Currently, the total market cap of crypto is 236.95 billion USD with a 24h Volume of 104.14 billion and BTC Dominance of 66.4% according to coinmarketcap.com.

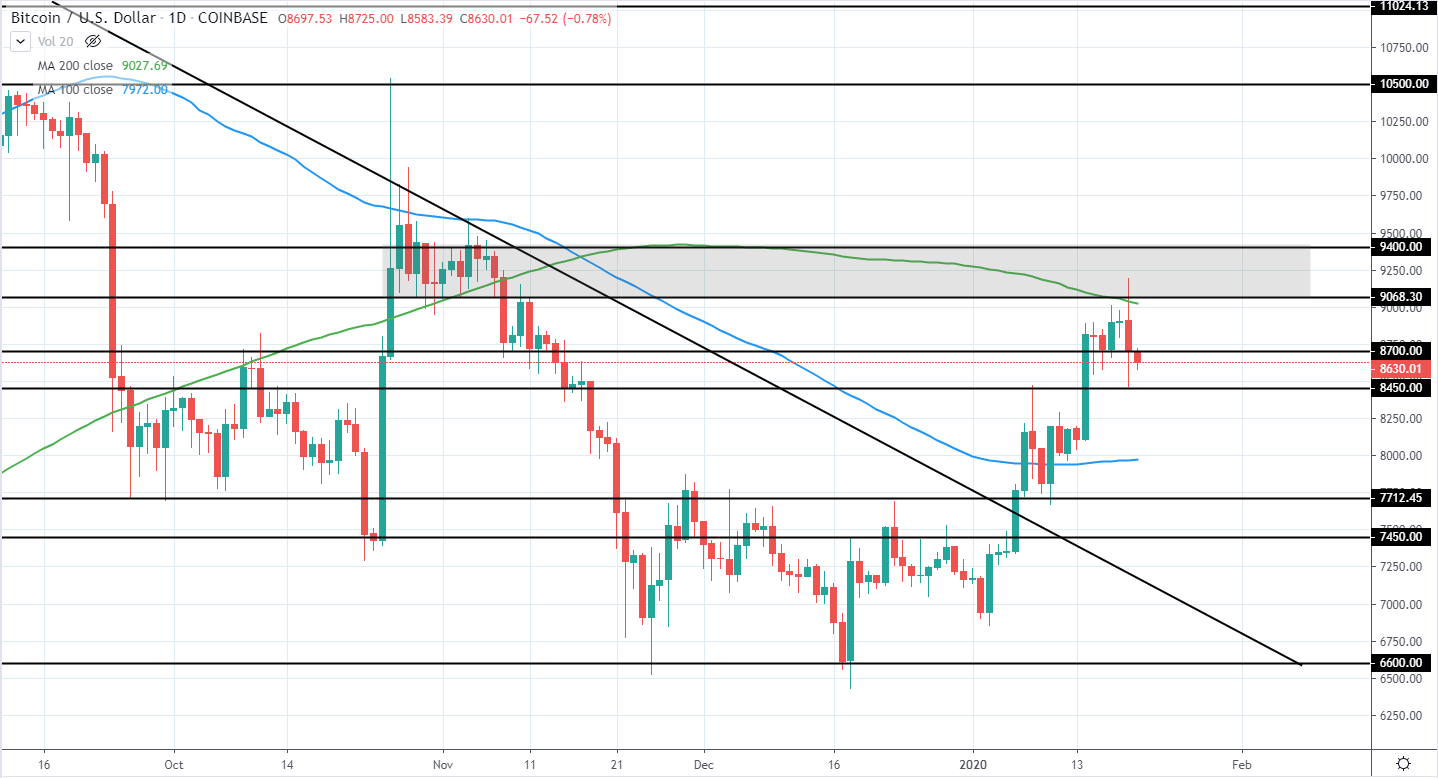

Bitcoin has a market cap of 157.26 billion USD and trades around 8,623 USD on Coinbase as it has continued to move higher for the past weeks and has reached 200 day moving average green line as well as previous resistance/consolidation area around 9070-9400 USD and seems to be rejecting back to the downside.

The overall market continues being very bearish as no major high has been broken and the previous low was considerably lower than the previous one as it peaked around 6.6k USD, compared to the previous one, which peaked around 7.45k USD. However, the price has broken above several month ascending trendline and indicates a clear slowdown in the current bearish momentum.

Therefore, we can start to look for short position entries in the expectation that the previous lows around 6.6k USD will be retested in the upcoming weeks, which would mean a potential downside of around 25% and likely more if another lower low is set.

BTC/USD Daily:

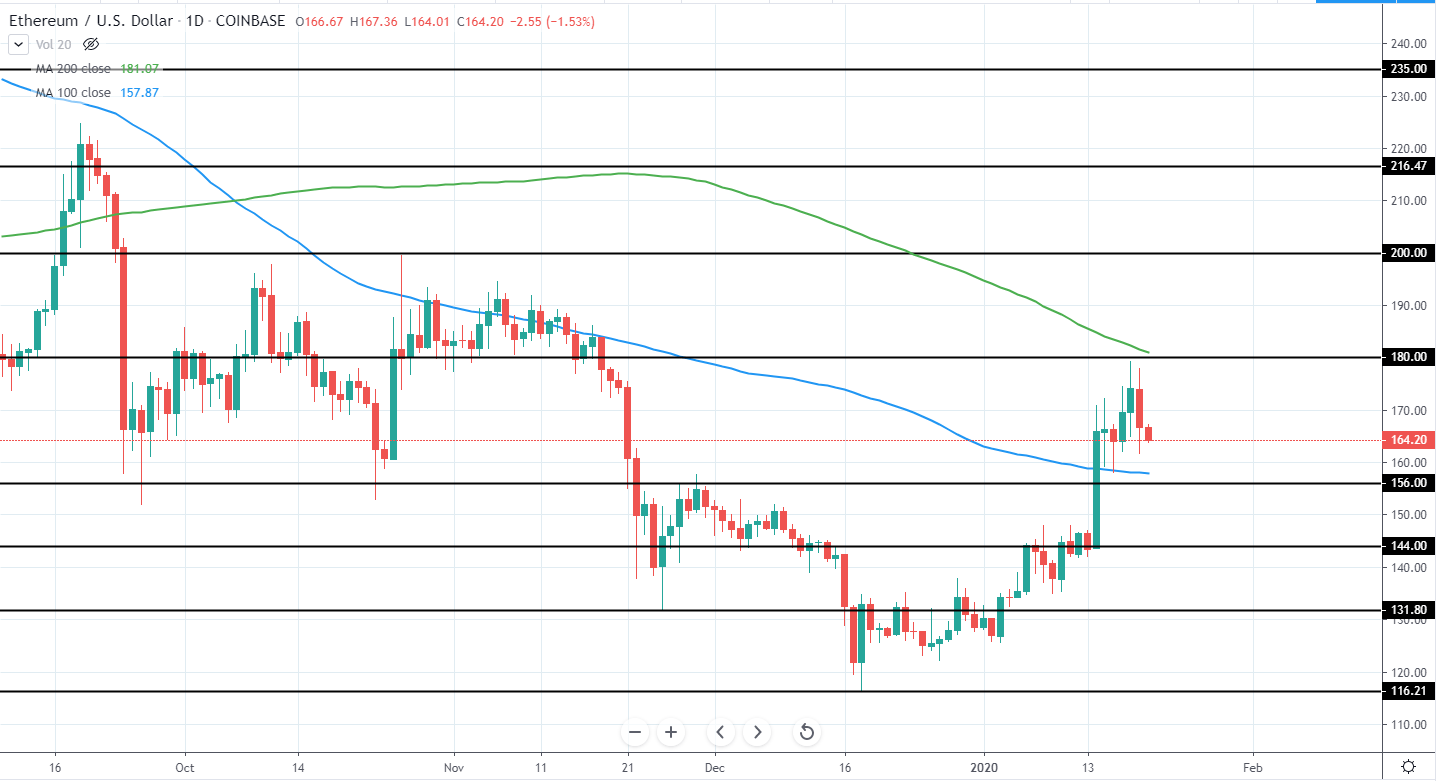

Ethereum currently has a market cap of 18 billion and trades at 165.4 USD on Coinbase and, similar to Bitcoin, has had very bullish past weeks as it looks to test 180 USD resistance as well as 200 day moving average.

After almost touching the 180 USD resistance, we saw a very bearish close yesterday. Therefore, since the overall trend is still bearish, we can start to look for a short position entry once a further rejection of bullish momentum is seen in the expectation that the previous low of 116 USD will be retested in the upcoming weeks, meaning a potential downside of around 30.5%.

ETH/USD Daily:

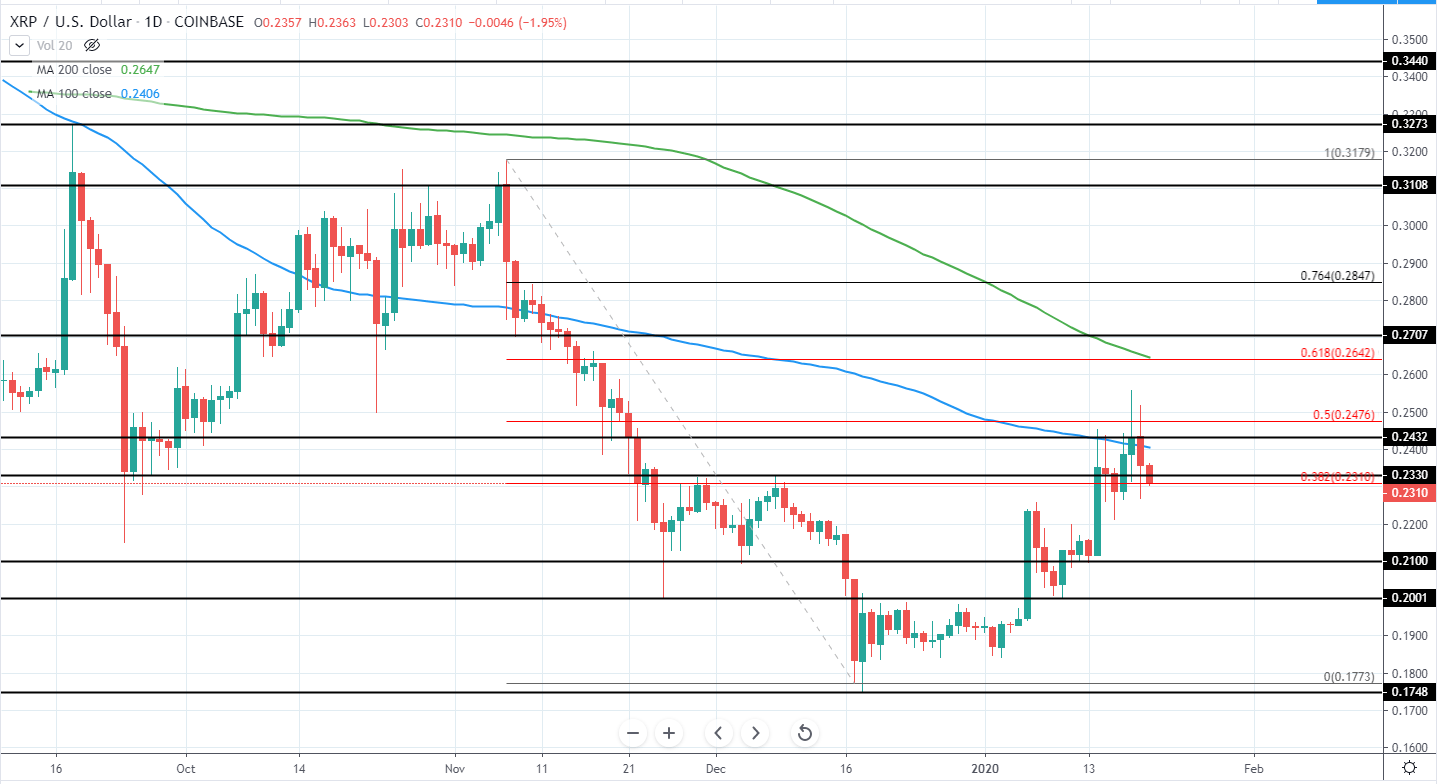

Ripple currently has a market cap of 10.11 billion and is trading around 0.231 USD on Binance as it has also reached previous major support around 0.233-0.243 USD, as well as 100 day, moving average blue line, in addition, to briefly testing 50% Fib retracement from the previous downswing with a clear rejection.

Therefore, once further bearish indications are seen, a short position can be taken in the expectation that the previous low of 0.1748 USD will be reached and likely broken, meaning a return of at least 25-26% in the upcoming weeks.

XRP/USD Daily:

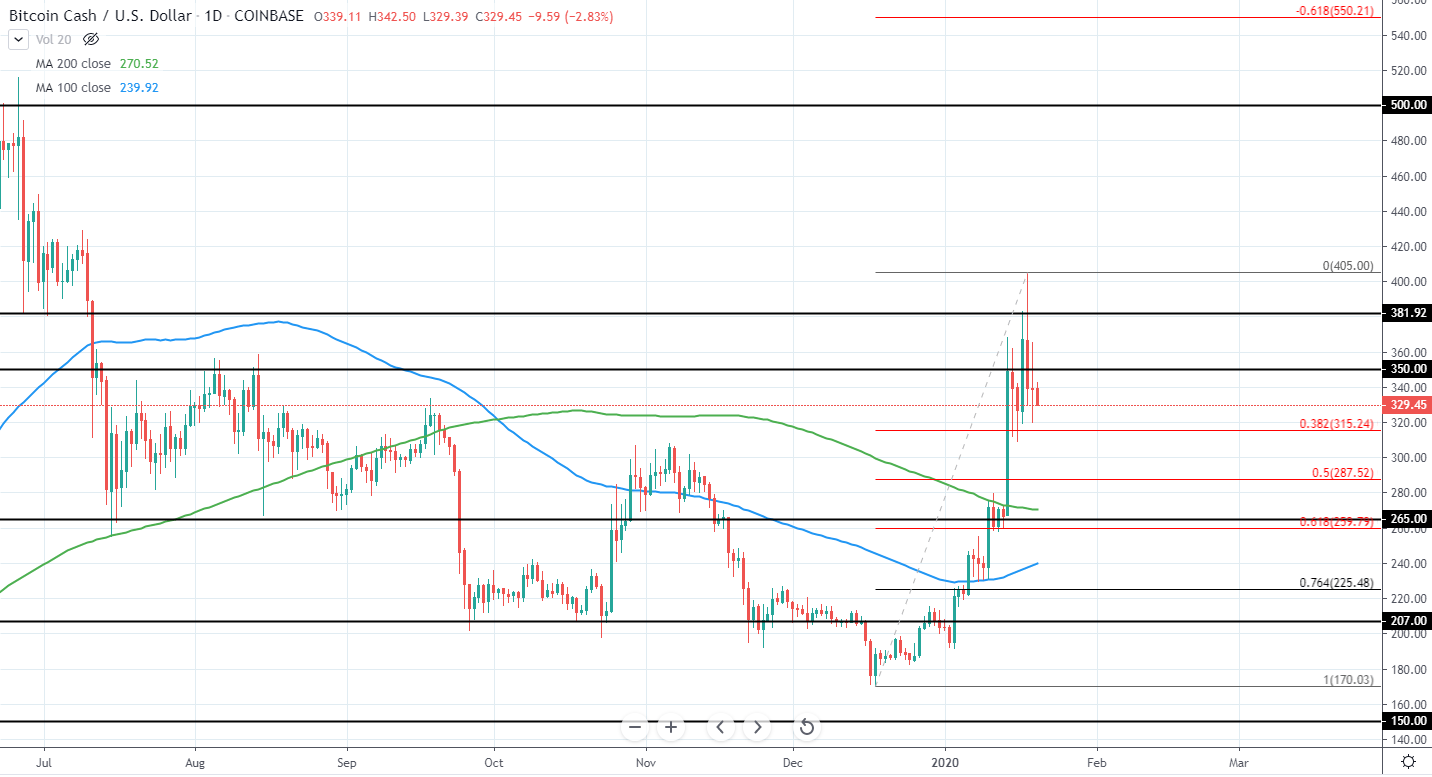

Bitcoin Cash has a market cap of 6.02 billion USD and currently trades around 329 USD on Coinbase as it has broken previous highs after setting another lower low around 170 USD which potentially indicates an upcoming trend reversal after the last half-year was spent retracing from the 2019 high of around 500 USD.

For now, however, since a very strong rejection for further upside can currently be seen, a short position can be taken with the expectation that the price will look to set a higher low above 170 USD. The most likely target can be seen around the 50-61.8% Fib retracement from the previous move, meaning the area around 259.5-287 USD could be used as a target for the short position. Additional support will likely be offered by 265 USD previous support as well as 200 day moving average green line around 271 USD.

Afterward, if the price can show signs of finding support and setting a new higher low, we can start to look for long position entry opportunities.

BCH/USD Daily: