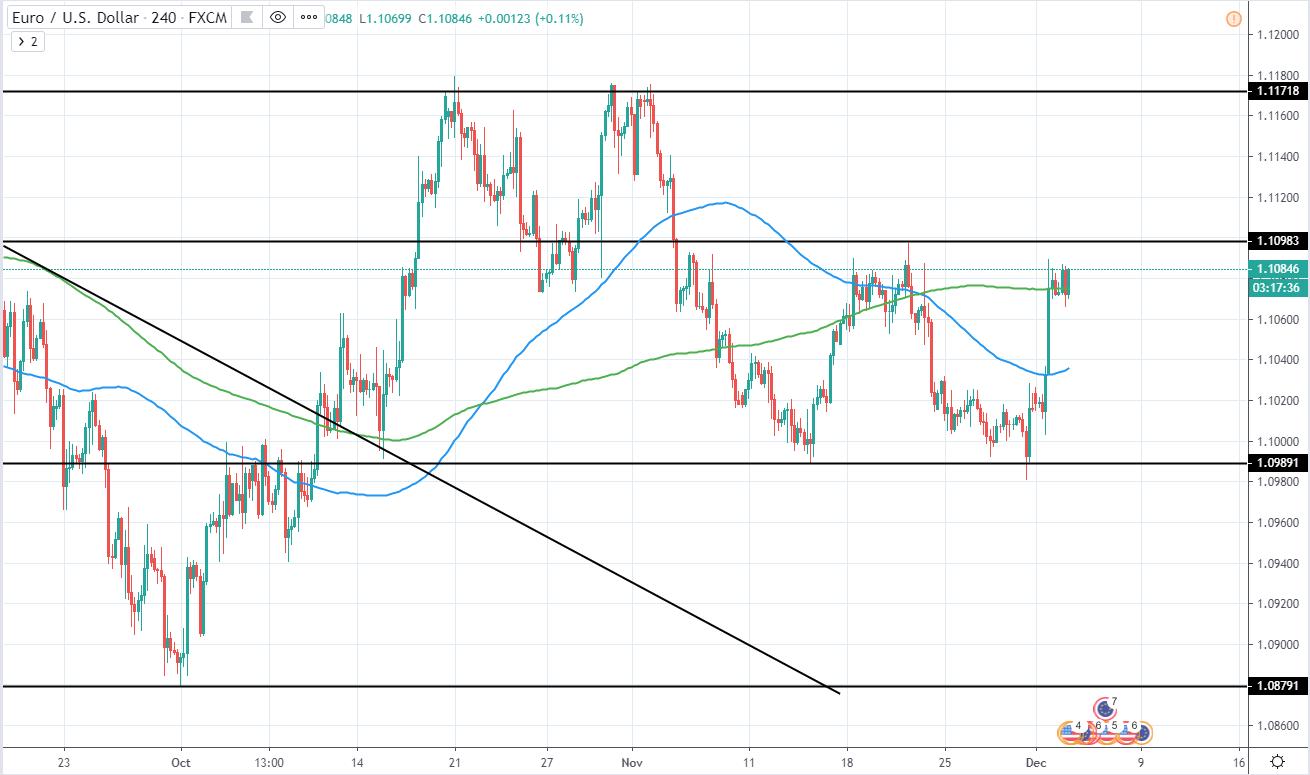

EUR/USD has seen strong bullish momentum in the past days as it reached previous resistance of around 1.08-1.095 in addition to 200 period moving average that is seen as a green line on the chart. Today the price consolidates around the current price level of 1.1083 as it potentially prepares for a retracement.

Therefore a short position could be made as it is close to the resistance and the next major support level can be seen as far as 1.099, which if reached would mean a potential move of 0.87% and would offer excellent risk/reward ratio when considering that the stop could be placed around 1.11 USD level, which is above the previous swing high that rejected the price quite strongly.

EUR/USD 4H:

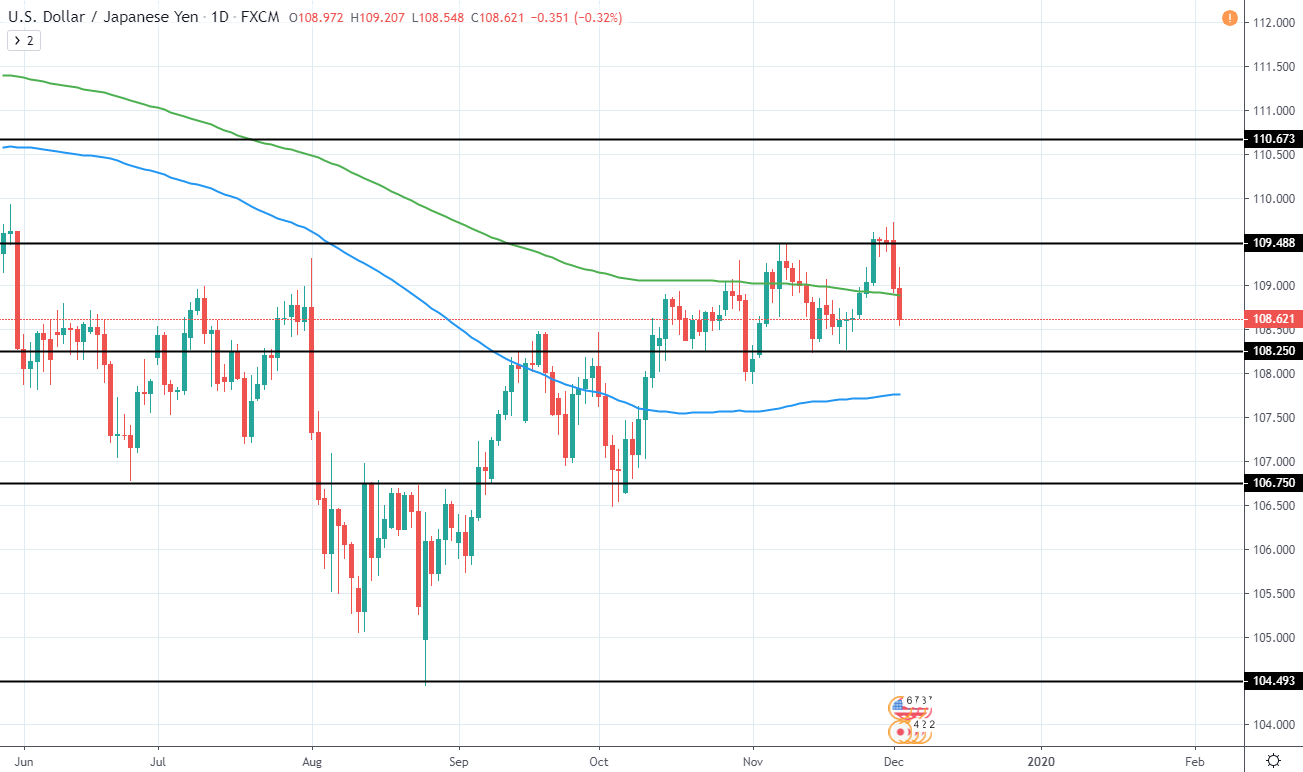

USD/JPY continues retracing after setting a slightly higher high above 109.488 previous one and peaking around 109.727 USD yesterday. This is quite a bearish indication for the overall several month uptrend, however, technically the trend is still to the upside and therefore an entry could be made as soon as signs of rejection for further downside are seen.

Currently the price is close to previous support of 108.25 USD and if we expect the price to set another slightly higher low, not much downside should be seen, therefore, once rejection of further downside is seen on 4h timeframe a position could be made in expectation that the price will reach at least the previous swing high around 109.5-109.7 USD, which if reached would yield a decent 0.90% from the current price and would offer a very good risk/reward ratio, therefore we are bullish for USD/JPY in the upcoming days.

USD/JPY Daily:

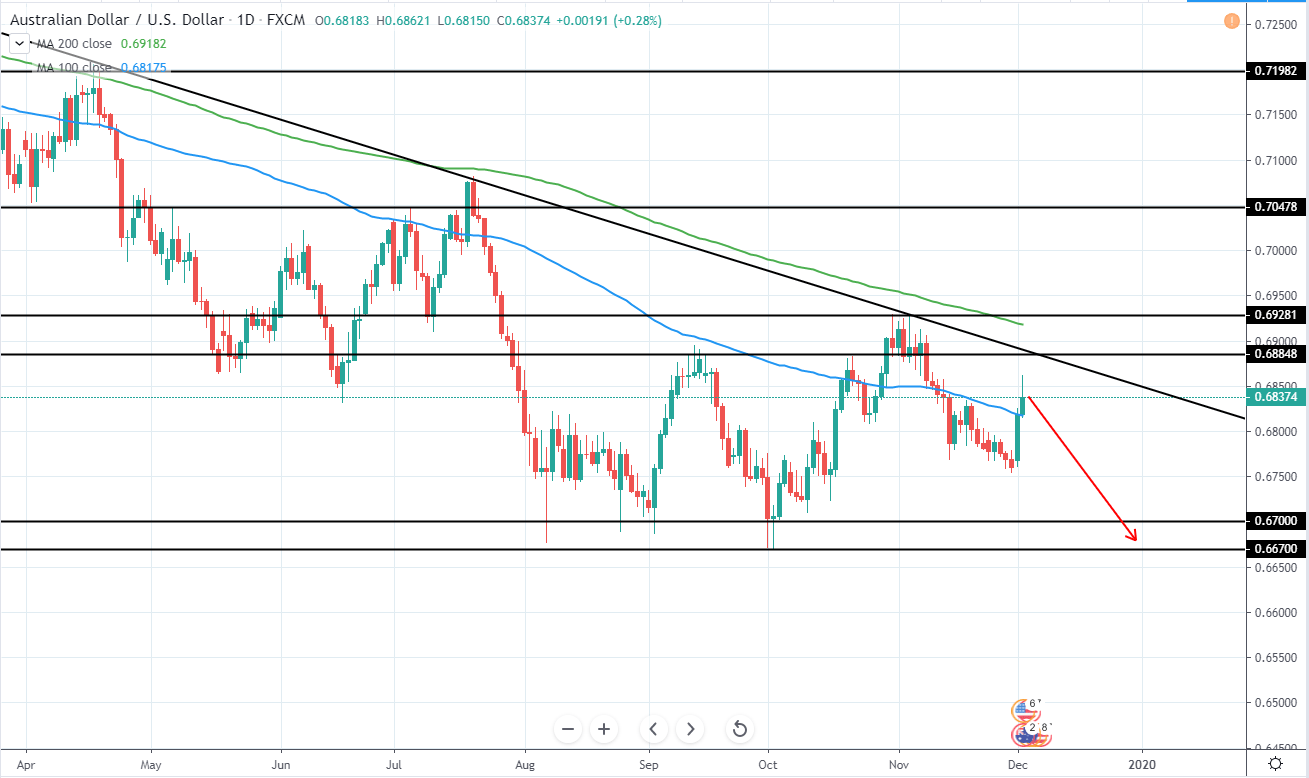

AUD/USD has retraced back to the upside once again as it likely looks to retest several month descending resistance trend line, however, as of now the price does seem to be rejecting further upside and therefore a short position could be made in expectation that the major support around 0.667-0.67 USD will be tested in the upcoming weeks.

Alternatively, if the daily candle closes bearish, it could be used as a signal to enter short position, however, it would not offer as good as risk/reward as entering right now. If previously mentioned support area is reached it would mean a gain of 2-2.5% in the upcoming weeks.

AUD/USD Daily:

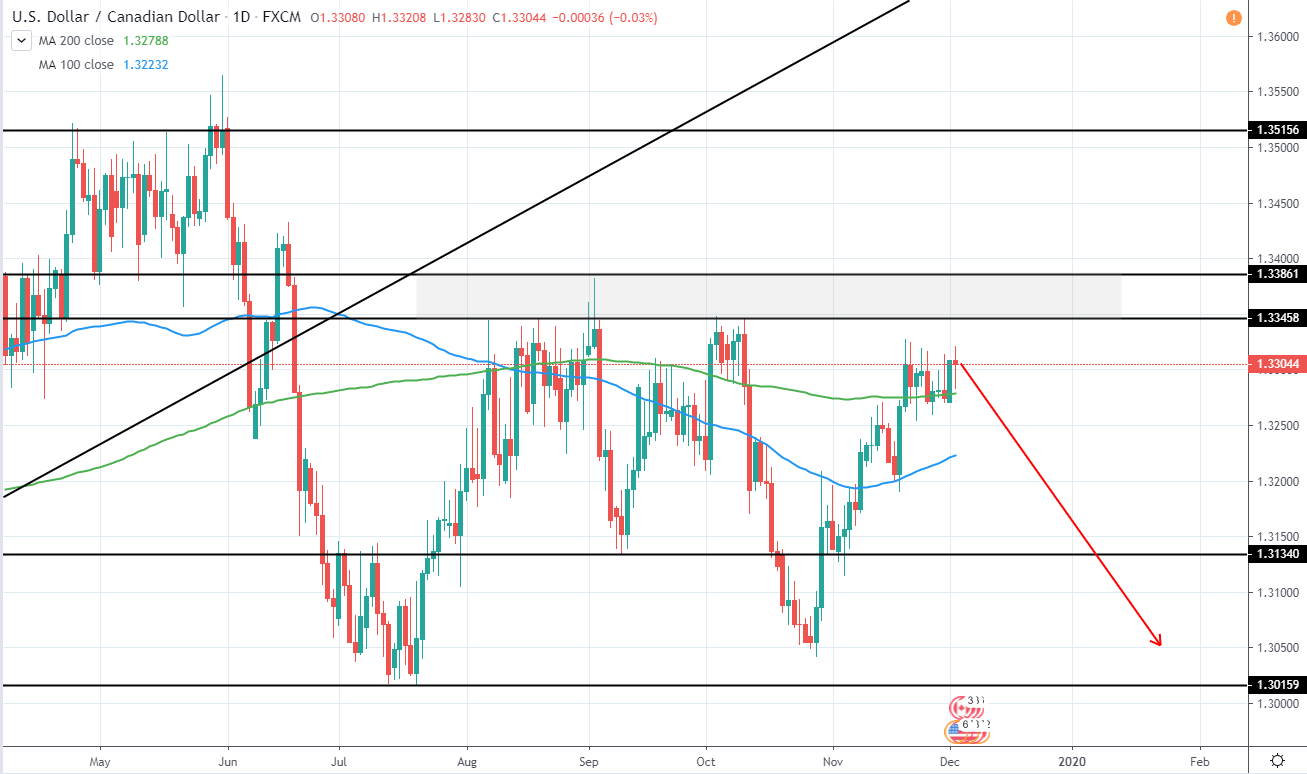

On the daily chart, we can see USD/CAD still ranging around 1.33 CAD as it rejects further upside, however, is not yer ready to move lower as 200 day moving average keeps acting as support for the past weeks.

Since the price is currently close to previous highs, a short position can be entered with a very good risk/reward potential as the next major support level can be seen as far as 1.0315-1.305 CAD an if reached would mean a potential gain of around 1.9-2.2%. Additional support level can be seen around 1.313-1.315 CAD and would still offer a decent downside of around 1.3%

Therefore, we are bearish for USD/CAD in the upcoming weeks.

USD/CAD Daily:

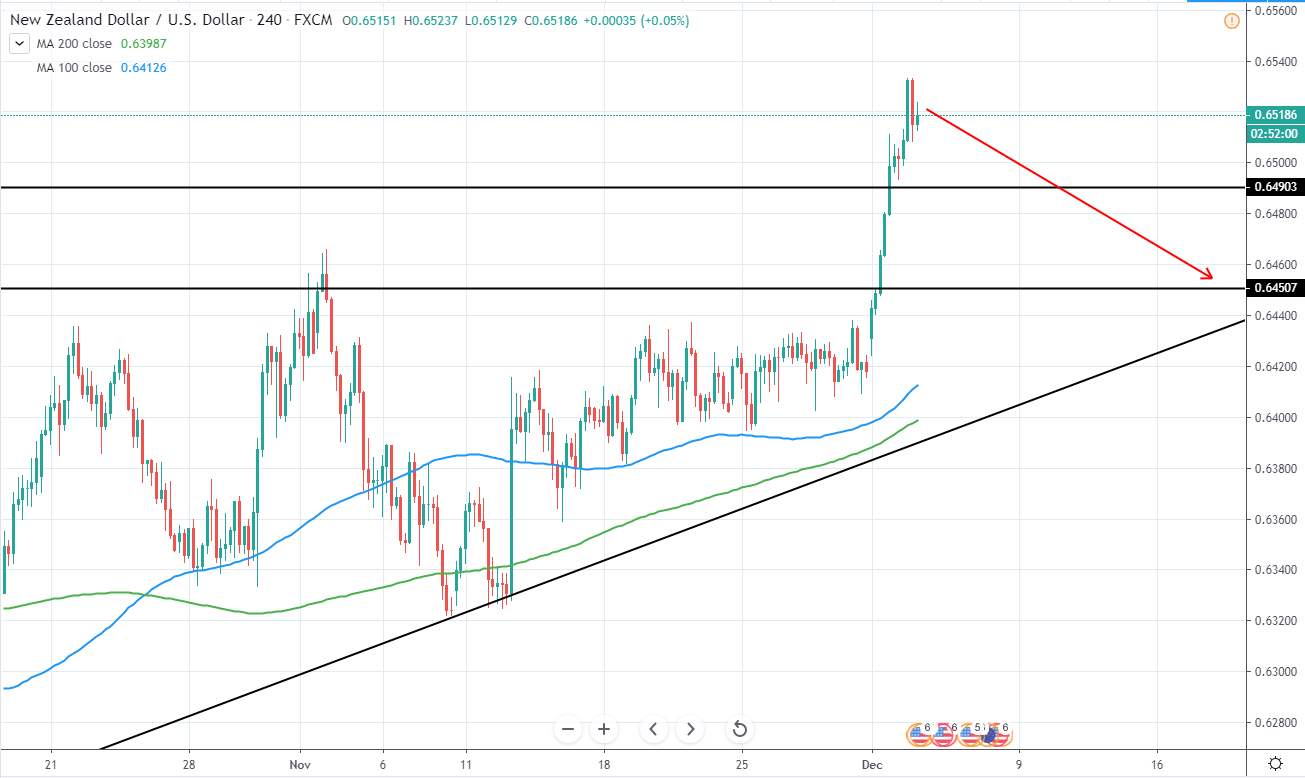

NZD/USD has been looking to retest 200 day moving average that is seen as a green line on the chart and currently has extended quite far away from the several week ascending support trendline.

In the past hours we can see rejection for further upside as the price peaked around 0.6533 USD, however further upside is still possible as the price has not made a lower low on any of the 4-hour candles in the last 12 hours. A short position, therefore, could be made when the price makes a local lower low and closes bearish and as the support level that could reverse the price once again is seen around 0.644-0.645 USD and would still offer a good risk/reward potential.

Additionally, several week ascending trend line in addition to both 100 and 200 period moving averages can be used as an additional target for the exit of short position.

NZD/USD 4H: