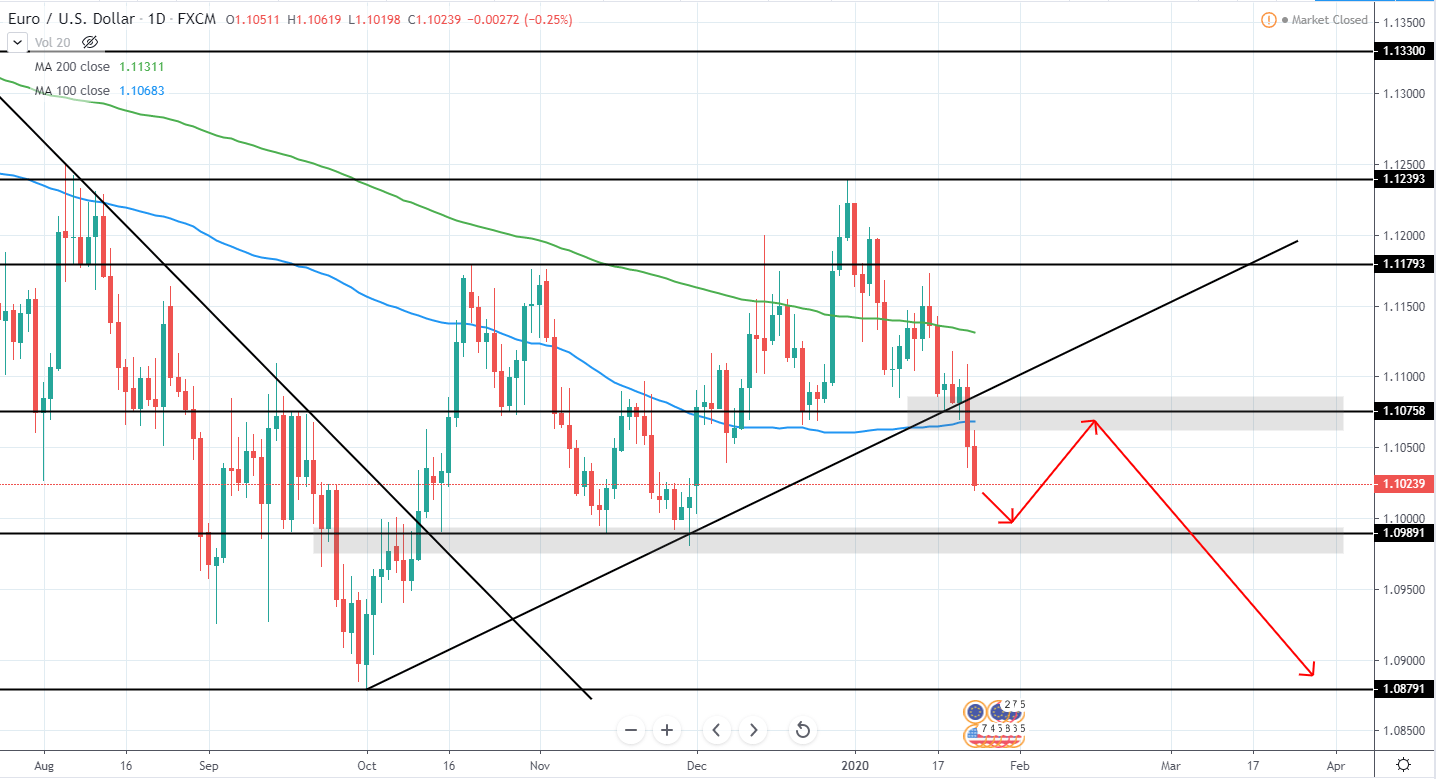

EUR/USD continues moving lower after peaking around 1.239 USD and breaking below several month ascending trend line, therefore, invalidating it as the third touch was not made.

The next support can be seen around 1.1 USD and we expect the price to reach it next week. IF support is found around this area, we will likely see a retracement to the upside as the price looks to retest previous support turned resistance around 1.075 USD, which can be used in order to enter a short position in the expectation that further downside will be seen in the upcoming weeks.

The next major support can be seen around 1.088 USD low that was set at the end of September, therefore, a potential short position could be taken from 1.1075 to 1.088 USD, meaning a potential downside of around 1.75%.

EUR/USD Daily:

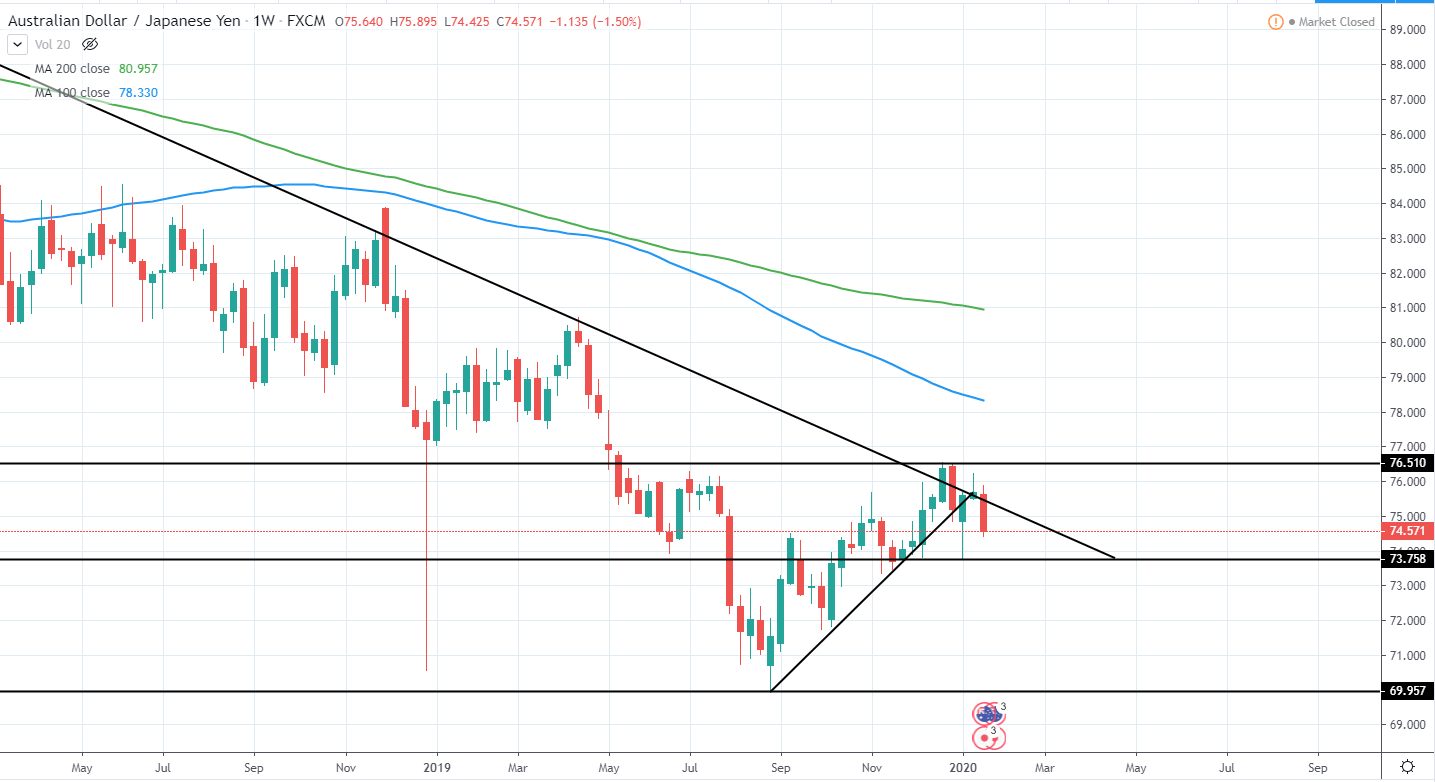

AUD/JPY continued to move lower last week after peaking around 27.5 JPY at the end of December and briefly breaking, however, returning below, several year major descending trend line of resistance.

Afterward, another local lower high was made and, therefore, we expect further bearish momentum to continue along the overall 2 year bearish momentum. A short position can be taken once a slight upside is seen in the expectation that the previous major low around 70 JPY will be broken in the upcoming months. This would mean a downside of at least 6.22% and a good potential short position set up in terms of risk-reward.

Alternatively, a short position can be taken once a lower local low is made below 73.75 JPY and the price retraces and sets another lower high as it would confirm a medium-term reversal back to the downside and offer the best entry.

AUD/JPY Weekly:

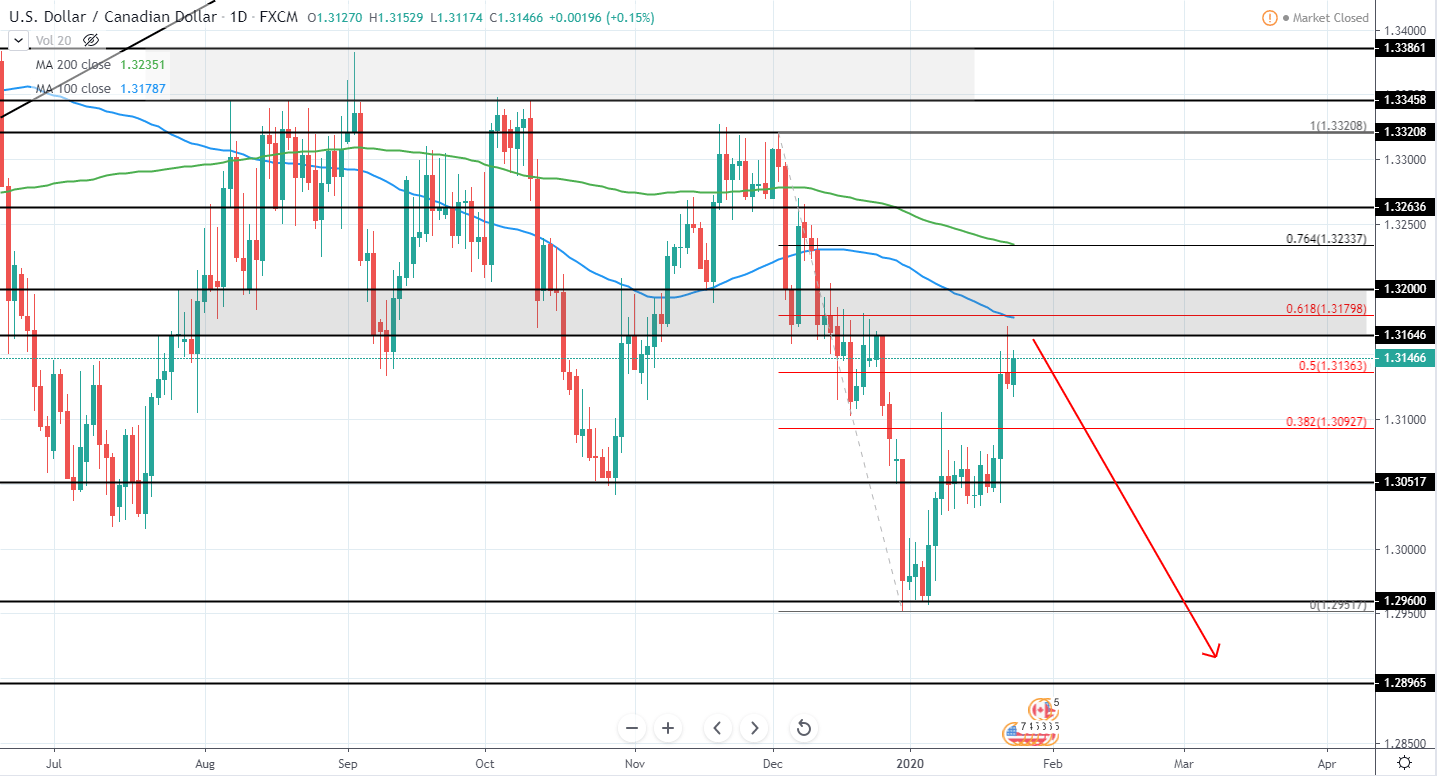

USD/CAD continued moving higher last week as it looked to reach the next major resistance area around 1.325-1.32 CAD as well as 61.8% Fib retracement from the previous downswing that set a clear lower low and indicates that we will see further downside in the upcoming months once the current retracement completes.

On Thursday a rejection for further upside was seen as the price closed bearish and formed a clear bearish pin-bar candle. Followingly, on Friday, a slight upside was seen and, therefore, a short position could be taken once the market opens in the expectation that the current retracement to the upside is finished and the price will look to continue lower in the upcoming weeks.

The target for the next move to the downside can be seen around 1.289 CAD and indicates a very good risk/reward setup as a move towards this level would mean a downside fo around 1.9% from the current price and likely even further as the bearish momentum gains strength.

USD/CAD Daily: