Currently, the total market cap of crypto is 277 billion USD with a 24h Volume of 139.4 billion and BTC Dominance of 64.3% according to Coinmarketcap.

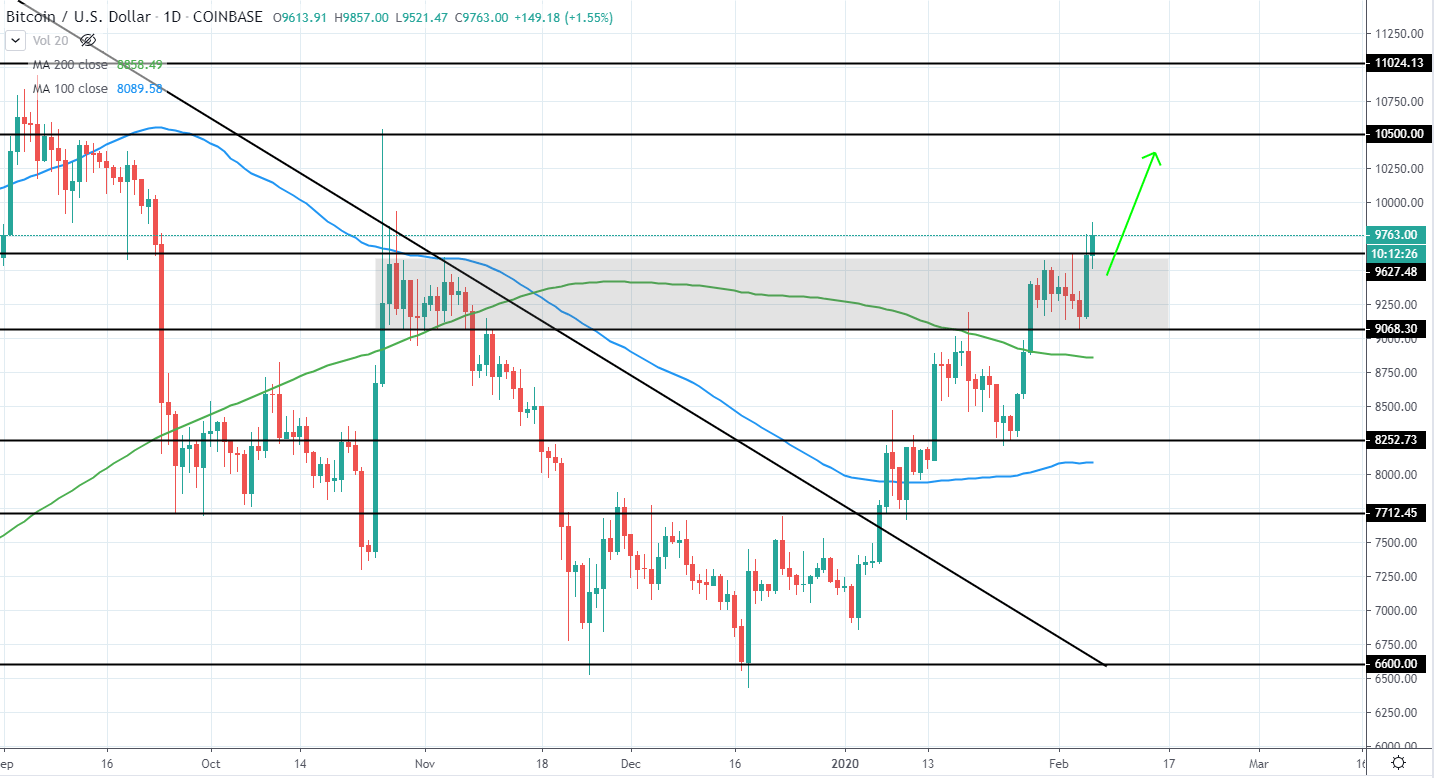

Bitcoin has a market cap of 178.5 billion USD and trades around 9,660 USD on Coinbase and has made another higher high today after retesting the previous high around 9070 USD. The overall trend starts to look even more bullish after a several month descending resistance trend line was broken at the beginning of January, however, a major higher high above 10.5k USD is yet to be made as a clear confirmation for a reversal to the upside.

Since the price has extended considerably since the previous major low around 6.6k USD, a long position right now would not offer good risk/reward. Additionally, previous major resistance around 10.5-11k USD is close by, therefore, for now, it is best to stay neutral and wait for a more significant pullback that sets a new major higher low.

Alternatively, a short term trade towards 10.5k USD could be made if the price sets another local higher low, however, this would be quite a high-risk trade.

BTC/USD Daily:

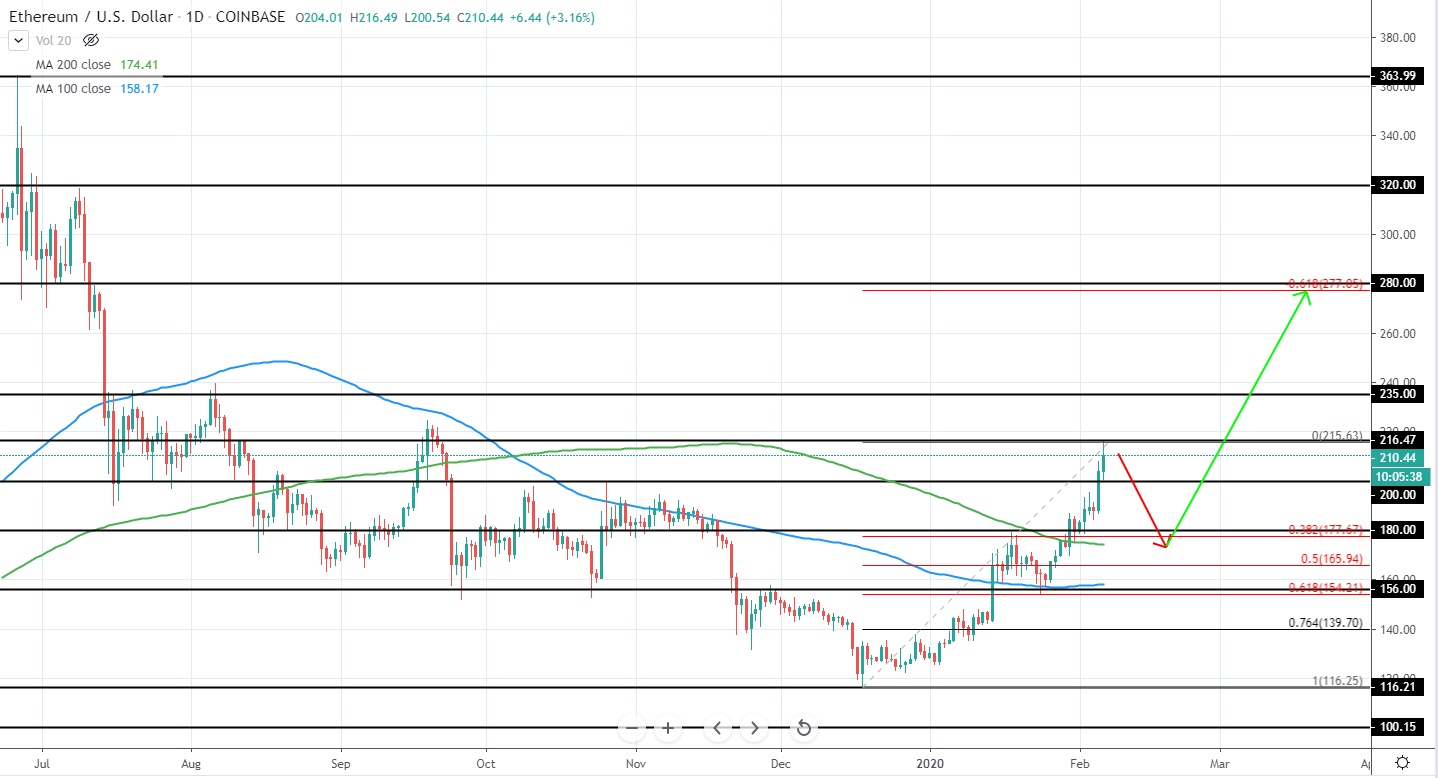

Ethereum currently has a market cap of 23.4 billion and trades at 210.4 USD on Coinbase as it has continued to move higher for the past week and has reached next resistance level of around 216 USD.

Since the previous high of 200 USD was broken in addition to 200 day moving average, the overall trend starts to look quite bullish, however, the price has extended quite far away from the previous major low of 116.2 USD. Therefore, an entry right now would not offer a good risk-reward potential and a significant retracement that sets a higher low needs to be made.

A potential area of support for the retracement can be seen at 50-61.8% Fib retracement around 154.2-165.9 USD as well as between both 100 and 200 day moving averages, seen as a blue and green line around 158.16 and 174.41 USD respectively. Additional previous support levels can be seen around 156 USD.

Therefore, for now, it is best to stay neutral and wait for further price action development.

ETH/USD Daily:

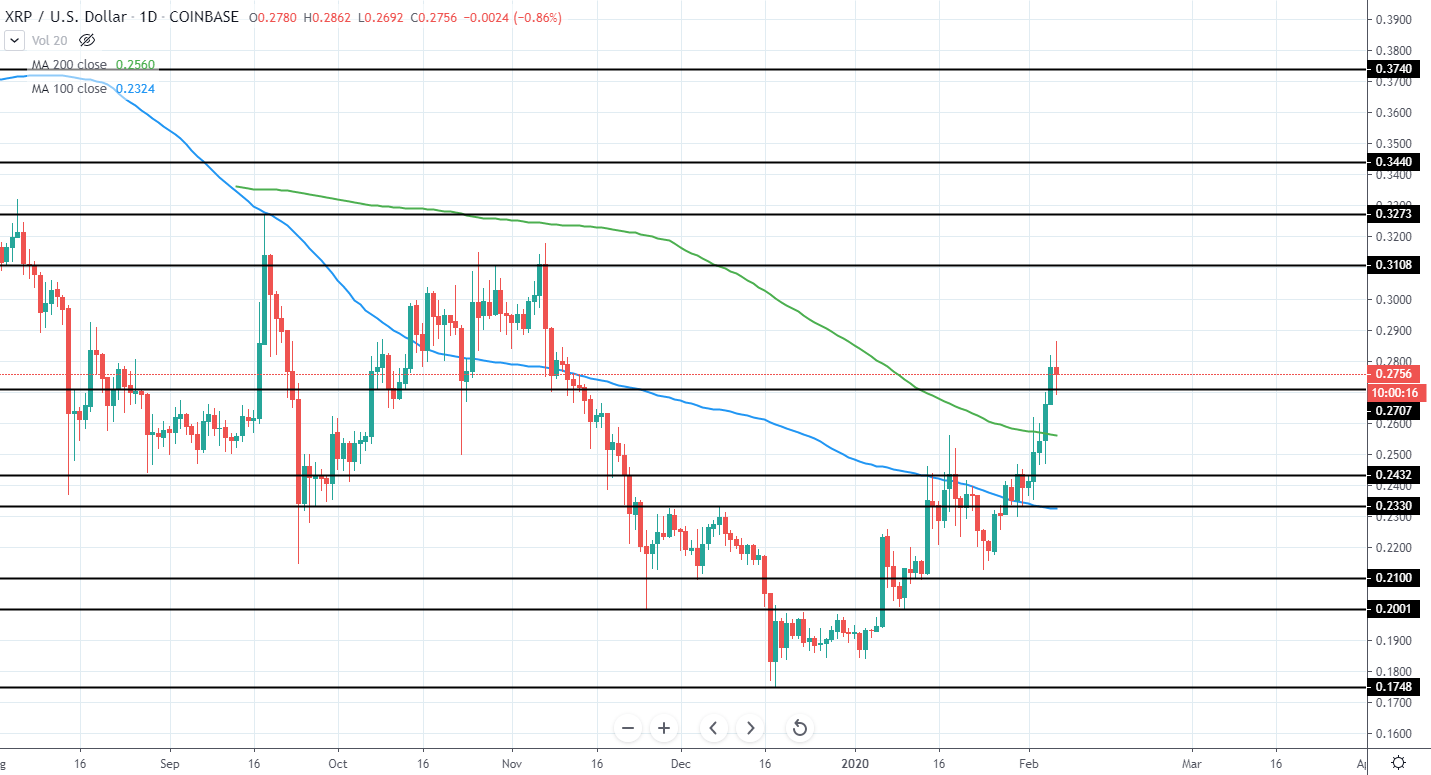

Ripple currently has a market cap of 12.32 billion and is trading around 0.275 USD on Coinbase as it has continued to move higher for the past week and has broken above a minor resistance of 0.27 USD as well as 200 day moving average.

The overall trend continues being bearish as the previous high of around 0.31 USD is yet to be broken. Until this is done, we remain bearish and expect further downside in the upcoming weeks.

XRP/USD Daily:

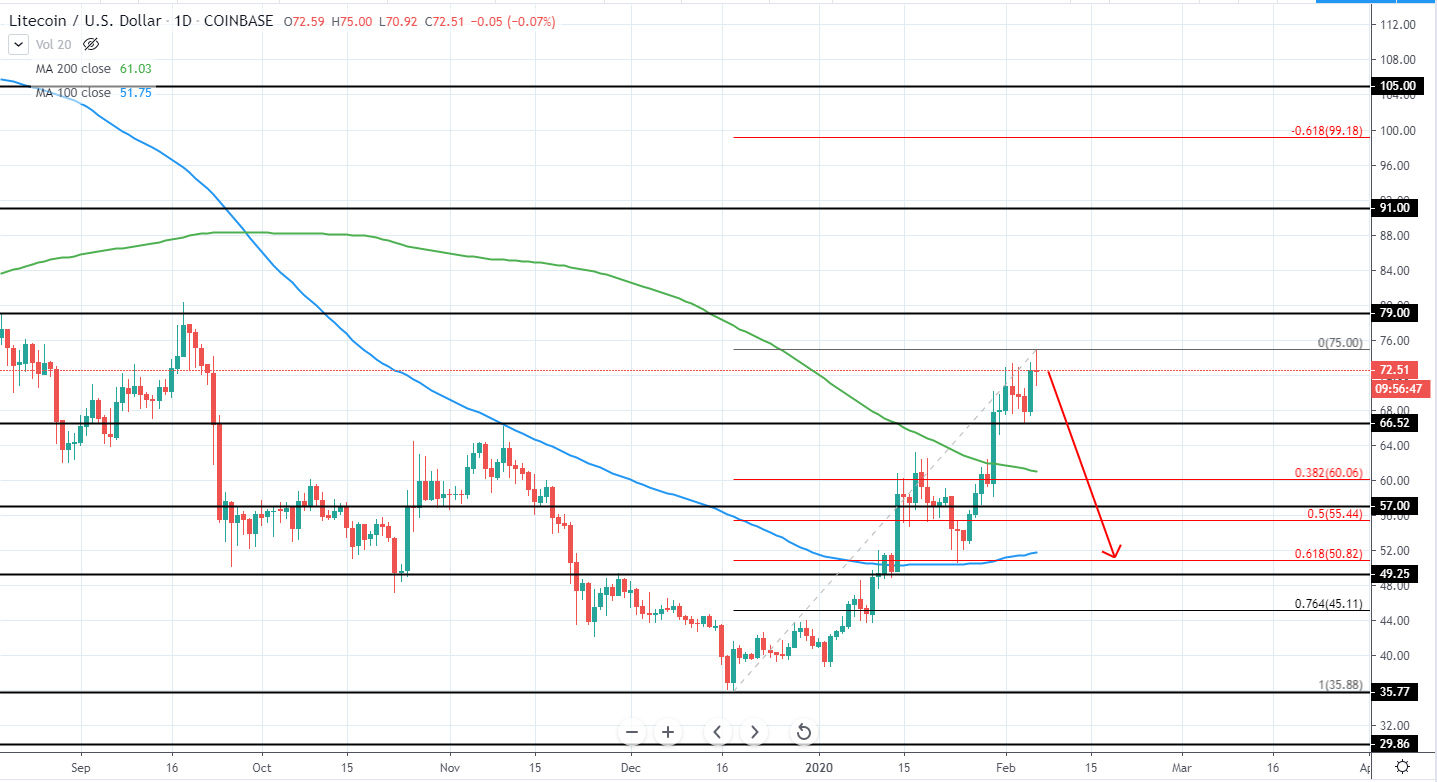

Litecoin has a market cap of 4.75 billion USD and currently trades around 72.2 USD on Binance as it has continued moving higher for the past week and has broken above previous major swing high of 66.5 USD and indicates a potential trend reversal.

Currently, however, the price has extended too far from the previous major low of 35.77 USD and a strong retracement that sets a higher low is needed in order to consider a long position. Therefore, for now, it is best to stay neutral and wait for a retracement towards 50-55 USD area.

LTC/USD Daily: