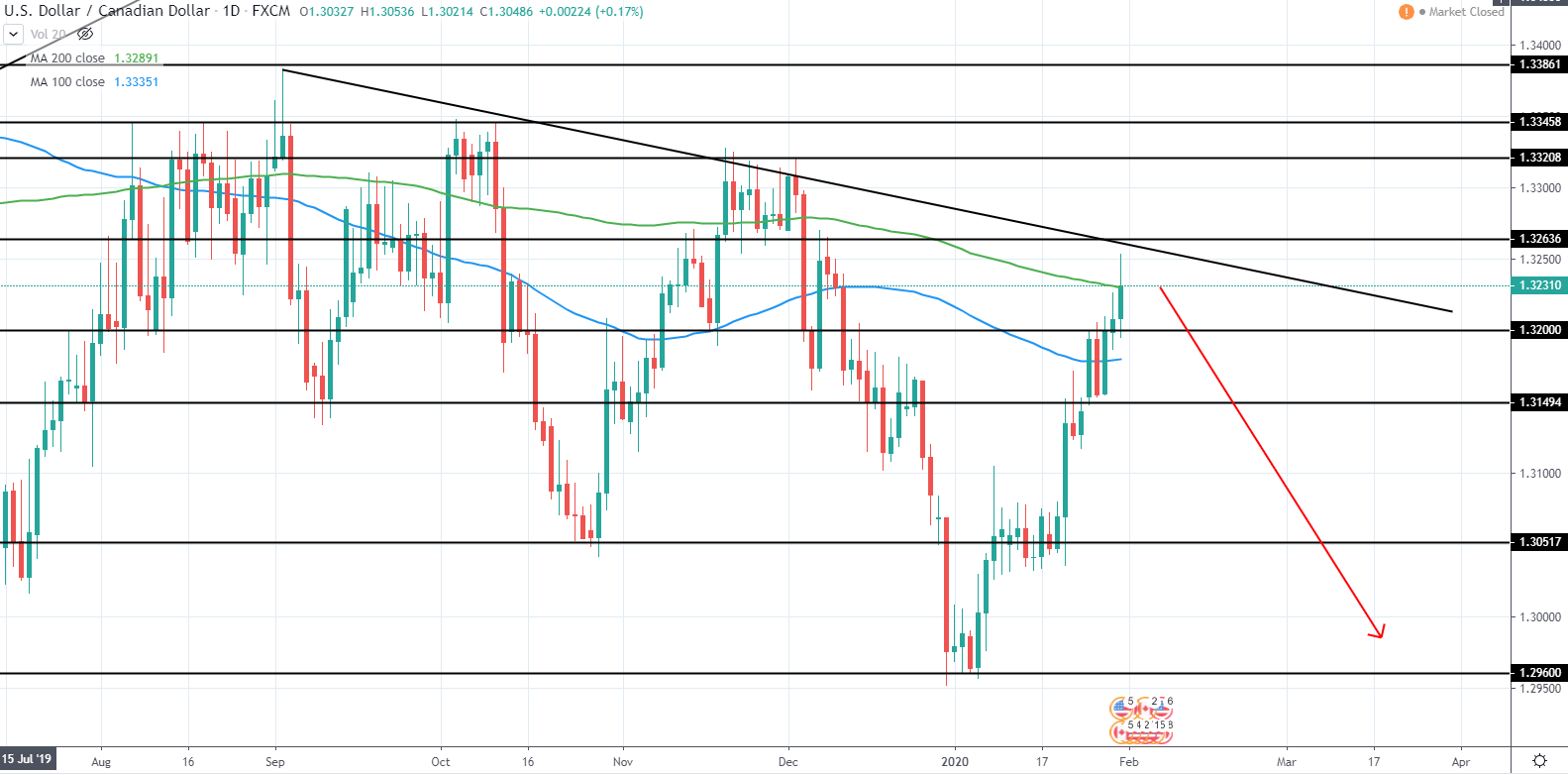

EUR/USD has reached next support level around 1.099 USD last week after a clear break below several month ascending support trend line was broken on 23rd of January. This indicates a reversal back to the downside along the almost 2 year long bearish momentum.

During the last 2 days a retracement back to the upside was seen as the price closed near the trendline as well as between both 100 and 200 day moving averages, seen as a blue and green line on the chart respectively. Further upside can still be possible, however, we will likely see some resistance around the current price area.

Therefore, we can start to look for an entry to the downside, however, there are not indication for a reversal back to the downside yet and the best option is to wait for further price action development.

EUR/USD Daily:

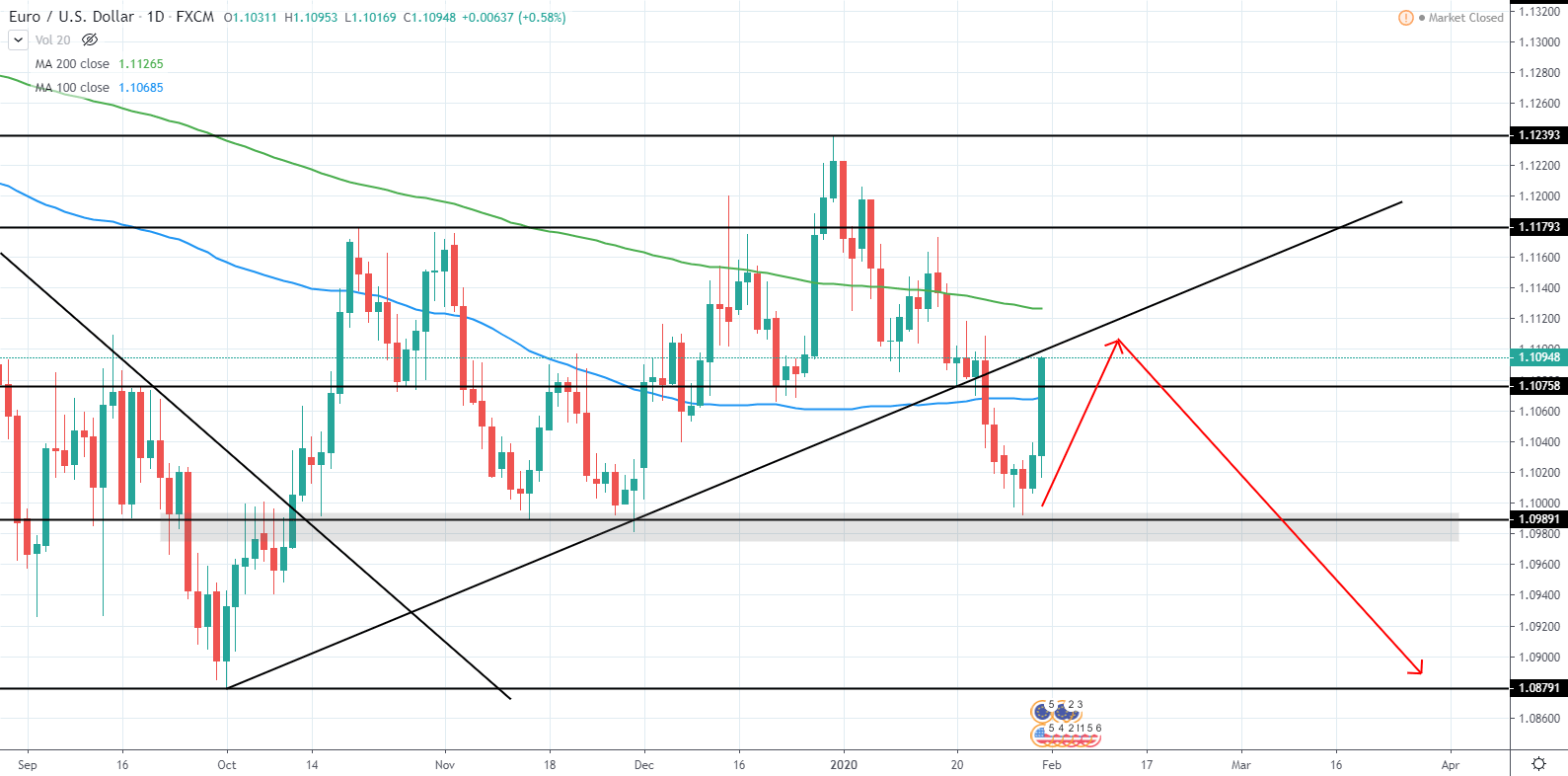

EUR/JPY has broken below a several month ascending support trendline and has been consolidating above 120 JPY support for the past days.

Since a slightly lower low has also been made, we can start to look for a trend reversal in the upcoming weeks. Additionally, a retracement back to the upside will likely be seen towards 121-122 JPY area and can be used to look for a short position entry once signs of rejection for further upside are seen. Afterward, the next downside support target is located around 117 JPY and would mean a potential gain of around 3.6% from 121.5 JPY price level.

For now, the best option is to stay neutral and wait for further price action development, however, a long position could be taken if further rejection for downside is seen next week as the overall trend has been bullish for the past months and we could see a reversal back to the upside once again.

EUR/JPY Daily:

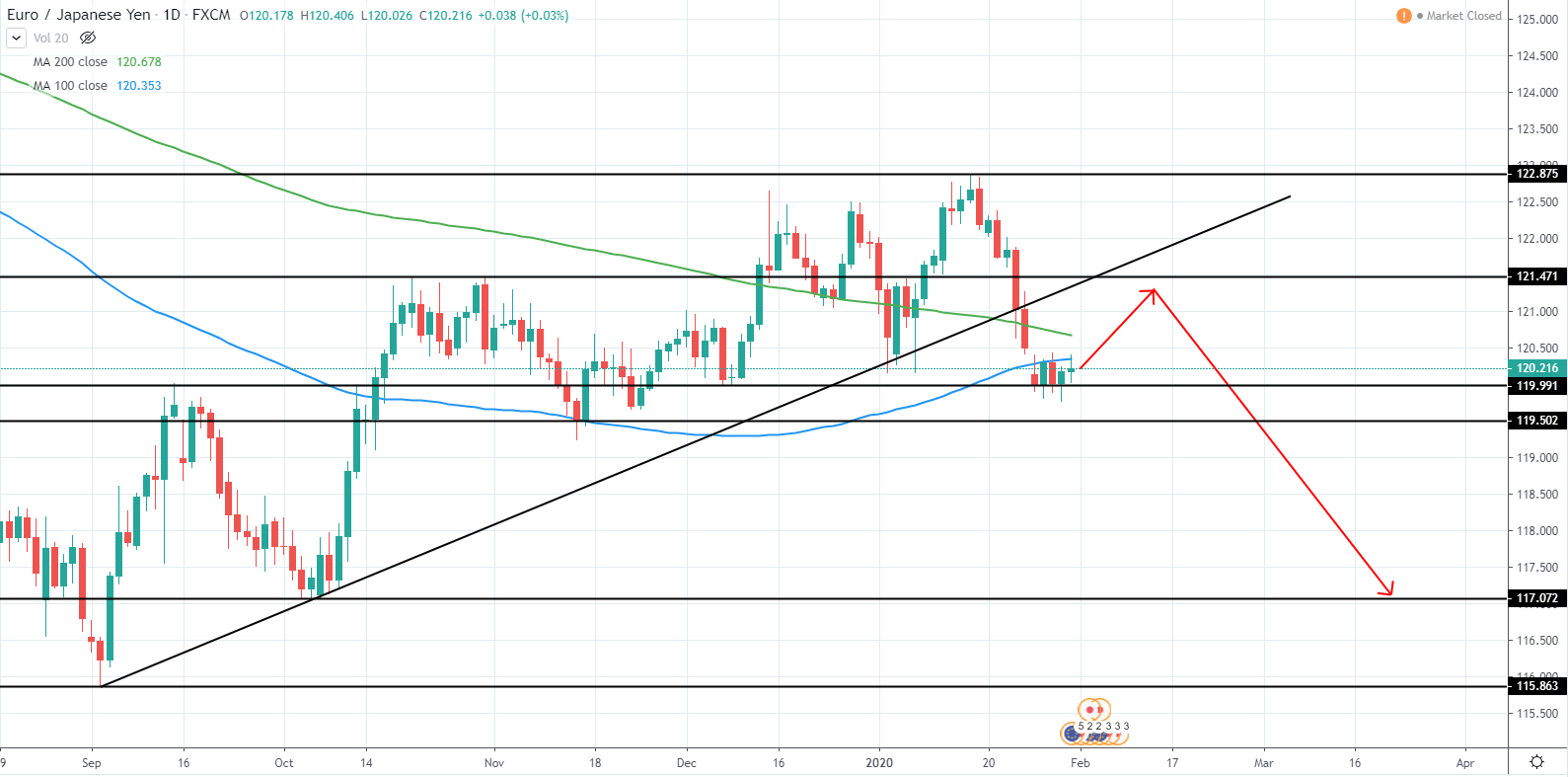

USD/CAD has continued moving higher last week as it looks to retest 1.326 CAD resistance as well as several month descending resistance trend line and 200 day moving average green line after setting a strong lower low around 1.296 CAD.

The lower low indicates that the overall trend is still bearish and we can expect further downside to come in the upcoming weeks once the current retracement is complete. Next target to the downside can be seen around 1.29 CAD and would mean a bearish potential move of around 2.5% and a very good risk/reward trade potential.

For now, however, the best option is to stay neutral and wait for further price action development in the form of rejection for further downside, after which a short position can be taken as the overall trend continues being bearish until a higher high above 1.332-1.3345 CAD previous high is made.

USD/CAD Daily: