Currently, the total market cap of crypto is 177 billion USD with a 24h Volume of 75.36 billion and BTC Dominance of 67.6% according to coinmarketcap.com.

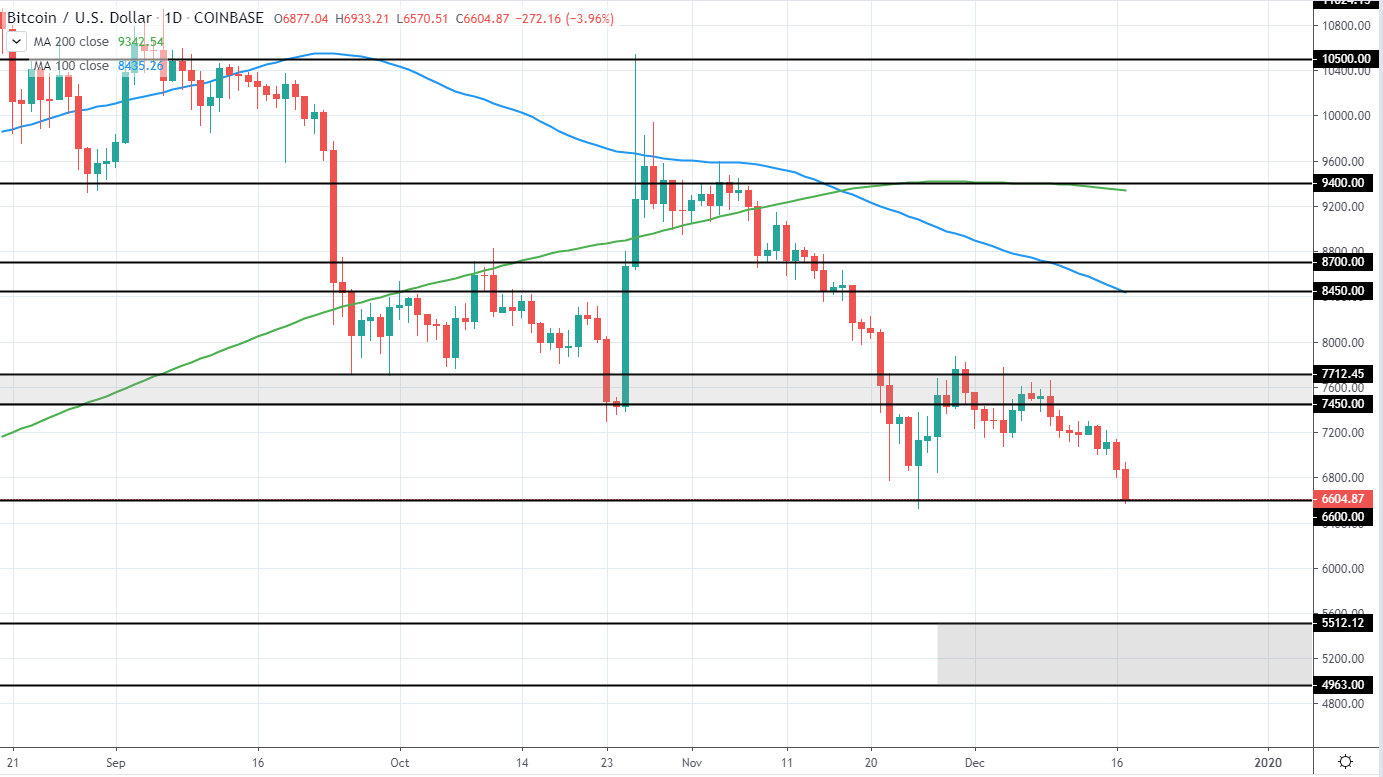

Bitcoin has a market cap of 119.7 billion USD and trades around 6,612 USD on Coinbase as it continues to move lower and test previous swing low of 6.6k USD after spending several days around 7.45-7.7k USD resistance area and failing to break above in order to retrace further.

Currently, the price has extended itself to the downside substantially and, therefore, a short position would not offer good risk/reward. The next support target can be seen relatively far away around 4.95-5.5k USD previous consolidation area and would mean a further downside of around 16.5-25%.

Therefore, we are bearish for the price of BTC in the upcoming days, however, a slight retracement is needed for good short position entry.

BTC/USD 4H:

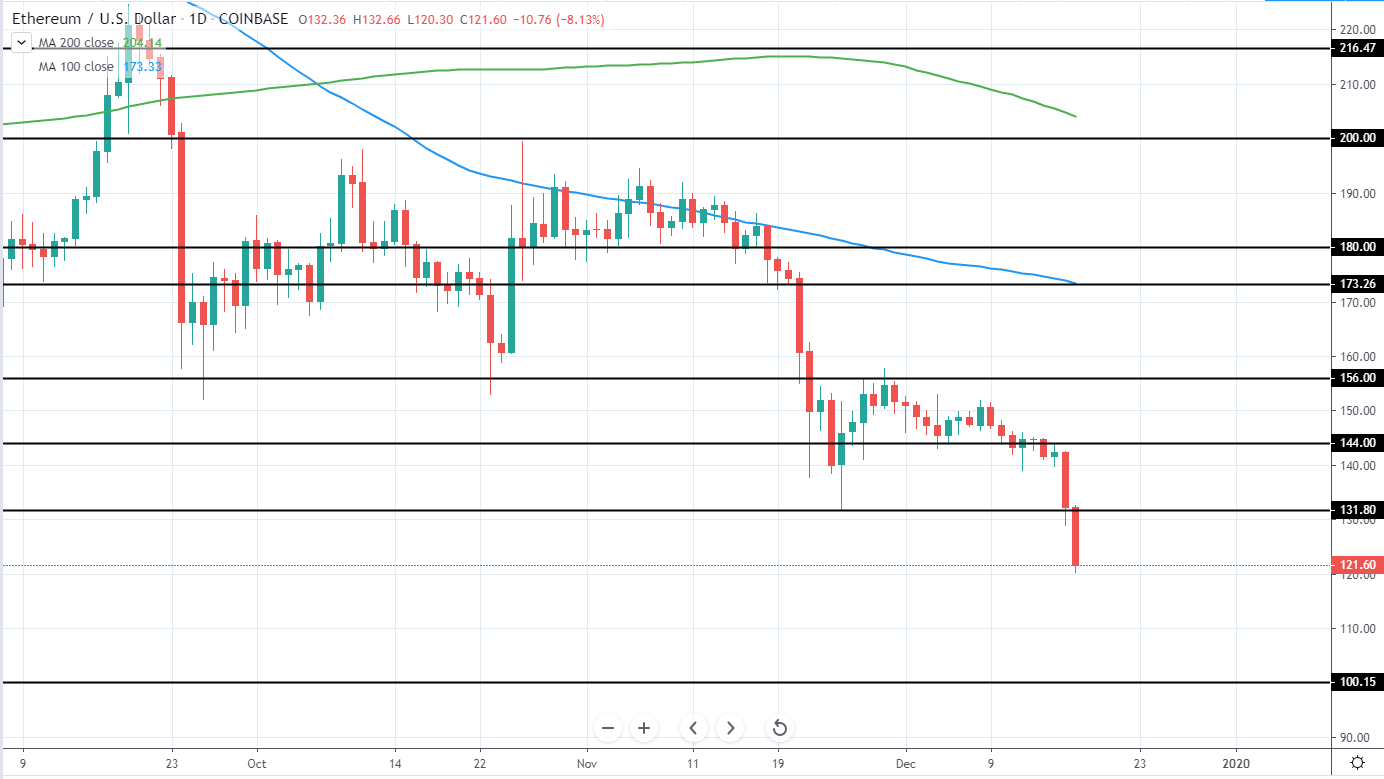

Ethereum currently has a market cap of 13.3 billion and trades at 122.19 USD on Coinbase as it has experienced much more bearish momentum and has clearly moved below the previous low of 131.8 USD.

The next support target can be seen around 100 USD, which would mean a further drop of around 17.5% if reached from the current price, however, unless a retracement is seen, shorting ETH right now would have a very bad risk/reward potential.

ETH/USD 4H:

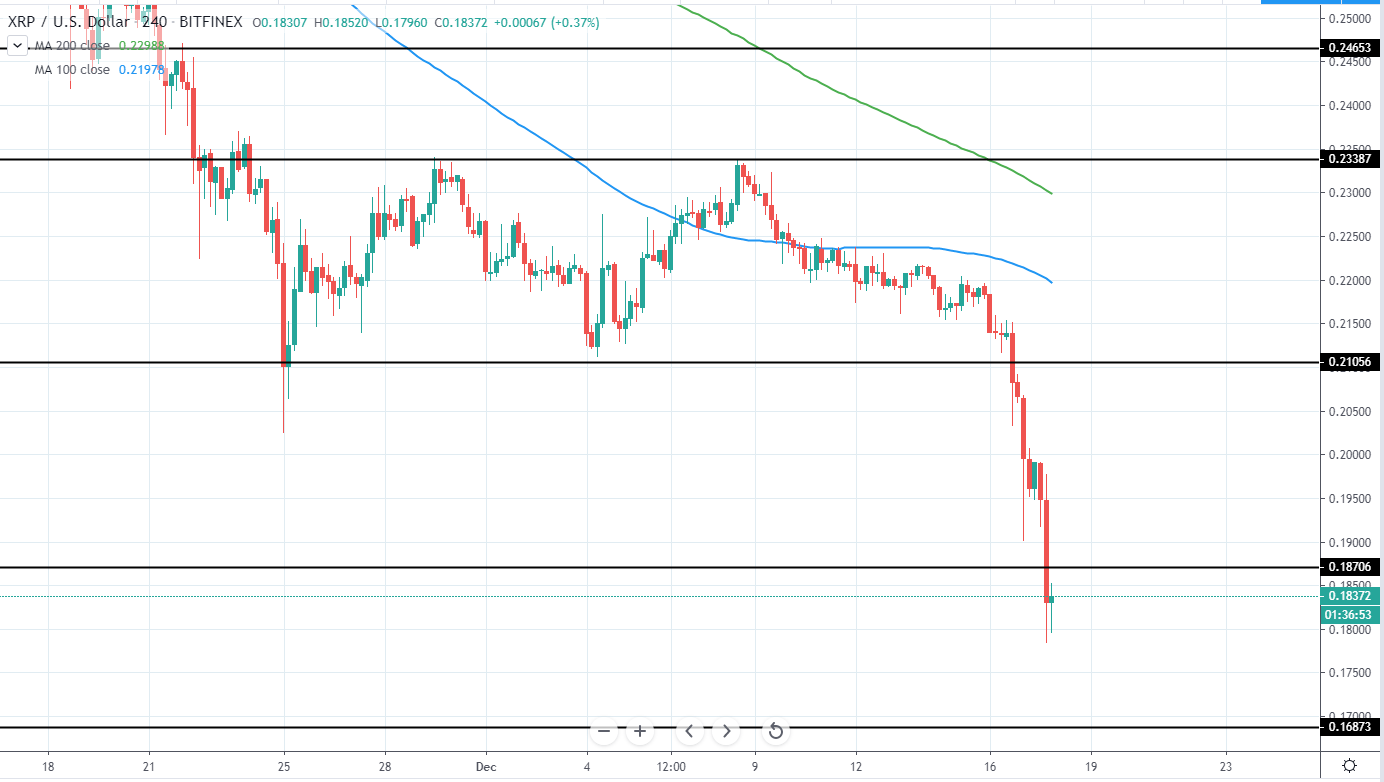

Ripple currently has a market cap of 7.96 billion and is trading around 0.184 USD on Binance as it has dropped towards new several-year low around 0.18 USD and shows slight rejection for further downside.

Since the market has extended so much, we can expect a bullish retracement in the upcoming days with a target for resistance being around 0.21 USD previous support, which, if reached from the current price would mean a potential upside of around 13.8%. This would, however, mean a trade against very strong bearish momentum and despite the good risk/reward potential, would imply a low probability of success.

XRP/USD 4H:

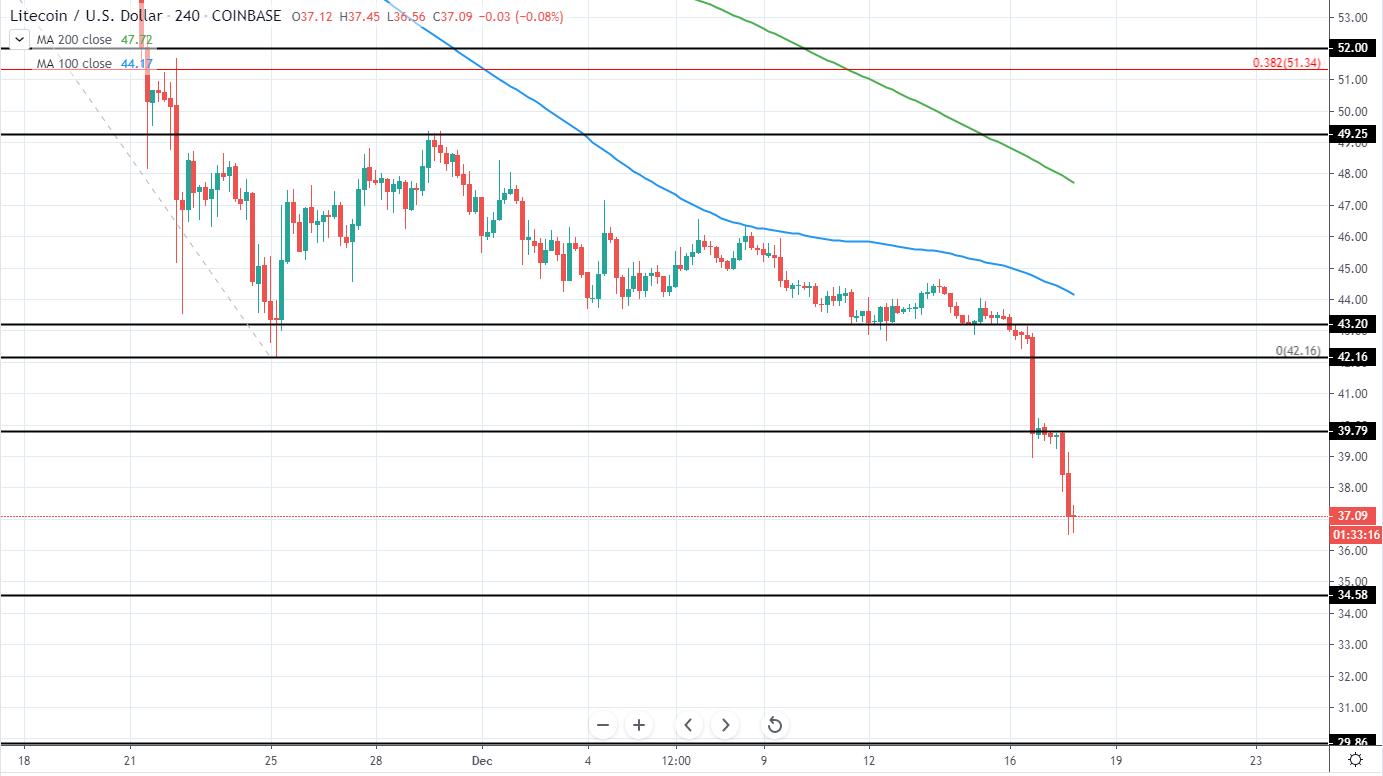

Litecoin has a market cap of 2.375 billion USD and currently trades around 37.32 USD on Binance as it also experienced very bearish past 24 hours and currently trades between 34.5 USD support and 39.8 USD resistance.

A significant retracement is needed before a short position can be considered again, the best being a retracement towards 42 USD previous support, which would mean upside of around 13% from the current price. Additional resistance can be found around 39.8 USD and needs to be monitored for bearish price action once reached as it could serve as the next reversal back to the downside.

Alternatively, a high risk, against the trend long position could be made towards previously mentioned resistance targets and would offer a good risk/reward potential.

LTC/USD 4H:

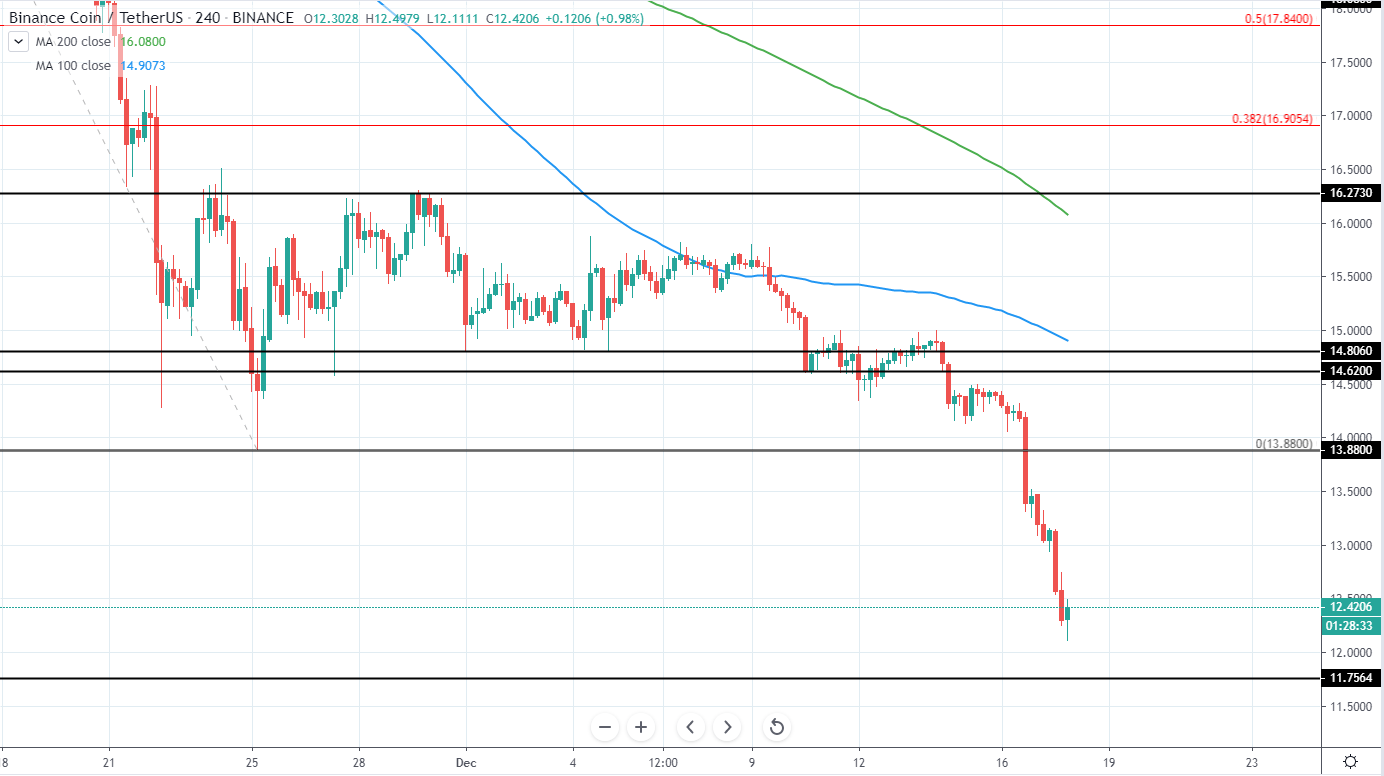

Binance coin has a market cap of 1,925 billion USD and trades around 12.38 USD on Binance as it looks to test 11.75 USD next support after very bearish past 24 hours.

Not much further downside can be expected and, therefore, the best option is to wait for a significant retracement back to previous support now turned resistance of around 13.88 USD before considering a further short position.

Alternatively, an aggressive long position could be made if the price shows further signs of rejection for further downside, however, would mean a trade against the major trend, despite the good risk/reward potential.

BNB/USD 4H: