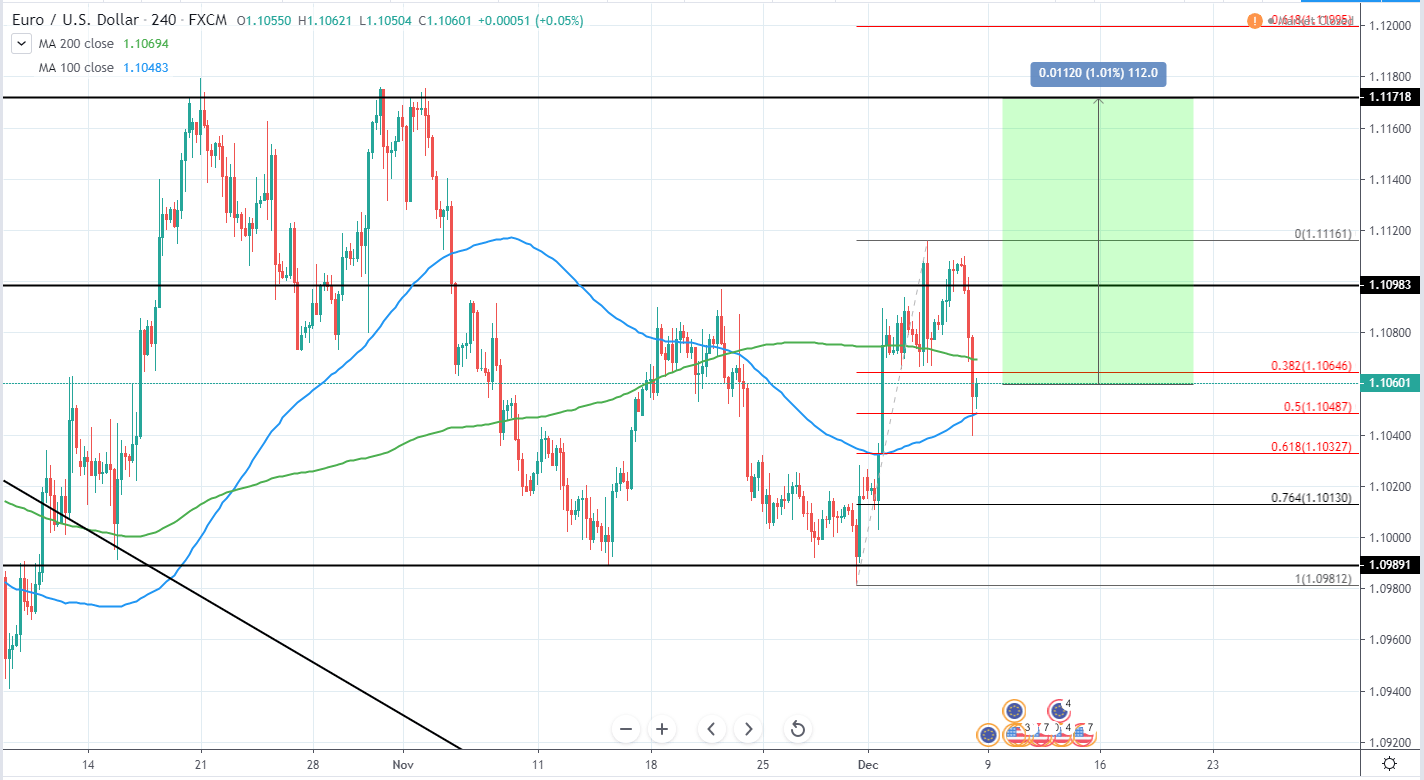

EUR/USD has rejected from the previous high during Friday and closed around 1.106 USD, which is close to 50% Fib retracement from the previous upswing. Additionally, the price is currently between 100 and 200 moving averages seen as a blue and green line on the chart respectively and rejection for further downside was seen once 100 MA blue line was reached.

Therefore, we can likely see a reversal back to the upside in the upcoming days, however, best would be to wait for further price action to play out and possibly offer an even better risk/reward entry than the one right now. If further signs of rejection of downside are seen, an entry can be made around the current price level or, alternatively, once 200 MA green line is broken once again to the upside.

The next major target can be seen around 1.117 USD and would offer a potential upside of around 1% from the current price and it could be reached by the end of 2019 if current volatility persists.

EUR/USD 4H:

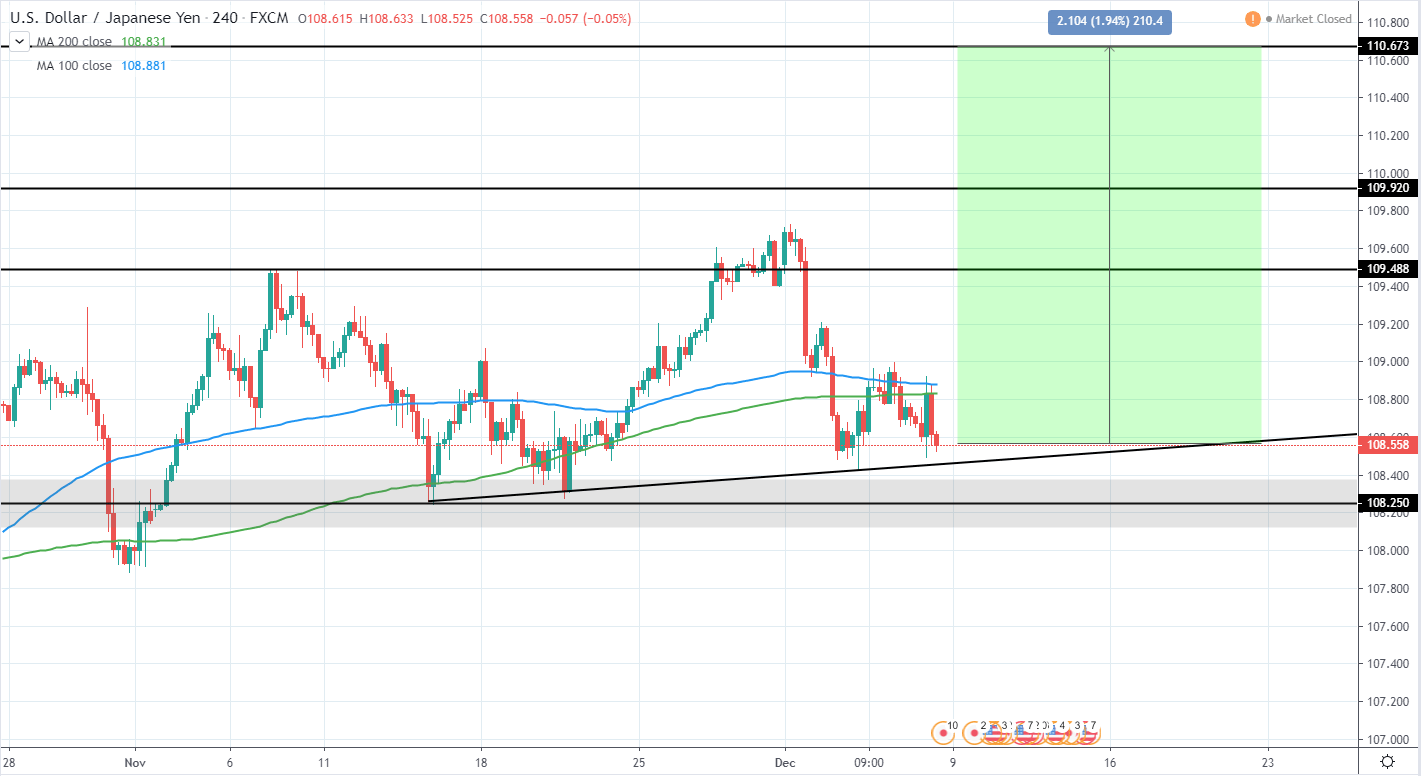

USD/JPY continues to consolidate near previous lows in addition to the ascending support trend line that was confirmed with the third touch earlier this month. Both 100 and 200 MA`s currently act as a resistance and once broken could be used as an indication for further upside to come.

Alternatively, entry could be made around the current price level as further downside seems unlikely. The next major target can be seen around 110.6-110.7 JPY and would mean a potential gain of around 1.95% if reached from the current price. Additional resistance level can be seen around 109.9 JPY and would still offer good risk/reward if the price does not go any further.

Therefore, we are bullish for USD/JPY next week and expect further upside unless the price moves below current lows, which would invalidate the current bullish momentum of higher highs and lows.

USD/JPY 4H:

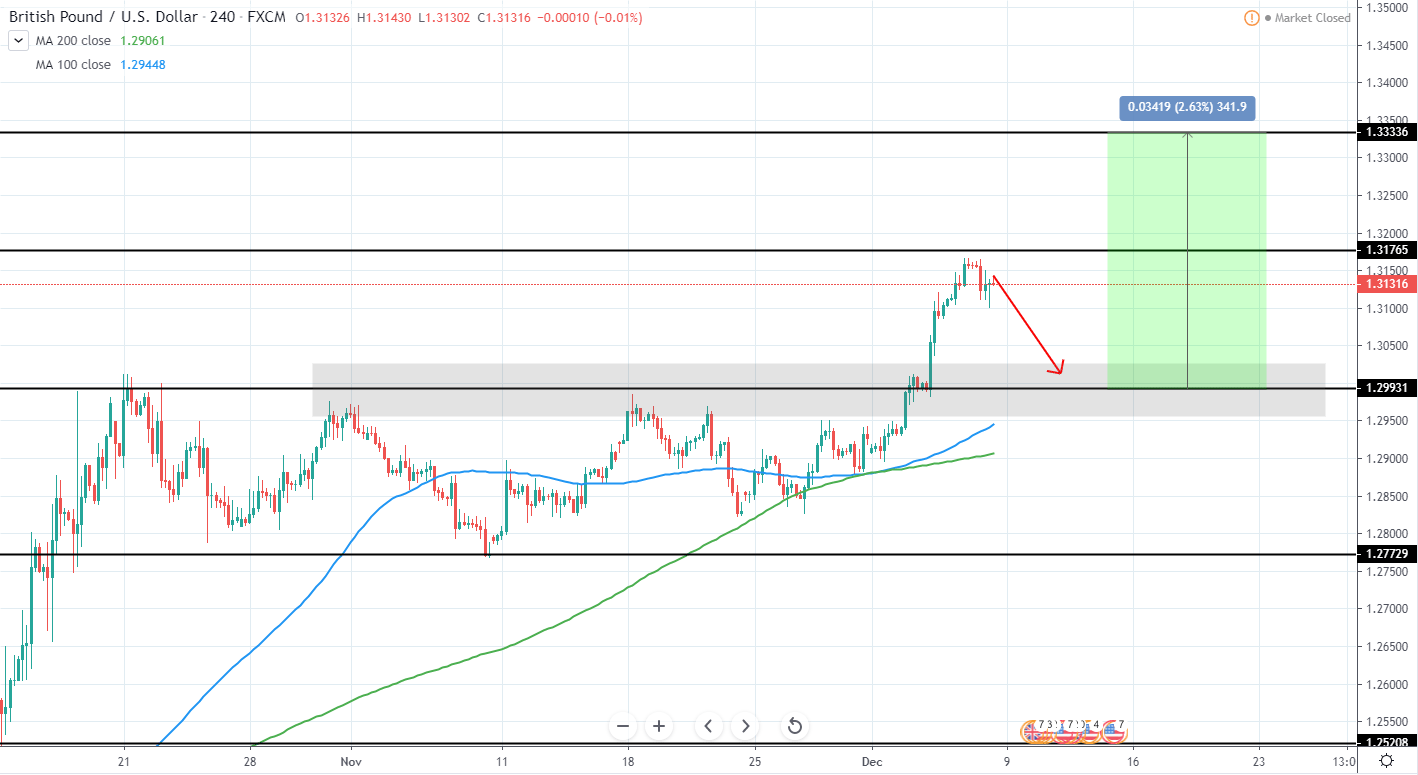

GBP/USD currently seems to have reached it next higher high around 1.317 USD previous resistance and therefore we expect a retracement to be seen during the upcoming week towards 1.3 USD previous resistance turned support. Additionally, 100 and 200 MA`s will likely be trading around this region in the upcoming days and offering additional support.

Therefore, once 1.3 USD area is reached we can start to look for a long position in the expectation that the bullish momentum will continue for the remaining month and the next target of around 1.333 USD will be reached, meaning a potential upside of around 2.63%.

For now, however, it is best to stay neutral and wait for retracement and signs of reversal around 1.3 USD support.

GBP/USD 4H:

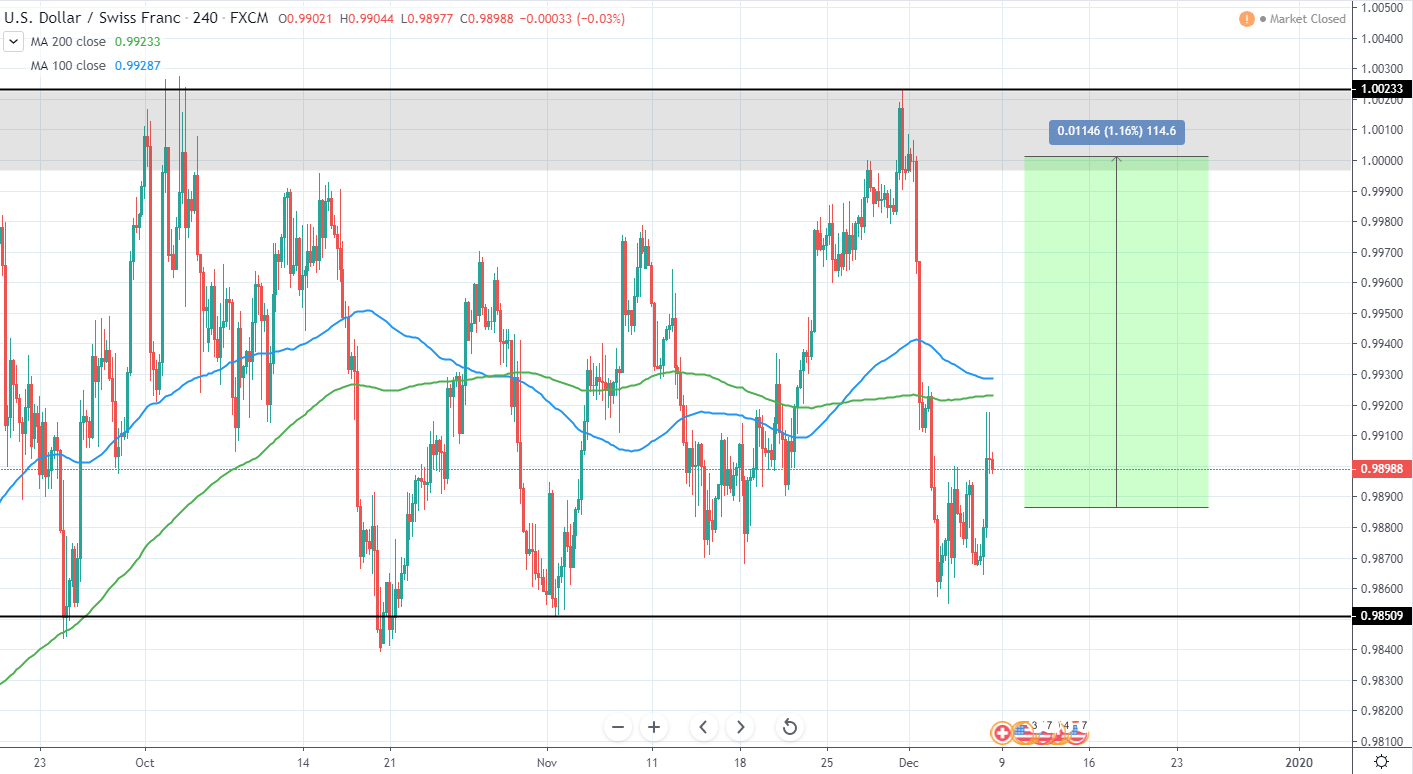

USD/CHF closed 0.98988 CHF after having strong bullish momentum on Friday. Further upside, however, seems to be rejected for now and we expect a retracement towards the consolidation area above 0.986 CHF current low.

This would offer a much better risk/reward for a long position as we can expect the price to continue to trade towards several month consolidations upper limit of around 1-1.002 CHF in the upcoming weeks, which if reached from around 0.9888 CHF level would mean a potential gain of around 1.16-1.35%

Therefore, we remain bullish for USD/CHF, however, slight retracement is needed in order to have a good entry.

USD/CHF 4H:

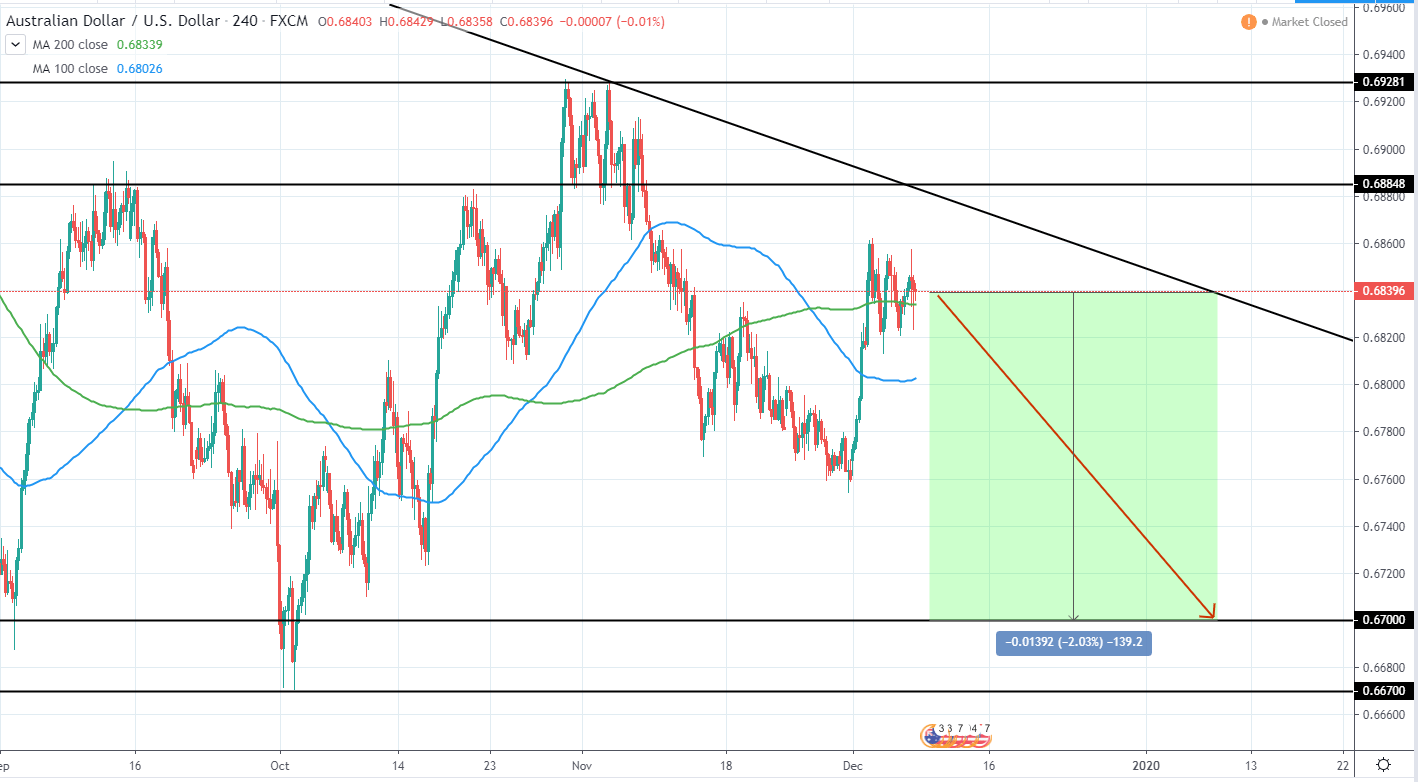

AUD/USD closed close to 200 MA green line on Friday after spending several days consolidating around it as further upside kept being rejected.

Since the overall several month trend is quite bearish and the price is currently retraced to the upside a short position could be made as we expect further downside to come in the upcoming weeks. The next major target can be seen around 0.67 USD and would mean a downside of around 2% if reached from the current price, meaning a good risk/reward short opportunity is currently available.

Alternatively, a short position could be made once the price breaks out of current consolidation around 0.6815 USD and would still mean having a good risk/reward.

AUD/USD 4H: