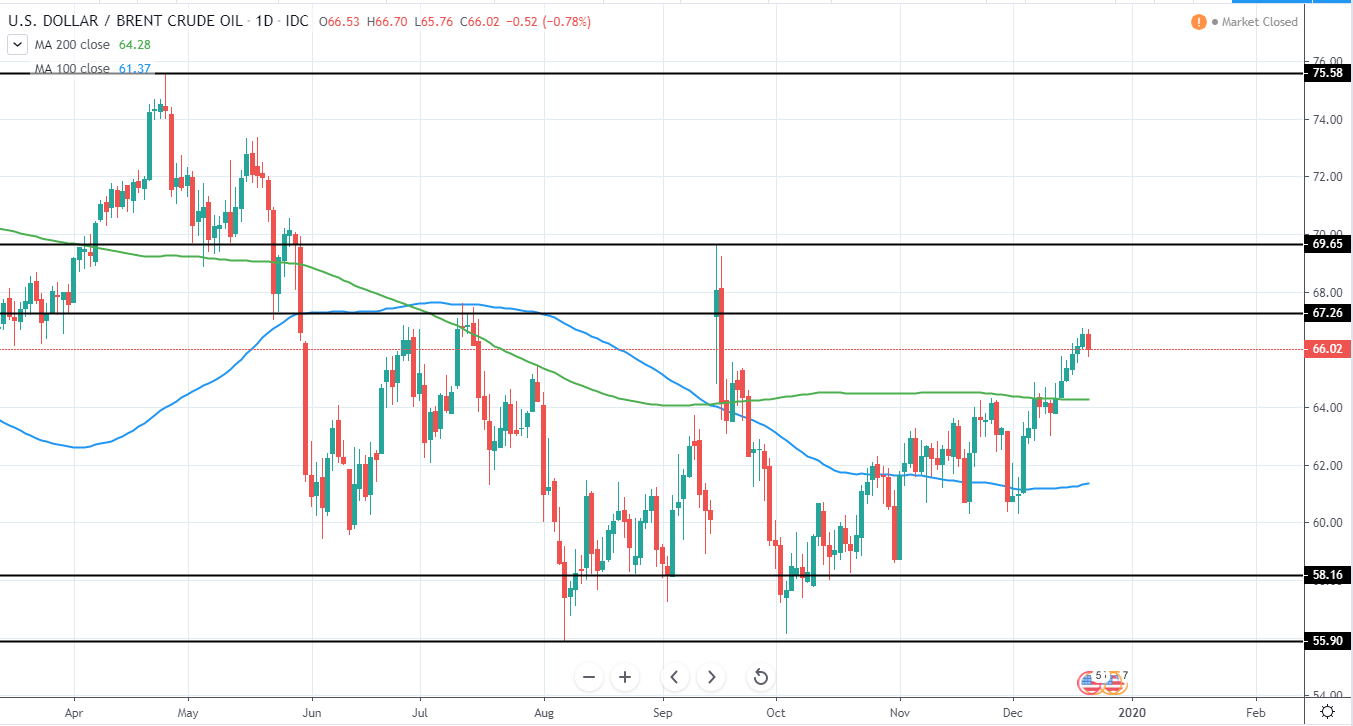

BRENT has continued to move higher towards the 67-70 USD resistance area last week and also closed quite bearish during the last trading session.

A short position could be made in expectation of further downside to come next week, however, further confirmation for this is needed. Next major support area is located around 56-58 USD and if reached from the current price would offer a decent return of 11.5-15%

Therefore, we remain bearish for the upcoming weeks, however, further upside could be seen as the price looks to retest previous swing high of 69.65 USD, which would offer a much better risk/reward setup for a short position.

BRENT Daily:

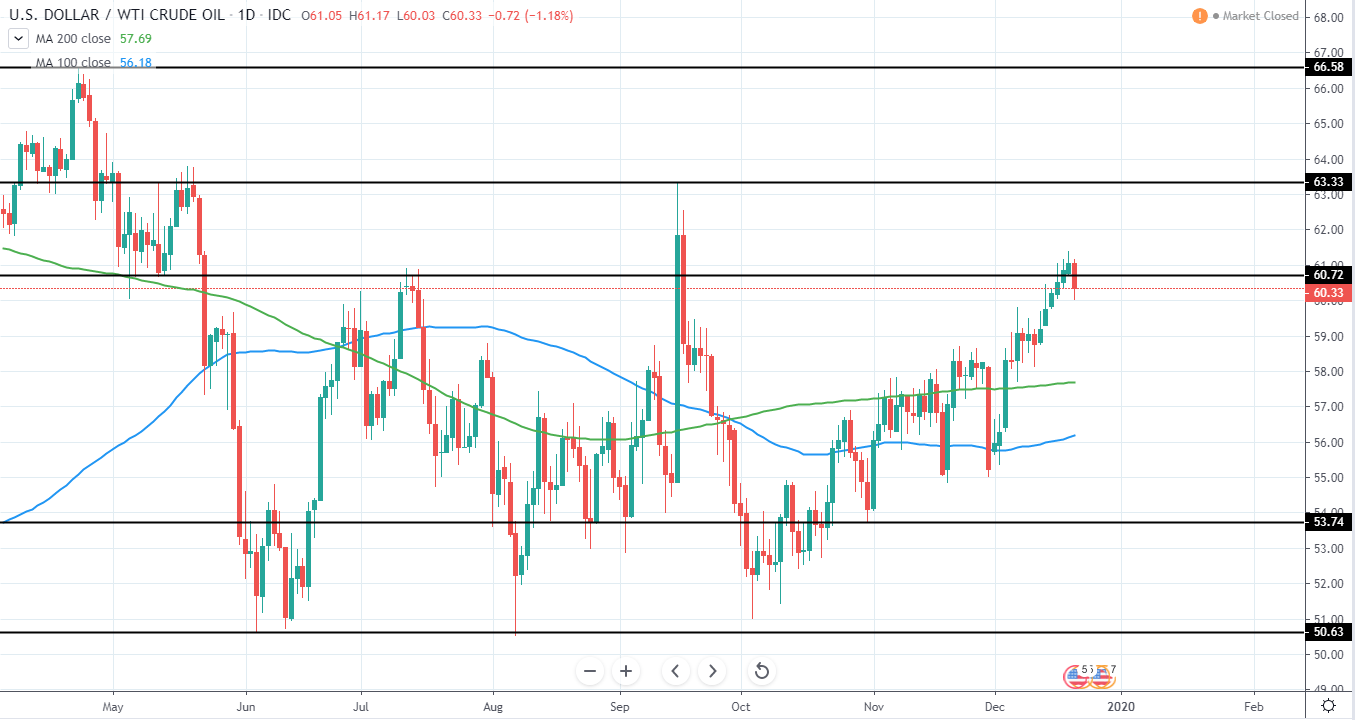

NAT GAS continues consolidating above 2.2 USD support and below 2.35 USD minor resistance after setting a slightly lower low on the 9th of December, however, immediately rejecting back to the upside.

Therefore, we expect the price to move higher in the upcoming weeks once again and look to retest 2.7-2.78 USD previous highs, which would mean a gain of around 17-20% from the current price. Additional minor resistance can be seen around 2.5 USD and, once reached, the price needs to be monitored for potential signs of rejection.

NAT GAS Daily: