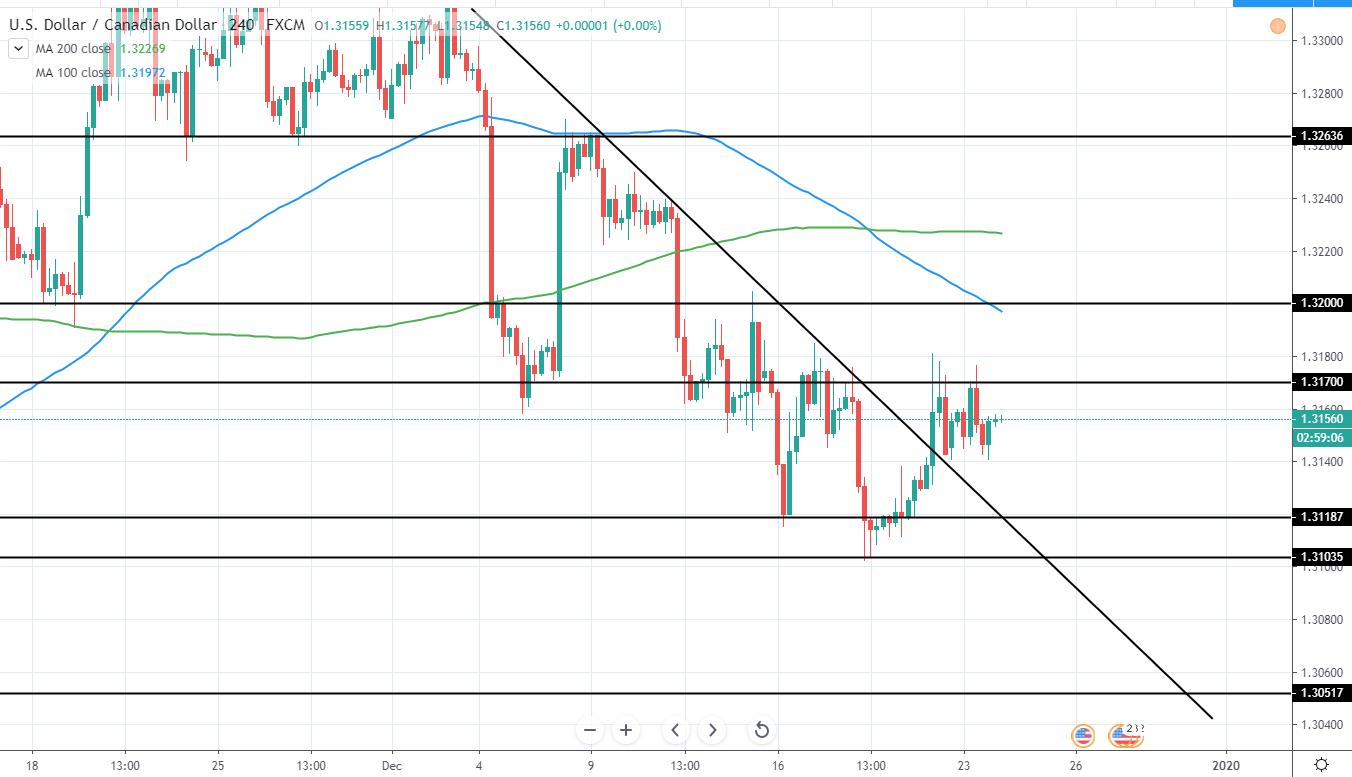

EUR/USD has moved lower in the end of last week and bounced off of 200 MA green line around 1.10669 USD, therefore, confirming a trend reversal as a previous major support area of 1.11-1.1115 USD was broken.

Retracement was seen followingly, however, further upside would be needed to offer a good risk/reward ratio for a short position, which, ideally, could be made from the same support area that now acts as resistance.

The next target to the downside can be seen around 1.04 USD and would mean a potential move of around 0.43% from the current price and around 0.6% from the middle of 1.11-1.1115 USD resistance area.

Therefore, for now, we remain neutral as a further retracement is needed, however, after that we expect further drop to be seen in the following days.

EUR/USD 4H:

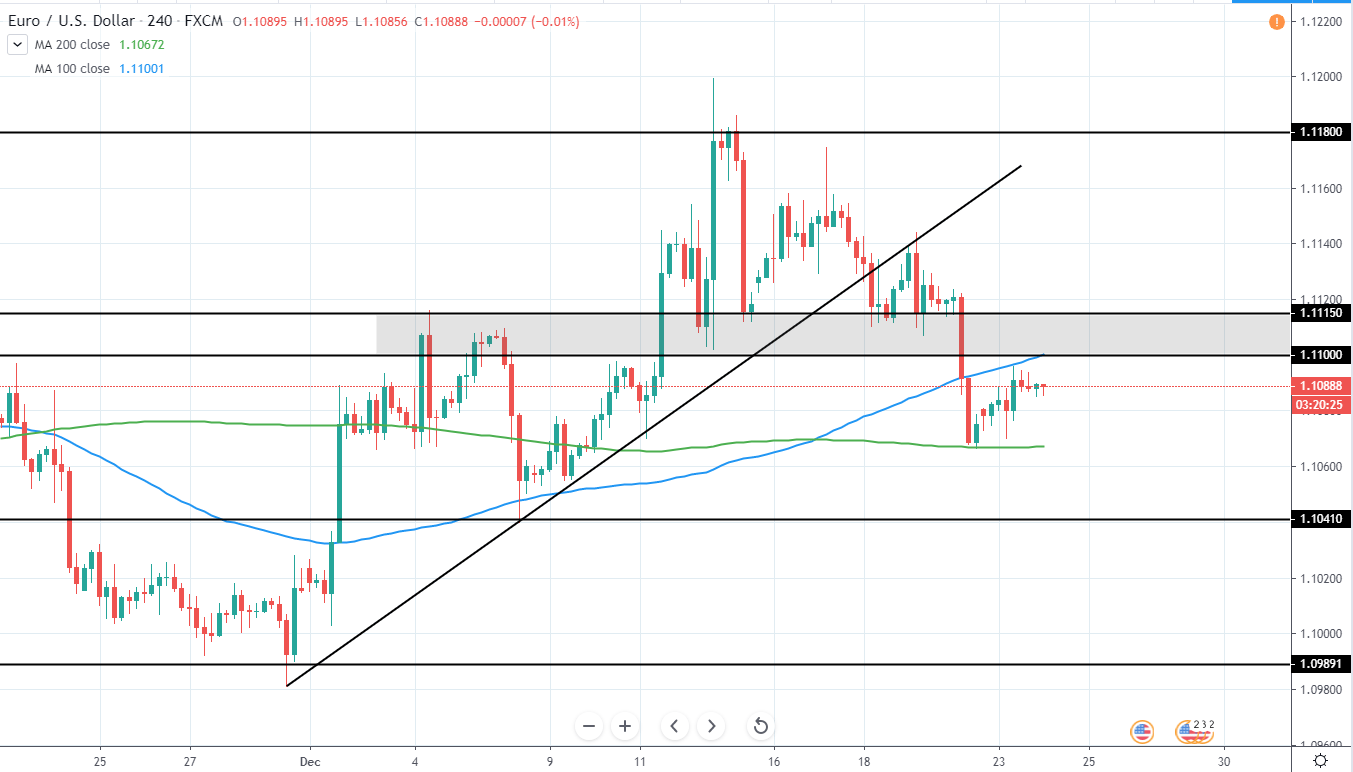

USD/JPY continues consolidating around 109.4-109.7 JPY resistance area and has set a local lower high in the past 24 hours, indicating that the pair is ready to start moving lower once again.

Therefore, a short position can be made around the current price levels in the expectation that the price move towards several week ascending support trend line around 108.7 JPY, which would mean a downside of around 0.65% from the current price and a good risk/reward short setup.

Additional support could be found in the area where 100 and 200 MA`s are located – around 109.016-109.103 JPY and the price action needs to be monitored around these levels.

USD/JPY 4H:

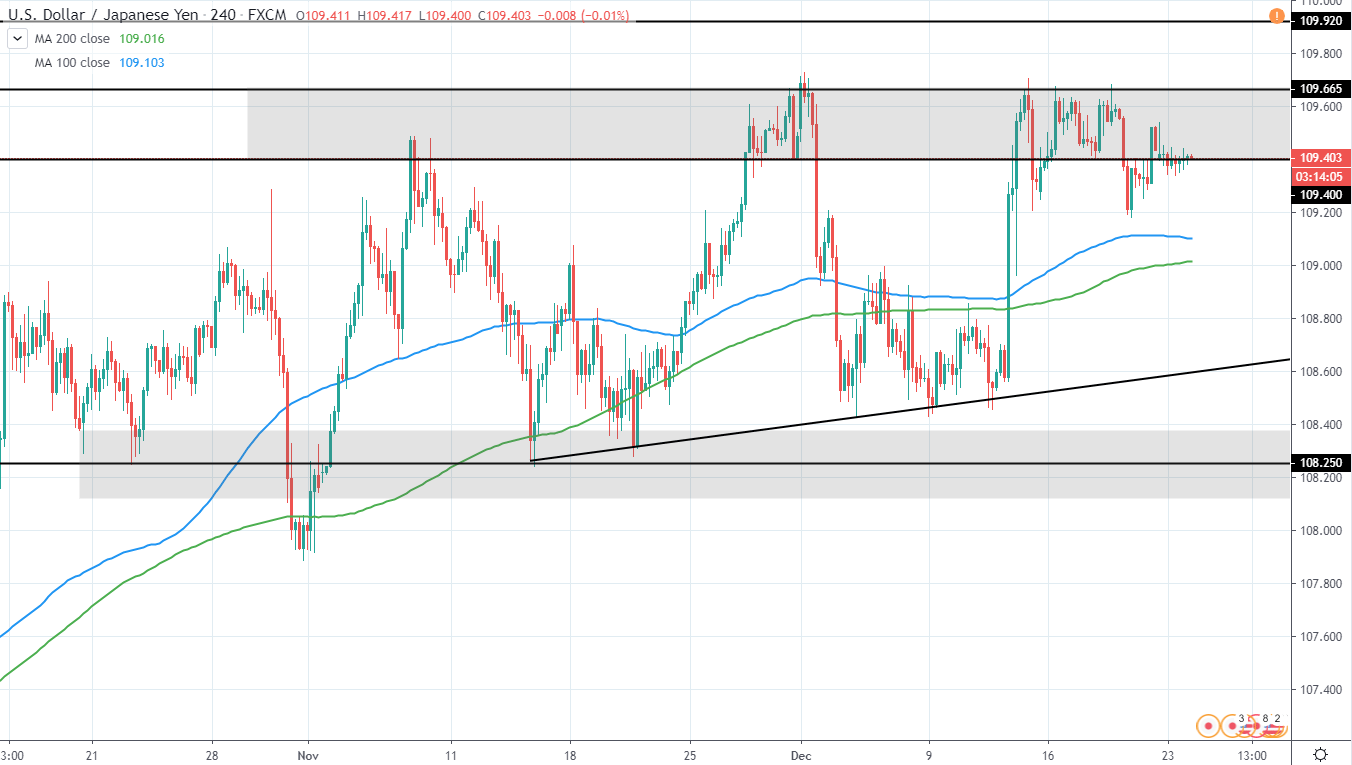

GBP/USD continues to move lower since peaking around 1.35 USD in a very strong, however, short move on the 12th of December and has broken below 1.3 USD support, which previously acted as strong resistance as well as 200 MA green line.

The next support level can be seen around 1.277 USD and likely will be tested in the upcoming days, however, a short position after such a strong downside move is not advisable. Additionally, there are no signs of a reversal back to the upside for now.

Therefore, it is best to stay neutral for now and wait for further price development.

GBP/USD 4H:

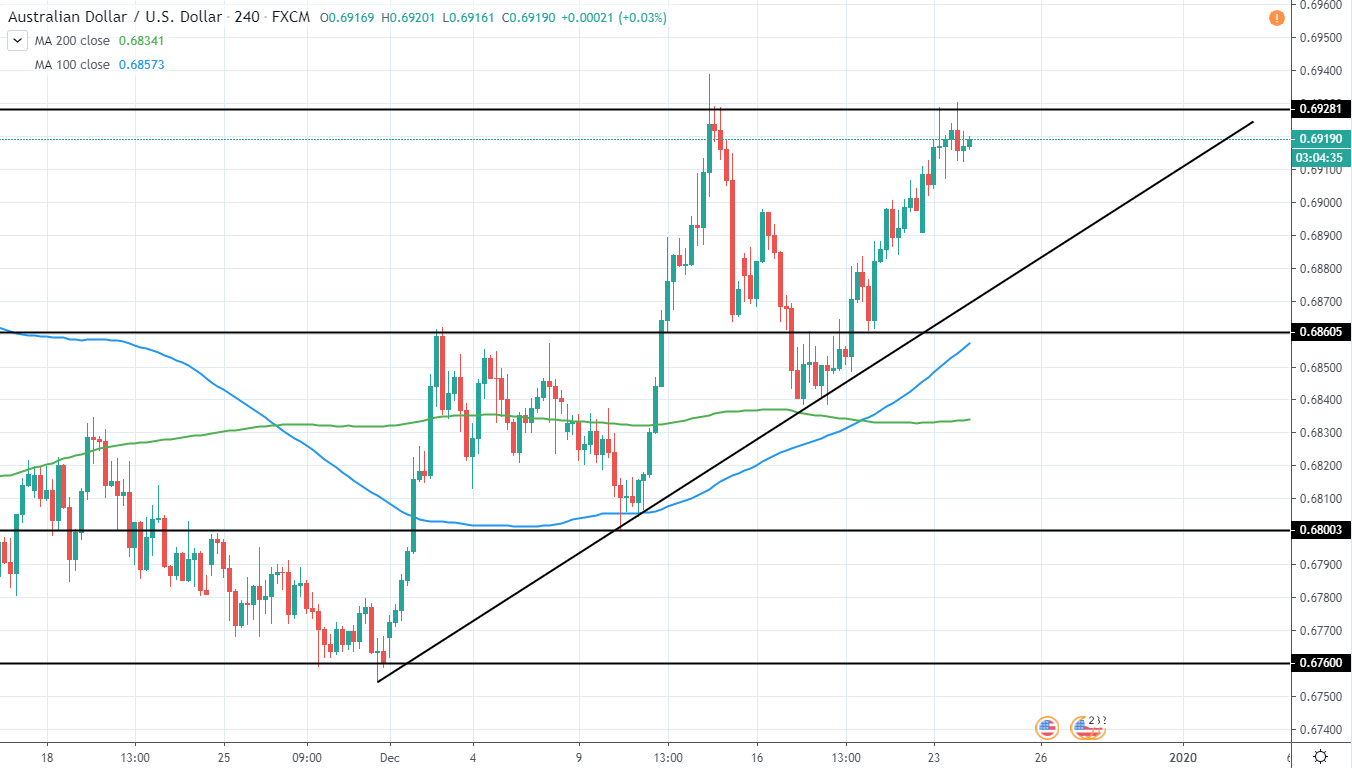

AUD/USD has reached a previous high of 0.693-0.694 USD and slightly rejected further upside for now as a bearish engulfing candle was set earlier this week.

Therefore, a short term short position could be taken in the expectation that another retest of several week ascending trend line will be made and a potential target around 0.688-0.689 USD could be set, meaning a decent potential risk/reward setup.

Additional support can be seen around 0.686 USD and could be used as the next target if the ascending trend line does not provide support and would further improve risk/reward potential for the trade.

AUD/USD 4H:

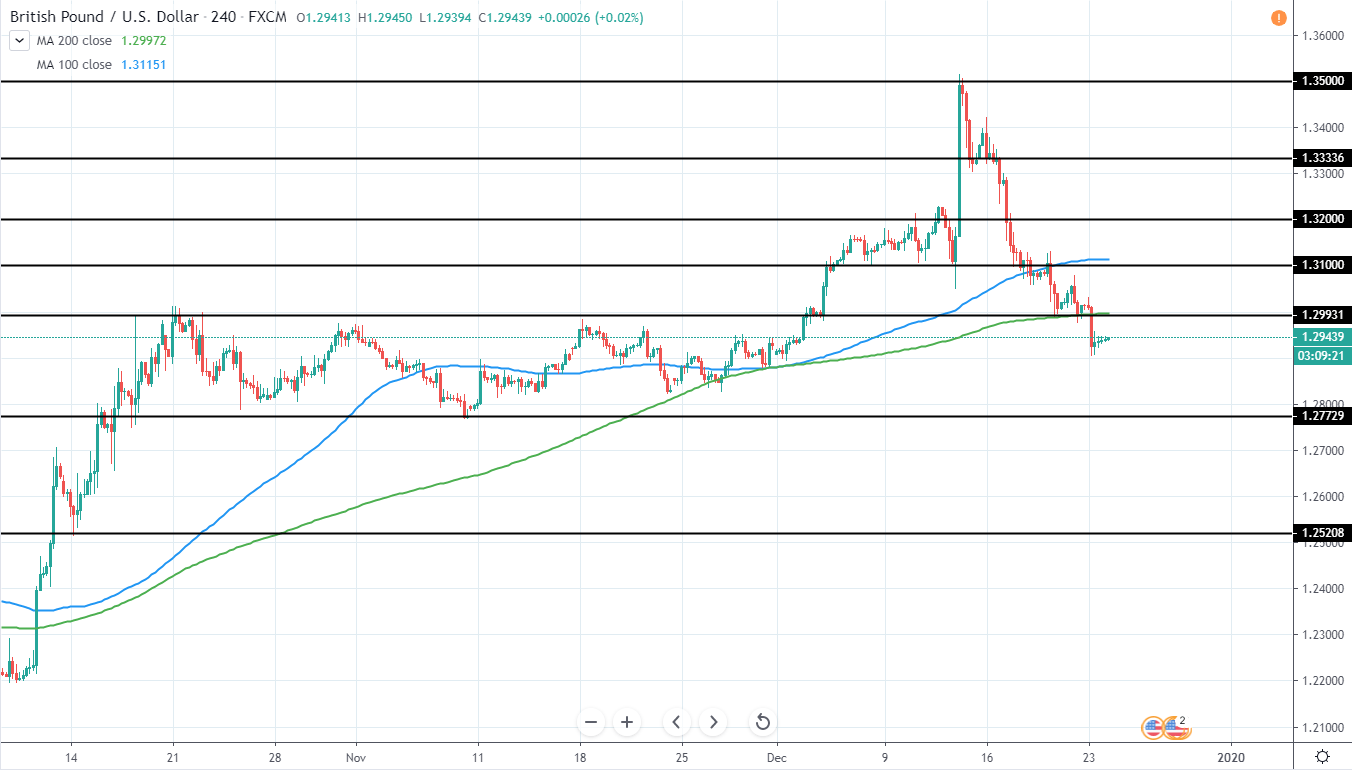

USD/CAD continues to test 0.317-1.318 CAD resistance after moving above several day descending trend line, however, it did not set a clearly higher high.

This indicates that we will likely see further downside in the upcoming days and another test of current lows around 1.31-1.312 CAD, which would mean a drop of around 0.3-0.4% from the current price and possibly more if another lower low is set.

Therefore, a short position could be taken once a slight upside is seen in the upcoming hours in order to further improve the risk/reward potential of the trade.

USD/CAD 4H: